There has been an increased chatter around private credit players and how they are poised to benefit from the current tailwinds that are associated with higher interest rate environment and more risk-averse (regulated) traditional banking sector.

Since the Fed decided to become more restrictive, the overall BDC space has gone nowhere but up, outperforming the S&P 500 by a notable margin.

While the industry-level dynamics remain extremely favorable for the BDCs indeed, in my humble opinion, it is worth paying a more careful attention towards the underlying risk profiles of these BDCs to make sure that once the tide turns, there is a sufficient buffer in place, which will help shield the high yielding dividend streams.

With this in mind, I will assess Prospect Capital Corp. (NASDAQ:PSEC), which is the fifth largest U.S. BDC (measured by NAV base).

Before I jump to the thesis, I will just underscore the immediate takeaway that we can digest already know – i.e., the benefit of size. Having larger AuM base comes with a plethora of benefits such as ability to better diversify, access to cheaper and more flexible leverage, ability to accommodate larger ticket size deals, which usually are not that risky as compared to transactions, where small businesses are involved, etc. In other words, the bigger, the better in the context of risk management.

Thesis

If we look at PSEC’s investment strategy, we will not find anything that deviates from the average BDC with a slight exception here:

PSEC also invests in other high income producing strategies including collateralized loan obligations (CLOs), marketplace lending, and multi-family real estate.

Carrying an exposure towards CLO products and marketplace lending is not that common across the BDC peer landscape as most of the companies usually stick with traditional and direct credit investments.

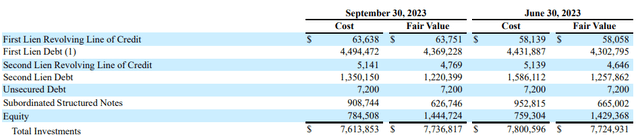

10-Q

However, the investment breakdown above clearly indicates that there are no material allocations in the categories, which fall outside of the conventional BDC investment type universe.

What we can notice from this table is also the following:

- PSEC has roughly 65% of its portfolio invested in first lien structures.

- About 18% of the portfolio is placed in second lien and subordinated note structures.

- And the remaining share is located in the equity structures (or investments).

For conservative BDC investors this should be a major red flag. The fact that PSEC has more than one third of the total exposure invested in more junior and inherently less protected assets (e.g., equity and second lien) that first lien does not send a comforting signal about the underlying resiliency and cash flow durability under the scenario of an economic distress.

It is not that often when we can observe so low concentration in first lien especially among the larger BDC players as usually the relevant range is somewhere between 70 – 85% (with several cases, where first lien consumes 95% and more of the portfolio).

There are, however, three (theoretically) offsetting features embedded in PSEC’s portfolio.

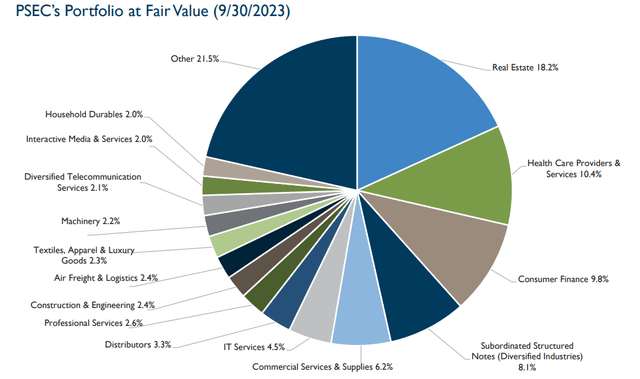

First, is the industry breakdown of the PSEC’s portfolio. The portfolio is spread across 36 different industries with ~77% of the AuM invested in non-cyclical industries. Here we can nicely see one of the many benefits that stem from large balance sheets.

Yet, before we transition to the second point, I have to pinpoint to the largest industry (Real Estate, accounting for 18% of the portfolio), which undergoing serious struggles, exhibiting uncertain economic prospects including the ability to refinance cheap loans that were assumed prior to the Fed’s decision to turn restrictive. If we put this together with the fact that in many instances PSEC is placed below first lien bodies, the picture suddenly gets less attractive.

PSEC Investor Presentation

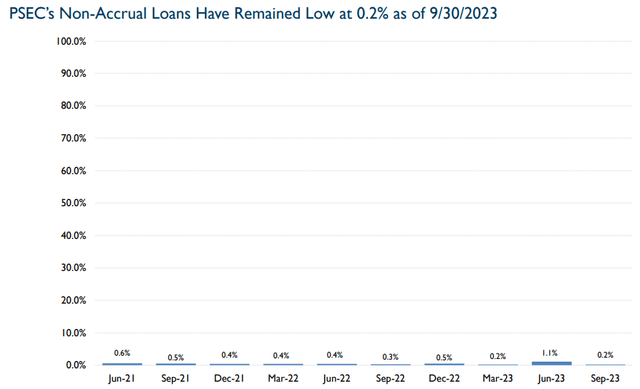

Second, PSEC’s track record of carrying a solid portfolio quality in a rather consistent manner is definitely an important nuance as it directly speaks to PSEC’s ability to cherry pick the right investment even though not all of them are necessarily in the first lien.

Nevertheless, to introduce another counterargument, we have to remember that so low level of non-accrual loans should not be deemed as something extraordinary and only characteristic to PSEC. While the relevant measure is indeed lower than on average in the BDC sector, it not that far away from the average temperature (i.e., ~2.5%, with several other BDC players registering 0% non-accrual loans as well).

PSEC Investor Presentation

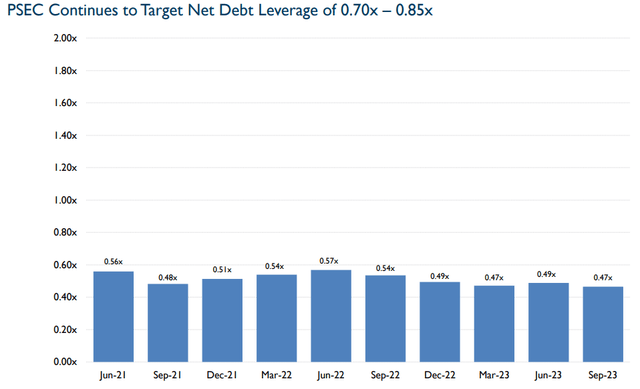

Third, although PSEC carries one of the largest portfolios in the BDC sector, its net debt leverage profile is truly conservative. As of December, 2023, the median debt to equity ratio in the BDC sector stood at 116%, which significantly above PSEC’s case of ~66% (adding back here the cash component).

For this I do not have any counterargument or additional context that would render the situation worse than what it might seem from the initial look. It is even the opposite, where I have to mention that with this small load of external debt, PSEC ranks as the second best BDC out there from the indebtedness perspective.

PSEC Investor Presentation

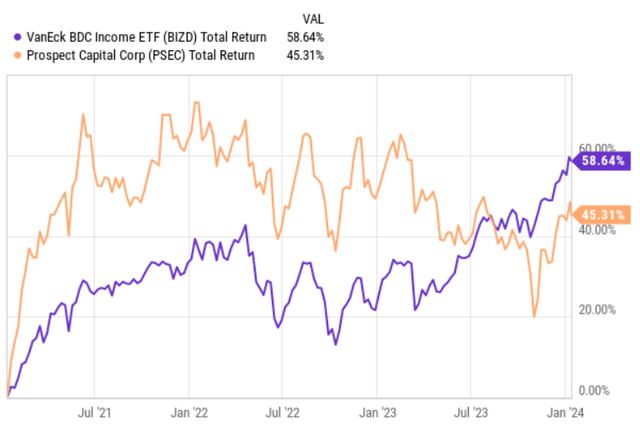

Finally, if we compare PSEC’s performance with that of the overall BDC market, we can notice how really since the start of 2023 (last year) PSEC has rather consistently underperformed, losing all of the alpha over BIDZ that was accumulated before that.

Ycharts

The key explanation (in my view) behind this divergence lies in the combination of two factors, which I have already mentioned above in the article:

- Concentrated exposure to real estate segment.

- Significant chunk of the portfolio invested in riskier capital structure levers than first lien.

The bottom line

As a result of the recent underperformance in the stock market, while having resilient cash flows and no registered investment write-downs, this has become an attractive moment to considering going long PSEC. For example, currently PSEC distributes ~11.9% in dividend (120 basis points above the average) with a payout ratio of ~139% and a balance sheet that has second lowest leverage in the sector.

Having said that, prudent investors, who seek not only high streams of current income but also stability, have to be cognizant of the risks that are associated with a heavy exposure towards relatively unprotected investment types (e.g., subordinated and second lien loans) that come on top of the ~18% allocation in the real estate sector, which is currently going through a very challenging period.

For these reasons, PSEC is a hold for me.

Read the full article here