Investment Thesis

Over the last year, Shake Shack (NYSE:SHAK) has underperformed the market denoted by the S&P 500 index, but some investors still remain bullish on their growth trajectory. Sometimes, when there is short-term underperformance in a stock, there may be an opportunity for long-term value investors to build a position and profit from the market’s volatility. However, based on a fundamental analysis, SHAK appears to be trading at an over extended valuation and I expect there to be a share price decline given any near-term headwinds. I believe SHAK should be categorized as a very speculative growth investment at this valuation due to the poor fundamentals such as high weighted cost of capital and low returns on equity along with their thin operating margins and net margins. Since the current valuation of the stock does not make sense based on the numbers, I am designating this a sell, meaning that I would not invest in this company today.

SHAK vs SP500 over the last year. (Seeking Alpha)

Company Outline

Shake Shack Inc. is a restaurant chain in the consumer discretionary sector that had their IPO within the last 10 years and was founded fairly recently in 2001. They are a growing chain that operates, along with franchises, Shake Shack restaurants that provide menu items such as premium burgers and chicken sandwiches. In their most recent earnings call, the company described a recent management transition that they are undergoing where their CEO Randy Garutti will be moving into more of an advisor role and a new CEO, Rob Lynch, will be taking over. They also provided commentary on the industry with uncertainties on consumer spending with the inflationary pressures as well as inflationary issues that they face.

As with most companies in the consumer discretionary sector, SHAK was significantly impacted by the pandemic and is still facing the repercussions of this as inflation remains rampant in the United States. Specifically, they have been affected with increases in wage costs for their employees, such as in California, where the minimum wage has significantly increased, and with increases in commodity products such as beef prices. SHAK anticipates these headwinds to continue in the near term, and are uncertain at this time about the impact moving forward. They are making up some of the increased costs associated with running the business with cheaper total build costs on their new shacks, which have decreased by about 10%, and revolutionizing their packaging. However, as you will see with the fundamental analysis below, the company is struggling to provide value for investors and is continuing to maintain razor-thin margins due to costs of advertising and their marketing spend when compared to peers in this sector.

Fundamental Analysis

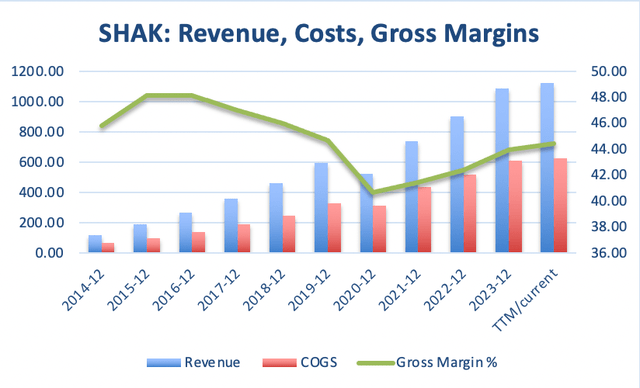

Since their IPO in 2015, Shake Shack Inc. (SHAK) has grown revenue nicely and has provided about an 85% return for investors based on stock appreciation. However, in spite of this stock appreciation, SHAK’s fundamentals indicate that the company is overvalued. On a trailing twelve-month basis, SHAK has a P/E ratio of 169.8, EV/EBITDA ratio of 35.7, and a price to sales ratio of 2.98. Compared to the sector, these values are all significantly higher. On a forward-looking basis, SHAK still trades at an elevated P/E of 115.3, an EV/EBITDA ratio of 23.5, and a P/S ratio of 2.7. These values are also significantly higher than the sector values. Moreover, this company has more total debt than cash on hand as overall costs of goods sold (COGS) continue to rise at a significant rate compared to revenue growth. Compared to their IPO year in 2015, revenue has grown 490% while costs have grown 532% and gross margins have declined 8%. As you see below, margins were affected by the pandemic in 2020, but were already declining before then close to the level they are now.

SHAK: revenue, costs of goods sold (COGS), and gross margins over the last 10 years and since their IPO. (GuruFocus)

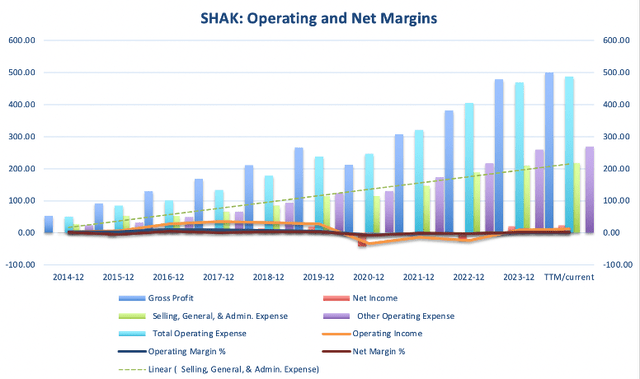

With gross margins declining, I wanted to evaluate margins specifically with total expenses accounted for. Operating margins on a trailing 12-month basis is 1.06% and on a net margin basis, the trailing 12-month return is only 2.1%. As you can see in the graph below, total operating expenses continue to significantly rise, and in some years outpaces total gross profit for the company. Although total net income and net margins are higher than in 2015, if we compare a 2.1% return to a successful peer in the industry, McDonald’s Corporation (MCD), MCD’s current net margins are just over 33%, or in other words almost 16x better than SHAK’s margins. With their razor-thin margins, I expect SHAK to struggle in any short-term economic turmoil as they did during the pandemic in 2020 since there is no room for error.

SHAK: gross profits and operating and net margins in relation to total expenses since their IPO. (GuruFocus)

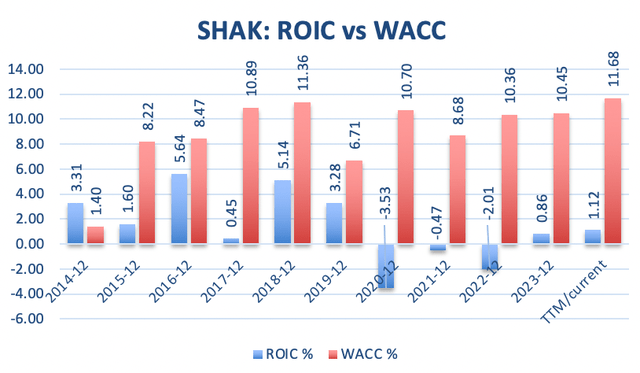

When evaluating great companies, I believe there should be high returns on invested capital, measured by [ROIC] when compared to weighted costs of capital that is denoted by [WACC]. As you can see in the graph below, WACC far outpaces ROIC since SHAK’s IPO and is currently 10x greater. This is concerning, even with a growing company, that they are not seeing high returns on their investments and potentially making poor business decisions. This is one fundamental that until it turns around, I will stay away from an investment in SHAK. However, as this is just one factor to consider, let’s look at returns on equity [ROE].

SHAK; return on invested capital versus weighted cost of capital. (GuruFocus)

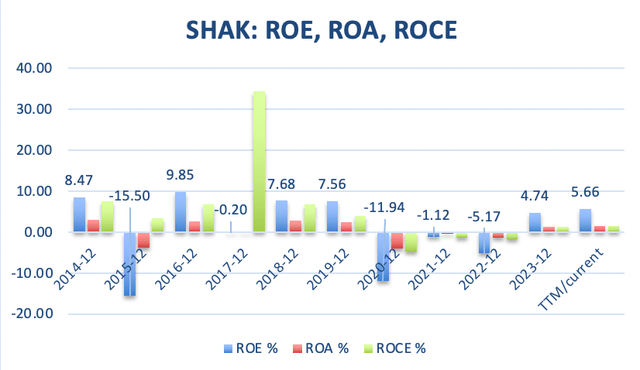

Growing companies that display high returns on equity typically indicate to investors that they will become a profitable business if they are not one already. However, with SHAK, ROE has been very low since their IPO and has gone negative in a few years. Typically, I would like to invest in a company that has a ROE of at least 10%, which indicates to me that I’m buying into a strong business model. Moreover, current returns on assets [ROA] and returns on capital employed [ROE] remain low as well and have not fully recovered since the impact of the pandemic in 2020. As the pandemic indicated an unprecedented time for all companies, it seems other companies in this sector are not having the same fundamental issues as SHAK at this point, and this is concerning to me about how SHAK’s management is handling growth and their investments.

SHAK: return on equity, return on assets, and return on capital employed over the last decade. (GuruFocus)

Per Share Value

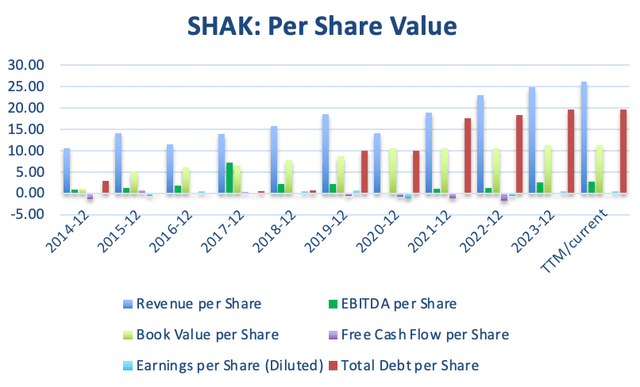

On a per-share basis, SHAK has taken on a significant amount of debt starting in 2019. Compared to 2014, this debt is 581% higher on a current level and may pose a risk to this business with such tight operating margins if the company runs into any headwinds. However, on a positive note, this company has grown earnings per share since their IPO and when compared to 2015, this value is 185% higher with current trailing twelve-month earnings of $0.55/share. Additionally, EBITDA has increased 121% and book value is up 122% since 2015. These are good sings that while the business is in good economic times, that earnings and EBITDA are growing. However, on a per-share value basis, one thing to note is that this company has never bought back shares and has continued to increase shares outstanding each year since inception. This may be an indication of underlying problems with maintaining capital, as they are issuing shares and taking on more debt to finance their operations and growth.

SHAK: Per share values over the last decade. (GuruFocus)

Risk To Investment Thesis

This investment thesis is limited in the fact that I am evaluating the past performance of the company and extrapolating this performance to determine the future price action of the stock. As past fundamental performance does not guarantee future stock performance, this is a risk to the investment thesis. Additionally, part of the historical fundamentals of SHAK include impacts from the pandemic, which could be a once-in-a-lifetime sort of event in the market that had an unprecedented impact on companies. This time period is still part of their history and should be included in a fundamental analysis, but may skew some of the results when the company may have otherwise performed better if that event had not occurred as drastically as it did. Finally, with the new CEO taking over, he may turn this company around given his background and this would pose risk to the current sell rating. However, if he is successful in turning things around, I would expect this to show up fundamentally, which would change the data presented here.

Concerns About The Company

If you take the time to listen to their most recent earnings call and the commentary they provided regarding some of their recent marketing and advertising campaigns, it seems to me that the company does not understand their consumer. They mentioned trying and investing in different marketing campaigns for The Korean Chicken sandwich, Chicken Sundays campaigns, and other offers and promotions. Additionally, they are investing in new operational models such as kiosk ordering and drive-throughs, improvements in interior furniture, and further optimization strategies as they continue to build and open new stores. This commentary is concerning that they are advertising and marketing so many different promotional items to maintain the same level of foot traffic in their stores, and this will continue to eat away at the company’s bottom line as same store sales growth remains in the low single digits. Right now, with same store sales growth primarily coming from enormous marketing and advertising spending, they are only growing at a modest rate because of how many new stores they are opening, which it looks like they are financing with debt and new share issuance. This is another concern I have of the overall business model and future prospects of this company.

The story with this company now is the hope that the new CEO with a marketing background will be able to target the consumer more efficiently so that they are able to generate consistent growth and profits without so much advertising spending. However, other concerns I have are regarding the commentary they provided around the impact of commodity prices and refusing to provide other remarks in addition to what was prepared for them. It seems to me, as they are undergoing this transition, they have not done a good job at hedging changes in beef prices, changes in the macroeconomy, or building strong pipeline relationships with their producers for a more consistent cost basis on their menu items. Successful companies that have been around for a long time, like The Hershey Company (HSY), have hedged against a massive increase in their commodity prices. As it currently stands, management has done a poor job building value for shareholders and understanding their target consumer, and the hope is that the new CEO can help reach their target population so that advertising and marketing campaigns do not continue to eat into the thin margins.

Conclusion

In conclusion, I believe that Shake Shack poses as a speculative risk investment in this sector and there are other companies out there that would make a better investment at this time with less risk of investment capital loss. Based on the fundamental analysis above, I believe the market will realize this sooner or later and the stock will start depreciating as they are not able to efficiently operate as other peers in this industry. Based on my analysis, the graphs above, high risk of this company moving forward due to their poor business model, and constant dilution of shareholders since inception, I am rating SHAK as a sell and would not invest in this company today. This analysis is solely based on my work and expresses my opinions about the company, investors should keep this in mind and perform their own research before making investment decisions.

Read the full article here