Investment Thesis

Since our last Buy stance on Legal & General Group Plc (OTCPK:LGGNY) (OTCPK:LGGNF) on the 9th of March, the share price has been down 14%.

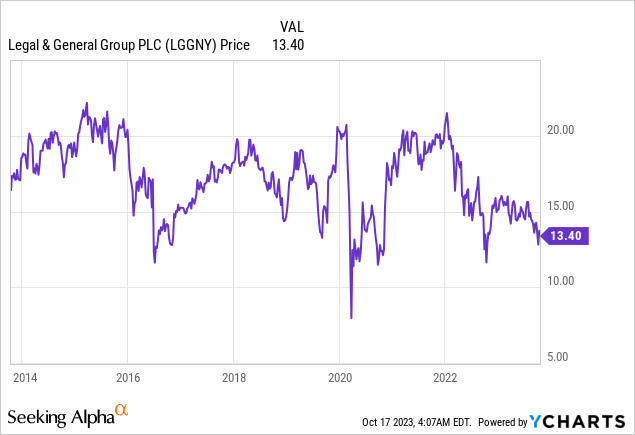

Seven months is not a long time of gestation. However, it is clear from looking at a long-term chart of 10 years, that the share price of LGGNY is now lower than what it was back at the end of 2013.

One share of the ADR LGGNY represents 5 ordinary shares of Legal & General Group Plc.

It is thoroughly loved by analysts here in SA, including us here at Tudor Invest.

SA analysts like LGGNY very much (SA)

The stock market is made up of thousands of participants. For the most, it is the large institutional players that drive the direction of the price, and not the retail investors/traders. Do they know something that we don’t know?

Here, we examine what could be potential reasons why it is not more “loved”.

Valuation

We like to start here, just as a mental checklist. Something we do for all our equities on a regular basis. Since we own Legal & General through their listing on LSE, we will use reference to the shares listed there and use the currency of GBP or GBpence.

The share price, as of the end of trading on the 16th of October was GBP 2.18

The TTM EPS is GBP 0.396, which gives it a P/E of just 5.5

We have a book value per share of GBP 1.94 which gives us a reasonable P/B of 1.12

As such, we rule out valuation as a valid reason for the share price being low.

Growth, or lack of it

The insurance business is not exciting. At least for me, when I imagine what an actuary looks like, I get visions of someone who is neither popular nor fashionable. Like an old uncle or aunt, I had back in Norway.

It is not high-tech with young and beautiful people as we see in some of these internet start-ups. Grab Holdings (GRAB), here in Singapore comes to my mind. All of these start-ups have one thing in common, they burn cash but sell investors on prospects of phenomenal growth.

Back to terra firma, where we live and invest, LGGNY has managed to grow its operating profits, excluding adjustments to asset valuations, quite well.

Over that 10-year period which we used to look at a lower share price, LGGNY increased the operating profit from GBP 636 million in FH 2014 to GBP 941 million in FH of 2023. It was even higher in FH of 2021 when they recorded GBP 1,079 million. But let us not “cherry-pick” numbers. Let us use GBP 636 and GBP 941. It was still growing at an average annual percentage of 4.79%.

In that same 10-year period, the inflation in the UK was only 0.314%. according to the Bank of England.

Some might argue that we are looking in the rear-view mirror. using data from the past. That is true.

When we want to look into what the future might hold, we tend to listen to the management and do our own research as to whether their growth projections make any sense. LGGNY is growing internationally.

Their Investment Management division had a net inflow of GBP 7.4 billion in FH of 2023. International AUM now stands at 39% of LGIM’s total assets under management.

Demand for retirement benefits is going to grow with a larger aging population and more countries’ governments unable to meet all of the people’s needs. This is for sure.

LGGNY reported in their FH 2023 financial report, a reference to a study done by Broadridge, UK Defined Contribution and Retirement Income report 2022 which stated that:

There are currently approximately GBP 600 billion in UK-defined contribution (DC) accumulation assets, of which LGGNY manages GBP 146 billion, and this is expected to more than double over the next 10 years.”

A growth of 4-5% annually is quite realistic, in our opinion.

Dividend Safety and Growth

This brings us to the dividend. Management has communicated that they see the dividend growing at an annual rate of 5% for the next couple of years.

Legal & General dividend growth (L&G FH 2023 Results Presentation)

The current dividend yield is a tantalizing 8.9% on a TTM basis. If we take into account the 5% increase per year going forward, we are looking at a yield north of 9%.

Financial consults will probably tell people that such high dividend yields are surely not sustainable and certainly not safe. Often that is true, too.

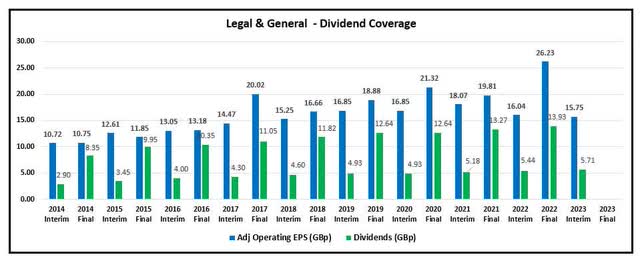

However, let us examine how well the dividend is covered. We do not use earnings that include adjustments for variations to market values of their investment assets. These are not important. We use operating earnings that exclude these accounting items.

Legal & General dividend coverage (Data from L&G. Compilation and graph by author)

The dividend is well covered by operating earnings, although we should point out that it is slightly lower in FH 2023 when compared to the last couple of years.

There are no guarantees in life. Only death and taxes. Nevertheless, we do think that LGGNY’s dividend going forward should get an “A” for safety.

Complex liabilities

Here is perhaps the Achilles heel.

Before we became shareholders in Legal & General, we did what we always do, that is to do a risk assessment of its assets and liabilities, amongst several other criteria we have.

We are not actuaries and have to admit that we came to the conclusion that it was hard to assess what the liabilities were. This has not changed.

Perhaps there are actuaries reading this, that have not been offended by our generalistic view of their lack of sense of fashion, that can educate us on how we should rightfully determine the liabilities.

Conclusion

In an efficient market hypothesis, all risks and rewards are interlinked.

The more risk you take, the higher the reward is. On that topic, we hold some preferred shares in one of Europe’s largest landlords Heimstaden AB (OTCPK:HMSNP) which now pays 16.9% per annum, after withholding taxes. The market is effectively saying that the company will at best stop paying dividends, or at worst go bankrupt.

Back to LGGNY, there is a risk that the share price continues to trade in the low GBP 2 per share or about USD 13 to 15 per ADR. At least, for those who are looking for a relatively safe income stream, we are of the opinion that the 9% per year is attractive enough to accept such a risk.

Our stance remains a Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here