TSMC (NYSE:TSM) recently reported its 2Q24 results and I joined in for the earnings call.

Before I jump in on the earnings results, I thought I would first comment on the earnings call.

In my opinion, the mood on the earnings call was much more jovial compared to prior earnings call and CEO Wei also sounded more energetic than he did before.

In fact, TSMC CEO Wei even tried to be funny by saying Nvidia (NVDA) CEO Jensen’s tagline and changing it for TSMC: “The more TSMC wafers you buy, the more you save.”

While the mood in the earnings call may not be quantitative evidence, it does provide qualitative evidence that TSMC’s business might, in fact, be booming and that good times are ahead.

I have written extensively about TSMC stock on Seeking Alpha, which can be found here.

2Q24 results

TSMC published 2Q24 results that exceeded the top end of its guidance.

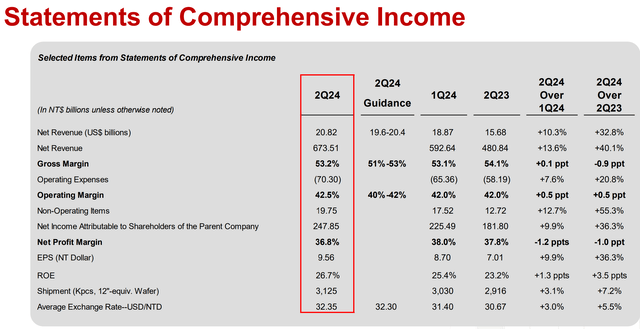

Here is a summary of the 2Q24 results.

TSMC 2Q24 results (TSMC)

Earlier in July, TSMC reported 2Q24 revenues of NT$673.5 billion, which was up 40% from the prior year and up 14% sequentially. This beat the high end of its own guidance and consensus expectations by 2% to 3%.

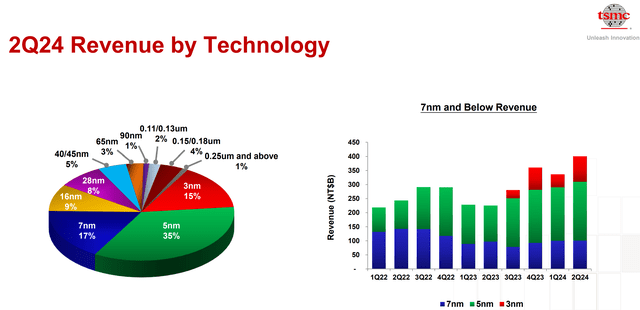

By technology, TSMC’s N3 process contributed 15% of wafer revenue, and this is the most advanced in production today.

In fact, revenues from TSMC’s N3 almost doubled from the previous 3-month period.

The N3 customers are actually not Nvidia.

These important N3 customers are Apple, Qualcomm and AMD.

TSMC revenue by technology (TSMC)

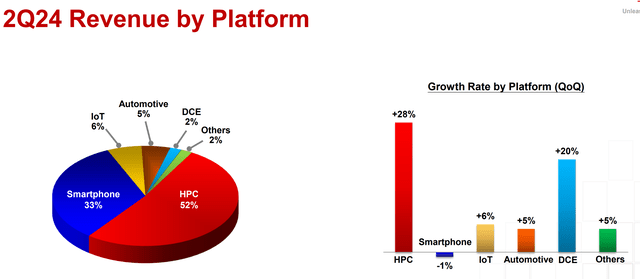

The high performance computing (“HPC”) segment is the most important segment for TSMC today. This is essentially the AI segment for TSMC.

It makes up 52% of TSMC’s net revenues.

The HPC segment grew very strong, which was up 28% sequentially.

Another important segment for TSMC is the smartphone segment.

Smartphones make up 33% of revenues, but in the 2Q24 quarter, was down 1% sequentially.

TSMC revenue by platform (TSMC)

From the margins and profitability side of things, TSMC also managed to beat expectations.

TSMC’s 2Q24 gross margin came in at 53.2%, beating consensus estimates of 52.6% and came in above the long-term goal of a consistent 53%.

TSMC’s 2Q24 operating margin came in at 42.5%, beating consensus estimates of 41.6%.

TSMC’s 2Q24 net income came in at NT $247.8 billion, compared to consensus expectations of NT $235 billion, beating consensus by almost 6%.

Capital expenditures for the first half of 2024 came in at $12.13 billion.

This implies that it will need to ramp up capital expenditures in the second half of 2024 to meet its capital expenditure guidance.

Outlook

TSMC’s outlook for its business was also strong.

TSMC expects 3Q24 revenues to be between $22.4 billion and $23.2 billion, growing +32% from the prior year at the midpoint.

TSMC expects 3Q sales to be driven by structural demand from AI and cyclical upturn demand from smartphones.

3Q24 gross margin is expected to be between 53.5% to 55.5%, and 3Q24 operating margin is expected to be between 42.5% to 44.5%, which beat consensus expectations of 52.5% gross margin and 42.1% operating margin respectively.

TSMC raised the 2024 guidance above mid 20% in USD terms.

The capital expenditure guidance range for 2024 was increased.

The initial range of between $28 billion and $30 billion was increased to the new range of between $30 and $32 billion.

70% to 80% of this capital expenditure will be used for advanced technologies.

Smartphones

TSMC provided solid commentary about smartphone demand.

TSMC CEO Wei said: “We expect our business to be supported by strong smartphone and AI-related demand for our leading-edge process technologies.”

He expects smartphone-related demand to be one of the growth drivers for TSMC in the second half of the year.

Within smartphones, with AI requiring more silicon content, with 5% to 10% die size increase in general, AI will provide structural growth opportunity for TSMC.

TSMC is also seeing more smartphone clients are moving to advanced packaging like InFO packaging.

Pricing

TSMC has long maintained that pricing is strategic, and never opportunistic.

TSMC stated that pricing is an ongoing and continuous process.

The company is likely in negotiations with key customers to increase prices in some key products.

TSMC CEO Wei said that: “My customers are doing very well, and we should do as well”.

Apart from the fact that its customers like Nvidia are doing well, and that there is very strong demand that the supply cannot catch up to, TSMC also mentioned some cost reasons that may help with its price hikes.

Specifically, TSMC mentioned that their costs are rising due to international expansion and high-power prices in Taiwan.

While there is rising concern over geopolitical tension given the upcoming US presidential election, TSMC mentioned that it would continue its overseas expansion to mitigate the risks. This includes the new fabs ramp in the US and Japan the next year and diversifying production locations. TSMC also reported government subsidies in the cash flow statement and balance sheet. If there is any tariff and trade policies, that will be paid by their customers, according to TSMC.

This is definitely good news for TSMC given that any tariffs imposed could lead to customers paying the extra and given that most of TSMC’s customers are based in the US, US companies end up paying the tariffs on behalf of TSMC.

I think this quarter’s report shows that with a strong market position, TSMC is in a favorable position in terms of pricing power, which helps with the long-term gross margins.

With strong pricing power, TSMC expects that its long-term gross margin is expected to be 53% and higher.

In fact, TSMC CEO Wei even emphasized on the “and higher” and he stated: When I have discussions with my customers, I will give the “and higher portion”.

Despite potential challenges from geological tensions or higher operating costs due to inflation, rising electricity costs and overseas capacity ramp-up, TSMC remains optimistic that it can achieve gross margin of 53% and higher.

This is a result of TSMC’s superior performance and efficiency of its products, which helps justify a premium pricing and this will also help with its long-term profitability.

In short, TSMC needs to ensure it maintains this superior performance and efficiency, if not this margin and profitability profile could deteriorate.

Growing its leadership and capacity

As mentioned in the prior section, TSMC needs to maintain a superior performance and efficiency level to be able to maintain its profitability.

With that, TSMC is growing its leadership within foundry, and adding to the much needed CoWoS capacity that is current in short of supply.

TSMC stated that for its N2 fabrication process, which is for its 2nm technology, the initial ramp up will be stronger than previous nodes like 3nm.

When asked about the progress about TSMC’s next two fabrication nodes N2 and A16, CEO Wei said that “almost all the AI innovators are working with TSMC.”

“He expects to have more N2 customers than for N3 and N5 and everything is going ahead of schedule with A16 development.”

As a result of better performance of scale, this has a positive impact on margin dilution, which will be less than what we saw with N2.

Another thing TSMC has been focused on is increasing the supply for CoWoS advanced packaging, which is essential to AI accelerators like Nvidia.

TSMC states that demand is very strong and that the company is working hard to meet this strong demand.

The goal here is to continue to increase supply, although TSMC expects supply to continue to be “very, very tight” all the way into 2025.

That said, TSMC is aiming to reach a balance sometime in 2025 or 2026 for the CoWoS supply and demand situation.

TSMC expects CoWoS capacity to be more than double from the prior year in 2024.

In turn, management expects growing AI demand to support its accelerated CoWoS expansion into the next one to two years.

TSMC highlighted in the earnings call the role of AI in driving demand and sees AI as a long-term growth trend, not just for TSMC, but for the semiconductor industry.

Valuation

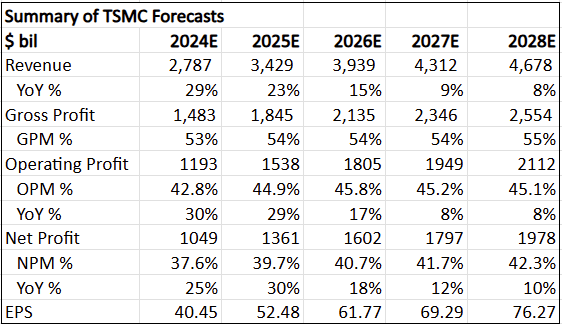

Below, I share my 5-year financial forecasts for TSMC. The revenue CAGR over the next 5-year period is 17% while EPS CAGR is slightly higher at 19%.

I use the free cash flow to equity derived from the financial forecasts for the intrinsic value calculation.

Summary of 5-year financial forecasts (Author generated)

My intrinsic value for TSMC is $184. This is based on the assumption of 21x terminal multiple and 12% cost of equity. TSMC’s 5-year average multiple is 23x, so I think giving a 20x terminal multiple is reasonable given the slower growth profile in the outer years.

I would buy TSMC at $147, or at a 20% discount to its intrinsic value.

My 1-year and 3-year price targets for TSMC are $228 and $302 respectively, which implies 25x 2025 and 25x 2027 P/E respectively.

Conclusion

At a time when the theme is rotation out of technology stocks and when AI has been likened to a bubble, TSMC’s business continue to shine and exceed expectations.

Strong demand for high performance computing, or AI, drove the bulk of the growth we saw in revenues for 2Q24, which is driven by strong structural demand from AI.

In the second half of 2024, apart from this structural AI demand, we will also see cyclical demand from smartphones as a result of an upcycle.

While revenue growth is great, when combined with growing margins, this cocktail of revenue growth and expanding margins is a very strong stock price mover.

Margins for TSMC are expected to be strong as a result of its dominant market position, superior performance and efficiency, which is driving pricing power and the ability to raise prices.

In addition, TSMC is not stopping there. The company continues to extend its lead over competitors to ensure that its margin and profitability profile can be maintained.

Read the full article here