By Tajinder Dhillon

Earnings season is in full effect and we preview the Russell 2000 (RTY) 2023 Q3 earnings season in granular detail, providing both aggregate and company-level insights using data from LSEG I/B/E/S, LSEG StarMine, and LSEG Datastream, which are all found in the desktop solution LSEG Workspace.

Earnings Commentary

The Russell 2000 is amid an earnings recession which is expected to last until Q4 of this year. However, Q3 has been a relatively positive earnings quarter when comparing to the start of October, which saw analysts downgrading estimates heading into earnings season. With approximately two-thirds of the index having reported results (as of Nov 8), 63.4% of constituents have beaten analyst expectations and marks the highest earnings beat rate in two years. Furthermore, the earnings surprise rate (actual vs. consensus on day of reporting) is 5.5%.

Q3 earnings growth at the start of earnings season was forecasted at -14.2% and has since improved by 530 basis points to -8.9%. From a breadth perspective, seven sectors have seen blended earnings growth rise over the same period which is an encouraging signal. Full-year growth expectations for 2023 are currently -8.8% with Q2 looking to be the ‘bottom’ in earnings growth.

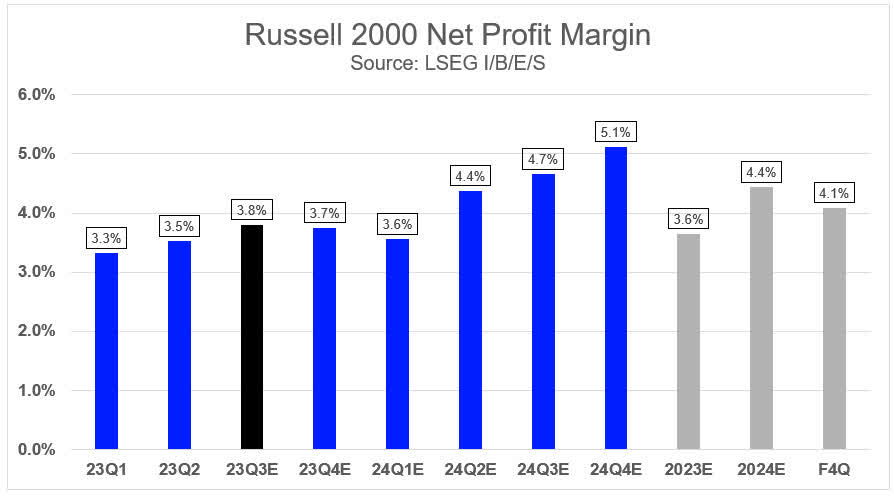

Furthermore, net profit margin expectations have risen for the third consecutive quarter to 3.8% and are forecasted to rise to 4.4% by the end of 2024.

However, we also caution that Q4 estimates have been downgraded aggressively and y/y growth expectations for the quarter have recently turned negative to -4.3%. Looking further out, 2024 Q1 and Q2 earnings estimates have also come down by 11.7 and 8.3 percentage points ((ppt)) respectively.

An important trend to monitor alongside actual revenue growth is the revenue beat rate and surprise rate, both of which have been trending downward in recent quarters. Q3 has seen a revenue beat rate of 55.9% along with a revenue surprise rate of 1.0%, both of which are below the prior four-quarter average. These two factors can corroborate concerns around pricing power and its impact on net profit margins. Also, real revenue growth (adjusted for inflation) is expected to be negative for the third consecutive quarter.

Part 1 – Earnings Growth and Contribution

Using data from the November 8th publication of the Russell 2000 Earnings Scorecard, Q3 blended earnings (combining estimates and actuals) are forecasted at $22.5 billion (-8.9% y/y, +1.0% q/q) while revenue is forecasted at $469.8 billion (-3.0% y/y, -0.3% q/q).

Ex-energy, earnings growth is forecasted at -5.2%, which marks the third consecutive quarter of negative ex-energy growth. Ex-energy, revenue growth is forecasted at -1.9%.

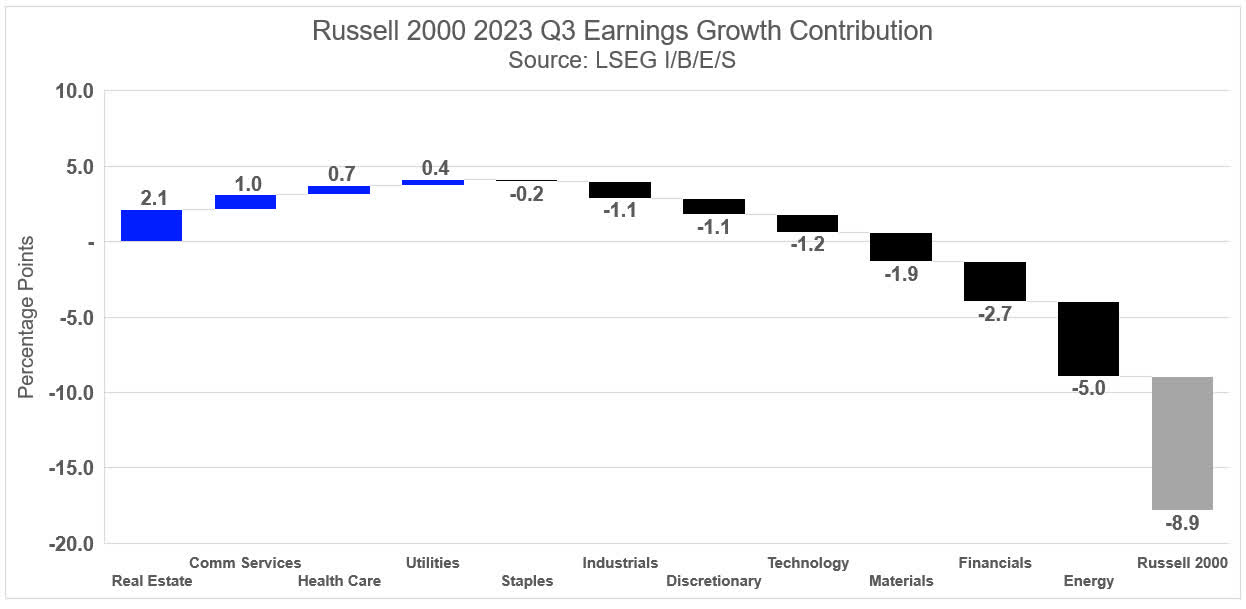

From an earnings growth contribution perspective, four sectors have positive earnings growth contribution while seven sectors have negative earnings growth contribution (Exhibit 1).

Real Estate has the largest earnings growth contribution of any sector and is forecasted to contribute 2.1 percentage points (ppt). Communication Services (1.0 ppt) and Health Care (0.7 ppt) are the next largest contributors while Energy (-5.0 ppt), Financials (-2.7 ppt), and Materials (-1.9 ppt) are the largest detractors to earnings growth this quarter.

We point out that Energy is no longer the ‘top dog’ from an earnings growth contribution perspective, which has been the trend in recent quarters. Instead, the sector now faces more difficult year-over-year comparisons going forward given the banner year of 2022, where the sector recorded close to $20 billion in earnings. Therefore, looking at quarterly growth rates will be more effective to gauge earnings performance this year. Energy is forecasted to post Q3 aggregate earnings of $4.5 billion, which translates to a q/q growth rate of 28.9%.

Exhibit 1: Russell 2000 23Q3 Earnings Growth Contribution

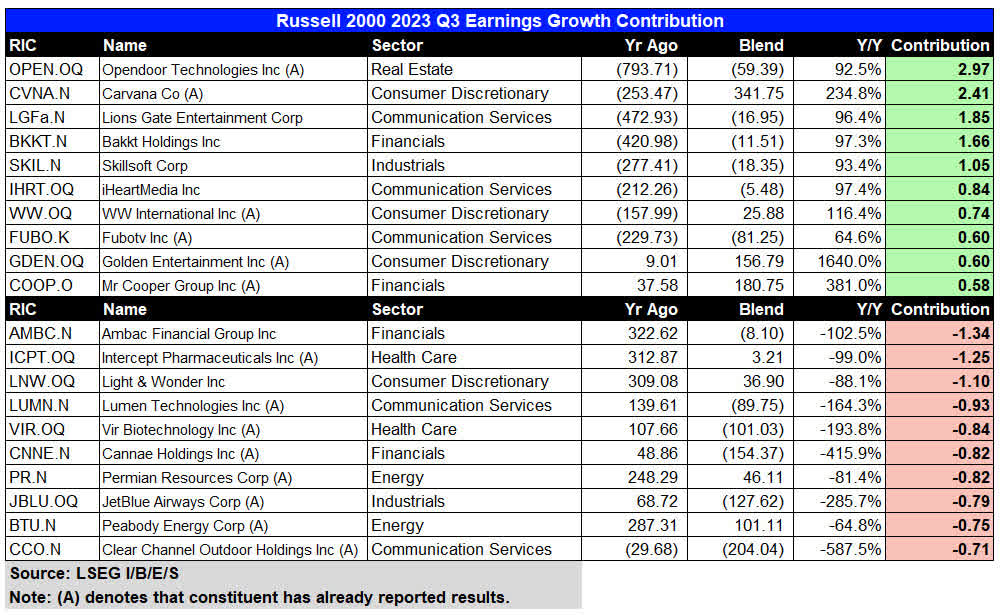

We also look at earnings growth contribution at a constituent level in Exhibit 1.1 and highlight the top 10 and bottom 10 contributors. Opendoor Technologies (OPEN) has delivered the lion share of earnings growth for Real Estate (3.0 ppt). The same can be said for Carvana Co. (CVNA) in Consumer Discretionary (2.4 ppt) followed by WW International Inc (WW) (0.8 ppt).

In the bottom half of the table, Ambac Financial Group Inc (AMBC) (-1.3 ppt) has been the largest individual detractor to earnings growth this quarter followed by Intercept Pharmaceuticals Inc (ICPT) (-1.3 ppt), and Light & Wonder Inc (LNW) (-1.1 ppt).

Exhibit 1.1: Russell 2000 23Q3 Earnings Growth Contribution

Part 2 – Market Cap vs. Earnings Weights

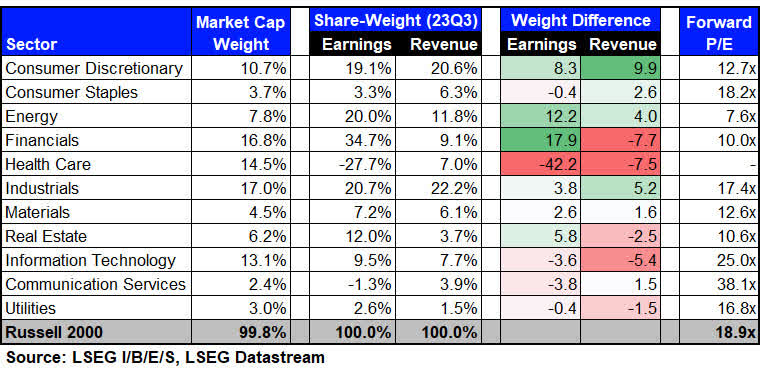

Exhibit 2 looks at the difference between ‘market-cap’ and ‘share-weighted’ weights for the Russell 2000 sectors. The Russell 2000 Earnings Scorecard utilizes a share-weighted methodology.

Financials has the largest earnings weight this quarter at 34.7%, which is more than 2 times greater than its market-cap weight of 16.8%. This results in the largest earnings weight differential of all sectors, yet trades at a discount vs. the overall index from a valuation perspective with a forward four-quarter P/E of 10.0x.

While Energy’s positive weight differential has declined compared to prior quarters, the sector continues to overdeliver on earnings relative to its market cap weight (earnings weight of 20.0% vs. market-cap weight of 7.8%) and trades at the cheapest valuation of any sector at 7.6x, which is a 60.0% discount to the overall index.

Exhibit 2: Market Cap vs. Share-Weight for Russell 2000 Sectors

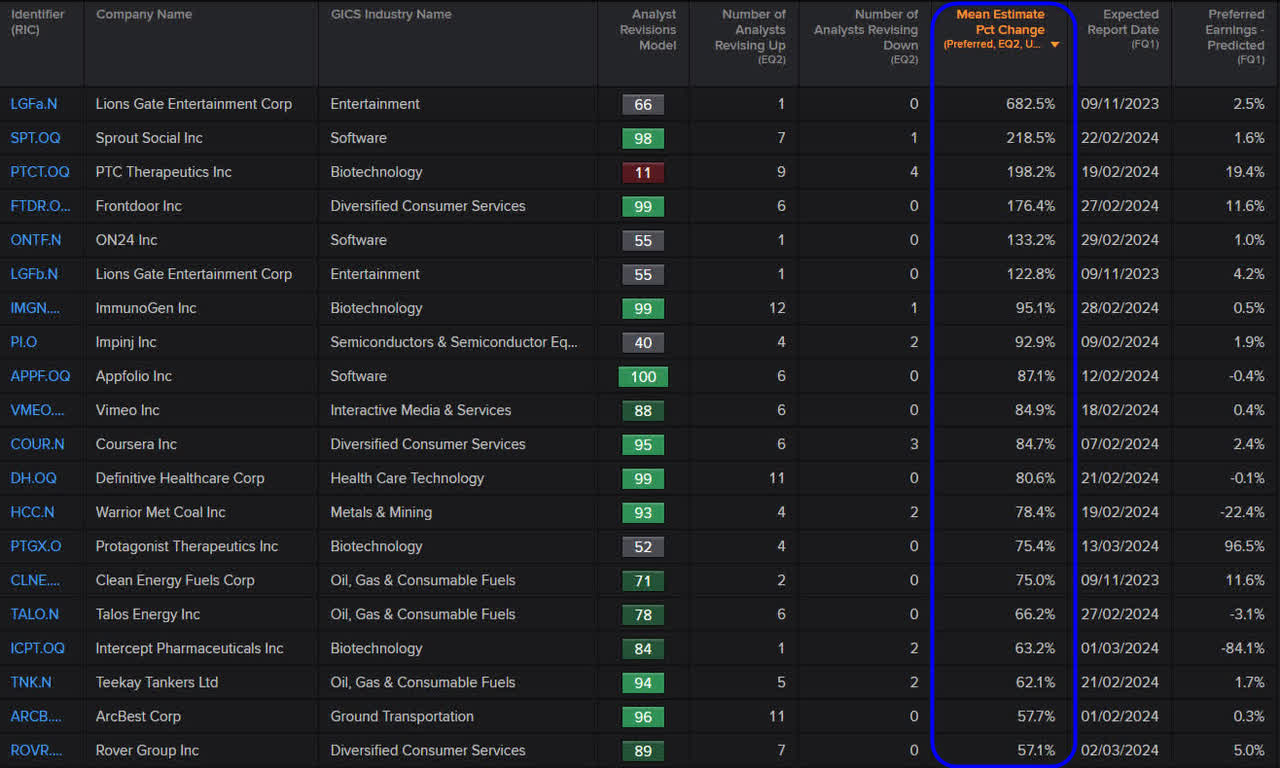

Part 3 – Which companies have seen the largest revisions for next quarter?

Using the Screener app in LSEG Workspace, we can gain valuable insights to how analysts have reacted after a company releases its financial results.

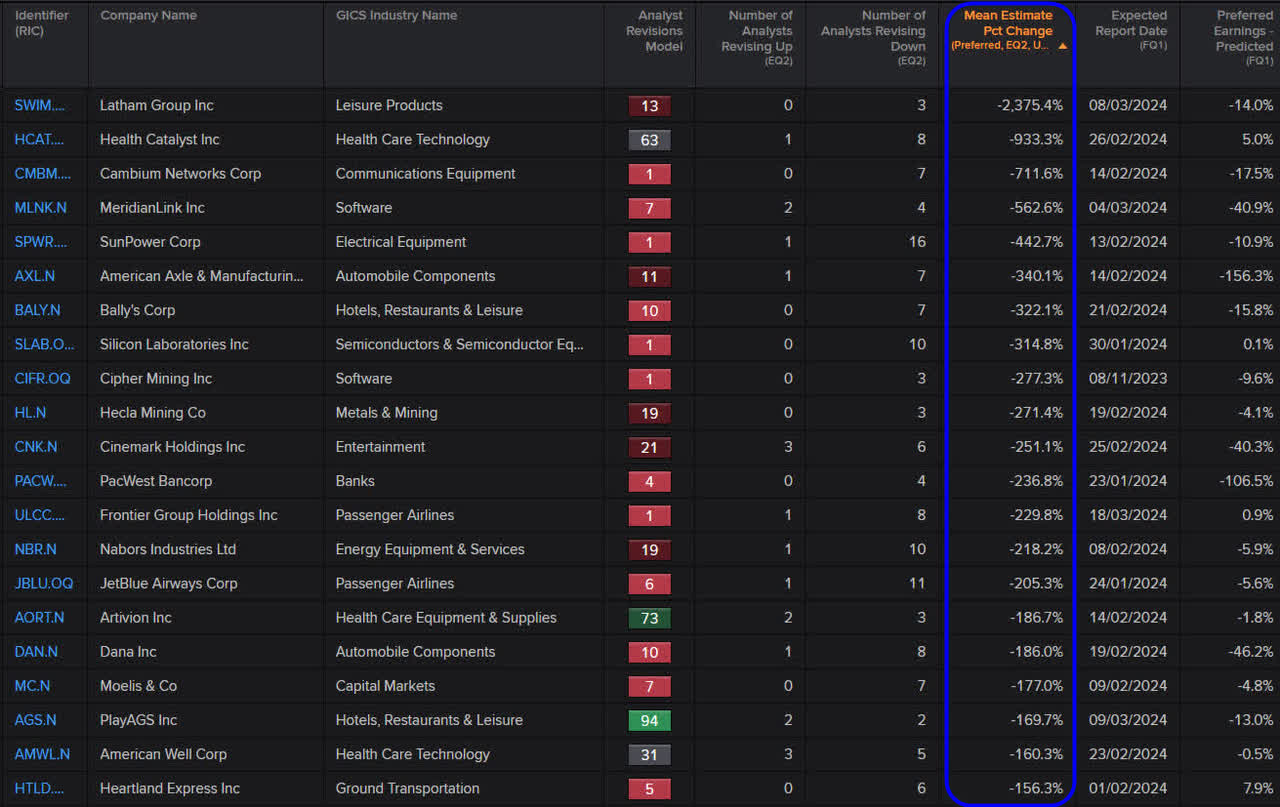

In this example, we show the 30-day percent change in the consensus Preferred Earnings mean estimate for 2023 Q4 (i.e., the next upcoming quarter). We include a filter to only include companies that have at least five analyst estimates for the current quarter. Preferred Earnings is defined as EPS for most companies except for Real Estate where it can be either EPS or FFOPS depending on analyst coverage.

Exhibit 3.1 is sorted by the largest downward earnings revisions for companies that have already posted results for the current earnings season period (column highlighted in blue). Said differently, we can see how analysts have revised estimates for the following quarter once a company reported results. Note: values less than -100% occur when an EPS estimate turns from positive to negative.

Exhibit 3.2 is sorted by the largest upward earnings revisions.

We also add additional columns of data for further insight – the first column shows the StarMine Analyst Revision Model (ARM) score. ARM is a stock ranking model designed to show current analyst sentiment and predict future analyst revisions by looking at estimate revisions across EPS, EBITDA, Revenue, and Recommendations over multiple time periods. We note a strong correlation between the 30-day percent change revision in consensus EPS vs. ARM score (i.e., companies that have seen their consensus EPS rise (or fall) significantly are typically associated with a high ((low)) ARM score.

The next two columns show the number of analysts who have upgraded or downgraded EPS estimates for the next upcoming quarter. Finally, we display the expected report date for next quarter along with the StarMine Predicted Surprise % (PS%). The PS% is a powerful quantitative analytic that compares the StarMine SmartEstimate© to the consensus mean. The SmartEstimate places a higher weight on analysts who are more accurate and timelier, thus providing a refined view into consensus. Comparing the SmartEstimate to the mean estimate leads to our PS%, which accurately predicts the direction of earnings surprise 70% of the time when the PS is greater than 2% of less than -2%.

The screener app provides a powerful workflow tool for Analysts and Portfolio Managers looking to parse through hundreds of companies during earnings season to identify thematic trends.

Latham Group Inc (SWIM) has seen the largest downgrade in the Preferred Earnings estimate over the last 30 days (-2,375.4%) followed by Marcus Corp (MCS) (-1,800.0%), Health Catalyst Inc (HCAT) (-933.3%), GrafTech International Ltd (EAF) (-725.2%), and Cambium Networks Corp (CMBM) (-711.6%). Note: values less than -100% occur when an EPS estimate turns from positive to negative.

Exhibit 3.1: Largest Negative Revisions for 2023 Q3

Source: LSEG Workspace

We see a positive correlation between constituents who have seen a large downgrade and a corresponding negative PS%. Furthermore, a positive correlation is shown between the mean estimate change vs. Analyst Revision Model (ARM) score (i.e., companies that have seen large downward earnings revision also have a low ARM score).

ARM is a percentile stock ranking model that is designed to predict future changes in analyst sentiment by looking at changes in estimates across EPS, EBITDA, Revenue, and Recommendations over multiple time periods. The last two columns display both the current ARM score and its 30-day change.

Looking at the PS% and ARM columns can be very useful during earnings season to assess the likelihood of whether companies are expected to beat or miss earnings while at the same time gauging analyst sentiment.

Exhibit 3.2 displays the same data for constituents with the largest upgrades in the Preferred Earnings estimate.

Exhibit 3.2: Largest Positive Revisions for 2023 Q3

Source: LSEG Workspace

Part 4 – Net Profit Margin Expectations

Using data from the Russell 2000 Earnings Scorecard, we look at quarterly net profit margins (Exhibit 4). The Q3 blended net profit margin is 3.8%, a slight improvement from the prior quarter. Over the next year, margin expectations are gradually rising according to analyst estimates.

Over the last three months, eight sectors have seen its net margin estimate decline, while three sectors have seen an increase. Real Estate has seen the largest decline in Q3 margin expectations (-276 bps, current value: -0.4%), followed by Communication Services (-195 bps, -0.4%), and Utilities (-73 bps, 6.2%). Health Care has seen the largest improvement in margin expectations (322 bps, -14.1%).

The 2023 and 2024 full-year estimate is currently 3.6% and 4.4% respectively, while the forward four-quarter estimate is 4.1%.

Exhibit 4: Russell 2000 Net Profit Margin Expectations

Part 5 – Forward P/E & PEG Ratio

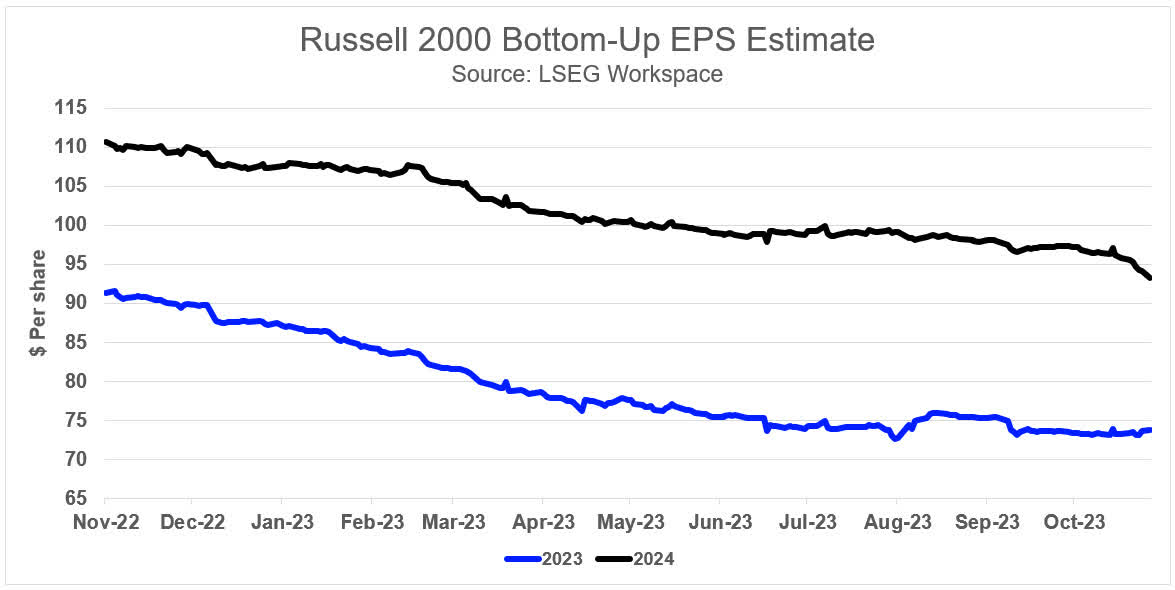

Using LSEG Workspace, the forward 12-month EPS is currently $91.58 per share which yields a forward P/E of 18.9x.

The 2023 and 2024 EPS estimate of $73.72 and $93.21 per share have declined by 19.2% and 15.8% respectively over the last year (Exhibit 5). In comparison, the Russell 2000 price index has fallen by approximately 4.2% over the same period.

Using LSEG Datastream, the Russell 2000 forward 12-month P/E ratio has fallen over the last three months to a current reading of 18.9x, which ranks in the 15th percentile (since 2002) and a 23.9% discount to its 10-year average (24.8x). For reference, the trough forward P/E during the last two recessions were as followed: 13.2x (Nov 2008) and 16.1x (March 2020).

Furthermore, the Russell 2000 ‘PEG’ ratio is currently 1.24x which ranks in the 20th percentile (since 2002) and a 23.4% discount to its 10-year average (1.61x).

Exhibit 5: Russell 2000 EPS Estimates

Conclusion

Q3 has been better than expected with one-third of the index yet to report results. While the broader index is amid an earnings recession, we continue to see downward revisions to next quarter along with Q1 and Q2 of next year for both earnings and revenue.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here