Just over 18 months ago, SSR Mining (NASDAQ:SSRM) was sector darling at $22.00 per share after a ~200% gain since its 2018 lows, which is when I warned that although we’d seen outstanding execution, it had tougher comps on deck. This is because SSRM was coming off a massive annual beat of ~794,000 gold-equivalent ounces [GEOs] with near peak grades at Seabee (~9.9 grams per tonne of gold), a huge year from Copler (~333,000 ounces sold), and would have to contend with inflationary pressures in a period of declining output. Unfortunately, inflationary pressures proved stickier than expected, production was well below expectations at Seabee this year, and the result is it will see production decline over 10% on a two-year basis while all-in sustaining costs have increased ~47% ($955/oz —> ~$1,415/oz). So, even though the company has softened the blow on a per share basis with opportunistic share repurchases, it’s no surprise that we’ve seen a violent correction in the stock.

SSR Mining Operations – Company Website

On a positive note, the Q3 results were much better sequentially vs. Q2 and Q4 is expected to be another strong quarter with maintenance complete at Copler and slightly higher grades at Seabee. That said, a sharp revision in FY2024 guidance overshadows the better near-term outlook, with FY2024 production likely to be closer to ~625,000 GEOs at all-in sustaining costs of $1,480/oz, translating to a significant decline in operating and free cash flow vs. the three-year average. In this update, we’ll dig into the Q3 results, the updated FY2024 outlook, and whether the stock is nearing a low-risk buy zone after its recent underperformance vs. mid-tier peers like Eldorado (EGO) and Alamos (AGI).

All figures are in United States Dollars unless otherwise noted.

Q3 Production

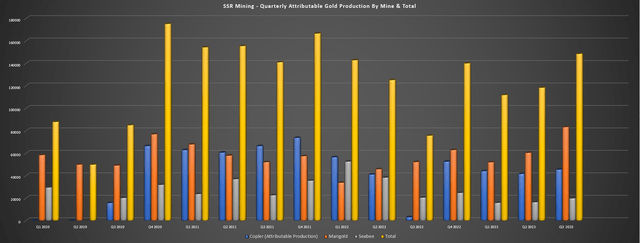

SSR Mining released its Q3 results this week, reporting quarterly production of ~192,200 GEOs, a significant improvement from the year-ago period. The sharp increase in production (+79%) was related to lapping easy year-over-year comparisons with a limited contribution from its Copler Mine Q3 2022 (temporary suspension), and relatively easy comparisons at Marigold which was affected by slower than planned recovery rates. That said, this was still a solid quarter for the company overall, despite the benefit of easy comparisons with record throughput at Puna, and a monster quarter at Marigold of ~83,300 ounces (best in the mine’s history). Plus, on the back of these much stronger results sequentially, SSR Mining should be able to deliver at the bottom end of its FY2024 guidance (700,000 to 780,000 GEOs) if it can put together a 204,000+ GEO quarter in Q4, which it has done before with ~211,700 GEOs in Q4 2021 (albeit with the benefit of much higher grades at Seabee).

SSR Mining – Quarterly Production – Company Filings, Author’s Chart

Digging into the operations a little closer, Marigold was certainly the standout, with ~7.73 million tonnes stacked at 0.45 grams per tonne of gold, a significant improvement from ~4.28 million tonnes at 0.59 grams per tonne of gold in the year-ago period. As for production and costs, gold production of ~83,300 ounces was up ~60% year-over-year with all-in sustaining costs [AISC] declining to $1,106/oz, well below the estimated industry average of ~$1,360/oz and down over 23% vs. Q3 2022 levels. This has pushed the mine’s year-to-date production to ~196,000 ounces, but the company noted that ore from Red Dot will be pushed into 2025 from H2 2024 previously because of moving trucks that were expected to be stripping at Red Dot to mining in its Mackay Pit to ensure the company can meet its annual guidance.

As for the company’s Copler Line in Turkiye, it was a decent quarter here, with ~56,800 ounces produced or ~45,400 ounces attributable to SSR Mining vs. ~3,700 ounces in the year-ago period. The better performance was related to the restart of mining vs. the temporary suspension that impacted its H2 2022 results after a spill of diluted cyanide solution in June, with ~618,000 tonnes processed at 2.92 grams per tonne of gold, and ~289,000 tonnes stacked at 1.47 grams per tonne of gold vs. no ore being stacked in Q3 2022 and much lower mining and processing rates. Not surprisingly, AISC improved materially to $1,378/oz and AISC margins increased to $550/oz. The other positive news was that SSR Mining has reached first ore at its Cakmaktepe Extension, with production from the Cakmaktepe Extension expected to total 10,000 to 15,000 ounces in Q4.

Seabee Mine – Google Earth

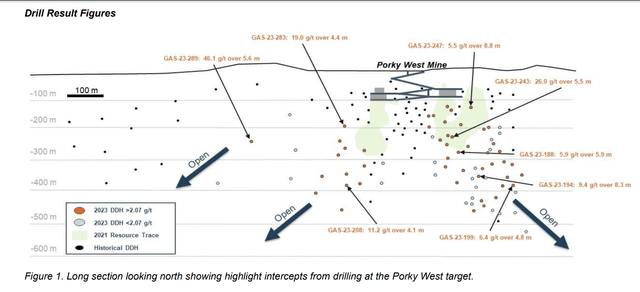

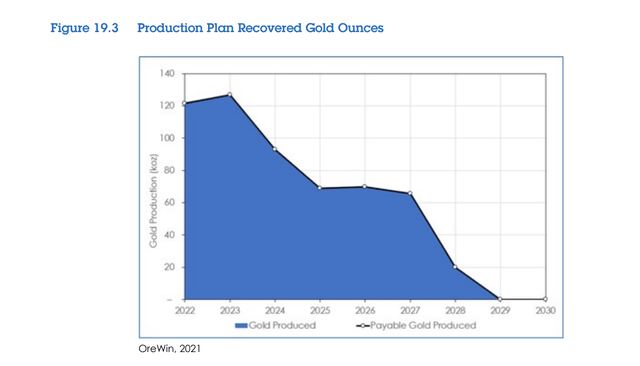

Finally, moving over to the company’s smallest Seabee Mine in Saskatchewan, production was down year-over-year to ~19,800 ounces (Q3 2022: ~20,500 ounces), with all-in sustaining costs up ~5% to $1,382/oz. Lower output was related to lower rec overie4s, which more than offset the increased throughput and grades, with ~105,000 tonnes processed at 6.17 grams per tonne of gold. And while Seabee’s production has been well below expectations this year after a tough Q1, Q4 is expected to be better with slightly higher grades. Plus, from a bigger picture standpoint, the company continues to see exploration success near-mine, with highlight intercepts of 5.5 meters at 26.0 grams per tonne of gold, 5.6 meters at 46.1 grams per tonne of gold, and 4.4 meters at 19.0 grams per tonne of gold northwest of the Seabee Plant. And following continued drilling over the past year, mineralization has been traced over 1.2 kilometers of strike between Porky West and Petunia and up to 500 meter vertical depths, suggesting the possibility of a new underground mining area.

Porky West Target Drilling – Company Website

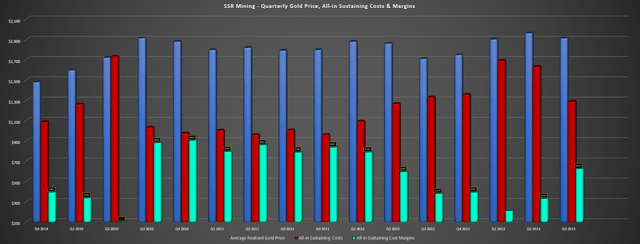

Sales, Margins & FY2024 Outlook

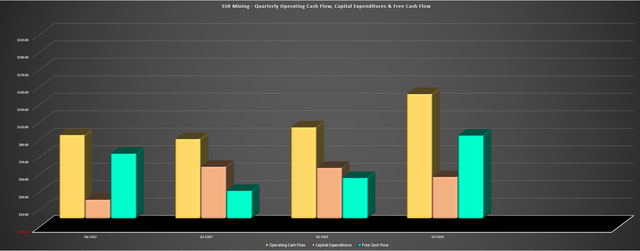

Moving over to sales and margins, SSR Mining reported revenue of $385.4 million, a 131% increase year-over-year because of the lack of sales from Copler in the year-ago period and the benefit of higher gold and silver prices. Meanwhile, all-in sustaining costs improved to $1,289/oz (Q3 2022: $1,901/oz), translating to a meaningful improvement in AISC margins which soared to $624/oz vs. [-] $210/oz in the year-ago period. Finally, operating cash flow before working capital changes came in at $142.4 million, while free cash flow was $94.9 million. And with a strong Q4 on deck (higher grades at Seabee, contribution from Cakmaktepe Extension, no maintenance activities at Copler), we should see another solid quarter financially, partially offset by a sales lag because of the timing of shipments (holiday season impact).

SSR Mining AISC & AISC Margins – Company Filings, Author’s Chart

SSR Mining Operating Cash Flow, Capex & Free Cash Flow – Company Filings, Author’s Chart

So, why was the stock hit so hard following its strong Q3 results?

While SSR Mining is tracking to meet the bottom end of its FY2023 guidance following the much better Q3 results, costs will come in near the high end of guidance ($1,425/oz), and the FY2024 outlook is much softer than expected for two reasons. For starters, and as noted earlier, waste stripping is being deferred, which will mean delayed access to Red Dot that will affect Marigold’s 2024 production levels. Second, continued exploration success at the Cakmaktepe has SSR Mining rethinking its prior plans of heap leaching oxide ore. The result is that the company is now looking at adding a grind leach circuit to boost recoveries from ~60% to ~80%, or an additional 300,000 ounces of gold recovered vs. stacking these ounces on heap leach pads and accepting lower recovery rates. However, while this is NAV accretive (and especially if new oxide ounces continue to be proven up), it will delay full production levels until late 2026 while the company works to incorporate additional processing equipment. So, when combined with a declining production profile at Seabee, we could see output decline over 12% year-over-year.

Seabee Production Profile – 2021 TR

Assuming SSR Mining produces at 13% below its planned FY2024 guidance midpoint (previous 2024 guidance midpoint of 710,000 GEOS), we would see annual production next year dive to ~620,000 GEOs, in line with its recent commentary that production would be 10-15% below the previous outlook. This is obviously a significant departure from the prior outlook, and it doesn’t look like 2025 production will reclaim the 700,000 GEO level either given that guidance was 700,000 GEOs and we’ll now see less contribution from Red Dot (partial year in 2025 vs. full year of contribution) and less oxide ounces than expected at Copler. Finally, this will be a more capital intensive period for SSR Mining than the 2020-2021 period when the stock shined (start of Hod Maden construction, grind-leach circuit, waste stripping at Red Dot), so SSR Mining will see much lower free cash flow generation than the previous outlook with negative free cash flow next year unless gold prices remain above $2,000/oz for the entirety of 2024.

Let’s see whether this less ebullient near-term outlook is priced into the stock:

Valuation

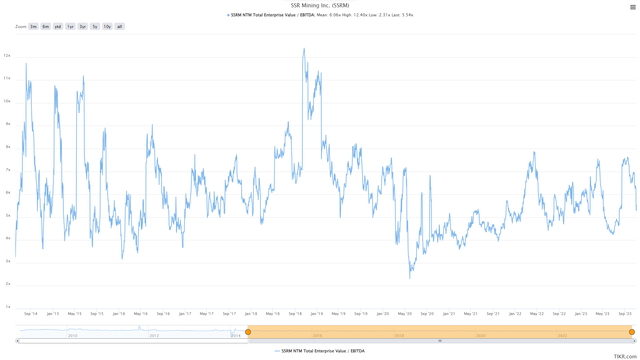

Based on ~204 million shares and a share price of $12.30, SSR Mining trades at a market cap of ~$2.51 billion and an enterprise value of ~$2.30 billion. This is a significant departure from its peak market cap of ~5.0 billion at its 2021 highs, and we’ve seen significant underperformance vs. in the stock since its peak. And while the valuation is much more reasonable especially given the portfolio optimization (non-core sales), bolt-on acquisitions and the addition of a 70% ownership in a world-class asset (Hod Maden), I still don’t see enough of a margin of safety just yet. The reason is that SSR Mining still trades at a premium to some of its peers at ~7.3x P/CF (FY2024 estimates of $1.68), and this is despite SSR Mining set to see production, margin, and free cash flow declines year-over-year at the same time as names like Barrick (GOLD) have much easier comparisons and will see meaningful growth across these three metrics.

SSR Mining EV/EBITDA Multiple – TIKR.com

Using what I believe to be fair multiples of 1.0x P/NAV and 8.0x P/CF (FY2024 estimates), and a 65/35 weighting to derive its fair value, I see an updated fair value for SSR Mining of US$17.00, pointing to a 38% upside from current levels. However, I am looking for a minimum 35% discount to fair value to justify starting new positions in mid-cap producers (especially if they are not solely Tier-1 producers), and this places SSR Mining’s low-risk buy zone at US$11.05 or lower. And while the stock may not revisit this level, I prefer to buy at a deep discount or pass entirely. That said, the long-term picture here is quite bullish post-2025 when Hod Maden is closer to first production, making SSRM one of the better turnaround stories worth buying on a dip if it can pull back further into its updated low-risk buy zone.

Summary

SSR Mining has a strong Q4 on deck, but the 2024 outlook is much weaker than I anticipated and the significantly lower cash flow outlook has left the stock trading in line with peers vs. a discount previously despite the share-price underperformance. And while the market might overlook the less robust outlook (Q1 2024 to Q2 2025) given that the stock trades at a discount to peers from a P/NAV standpoint (~0.62x), I still don’t see enough margin of safety here, so I continue to focus on more undervalued names elsewhere in the market. To summarize, nothing has changed for the bigger picture, and SSR Mining is one of the few consistent per-share growers, but I see the ideal buy zone coming in at US$11.05 or lower, so I remain on the sidelines for now.

Read the full article here