Above: Succession was emblematic of the quality level of HBO that sustains subscription growth into the out years.

“If you are going through hell, keep going…”

Winston Churchill

The media/entertainment sector has been anything but pretty, as the streaming wars continue to send torrents of losses destroying what pretenses are left of the business model. Nowhere does it appear that the guys at the helms of these companies have a certain clue as to how to staunch the losses, or repurpose their businesses to reflect the ugly reality of a sector yet to discover a viable path out of the mess they have gotten themselves into. None have been spared. All have appeared to reach for the quick fix of Captain Obvious solutions: layoffs, cost cuts, price increases, and the arrival of new content “viewers will love.” As a result, sector stocks in general seem dead pooled, sitting around at valuations that at best invoke shoulder shrugs from Mr. Market.

Pomp pom twirlers for Disney (DIS) and Netflix (NFLX) remain hopeful but that has not to any great extent translated to bubbly accelerations of their stock. Bears lurk as well. Countless investors still see most of the streamers as dogs with fleas. We have deep-dived many stocks in the sector, read countless appraisals by both bull and bear theorists.

Much of it here on Seeking Alpha has been very good in putting either case to readers. The problem as I see it is that no real compelling case has been made by most of the analysis that would lead investors to see a runway. There seems no case for exponential earnings growth ahead due to the solving of the core dilemma: What will the business look like over the next few years? Managements don’t seem to have the answer yet.

I hardly pretend to have discovered the all-elusive alpha that could drive one or more sector peers ahead of the pack at an entry point that would seem tantalizing. Yet, in going through all the trend lines, earnings prospects, and cures flooding the opinions of sector stocks, I have come back to my original thesis: Warner Bros. Discovery, Inc. (NASDAQ:WBD) is the horse to bet on.

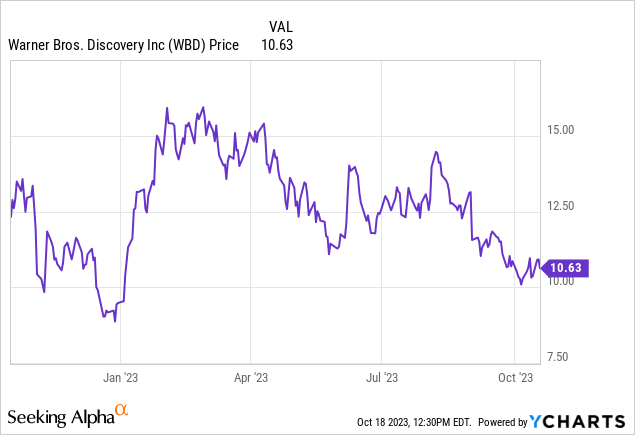

Part of my view comes from the recent price history of the stock. Relative to the ground-rooting prospects ahead, I concluded—rightly or wrongly — WBD at ~$10 a share is by far the best buy in the entire sector. It may not appear to have the simple business model of Netflix, or the diversity of Disney, or the IP of several other sector leaders. But what WBD does have is the clear commitment for hardscrabble cost savings as a mantra, debt repayment as a religion, and most of all, an array of content services easiest to sell off, consolidate, or spin off.

Born of an awful hodgepodge of AT&T (T) blunders, WBD offers much more clarity by now than what may appear to be evident to investors. That is why I believe the stock has been on the road to a dead-end street for so long.

Last September 14 th, I published in this space a view on WBD as a very attractive entry point of $11. My thesis then as it is now was that the massive inspection of the data and metrics of the stock across the entire spectrum of financial analysis essentially brought far more noise than light.

The logic was there, the metric cases presented were fine, but something was missing — particularly in opinion on WBD. By contrast, I presented a simple, and yes, some may argue, simplistic –conclusion as to a buy signal: Despite its many woes, WBD was in the hands of key people with a strong grasp on reality that I found better positioned to produce an upside than most competitors.

Plus WBD had a bigger, broader scoped inventory of product delivery services than most peers. In other words, I liked their chessboard position. I think they had more movable power pieces on their board than peers that made their strategic options formidable.

On February 22, 2022 WBD traded at $15.92. At this writing, it has dipped to $10.57. Its erosion can be traced to the negative sentiment in the sector in general without question. But there was something else. I believe there is little conviction that the mess inherited from AT&T has been solved yet, nor is there any evidence that it will be to date. Investors appear to be circling the wagons around Netflix as the penultimate, safest bet on the new era of streaming ahead. Understood, of course. But that is the move to buy into the $354 a share leadership play. They believe it offers the best shot at making money in that sector stock far and away. It’s hard to argue against the conviction here. Netflix is the easiest stock in the sector to understand.

But when you compare the flexibility of WBD in making more big moves faster with more product aimed at so many demos at $10 vs. Netflix, you can begin to sense there may well be a screaming buy hidden here. And my contention, I believe, is bolstered by the two prime chess masters WBD brings to the match: Messers Zaslav and Malone. I’ve sang their song several times on SA. Most commenters have agreed, others disputed that their presence could be that much of a plus against competitors. It’s a fair argument.

Yet as an analyst who has spent the majority of his career in the c-suite of billion dollar corporations, I stipulate that I come to the key man view from that perspective. I compare their track records and on-the-ground savvy in the media and entertainment fields with peers.

Just a few examples of sector leadership people engaged in the race

Robert Iger a Disney: Up from the ranks of ABC studio assistant, through rung-after-rung of the Disney ladder, mostly long periods when the company coffers were overflowing with cash. Iger was a top price buyer of IP, a happy steward over a happy place. Nowhere in his tenure, IMHO, did he face big-time challenges to the DIS fortress. Solutions to date, okay, but far from what DIS really needs to regain its lofty valuation at $200.

Shari Redstone and Robert Bakish at Paramount (PARA): Shari was fine snatching poppa Redstone out of the clutches of his gold-digging lady friends, but as the key personage in Paramount it would appear that her aim is to try and move the stock into a position where an avid buyer is found who is willing to park the Brinks truck at PARA’s back door. Bakish is a decent industry journeyman, not much else.

Ted Sarandos, Netflix: A solid performer who began life checking out videos in a store and built his way to the top, ultimately replacing the singularly brilliant Reed Hastings. But the Netflix business model is easy to understand, positioned for sustained leadership and very well financed. It’s a plus to have Sarandos, but he does not face challenges anything near what the WBD guys do.

By contrast, I believe the two primary chess masters for Warner Bros. Discovery, Inc., plus their ingenious COO Gunnar Wiedenfels, are all combat-tested winners in battles over long careers that literally became, from time to time, obstacle courses. No other sector peer has managements that have faced the demolition derby these executives are dealing with every day. They have stepped up to the plate and are grinding out base hits while generating respectable free cash flow (“FCF”), enabling them to steadily extinguish an enormous debt load.

Estimated guidance FCF for 2023: $5b

LT Debt at writing: $47.8b

Our calculation using standard formula for assessing intrinsic value comes to $26.53 per share.

Conclusion

We end with a question: Assuming you buy our thesis that WBD has a ton of moveable power product, is generating enough cash to comfortably meet massive debt service numbers, and key management operatives who thrive on challenges and get results—why would you not open a position on WBD at $10?

Yes, I understand there may be many reasons to resist that can line up and conclude — no way. But my alternate view brings me to sense a breakthrough on WBD price may not be that far away going to the end of this year — and ON TO Q1 2024.

Read the full article here