Vital Energy (NYSE:VTLE) has been making all these acquisitions lately, yet the profitability is not quite what management promised. The last article noted one more acquisition to improve profitability still more. Management even noted before they made that acquisition that they had raised the bar. Yet, the profits have not been what everyone expected. So, what exactly happened, and why is the profitability not yet what investors expected?

Earnings Miss

The website noted an expectation of earnings of $1.80 per share. But GAAP accounting has made trying to estimate earnings very tricky. Adjusted earnings are non-GAAP. But at least adjusted earnings take some of the variables that are not under the control of management “out of the picture”. So, the first issue would be if the expectation number is the GAAP number, or the non-GAAP adjusted earnings.

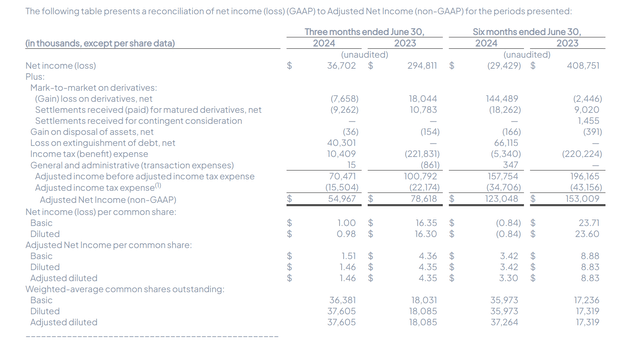

Vital Energy Adjusted Earnings Calculation Second Quarter 2024 (Vital Energy Second Quarter 2024, Earnings Press Release)

Probably the biggest distortion between in the adjusted earnings calculation (from the GAAP figure) involves the elimination of the loss on extinguishment of debt. Note that there is a big year-to-date loss on derivatives. But that noncash adjusting figure is likely to reverse if the lower oil prices persist.

The other figure that needs the investor attention is the sizable income tax benefit in the previous fiscal year.

What is left (as the adjusted earnings figure) then is management’s vision of what income operations delivered without some non-operational or nonrepeating items. That is already an improvement over what was reported. It is also far closer to the earnings expectations than the GAAP number reported.

Note that without the derivative effects, the company is profitable. Those hedges are really an opportunity cost for taking a certain price ahead of time in the expectation that the price taken ahead of time will produce a sufficient profit for the company to meet its needs. That cost is therefore not a cash cost because the cash cost appears when the hedges settle.

Production Costs

The other worry is that production costs climbed. But many times, the operator from which the properties were purchased was not current on low-cost operations. Therefore, the property breakeven is often far higher than it should be.

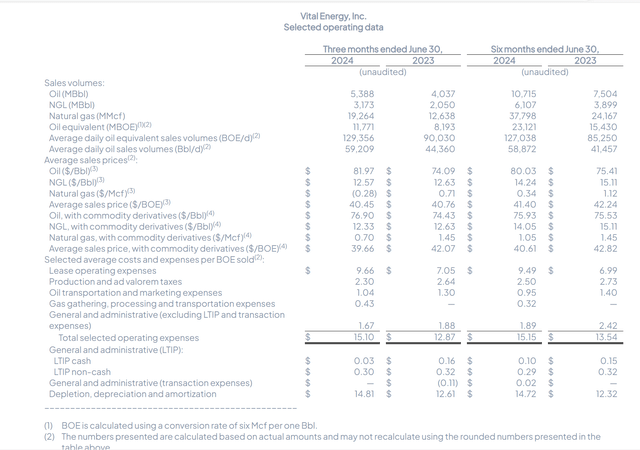

Vital Energy Key Sales And Production Data Second Quarter 2024 (Vital Energy Second Quarter 2024, Earnings Press Release)

Note that production and Ad Valorem taxes are higher than the year before. Generally, when a purchase is made, the buyer inherits the seller’s costs. It is honestly usually the reason that the seller wants to sell. This management will obviously be looking for ways to bring that cost down as time goes on.

Sometimes it is simply older production that is higher cost. Many sellers have not drilled recently on their acreage. Some have not drilled in many years. The average production cost then comes down simply by drilling new wells using the latest technology so that there is a production (age) average. Other times, there has to be enough new lower cost production established to bring down the average cost. Rarely is there a lot of optimizations that can bring down existing production costs a lot.

Similarly, the depreciation is likely determined by the assumptions made after the acquisitions close about the remaining production life of the wells. For tax purposes, usually management wants as much of the acquisition cost as possible attributed to the wells because they deplete as they produce, whereas the land value remains. A conservative stance means a relatively high depreciation protects that higher cost cash flow from taxes so it can be used to optimize operations and hence lower future costs.

The last consideration is that overall average BOE sales prices appear to be lower in the current fiscal year. The combination of buying high-cost production combined with lower sales prices caused the profits to evaporate. Then the items shown to get adjusted income finished the job.

How This Will Get Fixed

The first consideration was that the acquisitions are in areas that generate far more cash flow at current prices, provided the latest well drilling and completion techniques are used. After that, operating expenses need to be “rock bottom”.

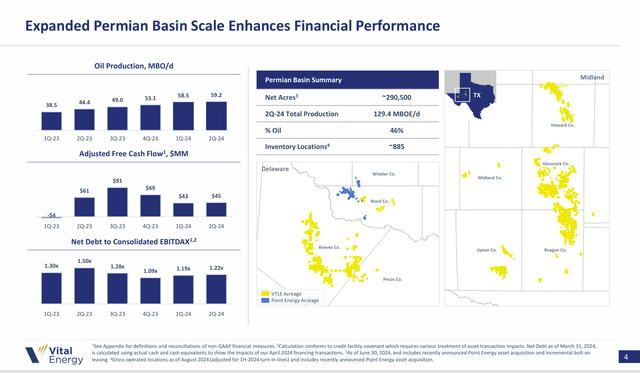

Vital Energy Movement Towards More Free Cash Flow And Lower Debt Ratio (Vital Energy Second Quarter 2024, Earnings Conference Call Slides)

Management is going for more oil production as a percentage of production by looking for acreage that will cash flow more than legacy acreage. The last article noted that new wells drilled are doing much better than the inherited production. Since unconventional wells have first year declines that are large and then that decline rate levels off in a few years, management can replace a certain amount of production with lower cost production each year. They just have to keep up with the technology improvements sweeping the industry.

The latest acquisition is shown above and continues that trend towards better cash flow acreage. Already, the debt ratio has improved tremendously, as shown above, since management took over. Now the next acquisition will be made for debt. So, the debt ratio will climb some. But if that acreage meets management’s raised guidelines, then the debt ratio should quickly respond and go lower.

New Well Design

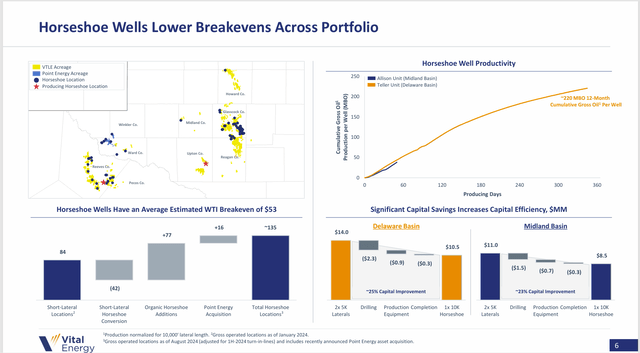

Shown below is one of the latest cost savings ideas for those areas that need a short well drilled.

Vital Energy Horseshoe Wells Cost Savings Demonstration (Vital Energy Second Quarter 2024, Earnings Conference Call Slides)

Basically, instead of two short laterals, the new idea is one Horseshoe well that saves more than 20% in well cost. A lot of the previous operators had breakeven points over WTI $60. Already management is making good progress towards lowering the breakeven point as shown above. This is very likely not the last attempt at becoming more efficient, either. ://

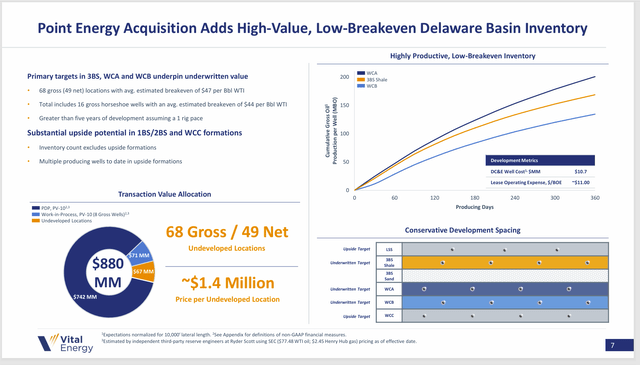

Vital Energy Point Energy Acquisition Advantages Summary (Vital Energy Second Quarter 2024, Earnings Conference Call Slides)

The other thing that usually helps is that management usually presents a conservative production graph. The constant technology advances often mean that management can beat the production graph shown above in a number of acquired locations.

Generally, that means that new production will have breakeven points in the WTI $40’s range. Since technology advances are expected to continue, there is every chance that later wells will have lower breakeven costs than the ones drilled immediately after an acquisition.

Even though the above slide is for one specific acquisition. Previous articles had expected production graphs, and then management announced better results from time to time.

Conclusion

The company is transitioning to a very different strategy than what management inherited several years ago. Much of the legacy acreage is now out of the picture as shown below:

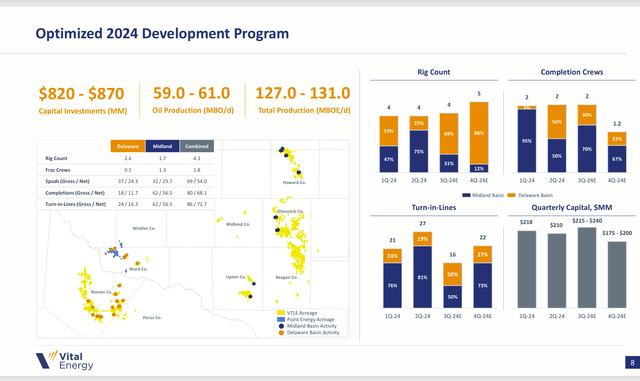

Vital Energy Development Plan With Pending Acquisition Included (Vital Energy Second Quarter 2024, Earnings Conference Call Slides)

Note that the pending acquisition competes for capital right away. In fact, it may be some of the best acreage in the portfolio. With the new design horseshoe wells, small acreage positions just became far more profitable than they have been in the past.

The rest of the cost reduction comes from an optimal well design and fracking strategy. That will likely develop over time. What is clear is that shareholders should see profitability improve materially each quarter as one-time costs fade and some of the management improvements are implemented.

One thing that has been happening is that many companies are reporting a lower capital budget as the year continues. That may happen here as well. But it is far from assured.

This company remains a strong buy recommendation as management continues to turn the company around to a positive cash flow level that agrees with the current market demands. The debt ratio is no longer a concern. Now it is the debt rating and adequate free cash flow in the current environment.

Risks

The technology advances that many see advancing for years into the future, can stop at any time without warning. However, this unlikely it may seem, there is never a guarantee as to when or if technology will advance.

Any acquisition can fail to meet expectations. This management is experienced at building and selling companies. Therefore, the risks of an acquisition being unsatisfactory are reduced. However, it can happen at any time.

Any upstream company is subject to the low visibility of future prices and the volatility of current prices. A severe and sustained downturn of commodity prices can change the future outlook of an upstream company.

The loss of key personnel can be particularly devastating to any company. That can be very true of a smaller company like this one that has a lot less people involved in running the company.

Read the full article here