W. P. Carey Inc. (NYSE:WPC) is a leading net-lease REIT that continues to represent deep value for passive income investors with a desire to capture recurring dividend income, but that also have an eye on the potential for capital appreciation.

The commercial net-lease real estate investment trust spun off its office portfolio to shareholders recently and has, in my view, a good chance of returning to funds from operations growth in 2025.

With short-term interest rates also potentially getting slashed, debt-financed acquisitions in the trust’s core business of industrial and warehouse real estate could make a difference and set W.P. Carey up for growth again.

My Rating History

A few months ago, I penned an article on W. P. Carey with the title W. P. Carey: Don’t Hold A Grudge, Buy The Drop And Lock In A 6% Yield in which I made an investment case for the commercial real estate investment trust as its portfolio reorganization continued.

Looking into the future, I see a net-lease trust that is poised to grow its adjusted funds from operations. With a clearer strategic outlook and cash from its lease business continuing to trickle in, I think W.P. Carey could soon focus on growing its cash flow through acquisitions again.

W.P. Carey: Portfolio Reorganization And Return To Growth

W.P. Carey partially sold and partially spun off its office properties after the real estate investment trust surprised investors in September of last year with its desire to change its portfolio composition.

Due to well-documented problems in the office industry, W.P. Carey laid out a new vision for the net-lease trust by returning to its industrial real estate foundation.

As of March 31, 2024, W.P. Carey owned a total of 1,282 properties in real estate including 168.4 million square feet. This real estate posture is poised to produce $1.28 billion in annualized sales for W.P. Carey in 2024. The future, however, should look more exciting for the trust as W.P. Carey utilizes its cash flow (and potentially lower interest rates) to go on the offensive.

Large Diversified Portfolio (W.P. Carey)

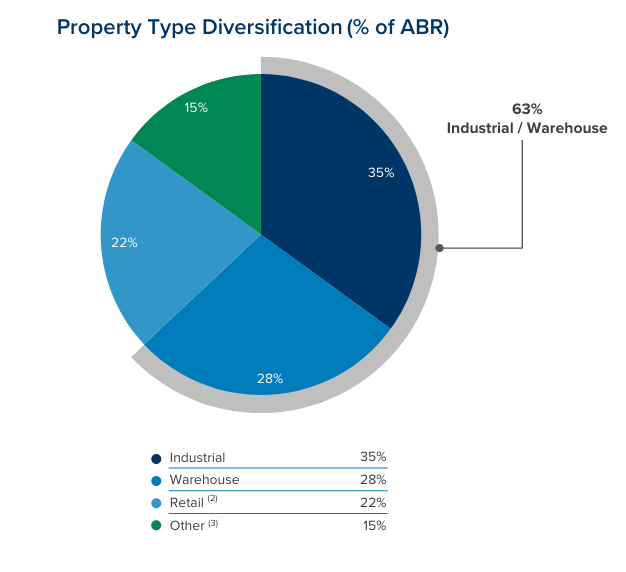

W.P. Carey is now, following the spinoff and sale of its office properties (of which the trust retains a small percentage, but is poised to divest of in 2Q24), primarily concentrated in industrial properties, warehouses and retail.

The trust has said that it plans to conclude its office sale plan in the first half of the year and that it anticipates to collect between $550 million and $600 million from such sales.

Property Type Diversification (W.P. Carey)

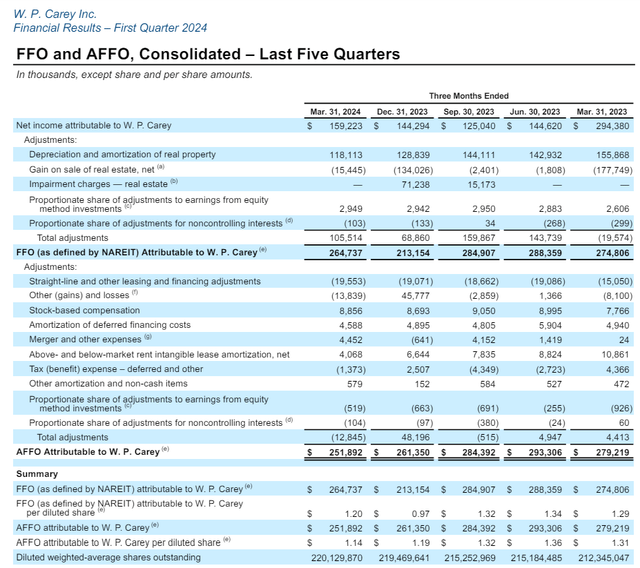

Moving forward, W.P. Carey is an attractive play on acquisition growth, in my view. The real estate investment trust produced $251.9 million in adjusted funds from operations in 1Q24, down 10% YoY. The decrease in AFFO is due to W.P. Carey selling office and spinning off office properties to NLOP.

One catalyst for new acquisitions could come from lower interest rates. As the central bank starts to lower short-term interest rates, acquisitions financed with debt would become more affordable and allow REITs like W.P. Carey to leverage their existing FFO strength.

AFFO (W.P. Carey)

Pay-Out Ratio Allows For Sustained Dividend Growth

W.P. Carey set its dividend at $0.865 per share in 1Q24 and it was the first quarter the net-lease real estate investment trust has grown its dividend (from $0.86 per share in the prior quarter) after the trust completed most of its office transactions. The increase in the dividend in the first quarter sends a strong signal to passive income investors that W.P. Carey will restart its history of dividend growth moving forward.

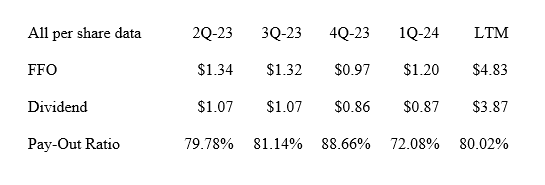

In the first quarter, W.P. Carey earned $1.20 per share in funds from operations which brought the dividend pay-out ratio to just 72%, down from 89% in 4Q23. In the last twelve months, W.P. Carey paid out 80% of its funds from operations, but the trust’s pay-out metrics are poised to improve in the next several quarters as W.P. Carey realigned its dividend with its lower AFFO potential.

From a dividend safety angle, I think that both the low 72% pay-out ratio as well as the fact that W.P. Carey has started to increase its quarterly dividend again, make an investment in the trust’s stock reasonably safe.

Dividend (Author Created Table Using Trust Information)

Moderate AFFO Multiple

W.P. Carey affirmed its 2024 guidance of $4.65 to $4.75 per share in adjusted funds from operations in 1Q24 which equates to an AFFO multiple of 12.0x. The guidance reflects the expectation that the net-lease trust will spend between $1.5 billion and $2.0 billion on acquisitions this year while guiding for a disposition volume of between $1.2 billion and $1.4 billion. The net acquisition volume of up to $800 million could be a catalyst for AFFO growth.

With a possible path towards AFFO growth, I think W.P. Carey could re-rate to a 14-15x AFFO multiple (implied intrinsic value of between $65 to $70) which the trust easily achieved before the office exit program was announced.

Realty Income Corporation (O), which is predominantly focused on retail properties, but which has some industrial exposure as well, is presently selling for an adjusted funds from operations multiple of 12.8x.

Why W.P. Carey Could See A Lower Valuation Multiple

W.P. Carey, as I alluded to, is now growing its dividend pay-out again which I think will draw more passive income investors back into the stock. There are a number of ways, however, in which W.P. Carey could mess up including a failure to grow its funds from operations through organic means (increasing rental income) or through acquisitions.

Higher-for-longer interest rates could also delay the possibility for W.P. Carey to tap credit to stem acquisitions to boost its AFFO growth.

My Conclusion

W.P. Carey is going through a transitional period, but the net-lease commercial real estate trust is poised to see a stabilization of its AFFO after the office transactions and the dividend pay-out ratio has improved as well.

Furthermore, the dividend has started to grow again and the trust is focused on doing a limited amount of AFFO-boosting property transactions that could help investors conceptualize W.P. Carey as a growing real estate investment trust with attractive, acquisition-driven AFFO upside.

I think that W.P. Carey’s valuation multiple has decompression potential if it announces more acquisitions and pushes for AFFO growth. Though 2024 is a transition year for W.P. Carey, the dividend is not at risk as far as I can tell and the growth story is soon to resume, in my view.

My conviction in WPC is so high that I made the trust my second-biggest REIT investment in my passive income portfolio.

Read the full article here