Vanguard International Dividend Appreciation Index Fund ETF Shares (NASDAQ:VIGI), launched on 02/25/2016 and managed by The Vanguard Group, Inc., is an ETF that focuses on primarily providing income through dividends paid by non-US companies.

With assets under management at $6.95 billion, this is one of the largest ETFs offering exposure to dividend stocks outside the United States. In this article, I will explain why I think that this won’t be of value to investors unless they already have exposure to U.S. dividend stocks and need wider diversification.

Methodology

First of all, this is a passive ETF in that it attempts to replicate the performance of the S&P Global Ex-U.S. Dividend Growers, an index that tracks the performance of high-quality dividend stocks issued in developed and emerging markets outside the U.S.

VIGI’s issuer has stated that the constituents have the ability and the commitment to grow their dividends; how the index assesses the second quality isn’t known, however, as S&P Global only reveals that the eligible companies have a 7-year dividend growth history. Another thing we do know is that out of the available universe, the index excludes stocks whose dividend yields make them rank in the top 25% based on the highest yield. That’s not unusual with such funds, but it may imply the assumption that the highest-yielding stocks in the universe may not be of high quality. That’s of course not unreasonable, but may result in an unnecessary filter if the dividend payment record is solid.

Another thing I need to comment on is how the index completely excludes the REIT industry. My best guess is the tax complications that may arise within the ETF regarding dividends paid by REITs as those are not qualified. The index also excludes China-A shares that trade on XHSE or XSHG. If I had to guess here again, I would say that this is related to a potential lower transparency with the financial results of many of the stocks listed there as well as government intervention presenting a risk.

You should also know that both common and preferred stocks are eligible for index inclusion and that the constituents are market-cap-weighted but have a weight cap of 4%. I appreciate the cap for such a portfolio because I believe that there could be a strong inverse correlation between market cap size and dividend yield; the biggest businesses are usually the most efficiently priced. While the ETF will reconstitute annually in March, it rebalances the portfolio every quarter to enforce that weight cap.

Allocations

With a portfolio of 312 holdings, this ETF is more than sufficiently diversified to provide greater income than traditional broad-market ETFs at a generally low volatility. Impressively, the median market cap was last reported at $77.5 billion, which further provides a sense of stability for income-oriented investors.

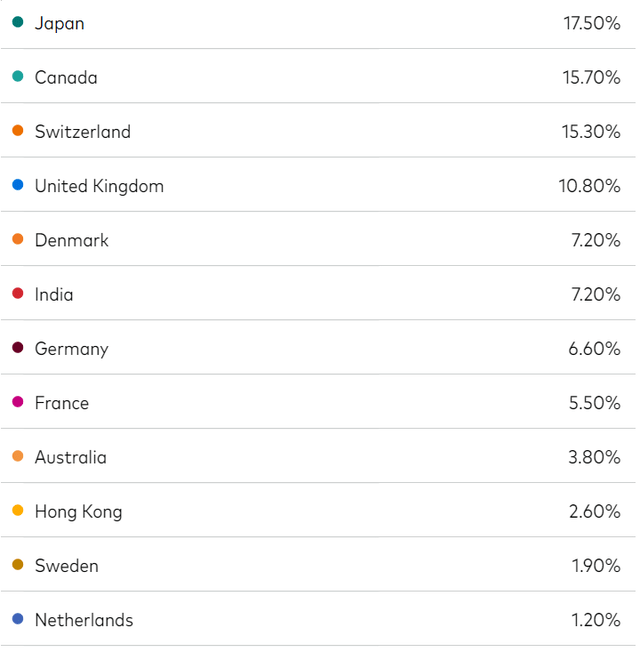

Not surprisingly, with the exclusion of U.S- and China-listed stocks the fund’s holders would be mostly exposed to Japan, Canada, and European countries:

vanguard.com

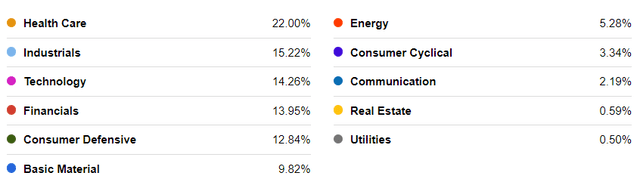

Moreover, investors should know that the current sector composition weighs more towards Health Care than the other sectors (not that this particularly reflects some extraordinary risk here, as the allocation is less than one fourth of total funds):

Seeking Alpha

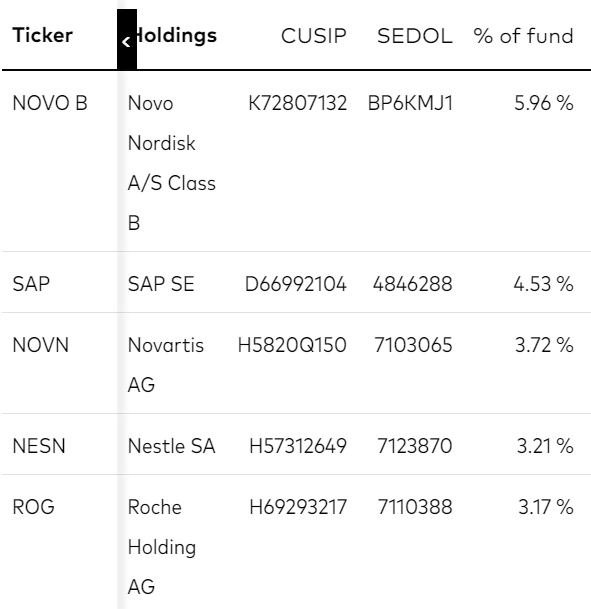

Last, it appears that the two top holdings that represent more than 10% of the fund both have dividend yields below 1.5% based on TTM distributions.

vanguard.com

However, the other three of the top 5 holdings have yields ranging from 3.2% to 4.6%. Regardless, this is where I usually object to the lack of a minimum yield criterion as VIGI’s current dividend yield is approximately 2%, which I doubt reflects a potentially attractive income stream for investors.

Performance & Cost

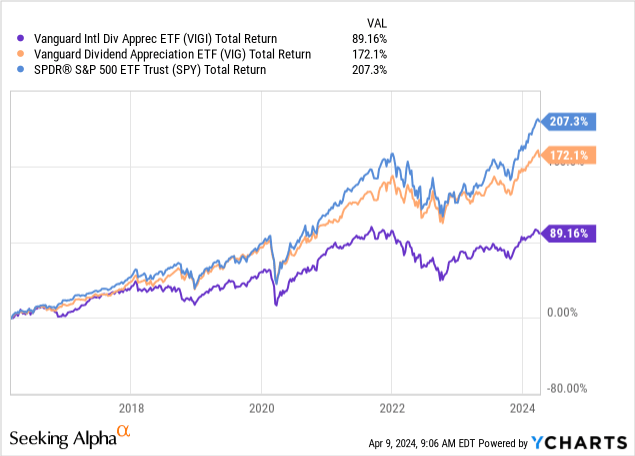

Moving on, its total returns have been underwhelming since VIGI was launched as it underperformed SPY by a great margin and its U.S. counterpart has done much better as well:

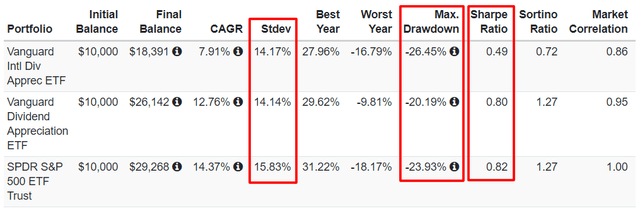

The Vanguard Dividend Appreciation ETF (VIG) has the same approach as VIGI, but focuses on U.S. large-cap dividend stocks by tracking the performance of the NASDAQ US Dividend Achievers Select Index. As illustrated by the table below, VIG has been as volatile as VIGI, but with a significantly lower maximum drawdown and a much better Sharpe:

Portfolio Visualizer

As such, VIG’s risk-adjusted returns have been much better as well. It also sports a 1.8% dividend yield right now, not much lower than VIGI’s.

While it’s true that the performance is not attractive when compared to U.S. dividend stocks, I think that the 0.15% expense ratio is not unreasonably high for VIGI. First, transaction and forex fees result in an overall higher cost, and competitors like iShares and Schwab charge far more than that.

Risks

Of course, the most significant danger here is presented by an opportunity risk. This is a well-diversified fund of large companies with solid dividend track records, and as far as I can see, it’s unlikely that investors will realize long-term permanent losses with VIGI.

However, I do believe that investors can underperform in the long term, ending up incurring an opportunity cost.

Verdict

All in all, I don’t see a reason that investors should pick this dividend ETF over VIG, for instance, unless they already own shares of the latter or a similar U.S. dividend ETF and desire wider diversification for their income portfolios.

What are your thoughts? Do you own this ETF or something else? Let me know below, and I’ll get back to you as soon as possible. Thank you for reading!

Read the full article here