The last time I wrote about Shopify (NYSE:SHOP) (TSX:SHOP:CA), I suggested that its fundamentals were improving on the back of a more focused strategy. Moderating growth and a high valuation have created an unfavorable setup for investors, though. The stock is down approximately 10% since then, despite strong Q4 results. This is likely to persist going forward, with Shopify’s high valuation limiting the gains from strong fundamental performance.

The valuations of many companies have increased significantly over the past 12 months, and the market is now looking for these companies to justify their valuations with strong financial performance. While Shopify’s stock is off its peak, the company will need to demonstrate strong results to maintain its share price at current levels. Shopify’s Q1 (expected on May 08th) is likely to be robust, but I think there is a reasonable probability that guidance disappoints investors.

While I believe that recent developments have helped cement Shopify’s future success, the macro environment looks precarious in the near-term. If this situation evolves into something more problematic, it likely won’t be until late 2024 or early 2025, though.

Macro Conditions

Shopify is a dominant player in ecommerce, with its business representing an estimated 11% of total ecommerce in the US. This means that the company’s future is increasingly tied to growth of the overall category. Shopify’s expansion offline is gaining steam though, providing the company with an extremely long growth runway, as around 80% of US retail is still offline.

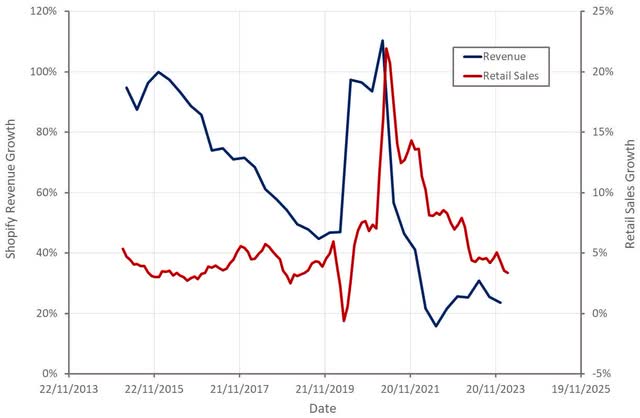

I think momentum slows in coming quarters though due to macro headwinds. Retail sales growth in the US is decelerating and pressure on consumer spending appears to be mounting. Whether this situation escalates into a recession remains to be seen, but a period of softer retail sales growth appears likely at a minimum.

Figure 1: US Retail Sales Growth (source: Created by author using data from The Federal Reserve)

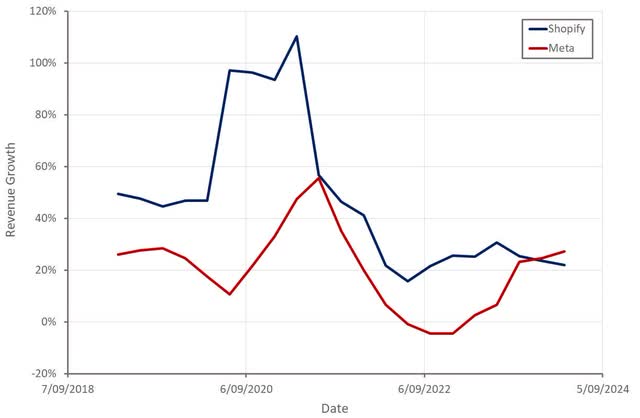

Some of Shopify’s recent strength appears to have come as the ecommerce ecosystem has reckoned with recent privacy changes, led by companies like Apple (AAPL). Meta’s (META) revenue growth bounced back sharply in recent quarters as the company’s advertising performance has picked up.

Figure 2: Shopify and Meta Revenue Growth (source: Created by author using data from company reports)

Shopify Business Updates

Shopify’s platform continues to evolve, with the company adding functionality that helps merchants manage their businesses. I believe Shopify still has a significant expansion opportunity in this regard, both in terms of adding new merchants and expanding within existing merchants.

Shopify’s move away from logistics indicates that it is being more measured in the way it offers merchants services. The company is now relying on partners to provide merchants with an end-to-end logistics network. While this doesn’t appear to be negatively impacting Shopify’s business, it limits the company’s addressable market.

Audiences

Audiences provides a hashed list of high intent buyers for the products that merchants would like to market. Lists are developed from Shopify data using machine learning. These lists can be exported to digital advertising platforms like Facebook and Instagram and helps to offset some of the loss of signal caused by Apple’s ATT initiative. Shopify continues to build out its Audience product, with partners now including TikTok, Snap, Pinterest and Criteo.

Merchants using Audiences are seeing up to 50% higher ROAS, making it a compelling solution. The benefit of Audiences could be diminished somewhat as companies like Meta continue to enhance their targeting and attribution capabilities, though.

Shopify isn’t monetizing Audiences yet, but this will come eventually and should be a material source of very high margin revenue. Audiences, and the fact it isn’t monetized yet, potentially goes a long way towards explaining Shopify’s premium valuation.

AI

Shopify Magic is an AI enabled tool which utilizes the merchant’s own data. It can be used for things like content generation and website creation. Sidekick is an AI assistant which leverages Shopify Magic to boost merchant productivity and improve decision-making. It can provide guidance and help in areas like writing, research and performing repetitive tasks. While I think these types of products have potential, there is a risk that a deluge of generic AI-generated content creates poor outcomes for most merchants.

Shopify has also introduced shop.ai, an AI shopping assistant which helps users to search for products. While this may seem like a fairly incremental product introduction, it has the potential to strengthen the Shop app as a source of demand generation for merchants, which is one of the few weaknesses of Shopify’s business.

Merchant Tools

Shopify continues to add to its merchant tools, supporting growth and enhancing the company’s competitive positioning. Driving adoption of a range of solutions should reduce churn and increase ARPU, improving the economics of the business.

- Shopify Bill Pay – expense management

- Shopify Tax – tax management

- Shopify Collective – enables Shopify stores to connect and cross-sell products. This has the potential to boost GMV and make the platform stickier by creating network effects.

- Marketplace Connect – allows merchants to sell across leading marketplaces and manage this from a single app.

- Commerce Components makes Shopify’s platform more modular, allowing merchants to integrate Shopify components into their existing tech stack. This should help with merchant acquisition by lowering the barrier to adoption.

Financial Analysis

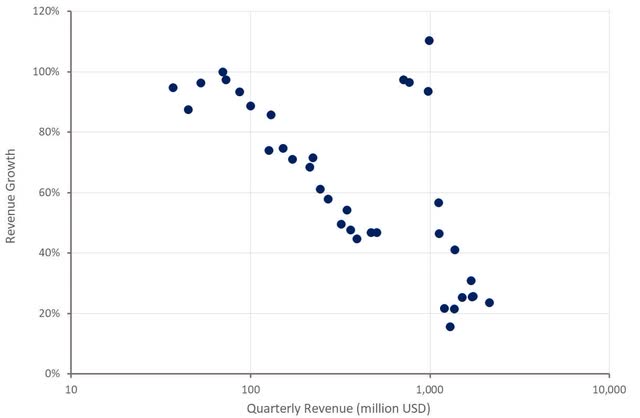

Shopify’s fourth quarter revenue was 2.1 billion USD, up 24% YoY, or 30% excluding the impact of the logistics business. Shopify specifically highlighted its international and enterprise businesses as areas of strength in the fourth quarter. Point of sale also continues to perform well, and it is also increasingly acting as a customer acquisition tool. Shopify’s Europe revenue increased 40% YoY in Q4, with a fairly even contribution from same-store sales growth and new merchants. Subscription Solutions revenue was 525 million USD, up 31% YoY, driven by both merchant growth and pricing. Price increases also continue to support growth, and Shopify believes that there is still further room to increase prices.

Fourth quarter GMV was 75.1 billion, up 23% YoY. Shopify’s offline GMV increased 28% YoY in Q4, with Shopify’s offline revenue reaching 441 million USD. Shopify’s B2B GMV was also up nearly 150% in Q4, driven primarily by existing merchants adopting B2B. Cross-border GMV was approximately 14% of total GMV in the quarter.

Revenue growth is expected to be in the low 20% range in Q1, or the mid-to-high 20s when excluding the impact of the logistics business sale. Guidance is conservative though, and I expect revenue growth in excess of 25% YoY in the first quarter. Underlying growth is likely to moderate throughout 2024, while headline growth could pick up as Shopify laps the exit of the logistics business.

Figure 3: Shopify Revenue Growth (source: Created by author using data from Shopify)

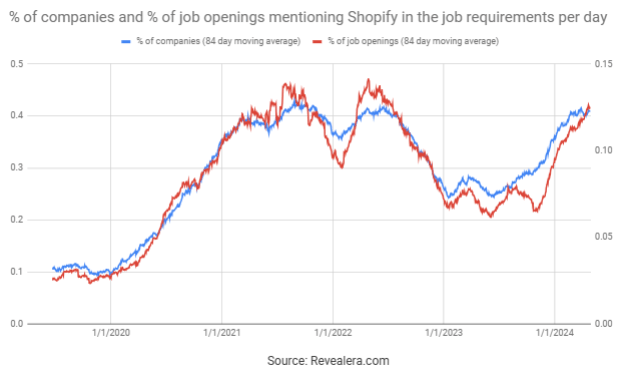

The number of job openings mentioning Shopify in the job requirements has increased dramatically over the past 6 months, which is suggestive of an improved demand environment.

Figure 4: Job Openings Mentioning Shopify in the Job Requirements (source: Revealera.com)

Shopify’s Subscription Solutions gross profit margin increased to 81.5% in Q4, supported by price increases. Shopify has also been trying to minimize cloud infrastructure costs, which has benefited gross profit margins somewhat.

Excluding the impact of the logistics business, Shopify’s Merchant Solutions gross profit margin declined YoY. While payments are supporting growth, this business continues to undermine margins, although contract negotiations could help to offset this somewhat. Shopify faces headwinds as it works with more larger enterprises, though. Merchant solutions like Installments, Tax and Markets Pro should support Merchant gross profit margins as they scale.

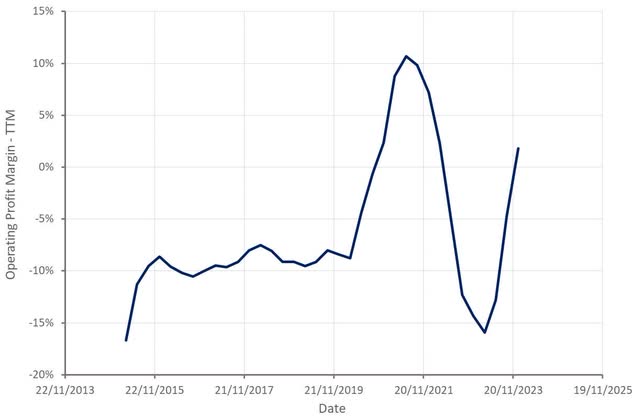

Cost control and strong growth are both contributing to a rapid increase in operating profitability. Shopify’s operating expenses were down 22% YoY in the fourth quarter, which was largely attributed to the sale of its logistics business, lower head count and the lack of a real estate impairment charge. Shopify has increased marketing spend though in support of growth, which the company believes is justified by compelling returns.

Figure 5: Shopify Operating Profit Margin (source: Created by author using data from Shopify)

Conclusion

Shopify’s revenue growth should remain robust over the long run, but the company’s high growth days are behind it. While I don’t necessarily think the stock is egregiously overvalued, it is difficult to see Shopify’s stock generating strong returns from current levels. This is heavily dependent on both the sustainability of growth and Shopify’s ability to generate high margins (> 30%). Newer Merchant solutions are a positive in this regard, as they expand the company’s addressable market and should have high margins.

While Shopify has a strong business, I believe the current environment makes exposure to consumer spending risky. There is a range of macro factors (declining retail sales growth, softening labor market, rising consumer debt levels) that could create in significant downside in the near-term. Q1 results should be solid, but there is a risk that guidance disappoints investors. The evolution of Shopify’s margins will be important in this regard. With strong growth and ongoing cost discipline, I expect Shopify’s margins to continue rapidly improving.

Figure 6: Shopify EV/S Multiple (source: Seeking Alpha)

Read the full article here