Summary

Utilities have been classified as boring, predictable, and safe stocks with regular dividend steam. Only three of the adjectives apply in today’s market, gone are boring, predictable, and safe thanks in great part to climate change and the policies to reach net zero i.e., de-carbonization and energy transition. These dual drivers require increasing capacity and strengthening the distribution systems (Grid) to meet higher loads in a hotter world. At the same time, this new capacity must come from renewable energy sources (wind and solar).

In less than 10 years the electric utility sector has been pushed into growth mode. This, I believe, would be positive for companies and investors if it were not for one pesky item. The cost of money, interest rates, the risk-free rate, and the discount rate all zoomed causing the sector’s valuation pain and perhaps earnings pain in the near future.

While it may be very tempting to buy into the utility sector and the Utilities Select Sector SPDR ETF (XLU) given the sharp price reductions, I would suggest caution. Are valuations low enough to factor in the higher rates? Can these companies continue to expand, take on debt, burn free cash flow, and still payout dividends?

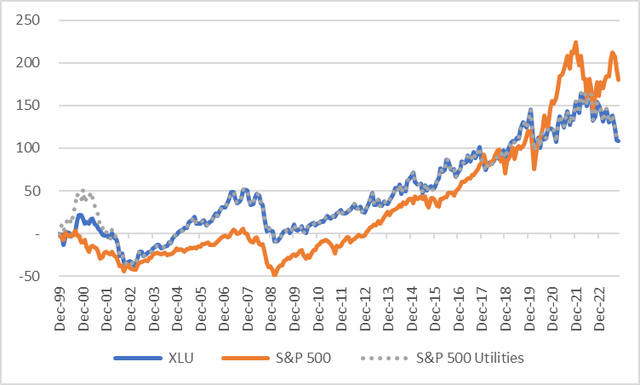

XLU vs SP Utilities Index (Created by author with data from Capital IQ)

Valuation First

Assets that are focused on paying out a significant part of earnings in the form of dividends are generally valued as bond proxies. REITs, limited partnerships, development companies, and utilities fall into this category. Bond values fluctuate vs the risk-free rate i.e., the US Treasury yields. However, bonds have a maturity date and one can simply hold to maturity and recuperate investment plus interest. Stocks do not have this luxury and may decline so that the dividend yield rises to meet or surpass the risk-free, the extent of the decline depends on the risk of the company or sector.

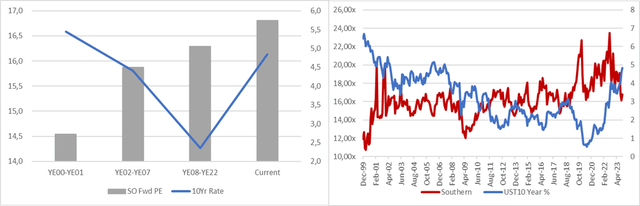

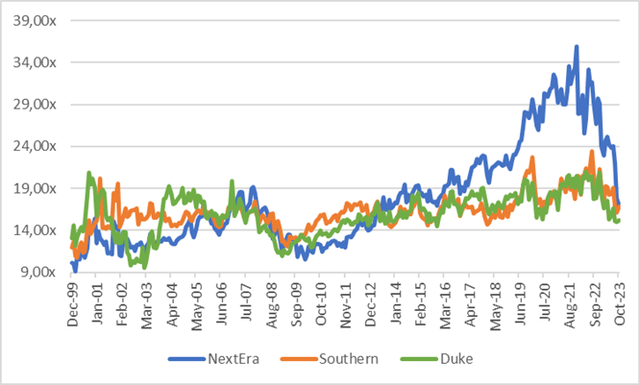

Thus, I believe that the utility sector is not out of the woods, the price decline is not yet sufficient to meet risk-free and compensate for the higher risk. Looking at the PE of a few large Utility stocks in the ETF portfolio, Southern (SO), Duke (DUK), and NextEra (NEE) vs the US 10yr Yield there seems to be some correction to go. The last time the UST 10yr was a 5% the PE of these stocks was closer to 14x PE vs 17x on YE24 consensus estimates.

Southern Company PE vs UST Rate (Created by author with data from Capital IQ)

Historic PE Ratio for SO, DU & NEE (Created by author with data from Capital IQ)

Portfolio Overview

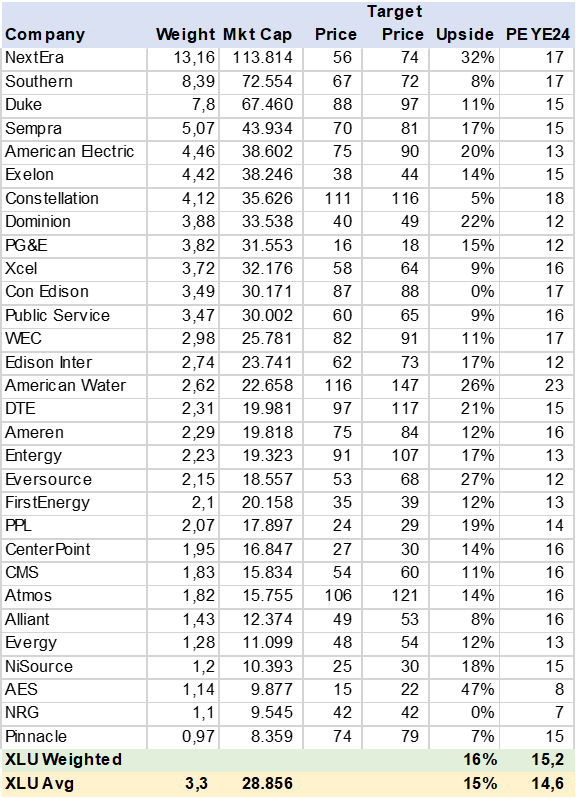

XLU is a relatively well-balanced and diversified portfolio with 30 holdings at an average weight of 3.3%. I used consensus estimates to calculate a series of metrics that should help investors identify if the ETF warrants a position. In this first analysis, I calculated the ETF’s upside potential of 16%, this is based on consensus price target for YE24. In addition, the portfolio is trading at 15.2x PE on YE24 EPS estimates. As mentioned above, this seems a bit high.

XLU Consensus Price Target (Created by author with data from Capital IQ)

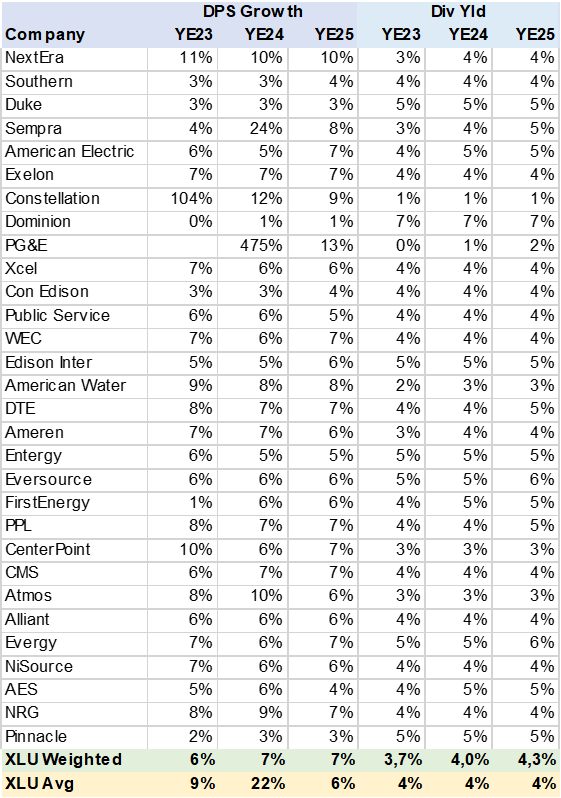

Dividend Growth

The ETFs holding are estimated to produce 7% DPS (dividend per share) growth through YE25 and payout over 4% dividend yield. In a low-rate world this would be very positive, however with UST yields at 5% it’s not so great in my view. The large growth at PG&E (PCG) is due to the expectation that this company will commence dividends in YE24. However, this big growth is tempered by a 1% dividend yield. Dominion (D) stands out with a 7% yield despite flat DPS. I do not find the dividend potential of this ETF a reason to buy.

XLU Consensus DPS Growth & Yield (Created by author with data from Capital IQ)

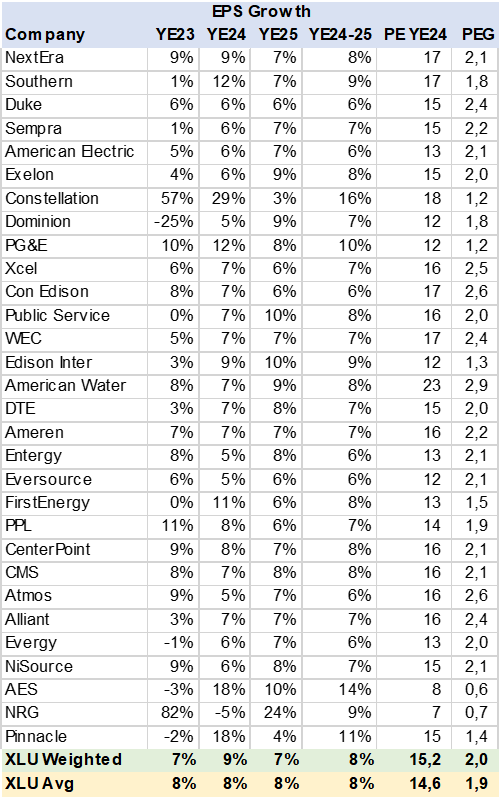

EPS Growth and PEG

I calculated that XLU has 8% EPS growth on consensus estimates for its 30 holdings, which is quite positive given the demand for electricity is growing around 3% per year. Electric utilities have a substantial component of regulated pricing that looks to provide a reasonable return on investment thus volumes and cost management are the differentiators.

When I compare EPS growth to the YE24 PE i.e., a PEG ratio, I find the sector a bit expensive at 2x PEG. A stock is generally viewed as cheap with a PEG of 1x or less and more expensive above 1x. In the recent analysis of (VGT) VGT: Need To Love Apple And Microsoft a technology ETF, I calculated a PEG of 1.6x. Valuations should be relative to growth, in my view.

AES (AES) and NRG (NRG) stand out as potentially cheap with a PEG under .7x. However, these two stocks seem to have more volatile EPS growth.

XLU Consensus EPS Growth & PEG (Created by author with data from Capital IQ)

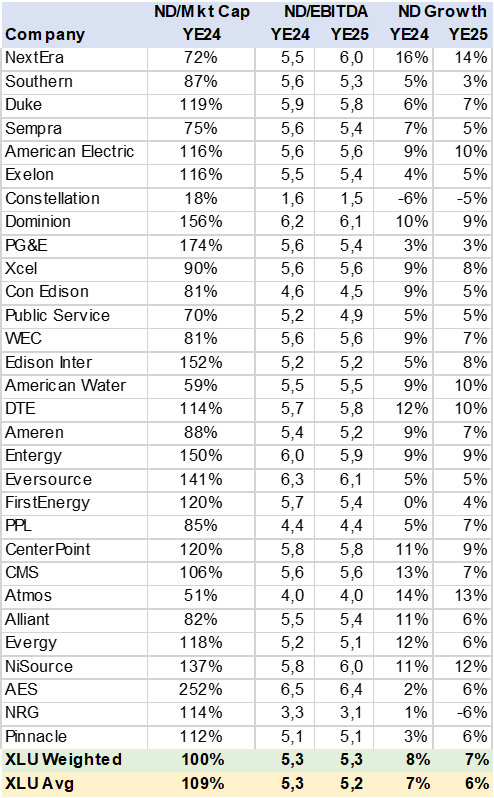

Escalating Debt Risks Dividends

The main risk to this sector and the ETF is the need for the companies to add capacity, update grids, and reduce carbon emissions that require high levels of capex that is funded with debt. This is or was a positive value creator when rates were far lower, today debt costs are increasing and may squeeze EPS unless the added costs are passed on in electricity rates.

I calculated that the XLU portfolio has an ND/EBITDA ratio of over 5x. This level of leverage is quite high, especially as debt costs have increased. In addition, ND (net debt) is growing at over 7% and is equal to market cap. All of this makes the sector very sensitive to rates and my main concern is that companies will need to reduce dividend payouts.

XLU Consensus Net Debt (Created by author with data from Capital IQ)

Conclusion

I rate XLU a sell. Higher rates or the cost of debt and risk-free have a dual negative impact on electric utilities. Higher rates impact valuations given the sector’s bond proxy status while debt cost to fund capex may squeeze cash flow and require dividend cuts that exasperate valuation risk.

Read the full article here