Mid-Cap Insider Buying in Q3 of 2023

As mentioned in the large-cap article, in Q3 of this year we collected a total of 18,958 unique insider purchases across give or take 2,400 publicly traded U.S. firms. In today’s piece, we will focus our discussion and analysis exclusively on those companies which fall into the mid-cap category, but the recurring series will be followed up with a third-quarter installment covering small-caps as well which will be published on our profile shortly. For the purposes of this article, we defined mid-cap companies as publicly listed firms with market caps less than $10 billion and larger than $2 billion.

Below is our list of research-worthy large-caps that, in our view, enjoyed a period of unusual and atypical interest from corporate insiders during the third quarter of the year and are worthy of further research

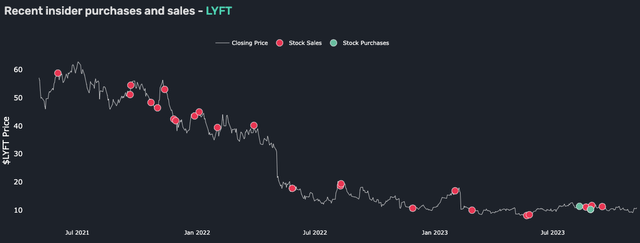

Lyft, Inc. (LYFT)

- Active Corporate Insiders: 3

- YTD Performance -5%

- Total Bought Back: $2,247,952

- Average Purchase Price: $11

It’s been about 4 and half years now since both Uber (UBER) and Lyft went public, and their fortunes have been far from the same. While not entirely impressive in that period, Uber has gained about 15% since its NYSE debut. Lyft on the other hand has shed 85% percent of its value since its IPO. While Uber has had some sizable insider purchases made by its CEO and several others, Lyft has had a total of 7 insiders make purchases in the time it’s traded on the public markets. That’s certainly worth noting considering the stock’s performance over the last few years. The company has some characteristics that provide context as to why it has lost so much value in the last several years. For one, it’s quite expensive at a P/E of 28x, and despite being founded more than a decade ago they are still posting quarterly and annual net losses. Their net income margin for the trailing twelve months is about -31%. Earnings however are not horrible, ignoring a dismal Q4 of 2022 where they posted EPS of -0.75, and have grown out of the negative range where they stayed for much of 2019, 2020, and 2021. Q3 earnings for this year will come out November 8th after-hours and analysts are currently expecting positive EPS and record Q3 revenue for the firm. It was recently appointed CEO, David Risher, and two directors that loaded up on shares recently. Risher and director Prashant Aggarwal both bought just more than $1 million in company stock while the other director made a smaller purchase of around $100k. The purchasing came in August, on the 11th and 28th to be precise, after the company announced Q2 earnings. Currently, shares of the rideshare company can be purchased for around $11.

Lyft Insider Trades (Quiver Quantitative)

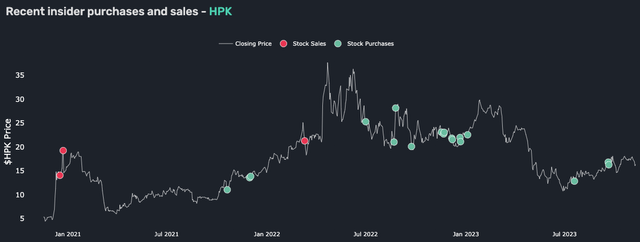

HighPeak Energy, Inc. (HPK)

- Active Corporate Insiders: 8

- YTD Performance: -30%

- Total Bought Back: $101,413,632

- Average Purchase Price: $12

This is probably the largest instance of insider buying we’ve covered from a company of this size. HPK currently trades at a market cap of around $2 billion meaning insiders bought back some 5% of the oil and natural gas firm. Much of this can be attributed to a massive purchase of $69 million from famous investor John Paul Dejoria in mid-July. We actually discussed HPK in a weekly insider article back at the end of September when additional insiders, like the CEO, started loading up on company stock. While appealing at a P/E of around 8x it doesn’t exactly stand out from many of its oil and gas E&P peers at that price although their debt to equity ratio of around 1.1x might be one reason why insiders have been so bullish recently. We discussed in the September weekly article the issue of HPK’s levered free cash flow, at the time it was -65%, and this has since continued to fall to now -59%. Not something to brag about but at least there is progress. That said they post strong margins in other arenas like a net income margin of 17% and a gross profit margin of more than 80%. Aside from the volume we already discussed, insiders like the VP, COO, CFO, and again the CEO had a large buying spree in mid-July around Dejoria’s purchase. At this point, insiders at HPK own about 83% of the company. Shares currently trade close to $16.

HighPeak Energy Insider Trades (Quiver Quantitative)

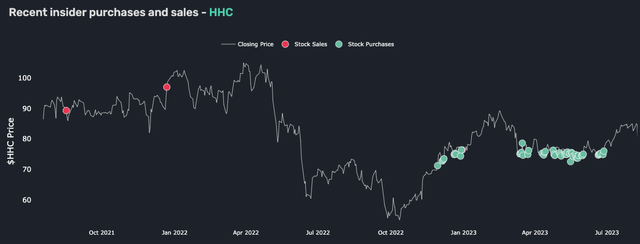

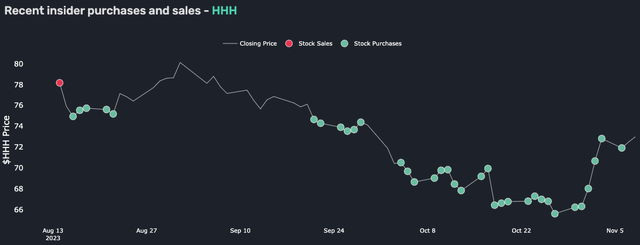

Howard Hughes Holdings Inc. (HHH)

- Active Corporate Insiders: 1

- YTD Performance: -8%

- Total Bought Back: $23,466,621

- Average Purchase Price: $74

Howard Hughes Holdings, formerly $HHC, is a corporate, residential, and mixed-use real-estate company. They also happen to be one of Bill Ackman’s favorite stocks. The firm has been part of his portfolio since 2010 but since the beginning of the year he has grown his position by 13%. It’s one of just three positions the investor as added to or grown this year. The other two being Hilton Worldwide Holdings (HLT) and Alphabet Inc. (GOOG)(GOOGL). Despite the interest from Ackman the company really doesn’t too many stand out attributes. They trade at a D/E ratio of about 2.1x and they’re operating with a net income margin of close to -50%. Overall it’s difficult as an outside investor to really gauge HHH considering the volatility of their earnings. That said, Ackman’s interest is intriguing to say the least. Shares jumped as much as 11% in the span of several days after Form-4 filings showed his fund, Pershing Square Capital Management, bought close to $8 million in stock on October 25th and $6.3 million five days later. The fund then bought some $8.5 million on November 2nd and close to $14 million another five days later. As you can see from the chart below the insider buying at HHH didn’t stop in Q3. I’ve included two charts; one for prior to the ticker change and one for post considering the change happened earlier this year. Usually the goal is to cover tickers with more diversified insider buying but considering Ackman is behind this and real-estate is a complex sector right now I thought it would be interesting to discuss and consider. His fund also closed out a large short position in U.S. Treasuries earlier this quarter which he had held for at least several months. The rate on the 30-Year was low 4% when he made the short position public and it now yields around 4.7%. As for HHH, shares currently trade at close to $70.

Howard Hughes Insider Trades (Pre-Split) (Quiver Quantitative) Howard Hughes Insider Trades (Post-Change) (Quiver Quantitative)

Coty Inc. (COTY)

- Active Corporate Insiders: 1

- YTD Performance: 11%

- Total Bought Back: $5,400,000

- Average Purchase Price: $10.80

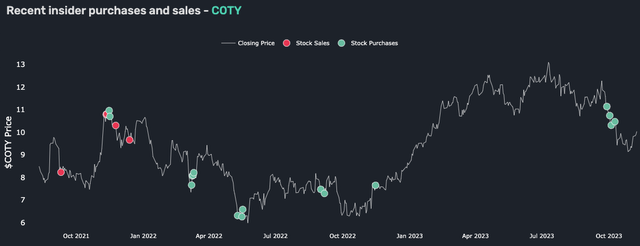

Coty manufactures and distributes beauty products for a global market through a large number of subsidiaries. The company is also well known for its connections to Kardashian-owned brands like Kylie Jenner’s beauty line Kylie Cosmetics and Kim Kardashian’s multi-product brand KKW. They’re the only company discussed here that’s managed to perform somewhat in line with the market; the S&P 500 has returned close to 15% YTD so COTY lags just slightly. Revenue will grow for the third straight year but is still some 30-40 percent down from the company’s record in 2017. That, a slightly high D/E ratio of 2.2x, and a pricey valuation at a P/E of nearly 24x are pretty much all the bad things you can say about the stock. As far as profitability goes it’s somewhat of a gem with gross profit margins of 64% and net income margins of about 6.5% over the trailing twelve months. While off from revenue highs, revenue CAGR over the last 3 years is still close to 10% which is well above most of its peers. There was just one active insider in Q3 at the tail-end; Director, Maria Aramburuzabala bought half a million shares for $5.4 million on September 28th. While it doesn’t technically count for the Q3 article, she was shortly followed by German ownership group JAB Holdings, who bought more than $32 million in stock, and another director. The company reported fiscal Q1 2024 earnings just earlier this week and now trades in the $9 to $10 range.

Coty, Inc Insider Trades (Quiver Quantitative)

Final Takeaway

No specific sector stood out with such concentrated insider purchasing as has happened in the last couple of quarters with regional banks and energy companies. Economic uncertainty appears to be growing and so anytime insiders use their own money to purchase company stock it’s probably worth taking note of. We’ll have to wait and see how future rate adjustments, inflation numbers, and so forth impact the investments and ultimately votes of confidence these insiders have just made.

Read the full article here