Investment action

I recommended a buy rating for UniFirst Corp. (NYSE:UNF) when I wrote about it in January this year, as I expected the business to continue growing at a mid-to-high single-digit percentage. As the business scales, it should continue to win share and expand margins. Based on my current outlook and analysis, I recommend a buy rating. My key update to my thesis is that I am now more confident that UNF can continue to expand margins as it scales, especially with the success that management has seen with its merchandise costs. However, the mixed revenue growth outlook has forced me to reset my expectations lower. That said, I believe the market is focused on UNF’s ability to expand margins; hence, so long as UNF can continue to grow margins while growing top line in line with guidance, valuation should rerate upwards.

Review

UNF reported 3Q24 earnings last week, where its revenue grew 4.1% organically. By segment, Core Laundry, which is the largest segment (88% of total 3Q24 revenue), grew by 4.7% organically, while the other two smaller segments: Specialty Garments declined by 3.7%, and First Aid grew by 6.9% organically. Adj EBIT margins saw a strong expansion of 130bps to 8.7% (adjust for the $3.9 million in key initiative cost), driven by Core Laundry’s adj EBIT margins expansion of 170bps to 7.7%. At the EPS level, UNF reported an adj. EPS of $2.19. On a GAAP basis, year-to-date earnings have tracked well ahead of my $123 million expectation previously (annualized year-to-date earnings = $134 million).

At the top line, organic revenue growth expectations are quite mixed. Starting with the positives. Core Laundry growth was solid at 4.7% organically, and this is consistent with the past 2 quarters (5.2% in 1Q24 and 4.8% in 2Q24). I continue to be positive about the growth outlook for this segment as UNF continues to win new logos (in particular, UNF saw strong traction with large accounts) and benefit from previous pricing actions. Therefore, I think the visibility of positive organic growth is very likely. What was worrying is that management noted multiple growth headwinds. For example, UNF witnessed a step-up in client churn rates, net wearer levels fell, and pricing increases for current clients became more difficult. And because of these headwinds, management guided Core Laundry organic growth (on a same-day basis) to decelerate to 3.5% in 4Q24 (from the 4.7% organic growth on a same-day basis seen in 3Q24). FY25 Core Laundry organic growth on a same-day basis was also guided to be more modest than 4Q24. That said, I am not too eager to turn super negative on the FY25 guidance yet, as I believe a part of the slower growth is due to the lapping of large national account wins. Also, management sounded quite positive that FY25 revenue could see upside if they win more national accounts.

Despite a mixed revenue outlook at the topline, UNF did deliver on margin expansion, and this supports my point that as UNF scales, its margin should continue to expand (on track to meet >10% EBIT margin). Importantly, 3Q24 Core Laundry performance (7.7% adj EBIT margin, an expansion of ~170bps vs. 3Q23) showed the market that the 2Q24 adj EBIT margin decline (from 8.6% in 1Q24 to 4.3% in 2Q24) was not indicative of a structural impairment to margins. Although 100bps of the ~170bps expansion was driven by tailwinds from lapping elevated healthcare claims and legal reserves in the prior year quarter, the notable aspect was that UNF saw 70bps of structural improvements from favorable trends in merchandise, payroll, and other operating input costs. Since merchandise amortization costs have been a consistent headwind for a while now, hearing about the improvement in merchandise costs was very encouraging. We can see that management has put in a lot of effort and has seen success in recent quarters. For instance, merchandise cost went from being a 20bps headwind to Core Laundry’s EBIT margin in 1Q24 to a 20/30bps tailwind in 3Q24.

Looking ahead, on a consolidated basis, management maintained its FY24 revenue guide of $2.415 to $2.425 billion but raised GAAP EPS range to $7.17 to 7.49. If we adjust back for the key initiative costs, this implies a midpoint adj EPS guide of $7.81, or ~$147 million adj net income.

All in all, despite the mixed messaging at the topline, I was very encouraged by the margin performance and the underlying drivers. The revised EPS guide was also supportive of the fact that margins are expanding nicely, which is supportive of my bull thesis. Given that the market has reacted very positively (stock was up 13.5% post-results) on this set of results, I am inclined to believe that the market is focused on margin expansion more than topline performance.

Valuation

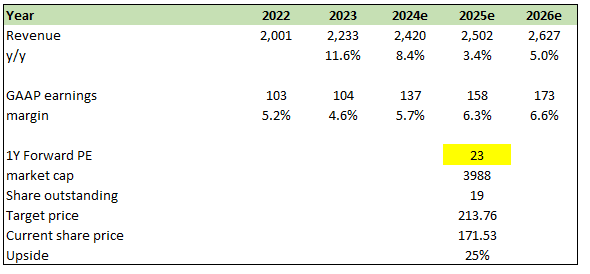

Author’s work

Given the mixed topline outlook, I have revised my growth expectations downward accordingly to reflect reality (the fact that management called out those headwinds for two consecutive quarters suggests that they are stickier than expected). Using the qualitative comment provided for FY25, I assumed growth to be 3.4% (similar levels to 4Q24), followed by a recovery back to 5% in FY26 (assuming that it can at least recover back to mid-single-digit levels as the economy gets better).

However, for margins, I am much more positive considering the performance seen in 4Q23. The step-up in guidance was extremely encouraging as well. Using the revised guidance, it implies GAAP earnings of $137 million for FY24, or 5.7% net margin, which is 60bps above my previous estimates. I have increased my margin expectations by 60bps for the next two years as well.

Overall, I believe the bull case for UNF is still tracking well, and margins can continue to expand as the business scales. While growth is not as good as I thought, I believe the mentioned headwinds are likely to stem from the weak macroenvironment rather than UNF mis-execution. As such, I still expect UNF to see its valuation revert back to its historical average of 23x over the next 2 years.

Risk

If organic growth continues to worsen, falling behind my estimates (or management guidance) by a wide margin, this may force the market to shift its focus from margin expansion to topline growth weakness. This could happen if the macro situation turns for the worse, and it is a fact that UNF is already seeing some negative impacts from this.

Final thoughts

My recommendation is a buy for UNF. While top-line growth is encountering headwinds, UNF ability to expand margins remains impressive. Strong Core Laundry segment performance and management’s success in controlling merchandise costs gave me more confidence that UNF can continue to scale profitably. The market’s positive reaction to the latest earnings report made me believe that its focus is more on margin expansion. The key risk lies in a significant deterioration of organic growth, potentially causing the market to prioritize top-line performance over margin expansion.

Read the full article here