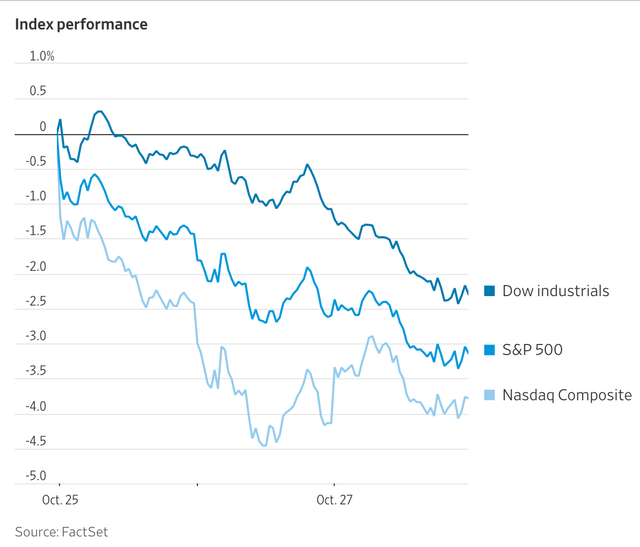

Two of the three major stock market indexes are in correction mode. That is they are down 10 percent from their previous highs.

The S&P 500 stock index fell into correction territory on Friday, while the NASDAQ index had reached that level earlier in the week.

Index Performances (FactSet)

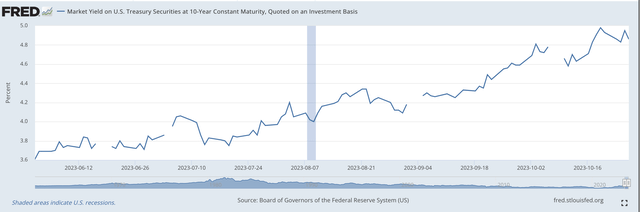

The bond market seemed to be the major “draw” this week as the 10-year U.S. Treasury note hit 5.00 percent for a while.

Bond yields have risen quite high…very fast.

Stocks have suffered for it!

Yield on 10-year Treasury Note (Federal Reserve)

The Federal Reserve has been in a policy mode of quantitative tightening for 19 months now and it has increased its policy rate of interest throughout that time period.

But, now, the temperature in the bond market seems to be rising to new heights as the economy seems to be growing strongly and the Federal Reserve is still considering more increases in its policy rate of interest.

So, what is in the future for the stock market?

Well, there still seems to be plenty of money around.

Although the Federal Reserve has been engaged in 19 months of quantitative tightening, the quantitative easing that went on before the beginning of the spread of the Covid-19 pandemic and subsequent recession, and the massive quantitative easing that took place in response to the Covid-19 pandemic and consequent recession, many trillions of dollars of securities had been added to the securities portfolio of the Federal Reserve.

A great deal of this money is still “hanging around” in the banks and the financial markets.

For example, the commercial banking system, according to the Federal Reserve release H.8, was holding on October 18, 2023, $3,343.1 billion in cash assets.

From the Federal Reserve H.4.1 release, commercial banks were holding $3,250.2 of Reserve Balances on October 18, 2023. The numbers from the two tables, therefore, are very close to one another, so this gives us some confidence that we are truly talking about the “free assets” of the banks.

These numbers represent, fundamentally, the “excess reserves” of the banking system. This is a lot of “money” being held by the banking system.

Two points. The first point is that the total assets of the commercial banking system on the Fed’s H.8 statistical release is $22,867.8 billion. Thus cash assets amount to 14.6 percent of the banking system’s total assets.

Historically, this is a very high percentage of the total assets.

The largest 25 domestically chartered U.S. commercial banks hold $13,248.1 billion in assets, roughly 58.0 percent of the assets of the banking system…not quite two-thirds of all the assets in the banking system.

These 25 banks hold almost 50.0 percent of all the cash assets in the banking system.

I reference these numbers to give some idea about how liquid the commercial banking system is, especially the largest banks in the system.

And, this huge amount of liquidity is in existence throughout the whole financial system.

My second point is this: what the holders of this “liquidity” do with their funds is going to have a tremendous impact on what happens in the stock market, what happens in the bond market, and what happens in the economy.

And, my point is, the Federal Reserve has a very long way to go to get control over financial markets, the banking system, and the economy.

Just the performance of the economy in the last quarter points to the fact that consumers, for example, can draw on these cash resources and generate fairly rapid economic growth, even though, and in spite of, the Federal Reserve is engaging in a round of quantitative tightening.

The money is there. It is just where investors are moving to when they receive new data.

The last week’s data highlighted the increased rate of growth of real GDP in the third quarter and the rise in bond prices.

The stock market went down.

Another week, investors feel that the Federal Reserve is going to back off its efforts of quantitative tightening.

The stock market went up.

My point is that there is a lot of very conflicting information going around and around in the United States.

With all the money that rests in bank accounts and elsewhere, the options for going up and the options for going down are all over the place.

What goes up and what goes down depends upon the news coming out in a particular week, especially news about what the Federal Reserve is doing or saying.

And, the concern over “sustainability” of the path of the federal debt.

With all the money that rests in bank accounts and elsewhere, nothing particularly seems out of consideration.

My own view?

My own view is that we are in a state of radical uncertainty where the policymakers really don’t know what to do. That our business leaders really don’t know what to do. And, the investment community really doesn’t know what to do.

We are in a situation where a lot of people could make a lot of mistakes.

This is a period of radical uncertainty.

We don’t even know some of the possible outcomes that could take place.

This, to me, is as much a cause of what is happening to the stock market as anything. It is just that as a part of this scenario, bond interest rates have been rising dramatically and this highlights the uncertainty that is around us.

But, as this uncertainty surrounds us, stock prices go into correction territory.

Maybe we have been too optimistic, thinking we have known too much.

Maybe we are “correcting” for that attitude and are now starting to argue that we need to have a new look at stock prices because we now see that maybe we don’t know enough.

Maybe…

Read the full article here