Investment Outlook

Upwork Inc. (NASDAQ:UPWK) is getting ready to report its Q4 2023 financial results on February 14.

I previously wrote about Upwork in 2018 when it went public in an IPO at $15.00 per share.

While the company has been through the sharp growth during the pandemic years and subsequent drop-off, employment remains strong in the U.S. and management has managed the company for profitability rather than growth at all costs.

Upwork Inc. is an excellent GARP (Growth at A Reasonable Price) candidate due to its improving growth, swing to profitability, strong free cash flow growth, and focus on simplification and the enterprise.

My outlook is a Buy on UPWK.

Upwork’s Approach And Model

Operating a two-sided talent marketplace is no easy feat. The firm has to balance myriad factors to create the greatest volume of success between clients (job posters) and talent (job seekers).

Most importantly for the company and shareholders, management has to optimize the fees that it charges (take rates) for various services to produce the best combination of incentives and value provided.

An example of some recent changes to its fee structure was the March 2023 change to its variable service fee charged to talent, from 5% – 20% to a flat fee of 10%.

Also, the company instituted a flat $4.95 fee per contract for clients. Management expects a gradual increase in its various take rates as it shifts to a simpler fee rate structure.

The firm also faces competition, most directly from Fiverr International (FVRR), another online talent marketplace, but also from a wide variety of online services, such as job boards and social networks, including LinkedIn and now X (FKA Twitter).

Recent Financial Trends And Valuation

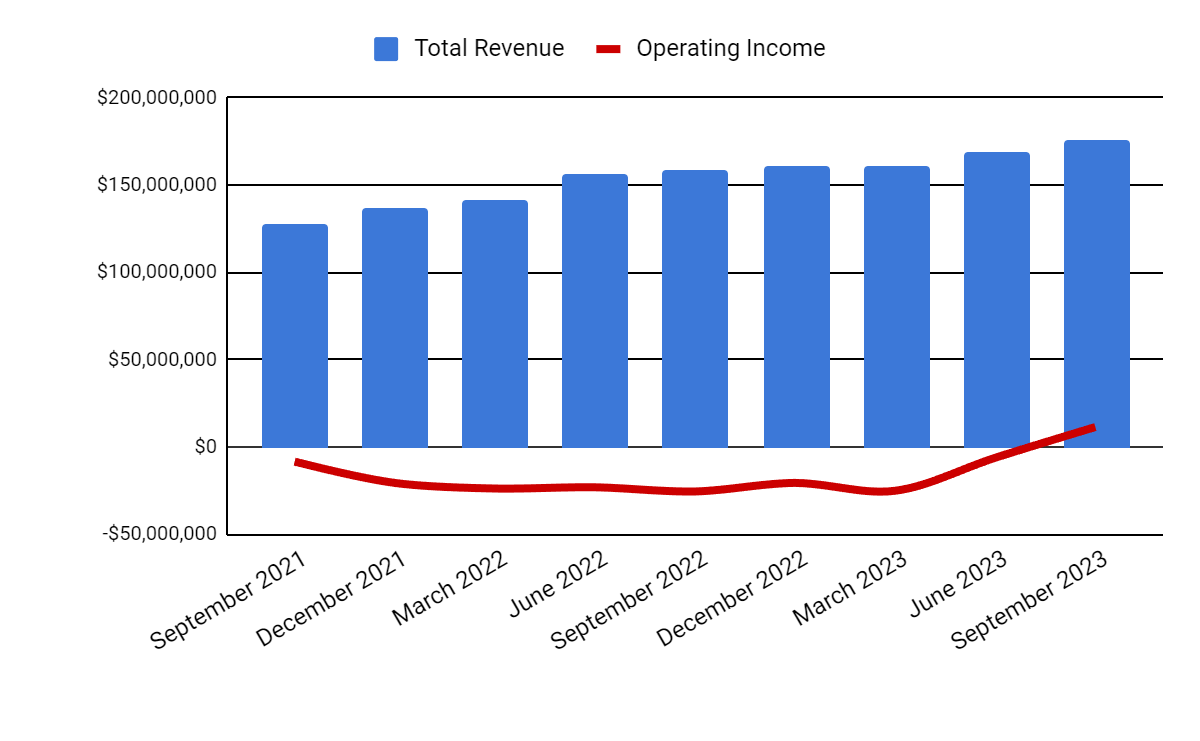

Total revenue by quarter (columns) has steepened its growth rate in recent quarters after flattening in most of 2022; Operating income by quarter (line) has turned positive for the first quarter in the last nine quarters, a notable milestone that is especially important in a higher cost-of-capital environment that penalizes operating loss-generating companies.

Seeking Alpha Data

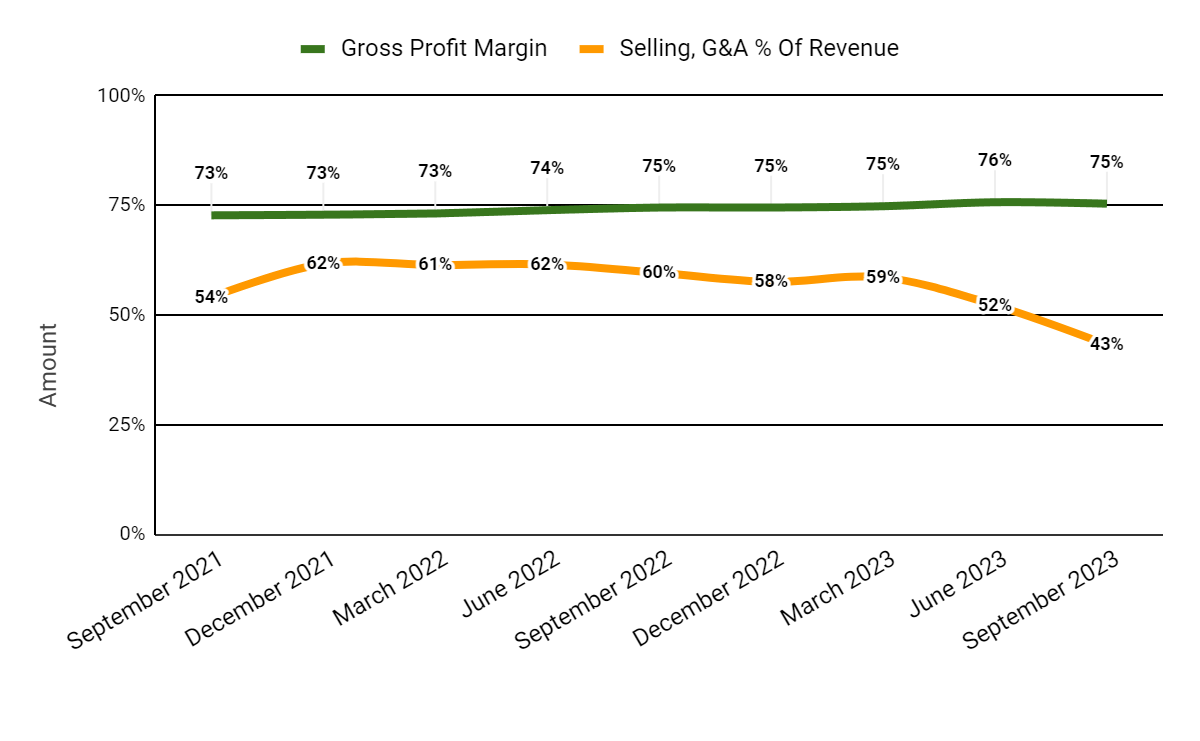

Gross profit margin by quarter (green line) has remained essentially flat in recent quarters; Selling and G&A expenses as a percentage of total revenue by quarter (orange line) have dropped markedly due to lower brand spend and sales team optimization.

Seeking Alpha Data

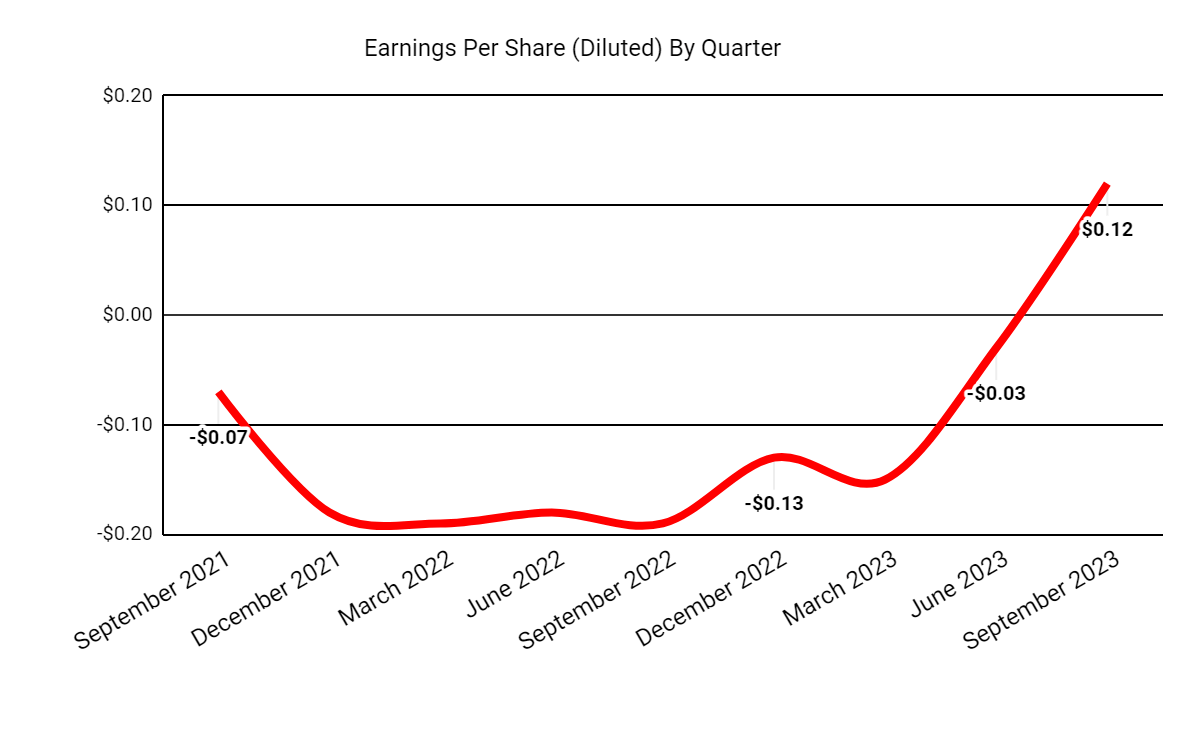

Earnings per share (Diluted) have improved markedly in Q3 2023 due to management’s reduced spending initiatives, focus on enterprise sales and constant take rate.

Seeking Alpha Data

(All data in the above charts is GAAP.)

UPWK’s total revenue growth rate is expected to increase marginally for 2024, to 15.6% from 12.3% through the first nine months of 2023, indicating growing analyst confidence in its prospects going forward.

A table of the firm’s major valuation metrics is here:

|

Metric |

Amount |

|

EV/Sales (“FWD”) |

2.5 |

|

EV/EBITDA (“FWD”) |

24.4 |

|

Price/Sales (“TTM”) |

2.8 |

|

Revenue Growth (“YoY”) |

12.3% |

|

Net Income Margin |

2.0% |

|

EBITDA Margin |

-5.2% |

|

Market Capitalization |

$1,900,000,000 |

|

Enterprise Value |

$1,710,000,000 |

|

Operating Cash Flow |

$41,020,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.19 |

|

2024 FWD EPS Estimate |

$0.69 |

|

Rev. Growth Estimate (“FWD”) |

15.6% |

|

Cash Flow/Share (“TTM”) |

$0.21 |

|

Seeking Alpha Quant Score |

Strong Buy – 4.71 |

(Source: Seeking Alpha Data.)

Compared to Fiverr, another online talent marketplace, Upwork is being valued at higher multiples, likely due to its higher revenue growth rate and positive income margin, as the table shows below:

|

Metric |

Fiverr |

Upwork |

Variance |

|

EV/Sales (“FWD”) |

2.2 |

2.5 |

12.1% |

|

EV/EBITDA (“FWD”) |

13.7 |

24.4 |

78.8% |

|

Rev. Growth Estimate (“FWD”) |

11.1% |

15.6% |

40.9% |

|

Net Income Margin |

-0.7% |

2.0% |

-395.5% |

|

Operating Cash Flow |

$65,240,000 |

$41,020,000 |

-37.1% |

(Source: Seeking Alpha Data.)

To view a full comparison between Upwork and Fiverr on Seeking Alpha, click on this custom Comparison page.

Also, although the company is not in the enterprise software space, a look at its Rule of 40 performance, which simply adds its revenue growth rate and operating margin, is instructive:

|

Rule of 40 Performance (Unadjusted) |

Q3 2023 |

|

Revenue Growth % |

12.3% |

|

Operating Margin |

6.5% |

|

Total |

18.8% |

(Source: Seeking Alpha Data.)

This is a middling performance, with moderate revenue growth and less operating margin, so the firm has room for improvement in both areas.

Why I’m Bullish On Upwork

I see Upwork as a solid “growth at a reasonable price” [GARP] candidate, given that management is focused on continuing to reduce costs, including marketing spend, while producing respectable revenue growth.

It appears clear to me that they are managing the company for profitability rather than pure “growth at any cost,” which was the opportunity during the pandemic when the stock soared on heavy work from home usage by clients and talent.

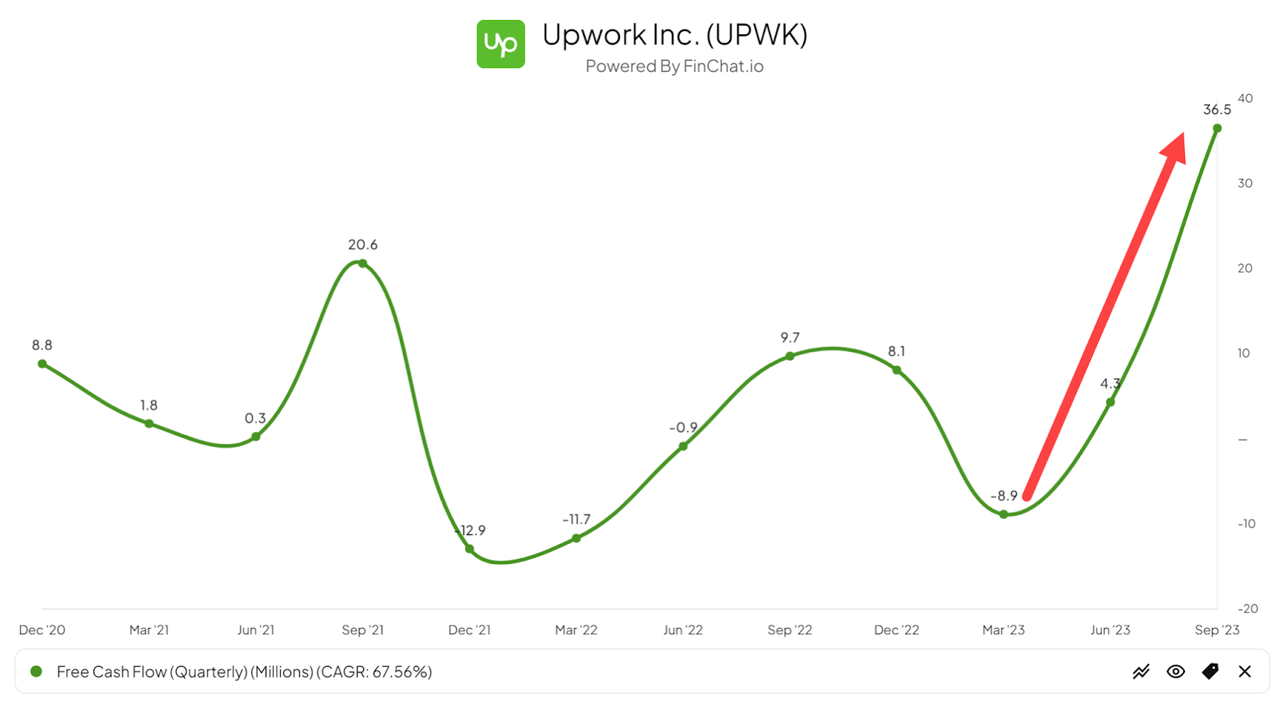

As a result, free cash flow has soared in the most recent quarter, as the chart shows here:

FinChat.io

Also, management’s focus on its enterprise segment, which is aimed at companies of greater than 250 employees.

Upwork charges its enterprise clients a monthly or annual subscription fee plus a service fee as a percentage of their spend on talent through the system.

The company is also seeking to enhance its partnership channel, which it views as a way to broaden its reach into new customers, as well as its education services which enable talent to add to their skills.

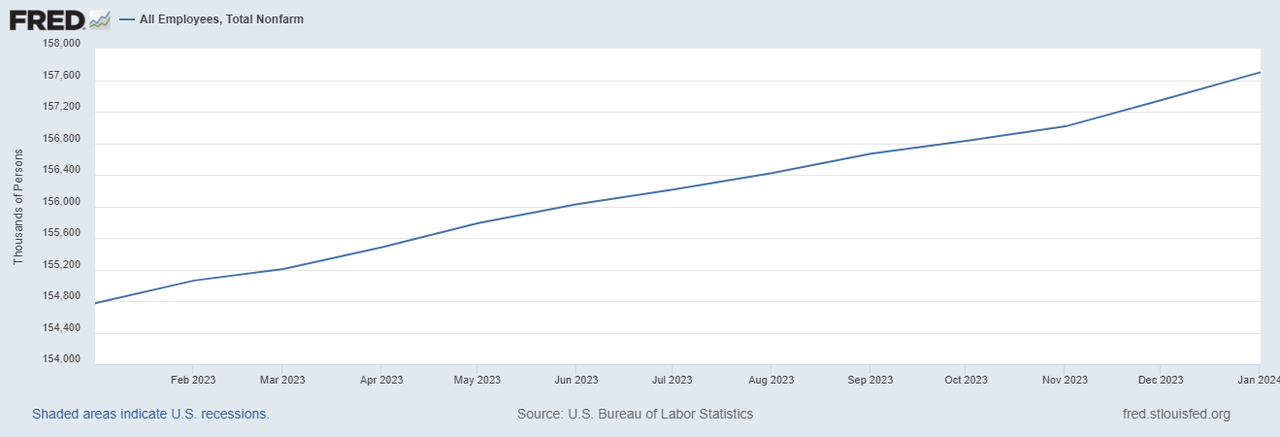

Also, the U.S. non-farm employment figures continue to rise, indicating substantial growth in the past year, as the chart shows here:

St. Louis Fed

So, the U.S. employment environment remains robust as clients continue to work hard to find talent to fill large numbers of job openings, which remained above 9 million as of December 2023.

As Upwork puts additional quarters of positive operating profit behind it, I suspect the market will buy further into its GARP story and have greater confidence in its ability to generate consistent earnings and strong positive cash flow.

While the pandemic’s sharply higher demand for talent marketplace effects have waned, Upwork’s increasing growth rate and positive net income margin make it an excellent candidate for investor interest.

My outlook on Upwork Inc. is a Buy on demonstrated strong free cash flow growth, a combination of revenue and forward earnings growth, focus on the enterprise and partnerships and continued strength in the employment environment.

Read the full article here