Historically, airlines have been among the worst-performing industries on the stock market. Since its launch in 2015, the US Airline ETF (JETS) has not delivered positive returns, stuck in various trading ranges for years. Fundamentally, I’d argue airlines are not well-suited for public markets. Airlines are highly capital-intensive, have significant cyclical exposure, face tremendous price competition (it is hard to create niches and moats), and can be hindered by government regulatory changes. Hence, in other countries, they’re often government-sponsored entities. Even in the US, many depend on various government bailouts.

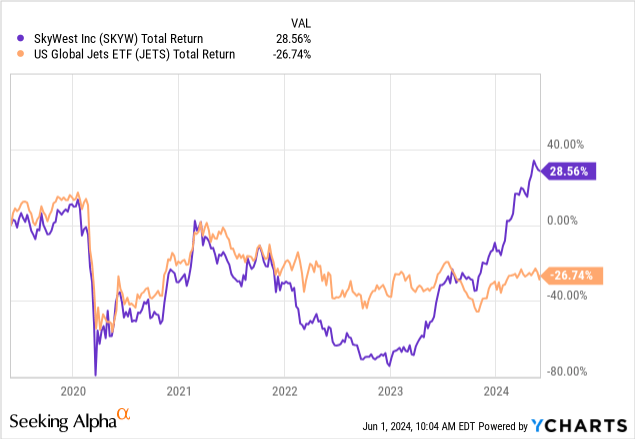

Most airline stocks prices have not recovered since 2020 despite air travel volumes hitting consistent record highs. There are a few exceptions. SkyWest (NASDAQ:SKYW) has seen solid performance in the past year, particularly compared to the industry. See below:

Usually, stocks rarely perform far better or worse than their industry. However, SkyWest appears unaffected by the ongoing strains facing airlines. Indeed, there are many fundamental positive qualities of SkyWest vs. its peer group. That said, the stock trades at a notable valuation premium to most airlines and may not necessarily deliver on the rosy expectations implied by its valuation. Thus, I believe it is a good time to take a closer look at the company and its macroeconomic exposures to determine its long-term value potential.

The Secrets To SkyWest’s Performance

SkyWest’s business model is fundamentally different from that of most other airlines. It is a regional airline focusing on smaller flights toward smaller airports, already giving it a competitive niche. SkyWest is the largest regional airline fleet in the US, creating potential pricing advantages as it has both cost scale and the slight oligopoly pricing power natural to regional airlines. That is, route price competition is much lower regionally than nationally.

SkyWest flights are contracted by Alaska (ALK), American (AAL), Delta (DAL), and United (UAL). The company generally takes fixed-fee long-term contracts with these airlines, which book regional flight routes. Since SkyWest is large, it has more significant degrees of scale that should result in it offering lower prices than other regional airlines or these carriers, giving it a significant competitive advantage and a continued flow of customers.

Moreover, because it does not manage booking and flight marketing, it has lower operating expenses. Airlines typically spend a lot on obtaining customers in a hypercompetitive online marketing space, but SkyWest generally gets customers through its larger peers. Indeed, its operating expense-to-sales ratio was 9.1% last year. United Airlines’ was 18.7%. Spirit (SAVE) and JetBlue (JBLU) were also in the 18% range. Southwest’s (LUV) was 15.3%. American Airline’s was 14.8%. Alaska, Frontier (ULCC), and Allegiant (ALGT) had similar operating expense rates to SkyWest but have terrible stock performance and income, indicating they’re avoiding marketing (and other overhead) expenses to save. Delta also had a low figure, likely due to its high customer loyalty and satisfaction.

Fundamentally, I’d argue that SkyWest is a particularly unique airline that does not face many of the industry’s critical issues. Namely, its competitive pressures are tremendously lower than all other major airlines because it is regional and contracted by more prominent peers. It is still exposed to capital intensity and cyclical risks, which are heightened with interest rates but is among the few airlines that I’d argue has a significant economic moat.

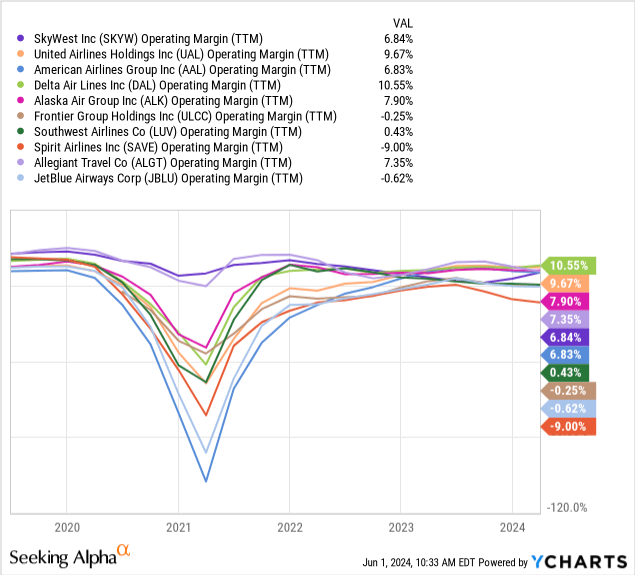

Since SkyWest’s model is not business-to-consumer and more business-to-business, its primary aim is to offer lower prices to maintain dominance in getting long-term contracts. Therefore, it has notably lower gross margins than the major airlines, excluding the discount airlines that I believe are at risk of failing today (Spirit, Allegiant, and Frontier). Overall, its profitability is in the middle of the US airline industry. That said, its margins are far more stable, not suffering catastrophic declines in 2020 nor the competitive pressure declines we’re seeing in discount airlines today. See below:

Again, I believe this places SkyWest at a vast advantage that differentiates it from other airlines. From an investment standpoint, I’d argue profit margin stability is far more critical than overall margins because stocks are valued based on expectations. We’ll typically expect higher valuations if those expectations are not at risk of wild changes.

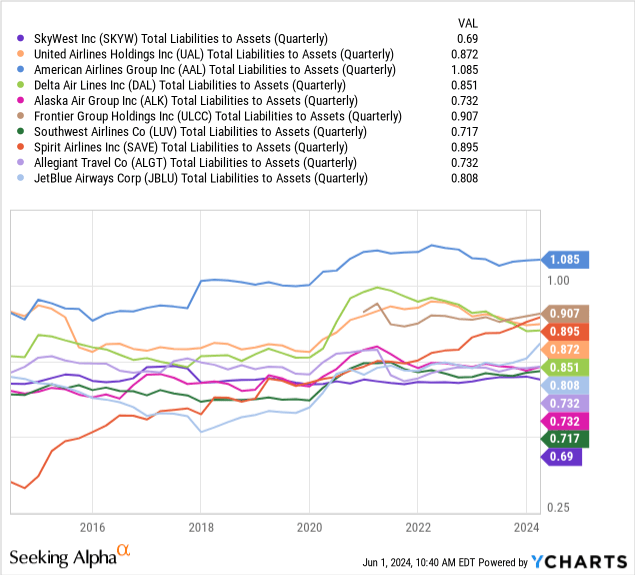

Further, SkyWest’s business model protected its margins in 2020, so it did not face the considerable debt increase that most other airlines did. Virtually all US airlines had to take on immense debt in 2020-2021 as lockdowns caused negative cash flows. Total liabilities-to-assets is an imperfect leverage measure, but debt-to-EBITDA may be worse because airlines’ income is so volatile. By this measure, SkyWest is the least leveraged, having not seen material liabilities growth during the lockdowns:

With interest rates rising, many airlines may see continued pressure on their incomes as they must repay or refinance that debt at today’s higher interest rates.

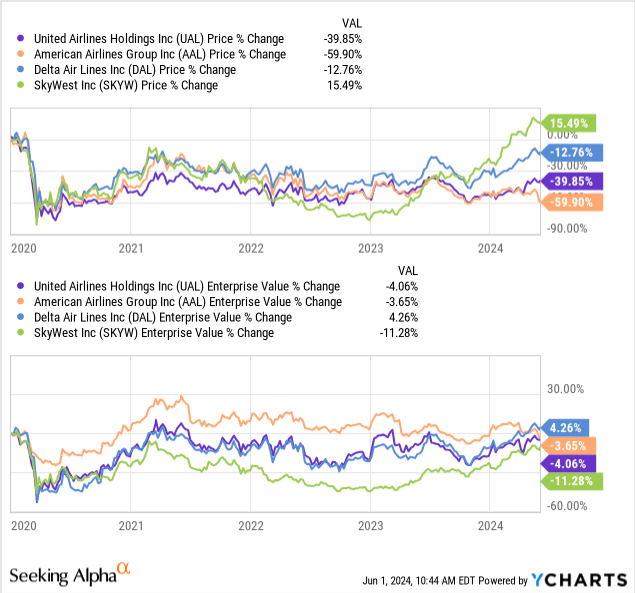

Even more, many who may not understand fundamentals often point to airlines’ low stock prices as a sign that they’re discounted. Indeed, most airlines’ stock prices remain well below pre-2020 levels. However, that alone is no indication of a discount. The accurate indication of a discount is Enterprise Value, which measures market capitalization and debt or the total combined value of a company. If a company takes on significant debt but does not increase its income, its stock price should be lower. That is the case for most airlines today. Indeed, from an Enterprise Value standpoint, the major airlines have recovered. Although SkyWest’s stock price is much higher, its Enterprise Value is lower. See below:

As an Enterprise, SkyWest is 11.3% cheaper today than in January 2020, while the big three are all about the same. That alone does not mean SkyWest is discounted, as that depends on how its income outlook has changed. That said, the argument that the big three are discounted because their share prices are lower is not logical because their debt levels have increased proportionally to their equity devaluation.

What is SkyWest Worth Today?

In my view, SkyWest stands out from other airlines, facing far lower risks. Indeed, between pilot and customer competition, I believe many airlines are at risk of income declines, with the discount airlines seemingly at risk of significant financial strains as they struggle with debt repayment pressures. This makes SkyWest tricky to value, as its valuation ratios should likely be far above its peers. That said, there is still a price where SkyWest is likely overvalued, particularly considering the company is still exposed to recessionary cyclical risks if air travel volumes reverse.

Airline valuations differ today because some face more acute risks than others. SkyWest has a forward “P/E” ratio of ~11X, which is around the middle of the group. JetBlue and Spirit are not expected to profit on a forward basis, owing to what I feel is their competitive failure. Southwest and Allegiant have forward valuations of 23 and 18X, respectively, owing to depressed income outlooks. In my view, Southwest is not strong because it is trying in vain to compete with the Big Three, abandoning its more profitable regional roots.

Frontier’s valuation is similar to SkyWest’s at 11.4X, though its stock has declined by ~75% since 2020. In my view, Frontier and Allegiant are both at high risk of long-term income declines because they’re struggling to compete in the hypercompetitive discount airline space. On the other hand, the Big Three all have lower valuations than SKYW, with UAL and AAL at ~5.2X and DAL at ~7.7X. That said, those companies have tremendous debt.

These companies’ forward “EV/EBITDA” levels are more telling because they account for debt leverage. SKWY has a forward “EV/EBITDA” of ~5.9X around the pack’s upper middle. Again, JetBlue and Spirit have higher figures at ~10X and ~7X, respectively, because their income outlooks are low, but investors seem to expect them to survive. Frontier’s is a measly ~1.4X, potentially indicating restructuring risk or a fire sale discount, likely stemming from its poor margins and immense debt leverage.

The other airlines have forward “EV/EBITDA” ratios ranging from ~3.6X (Alaska) to ~5.9X (Allegiant). Again, even correcting for debt, we see SkyWest’s valuation is notably above those of the Big Three, which range from ~3.7X (United) to ~5X (Delta), averaging 4.5X. At ~5.9X, SkyWest’s multiple is at a 31% premium to the Big Three’s average.

SkyWest’s EV is $5.08B, and its market capitalization is $3B, or ~$2.1B higher. That difference is fixed (for our purposes of valuing it based on its latest balance sheet), so for its EV to decline, its market capitalization would need to see a larger decline (in percentage terms) than its Enterprise Value. For its forward “EV/EBITDA” to be 4.5X, its EV would need to fall to ~$3.87B, meaning its market capitalization would need to decline by ~$1.2B, or about 40%.

In my view, this is a more accurate valuation metric than using forward “P/E” ratios as it accounts for SkyWest’s lower debt levels. To illustrate, the mean forward “P/E” of UAL, AAL, and DAL is ~6.1X today while SKYW’s is ~11X. For its “P/E” to decline to 6.1X, its price would need to fall by ~45%. However, I’ll use the “EV/EBITDA” relative valuation method because that accounts for its lower debt level.

The Bottom Line

From the standpoint of forward “EV/EBITDA,” I argue SKYW is at a ~66% premium to the Big Three, or it would need to be 40% lower to have a similar range. Then, we must ask ourselves if that significant premium is justified by its lower risk or superior organic growth potential.

SkyWest’s business model is, in my view, far less risky than those of the Big Three airlines because it contracts with them, giving it a huge moat that is rare in the industry. SkyWest is expected to see 6% to 14% annual sales growth over the next three years, which is better than analysts expect from AAL, DAL, and UAL. The Big Three’s revenue growth outlooks are not necessarily expected to even keep up with inflation, partially justifying SkyWest’s premium. SkyWest can likely continue to grow by outcompeting smaller regional peers through its economic scale, not being as dependent on general economic growth (which is hardly existent).

SkyWest is also the only airline with a significant stock buyback program recently, with its share count falling by 20% last year. The company’s CFO is $744M TTM, while its CapEx was $250M, far below its previous levels. To me, that indicates SkyWest is pivoting away from capital growth but could still see substantial EPS expansion through share buybacks. Other forms of negative cash from financing (dividends or deleveraging) may also benefit the stock as it will likely continue to earn significant cash returns over the coming years.

Overall, there is a lot to like about SkyWest. That said, my outlook for SKYW is neutral because I believe its positive qualities are well-accounted for in its valuation premium. Further, SKYW may face the risk of declines if air travel levels decrease, stemming from what I view as another potential wave of inflationary pressures that will negatively impact consumer spending, as detailed in some of my recent articles. However, I am somewhat bearish on all the other airlines. Hence, although I do not believe SKYW is undervalued, I think it is the best investment choice in what I feel is a hardly investable industry.

Read the full article here