Uniswap (UNI-USD) is a protocol and token that I’ve covered a few times for Seeking Alpha over the last couple of years. The protocol is the leading decentralized exchange, or DEX, in the crypto market and has integrations with 13 different EVM blockchains including Ethereum (ETH-USD), Aribtrum (ARB-USD), Polygon (MATIC-USD), and Optimism (OP-USD). Unlike centralized exchange competitors like Coinbase (COIN) or Binance (BNB-USD), Uniswap doesn’t require KYC/AML procedures as it never custodies users’ assets and merely acts as a middleman between liquidity providers and traders on public blockchains.

Past Coverage

To quickly summarize my prior work; I think Uniswap is a terrific platform. However, I’ve been much less convinced about the necessity of the UNI token itself as the sole purpose to this point has been for decentralized governance. I’ve made the case previously that important platform decisions have failed to come to a vote and participation in proposals is generally poor. Thus, the core function of UNI as a governance tool hasn’t been a strong enough reason to justify holding the token. But my may personal view on UNI may be changing soon.

Fee Switch

As a DEX, Uniswap takes a small fee for enabling swaps between crypto traders and liquidity providers. While other DEX tokens have offered a portion of these fees to token holders in the same way a company would pay stockholders dividends, Uniswap has not paid out a portion of fees to tokenholders. On February 23rd, Uniswap Foundation Governance Lead Erin Koen published a proposal to turn fee sharing on in Uniswap’s next upgrade:

The UF is proposing a large-scale upgrade to Uniswap protocol governance to incentivize active, engaged, and thoughtful delegation. Specifically, we propose to upgrade the protocol such that its fee mechanism rewards UNI token holders that have delegated and staked their tokens.

It is widely anticipated within the crypto community that this proposal will be approved when it is put to a vote. Importantly, the fee switch will be shared with the platform’s liquidity providers, and it isn’t yet clear what those ratios will be:

Protocol fees are expressed as a fraction of LP fees (which themselves range from 1 to 100 bps). The specific fraction is adjustable by governance, and could be 0, 1/4, 1/5, 1/6, 1/7, 1/8, 1/9, or 1/10. They are currently set to 0.

Depending on which pool a staker uses and how long the stake has been delegated, the reward to the token holder will vary. When tokenholders have more clarity on how those ratios will be determined, it will be easier to value UNI as a yield-bearing instrument. It also bears mentioning that the payout coin will be Wrapped Ethereum (WETH-USD) rather than new UNI tokens. This is a good thing, in my view.

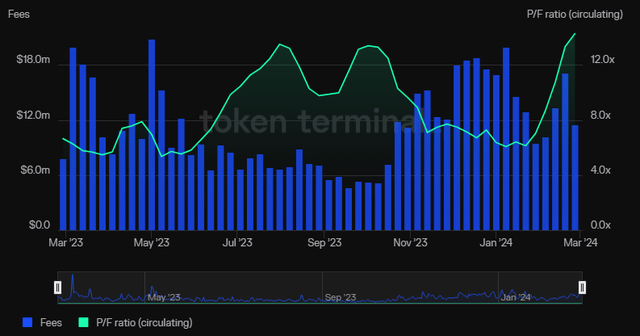

Uniswap Token (Token Terminal)

Currently, UNI is trading at about a 14.3 circulating price to fee multiple. I wouldn’t say this is an expensive token judging by that ratio alone, with Token Terminal’s median circulating P/F ratio coming in at 36.1x. That said, there are certainly cheaper protocols within the ecosystem, but UNI is roughly in line with competing DEX token valuations at current levels.

The Platform

When a trader engages with a DeFi protocol, they want to be able to trust that there is ample liquidity and deep asset pools to minimize slippage and poor conversion rates. Uniswap remains the top DEX in the market, and it isn’t all that close from both a volume and TVL standpoint.

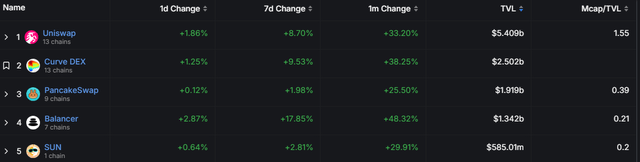

DEX TVL Comps (DeFiLlama)

At $5.4 billion in Total Value Locked, or TVL, Uniswap has a larger share of DeFi value than the next two protocols combined. This level of liquidity has been why Uniswap has historically commanded such a large share of DEX volume:

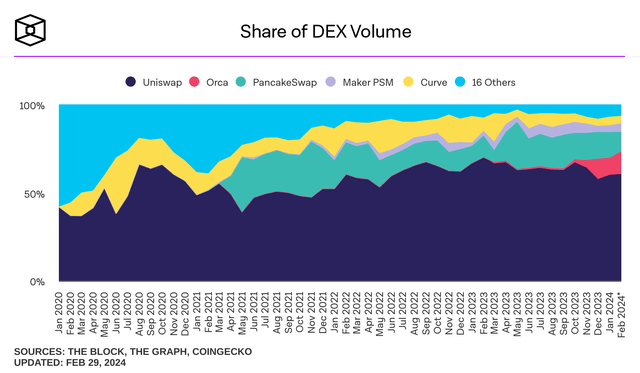

Share of DEX Volume (TheBlock)

At 60% in January, Uniswap remains the biggest horse in the DEX market. Though it should be noted that share has been generally in decline from 66-67% from the beginning of 2023. Furthermore, even though Uniswap is still the largest DEX by TVL, value locked is still well below where it was during the crypto highs of late 2021:

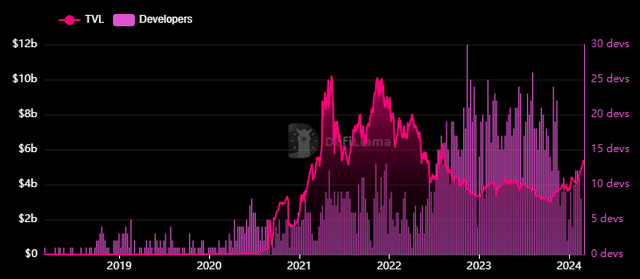

Uniswap (Defi Llama)

That said, development has been on the rise, and that’s typically viewed as a positive sign for a DeFi applications. The point is, Uniswap is still a monster in the ecosystem, but it seems as though it does have the most to lose as competition rises and smart contract blockchains outside of the Ethereum/EVM ecosystem could be viewed as more attractive to developers in the future.

Risks

In my view, UNI does carry some regulatory risk in the United States when protocol fees ultimately get turned on. When token holders are effectively paid a yield for the actions and swaps of other market participants, the token starts to look a lot more like a security – in this case, of the unregistered variety. The counterpoint to that would be that UNI was airdropped to most of its holders, thus, there was never a purchase or expectation of contract obligations. However, Uniswap raised $189 million to fund development, roughly 7% of which came through a public sale. Additionally, 18% of the token allocation went to original investors in the project. If the US SEC wants to make a case with Uniswap, I wouldn’t say the agency necessarily has a weak one.

Summary

Uniswap switching on fees presents a bit of a conundrum. On one hand, the very thing that solidifies UNI’s value also theoretically brings regulatory risk to the token. I like Uniswap personally, and I’ve used it in the past. I think it’s great for traders and speculators alike. But, I’m not longing it yet.

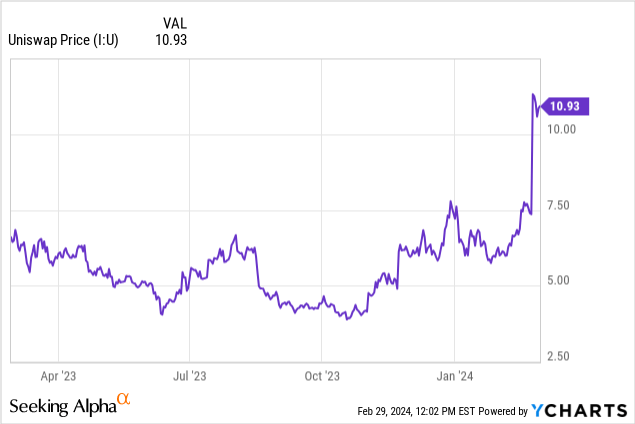

When news broke that the Uniswap Foundation was putting the fee switch proposal back to a vote, the coin rallied about 50% in a single day. In my view, the benefit from holding UNI isn’t totally clear yet until holders have a better sense of pool ratios and fee percentages. There’s also the possibility that other DEX competitors could continue to erode Uniswap’s volume share if liquidity providers seek alternative platforms. All this said, I’m going to upgrade UNI to “buy.” But I don’t personally plan to grab any until we see a retracement of the recent move. I do think UNI still serves as a great trading instrument in the meantime.

Read the full article here