Recap

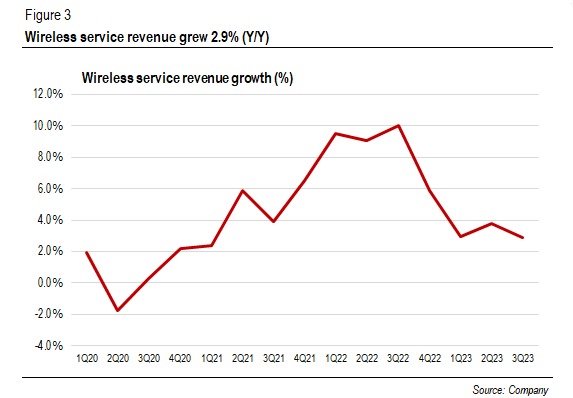

Since our last article in September, Verizon (NYSE:VZ) shares had dropped to as low as $30/share before rebounding by almost 10% following the release of the 3Q23 earnings report. We previously pointed out that Verizon’s loss of customers in the Consumer segment was a contributing factor to the stock’s decline. Yet, in the last quarter, we witnessed promising signs of improvement in the postpaid phone net adds. Additionally, mobile operators raised their free cash flow guidance as capital expenditures continued to decline. We still maintain our BUY call because the key drivers for the stock, including improving Consumer postpaid phone net adds and higher free cash flow due to lower Capex, remain intact, but shares remain at a decade-low level.

3Q23 Earnings Results

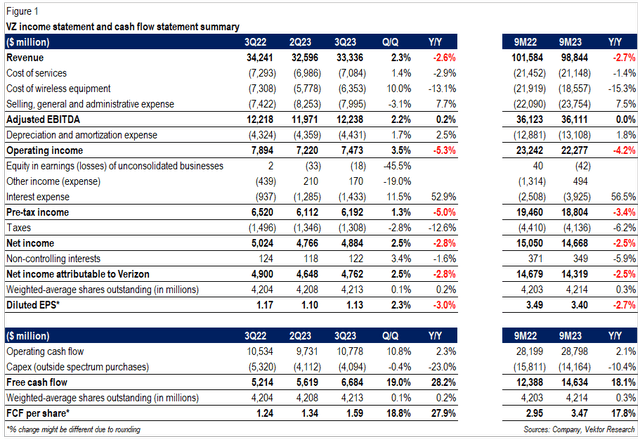

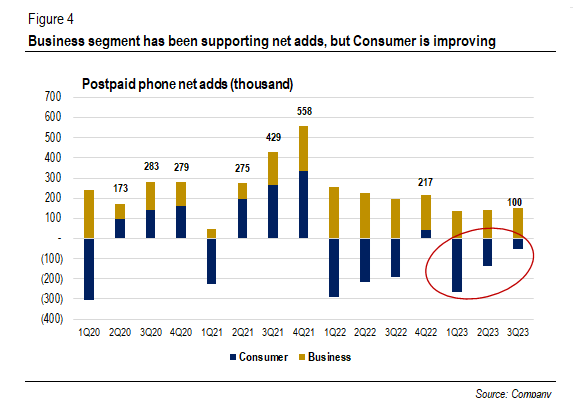

Please see the figures below for the 3Q23 earnings summary:

VZ 3Q23 income statement and cash flow statement summary (Company, Vektor Research) VZ segments summary (Company, Vektor Research)

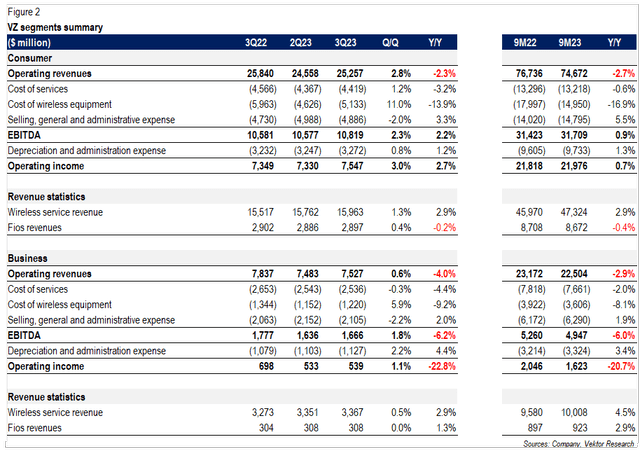

Revenues were down 2.6% (Y/Y) to $33.3 billion. But if we look more closely, wireless service revenue actually grew 2.9% (Y/Y), and the consolidated figure was dragged down by wireless equipment revenue (-12% Y/Y) due to lower postpaid upgrades. On the 3Q23 earnings call, the management attributed the growth to pricing actions, plan upgrades, and fixed wireless access (FWA). A third-tier Ultimate Unlimited is claimed to have driven premium mix and ARPA growth. During the quarter, retail postpaid ARPA increased 4.2% (Y/Y) to $156.

VZ wireless service revenue growth (Company)

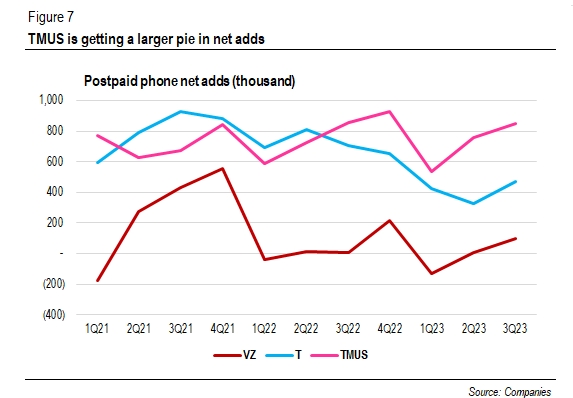

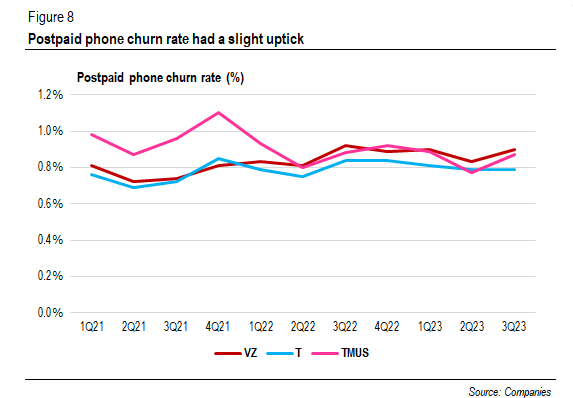

Improving postpaid phone net adds also helped. Postpaid phone gross adds stood at 2.6 million (+0.8% Y/Y). But on a net basis, the figure improved from 8,000 to 100,000. The postpaid phone churn rate slightly rose to 0.9% from 0.92% a year earlier. Indeed, in the Consumer side, Verizon is not out of the woods yet, for it is still losing customers. Yet, we note a significant improvement from the previous quarters (see Figure 4).

Postpaid phone net adds (thousand) (Company)

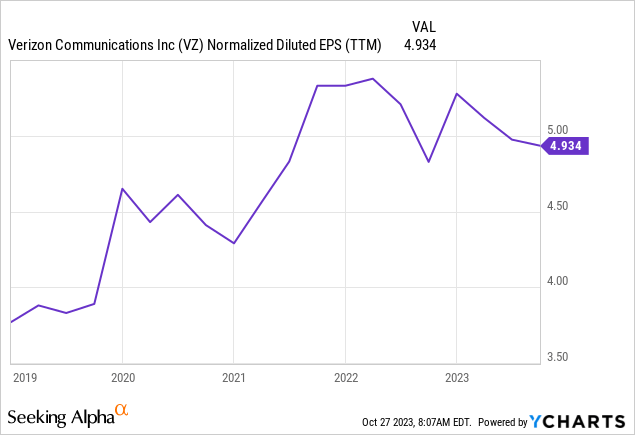

Adjusted EBITDA rose only 0.2% (Y/Y) to $12.2 billion, and its margin expanded by 100 bps. Interest expenses increased 11.5% (Q/Q) due to lower capitalized interest from the recently cleared C-band spectrum. Management expects another incremental $0.03 to $0.04 interest costs in the fourth quarter. Furthermore, adjusted EPS came in at $1.22, beating consensus estimates by $0.04. Verizon has beaten consensus estimates in 14 out of the last 15 quarters.

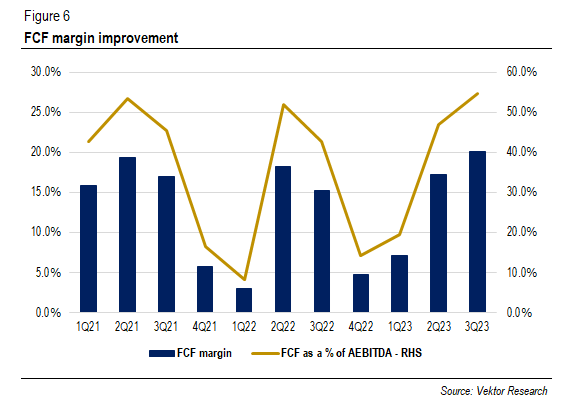

Lastly, free cash flow stood at $6.7 billion, up by more than 28% (Y/Y). Free cash flow margin was over 20%. This was mainly caused by lower working capital due to fewer upgrades and lower inventory levels. Additionally, Verizon is coming out of its high-capex cycle, resulting in higher free cash flow. Capex as a percentage of revenue was 12.3%, down from 15.5% in 3Q22.

VZ FCF margins (Vektor Research)

More Rational Competitive Landscape

While Verizon has shown notable improvements in postpaid phone net adds, it was still well below its competitors: T-Mobile (NASDAQ:TMUS) with 850,000 and AT&T (NYSE:T) with 468,000. Verizon and T-Mobile had a slight uptick in churn rate. But given most Americans already have phones, where do those net adds come from? Normal switchers, broader age groups using phones, strong demand from enterprises, and migration from prepaid to postpaid help explain the discrepancy.

Postpaid phone net adds (thousand) (Companies) Postpaid phone churn rate (%) (Companies)

According to T-Mobile CEO Mike Sievert during the 3Q23 earnings call:

And there’s lots of things driving that. You see enterprises carrying two lines, sometimes on the same phone, sometimes on separate phones. You see postpaid growing at the expense of prepaid. That trend continues, although T-Mobile continues to grow our prepaid base across all types of connections.

As Verizon CFO Tony Skiadas said:

We saw a great phone net adds in the quarter, 151,000 and over 430,000 year-to-date. And we saw healthy demand across the board. That would be enterprise public sector and small medium biz.

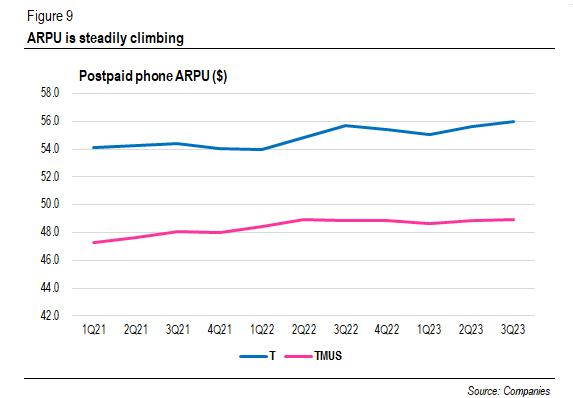

Additionally, the industry is getting more rational despite aggressive moves from cable companies. For example, some players like Verizon and AT&T increased prices for older plans, not to mention pricing actions last year. In addition, Verizon also raised its FWA offerings by $10 per month. Indeed, it makes sense for operators to demand higher returns for the massive investments they made in the last couple of years.

We believe T-Mobile will still take a larger pie in net adds thanks to its 5G leadership, while Verizon and AT&T will retain their customers and encourage them to upgrade their plans. In addition, T-Mobile announced they were leading the share gain in smaller markets and rural areas, defined as 40% of the country. As we noted in our article published in February 2022:

“In our view, we think that T-Mobile could attract more subscribers at least in the foreseeable future, thanks to its early mid-band spectrum deployment. On the other hand, Verizon will encourage more of its subscribers to upgrade to an unlimited premium tier, which could help drive growth.”

John Stankey on the 3Q23 earnings call:

…but from the best of what I can glean in our sensing mechanisms that are out of the market, we’re kind of back into a ratable share position and I think that’s actually a preferred position because the way we think about this is I’m actually more interested in growing our share of revenues as opposed to just our share of raw number of customers. And I think we’re doing as good a job of that in the industry as anybody, we’re bringing on highly accretive customers and we continue to see our share of industry revenues improve at a better rate than the share of our actual subscriber counts, which tells me that I think we’re focused on those profitable customers and bringing in the right customers.

Postpaid phone ARPU ($) (Companies)

Indeed, Verizon has access to its remaining C-band spectrum (an average of 161 MHz nationwide) purchased for more than $52 billion. On the 3Q23 earnings call, Hans Vestberg said the additional C-band was allocated straight to urban areas and would start deploying in suburban and rural areas next year. AT&T also has an averaged 120 MHz in mid-band spectrum.

But T-Mobile still has something in its sleeve: the 2.5 GHz spectrum, mostly in rural areas, from Auction 108 (still inaccessible); C-band and 3.45 GHz spectrum planned to be deployed in 2024; and possible AWS re-farming. T-Mobile covers 300 million people in mid-band two months ahead of the schedule and aims to reach 200 MHz by the end of the year.

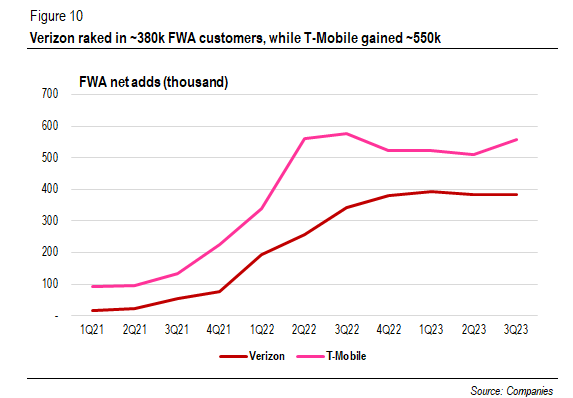

Still, in our view, the remaining C-band spectrum will help Verizon strengthen its competitive position in the FWA space. In addition, the company has witnessed a reduction in churn in C-band markets compared to non-C-band ones. Verizon raked in 384,000 FWA customers in 3Q23, a number that has remained fairly consistent in the last four quarters. At this pace, the number of subscribers could surpass 6 million subscribers, far exceeding the 4-5 million targets by 2025.

FWA net adds (thousand) (Companies)

Nonetheless, AT&T recently launched its latest FWA product, Internet Air, and has gained 25,000 subscribers. AT&T’s primary strategy is like other two players, utilizing excess capacity. But the scope is slightly different. AT&T will target customers in areas where copper network has been decommissioned and fixed infrastructure is unavailable.

We view that FWA growth will decelerate, but it should not be until excess capacity runs out and cable companies complete their DOCSIS 4.0 network upgrades, which will enable them to make better marketing claims. FWA operators have factored in wireless phone growth and still remain confident in their short-term goals. Comcast (NASDAQ:CMCSA) has started rolling out DOCSIS 4.0 in selected areas, but the expansion will occur gradually in the next few years. Charter (NASDAQ:CHTR) might delay the completion of its network upgrades by six months to mid-2026 due to its aggressive rural buildout.

Verizon Revised Its FCF Guidance

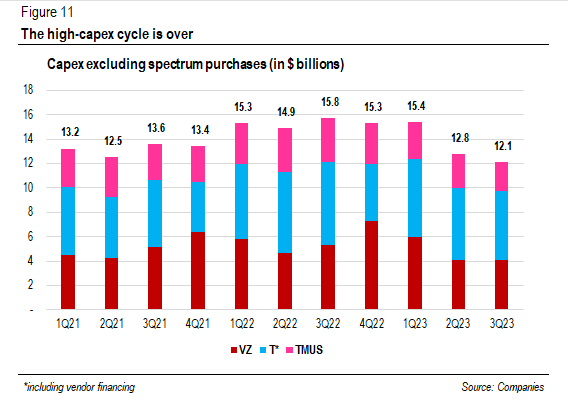

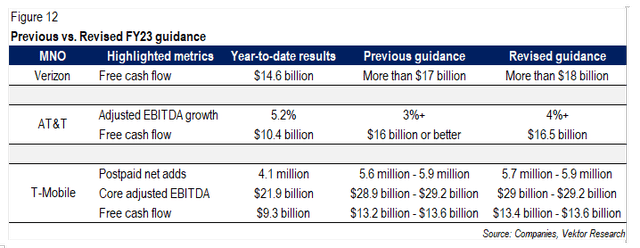

As the 5G mid-band buildout is nearing completion, operators are gradually winding down their capital expenditures. Compared to a year ago, capital spending by three players in 3Q23 was down between 3% and 6% as a percentage of revenue. Quarter-on-quarter basis, the decline was between 0.3% to 1.9%. This results in them tweaking their full-year guidance, after which shares jumped.

Capital spendings by the big three ($ billions) (Companies) Change in FY23 guidance (Companies, Seeking Alpha)

Verizon has provided guidance of over $18 billion in free cash flow for the full year, taking into account that Capex will be at the upper end of the guidance range at $19.25 billion. As expenditures will revert to the business-as-usual levels of $17 billion to $17.5 billion next year, we estimate that Verizon will be able to pay $11 billion dividend and reduce its debt by $8 billion per year.

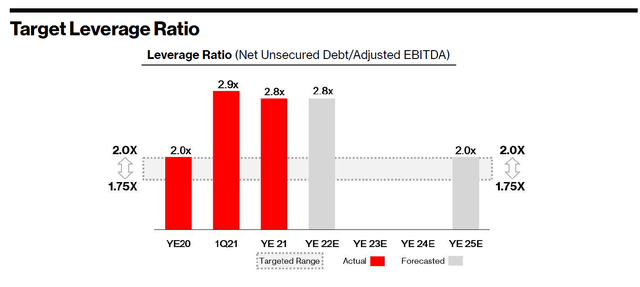

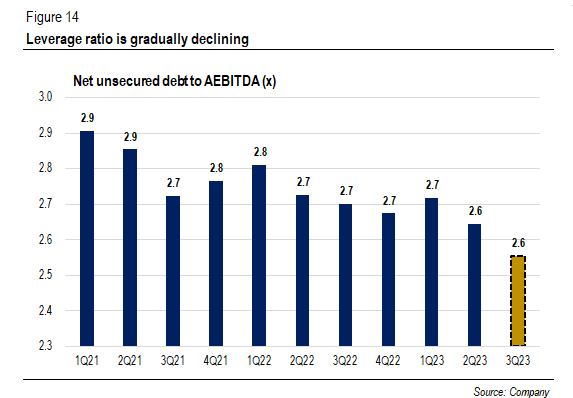

In 3Q23, Verizon’s net unsecured debt declined from $126.6 billion in the previous quarter to $122.2 billion after Verizon had paid down $2.6 billion in debt. The reduction results in a leverage ratio of 2.6x. Share buybacks come after dividends and deleveraging in the pecking order. But we might be talking about buybacks once the leverage ratio reaches 2.25x.

VZ target leverage ratio (Company (Investor Day 2022))

To reduce the leverage ratio from the current level to 1.75x to 2.0x adjusted EBITDA, Verizon would need to pay down roughly $26.5 billion to $38.5 billion. But to reach a 2.25x ratio, it would “only” need to reduce $14.6 billion from its balance sheet. We should be hearing discussions about share buybacks in two years, assuming an annual $8 billion debt reduction. The management has indicated that this would not be a one-time event:

But we want to do buybacks not that one-off or something. It has to be a consecutive program all the time. So, but we’re not there yet. But the team is doing great job. Tony talked about the 2.6 billion they we reduced debt this quarter with the tenders were down. So we will continue to do that with the cash flow. That’s where we are yielding right now.

VZ net unsecured debt to AEBITDA ratio (x) (Company)

Investment Risk: How Long Until the Next High-Capex Cycle Begins?

Estimates suggest that 6G is likely to be launched in 5-7 years. The new spectrum band, ranging from 7 GHz to 20 GHz, is said to be the “sweet spot” for 6G, but it is also likely to have limited signal propagation, like millimeter wave bands. That might require more cell sites and thus more dollars to spend, leading to higher capital requirements. This poses the question of whether customers will be willing to spend more for 6G services. Will there be any compelling use cases for the new technology?

Valuation

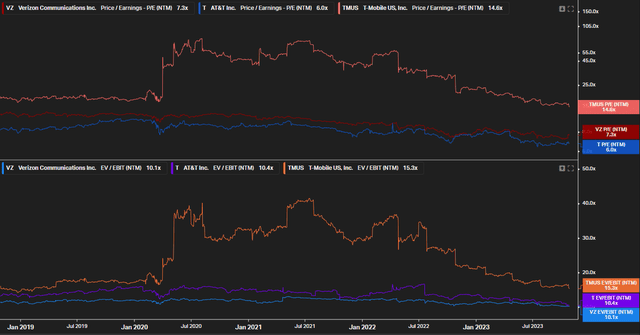

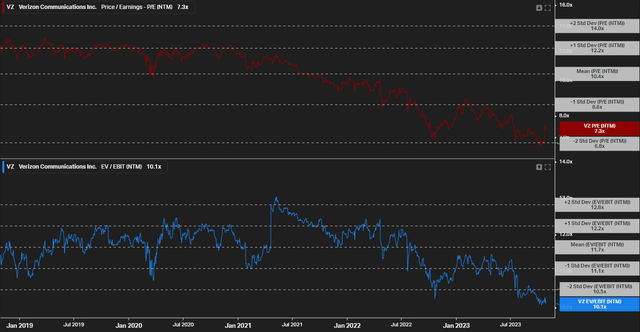

Verizon is trading at 7.3x forward earnings and 10.1x forward EBIT. Understandably, T-Mobile is trading at a higher multiple due to its 5G leadership and higher expected earnings growth compared to Verizon and AT&T. When we look at historical multiples, Verizon shares are trading around -1.5 standard deviation.

We believe this was caused by several factors. First, high capital expenditures have put pressure on free cash flow. Additionally, its balance sheet is burdened with massive debt, but it is necessary to compete with T-Mobile. Second, Verizon is losing customers in the Consumer segment. But we are already seeing signs of improvements in these areas. This might suggest that shares are undervalued.

The big three multiple valuations (Koyfin) VZ 5-year average historical valuations (Koyfin)

Conclusion

Wireless service revenue grew nearly 3% (Y/Y) thanks to increasing ARPA and solid demand from enterprises. With capital expenditures expected to be down next year, free cash flow should be available for dividends and deleveraging. Competition is more rational as players are gradually raising prices, despite aggressive moves from cable companies. We still expect T-Mobile to take a larger pie in net adds thanks to its extensive mid-band spectrum.

From a valuation perspective, Verizon shares are trading at a discount relative to historical multiples. But we like where this is going: lower Capex means ample room for dividends and deleveraging, which should eventually lead to share buybacks after reaching a certain leverage ratio. Furthermore, we have witnessed an improvement in postpaid phone net adds in the Consumer segment. Maintain BUY. If you have any thoughts, please do not hesitate to comment below.

Read the full article here