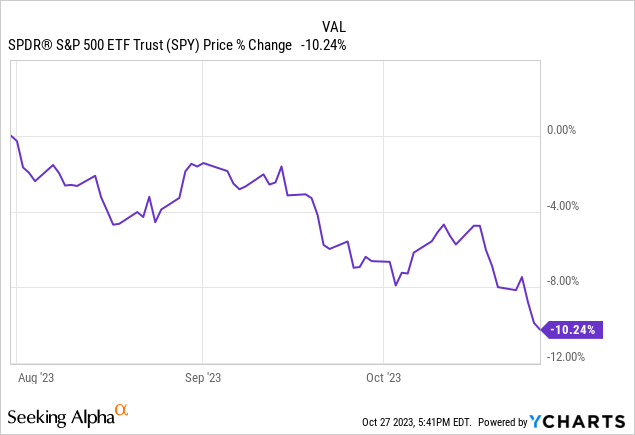

The SPDR® S&P 500 ETF Trust (NYSEARCA:SPY) just entered correction territory:

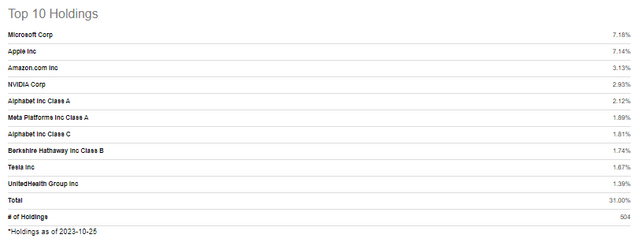

The rise of AI earlier this year boosted the technology mega-cap stocks – Microsoft Corp (MSFT), Apple Inc. (AAPL), Amazon.com, Inc. (AMZN), NVIDIA Corp. (NVDA), Alphabet Inc. (GOOG)(GOOGL), Meta Platforms, Inc. (META), and Tesla, Inc. (TSLA) that dominate SPY’s top holdings:

Seeking Alpha

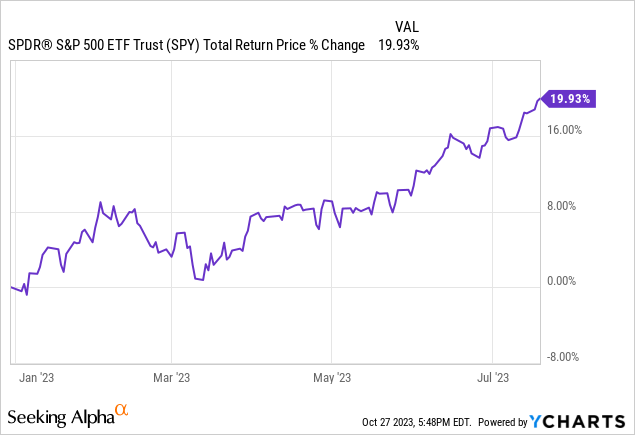

As a result, SPY got off to a roaring start to the year:

Since then, however, long-term interest rates have soared higher, geopolitical tensions in the Middle East have increased significantly, and the assumption that interest rates will remain higher for longer has taken hold on Wall Street. Moreover, some of the aforementioned mega-cap tech stocks have posted Q3 results that disappointed Wall Street, further weighing on SPY. SPY is also likely suffering from the fact that it is trading at an elevated valuation and growing fears of a recession.

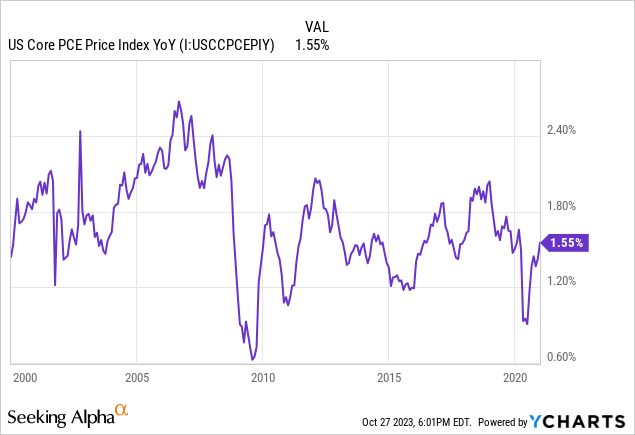

That being said, some good news came out today, with the single most important inflation metric signaling that we are basically back to the Federal Reserve’s long-term target level. In this article, we will look at the specifics of this more and discuss its implications for SPY.

The Single Most Important Inflation Metric

Today news broke that in September inflation remained stable without any significant cooling or resurgence, as reported by the U.S. Department of Commerce. The September Core PCE Price Index, the Federal Reserve’s main inflation measure, rose 3.7% Y/Y, which was similar to the consensus estimate and slightly down from August’s 3.8%.

On a month-to-month basis, core PCE, which omits energy and food prices due to their volatility and sensitivity to short-term factors like weather and geopolitical events, rose 0.3%. Furthermore, the overall PCE Price Index increased 0.4% M/M, while on a Y/Y basis, it grew 3.4%.

The best news of all is that – on a three-month annualized pace – core PCE has slowed to 2.4%. If the Federal Reserve’s target inflation rate is ~2%, that means that inflation is nearly back to normal levels that we last saw in 2020:

RSM US Chief Economist, Joseph Brusuelas, seconded this notion when he stated:

Core PCE is the best predictor of long run inflation and the direction in this metric is quite encouraging.

Besides being the Fed’s favorite inflation metric, the Core Personal Consumption Expenditures index is often cited as the best predictor of long-term inflation for the following reasons:

- Exclusion of Volatile Components: Core PCE offers a more stable and consistent measure of underlying inflationary trends by excluding food and energy prices, which tend to be influenced by a variety of short-term factors, such as geopolitical events, weather conditions, and supply disruptions.

- Comprehensive Coverage: PCE captures a more holistic view of the economy’s overall inflation level by covering a wide range of goods and services consumed by households, making it more comprehensive than some other inflation indicators.

- Weight Adjustments: Unlike some other indices, the weights in the PCE are regularly updated to reflect the actual consumption patterns of households, making it more relevant and accurate in portraying the actual inflation experienced by the average consumer.

Another piece of excellent news for inflation’s outlook was that consumer spending – which is largely credited with being the main force keeping inflation sticky – surpassed personal income. Personal income increased by 0.3% M/M, while spending rose by 0.7%, pushing the personal saving rate down to 3.4%, its lowest level of the year. As a result, inflation is likely going to subside at an accelerated pace in the coming months as consumer spending is on an unsustainable pace and the saving rate is reaching low levels. As Morning Consult’s senior economist, Kayla Bruun commented:

Faster price growth last month neutralized real income growth and the personal savings rate fell to its lowest level since the end of 2022, suggesting households may need to either pull back on spending or rely more on debt to going forward.

With interest rates soaring and credit card debt at historical highs, it is highly unlikely that the consumer is going to be able to rely much more on debt to sustain its shopping spree moving forward. As a result, we think the conclusion is inevitable that we are on the threshold of inflation falling meaningfully. With Core PCE already nearly at the Federal Reserve’s long-term target, a decline in consumer spending will likely push us below 2%, enabling the Federal Reserve to not only pause but likely begin to pivot towards cutting interest rates.

SPY Implications

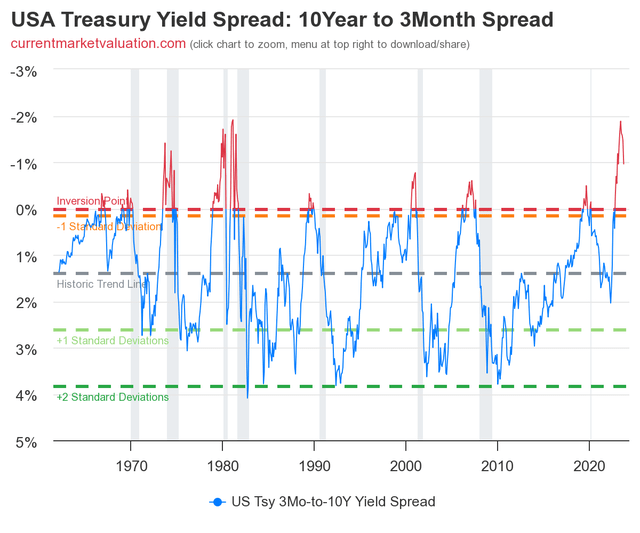

Declining inflation and falling interest rates would undoubtedly be a tailwind for the stock market, and SPY would be no exception. That being said, we also need to bear in mind that falling consumer spending would likely mean that a recession hits the economy as well, which will weigh on some of the less defensive names in the index, including mega-caps that are more consumer-facing such as AAPL, TSLA, and AMZN. After all, recent yield curve behavior implies that a recession is highly likely, as when the spread between the 10 Year treasury yield and the 3 Month treasury yield becomes negative (yield curve inversion), it has historically been a precursor to recessions, as seen by the “Inversion Points” in the chart below:

currentmarketvaluation.com

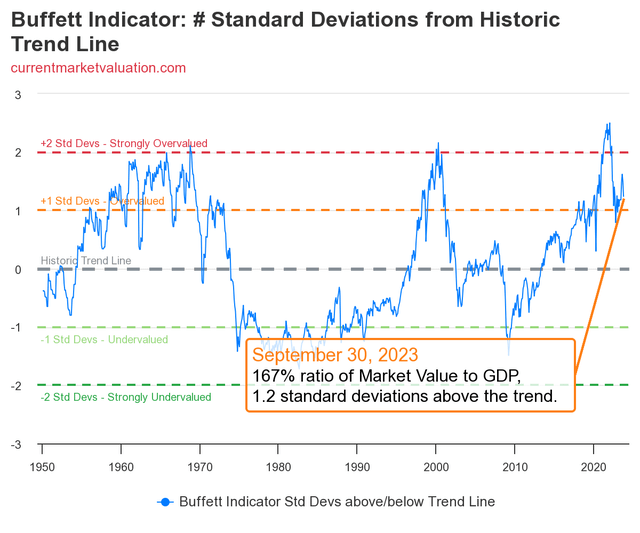

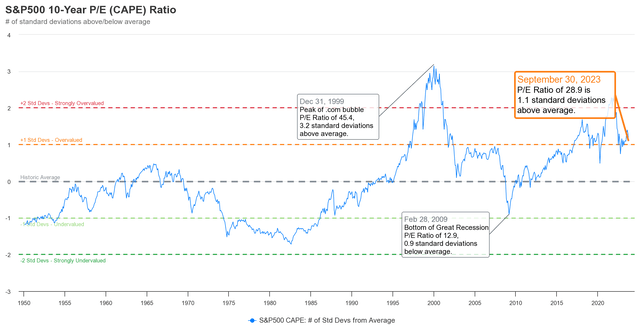

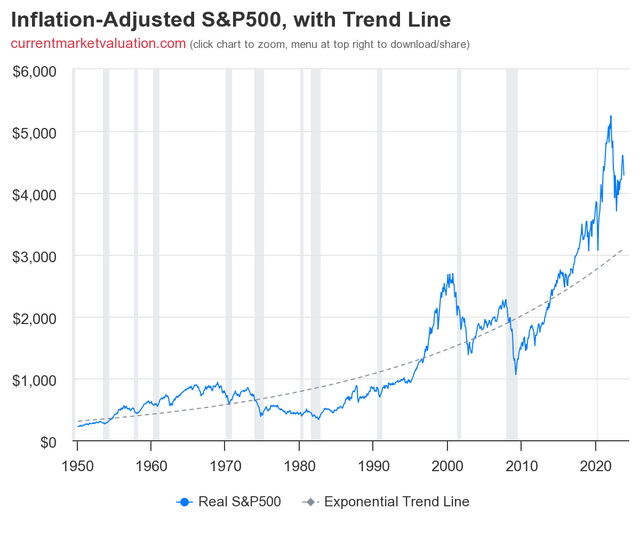

Moreover, SPY is clearly overvalued based on several valuation metrics, including:

- the Buffett Indicator model:

currentmarketvaluation.com

- the S&P 500 P/E Ratio model:

currentmarketvaluation.com

- and the S&P 500 Mean Reversion model:

currentmarketvaluation.com

As a result, while falling inflation and interest rates could potentially cheer the market up in the near term, a corresponding decline in corporate earnings due to an economic downturn will likely offset much of this initial cheer and potentially cause investors to take a fresh look at the lofty valuations that they have assigned to some of these companies.

Investor Takeaway

What does this mean for us as investors? For starters, we remain bearish on SPY and expect it to underperform its historical average returns in the next few years. As a result, we rate SPY a Sell.

That said, with so much of the market priced for higher-for-longer interest rates, opportunities for investors certainly do abound right now. We think that hedging against geopolitical and financial crisis risk is certainly prudent right now, making gold (GLD)(GDX) a particularly compelling investment at the moment. Energy (XLE) is also a compelling investment given the soaring geopolitical risk in top oil-exporting nations like Iran and Russia. That said, the risk of a sharp economic downturn could lead to significant near-term downside for oil prices should geopolitical risks not manifest into an actual supply chain disruption event, so we think that the risk-reward is more favorable in the midstream (AMLP) portion of the sector right now.

We also think that beaten-down quality defensive names in the utilities and yield co (XLU) and REIT (VNQ) sectors make a lot of sense right now as these stocks offer very attractive dividend yields right now, are poised to soar in the wake of falling interest rates, while also providing strong protection against an economic downturn. As a result, we are buying precious metals, midstream, infrastructure, and REITs hand-over-fist right now, while avoiding SPY and the richly valued mega-cap tech names that dominate its portfolio composition.

Read the full article here