Investment overview

I give a hold rating for Vestis Corp. (NYSE:VSTS), as the business has yet to show tangible organic growth improvements so far. While I do appreciate the developments so far (improved retention rates and an improved sales team), I think it is too early to conclude that VSTS has managed to turn things around. Hence, I believe VSTS will continue to trade at a discount to peers in the near term.

Business description

VSTS is the second-largest provider in the US Uniform Services industry, coming behind Cintas Corp. (CTAS) (UniFirst (UNF) is the 3rd player behind VSTS). VSTS’ Core business is a very simple model where it collects uniforms from clients on a periodic basis, washes them, and returns them to the clients. VSTS collects a recurring fee from this contractual agreement. The driver of topline growth is tied to the number of contracts and revenue per contract. Profit-wise, the more route density VSTS is able to capture, the higher the margin because of the fixed cost per route. Breaking down revenue by geography, >90% of revenue comes from the United States and the rest from Canada.

3Q24 earnings (announced during the 1st week of August)

VSTS reported 3Q24 revenue of $698 million, a 1.6% y/y decline, but it was better than what consensus expected (a 3% decline). On an organic basis, revenue declined 1.4% year over year, which was a major negative turnaround from the positive ~1% growth reported in 2Q24. If we break down the growth drivers, it was a mixed bag. VSTS did capture new business deals, which contributed 700 bps of growth, and it also managed to upsell (100 bps contribution) and increase price (60 bps contribution). However, it saw major churn, which contributed -920 bps to growth. This ultimately led to adj. EBITDA margins contracting by 90bps to 12.4%.

Tangible results need to be seen

Redfox Capital Ideas

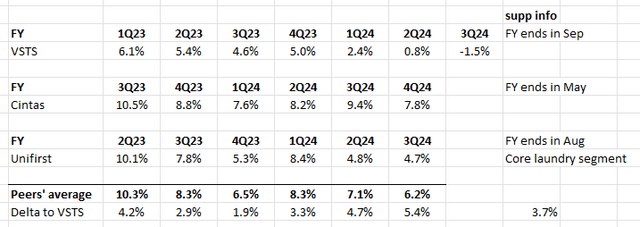

VSTS has underperformed peers by a huge margin on a year-to-date (YTD) basis (VSTS down by 51%, CTAS up 48%, and UNF up 3% (from 1st Jan) but up ~15% from 3rd Jan). I believe the reason is because of the continuous poor organic growth performance over the past few quarters. Based on my analysis, VSTS has underperformed peers on average by 3.7%, and the delta has widened over the past few quarters to a peak delta of 540 bps in 2Q24.

The positive development that investors can look forward to is that in 3Q24, the VSTS noted that the business has seen visible operating improvements. Firstly, VSTS saw recurring revenue customer retention improve 210 bps y/y to 92.5% on a YTD basis. This is good because it indicates that VSTS is not seeing large national account losses (a major turnaround from the loss of multiple large accounts last year), SME churn is now at a normalized level, and it has only seen 1-2 regional account business losses so far. This further proves that the efforts made to enhance customer service by minimizing installation time, eliminating inventory shortages, improving communications with customers, and ensuring on-time delivery are successful. For the benefit of new readers, poor service quality has been the key reason for VSTS poor performance (as per this complaint document), so this improvement in retention rate is a very positive indicator that management is working hard to rejuvenate this.

Unbeknownst to investors, however, Aramark had chronically underinvested in the Uniform Services division in the years leading up to the Spinoff, leaving the business with outdated facilities and an underperforming sales force. As a result, and as Defendants have now admitted, “service gaps” persisted within Vestis leading up to the Spinoff and throughout the Class Period that rendered Vestis unable to execute any of the levers of growth Defendants had touted.

Second, VSTS has hired a new chief operating officer [COO] with over 30 years of sales leadership experience at UPS and a senior vice president of sales [SVP] with over 19 years of sales leadership experience at CTAS, bolstering their sales and operations teams. The SVP hire (Peter Rego) should be especially noted as he brings a wealth of experience to the leadership team, having previously worked for CTAS (which has significantly outperformed VSTS). To further enhance sales force productivity, VSTS has flattened the organization, refocused on national accounts, and established a new sales center of excellence as part of its sales organization realignment.

These two developments are certainly positive on paper and directly address the key reasons for underperformance. However, I don’t think the market is going to give credit to these until VSTS reports tangible improvements in organic growth. From what I can see, organic growth continues to underperform, and management has reiterated the FY24 revenue growth guide of flat to -1%. This implies that 2H24 is going to see an even worse organic growth performance vs. 1H24 (note that 1H24 saw positive organic growth for both quarters).

I am giving management the benefit of doubt that the amount of work that needs to be done to rejuvenate organic growth is a lot more than it seems, and hence, this necessitates a lot of time to work things out. However, I also point out that, for the same reason, the stock price is unlikely to see any positive momentum for the next 1 or 2 quarters.

Valuation

The way I see it, the key to VSTS closing its valuation gap (forward PE) between itself and peers is when it accelerates its organic growth to similar levels. Since CTAS is a much bigger player than VSTS (CTAS revenue size is ~7x larger), the better competitor for VSTS is UNF (similar revenue size). VSTS now trades at 17.4x forward PE while UNF trades at 22x forward PE, and this discount is in line with the historical average (~22% discount). Given how VSTS share price has traded since the result (share price traded upwards), I think it reflects that the market is appreciating the improvement in retention rates (an early sign of a turnaround). For myself, I think it is still too early to give a buy rating. I would wait for VSTS to show a consistent trend in improving its organic growth performance (it seems like this is going to happen in FY25). Until then, VSTS should continue to trade at a discount.

Conclusion

I give a hold rating for VSTS. Although there are early signs of improvements, notably in customer retention and sales team enhancements, organic growth continues to fall behind peers. Until VSTS shows tangible improvement in this aspect, I believe the stock will continue to trade at a discount to peers.

Read the full article here