Source: Own Processing

Precious metals royalty and streaming companies represent a very interesting sub-industry of the precious metals mining industry. They provide some leverage to the growing metals prices, similar to the typical mining companies; however, they are less risky in comparison to them. Their incomes are derived from royalty and streaming agreements. Under a metal streaming agreement, the streaming company provides an upfront payment to acquire the right to future deliveries of a predefined percentage of metal production of a mining operation.

The streaming company also pays some ongoing payments that are usually well below the market price of the metal. They can be set as a fixed sum (e.g., $300/toz gold) or as a percentage (e.g., 20% of the prevailing gold price), or a combination of both (e.g., the lower of a) $300/toz gold and b) 20% of the prevailing gold price). The royalties usually apply to a small fraction of the mining project production (usually 1-3%), and they are not connected with ongoing payments. They can have various forms, but the most common is a small percentage of the net smelter return (“NSR”). The NSR is calculated as revenues from the sale of the mined products minus transportation and refining costs.

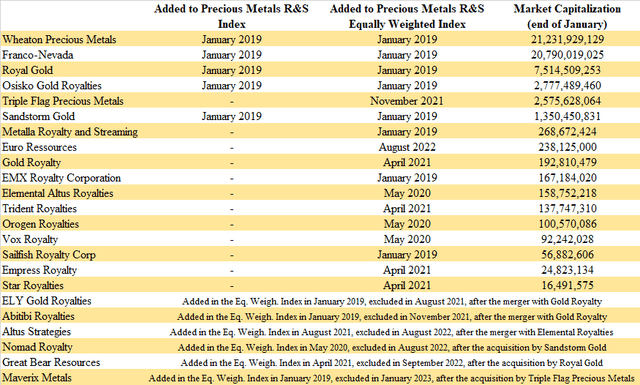

To better track the overall performance of the whole sub-industry, I created a capitalization-weighted index (the Precious Metals Royalty and Streaming Index) consisting of 11 companies (in June 2020, expanded to 15). Later, based on the inquiries of readers, I also introduced an equal-weighted version of the index. Until March 2021, both indices included the same companies and were calculated back to January 2019.

However, some major changes occurred in April 2021. Due to the boom of the royalty and streaming industry and the emergence of many new companies, the indices experienced two major changes. First of all, the market capitalization-weighted index was modified to include only the 5 biggest companies: Franco-Nevada (FNV), Wheaton Precious Metals (WPM), Royal Gold (RGLD), Osisko Gold Royalties (OR), and Sandstorm Gold (SAND). The combined weight of these 5 companies on the old index was around 95%, therefore, the small companies had only a negligible impact on their performance. The values of the index were re-calculated back to January 2019, and between January 2019 and March 2021, the difference in the overall performance of the old and the new index was only 2.29 percentage points. The second change is related to the equally weighted index that was expanded to 20 companies.

The previous editions of the monthly report can be found here: May 2019, June 2019, July 2019, August 2019, September 2019, October 2019, November 2019, December 2019, January 2020, February 2020, March 2020, April 2020, May 2020, June 2020, July 2020, August 2020, September 2020, October 2020, November 2020, December 2020, January 2021, February 2021, March 2021, April 2021, May 2021, June 2021, July 2021, August 2021, September 2021, October 2021, November 2021, December 2021, January 2022, February 2022, March 2022, April 2022, May 2022, June 2022, July 2022, August 2022, September 2022, October 2022, November 2022, December 2022, January 2023, February 2023, March 2023, April 2023, May 2023, June 2023, July 2023, August 2023, September 2023, October 2023, November 2023, December 2023.

Source: Own Processing

No major changes occurred in the ranking of the precious metals R&S companies by market capitalization. Only Osisko Gold Royalties (OR) replaced Triple Flag Precious Metals (TFPM) on the 4th place, and Orogen Royalties (OTCQX:OGNRF) outgrew Vox Royalty (VOXR). At the top of the ranking remains Wheaton Precious Metals with a market capitalization of $21.2 billion, closely followed by Franco-Nevada ($20.8 billion). At the very bottom remains Star Royalties (OTCQX:STRFF) with a market capitalization of only $16.5 million.

Source: Own Processing

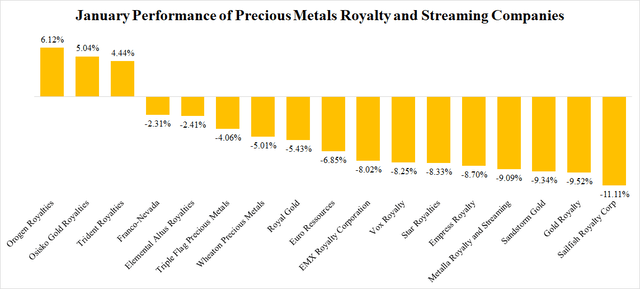

The first month of 2024 was not good for the precious metals R&S companies. Out of 17 companies, only 3 ended in green numbers. The highest gains, as high as 6.12%, were recorded by Orogen. Its good performance can be partially explained by the news regarding its 2024 plans and projections. Osisko Gold Royalties experienced more than 5% growth, supported by record-high Q4 sales and revenues. On the other hand, the biggest decline was recorded by shares of Sailfish Royalty. They lost more than 11% of their value, although there were no company-specific news. Also, Sandstorm Gold lost nearly 10%. Despite positive news about record-high Q4 sales and revenues.

Source: Own Processing

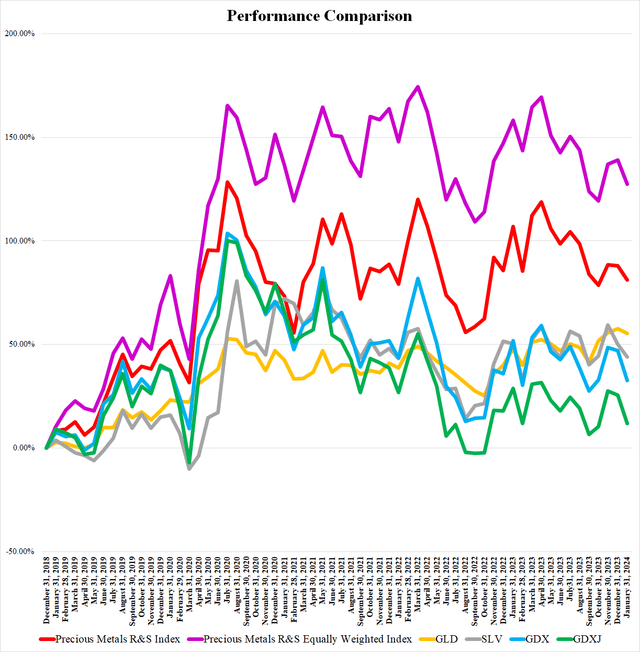

In January, the value of the Precious Metals R&S Index declined by 3.68%, and the value of the Precious Metals R&S Equally Weighted Index declined by 4.87%. The negative performance was driven by the poor performance of precious metals when the share price of the SPDR Gold Trust ETF (GLD) declined by 1.42%, and the share price of the iShares Silver Trust ETF (SLV) declined by 3.99%. But the precious metals miners did even worse. The VanEck Vectors Gold Miners ETF (GDX) and the VanEck Vectors Junior Gold Miners ETF (GDXJ) lost 9.9% and 10.84% respectively.

The January News

After a relatively calm December, also the January news flow remained weak. Some companies reported preliminary Q4 sales numbers and several small deals took place. But none of the news was particularly interesting.

Franco-Nevada (FNV) decided to increase the quarterly dividend from $0.34 to $0.36 per share. The next payment is scheduled for March 28. The dividend will be paid to shareholders of record as of March 14. The company also announced that it will release the Q4 financial results on March 5, after the market close.

Wheaton Precious Metals (WPM) announced that it has ranked among the Corporate Knights’ 2024 100 Most Sustainable Corporations in the world.

Royal Gold (RGLD) reported Q4 sales of approximately 39,100 toz gold, 556,300 toz silver, and 1,100 tonnes copper, or 49,900 toz of gold equivalent. The company will release its financial results on February 14, after the market close.

Osisko Gold Royalties (OR) reported attributable production of 23,275 toz of gold equivalent in Q4. The preliminary revenues amounted to C$65.2 million ($48.4 million). The company also made a C$136 million ($101 million) repayment on its revolving credit facility, and ended the year with cash on hand amounting to C$67.7 million ($50 million). Osisko will release its Q4 financial results on February 20, after the market close.

On January 24, Osisko announced the appointment of David Smith, the former CFO of Agnico Eagle Mines (AEM) to its Board of Directors.

Triple Flag Precious Metals (TFPM) announced Q4 gold equivalent sales of 26,243 toz, and revenue of $51.7 million. The total 2023 sales amounted to 105,087 toz of gold equivalent which is a new record high. The company was able to increase its sales volumes for the seventh consecutive year. The Q4 financial results will be released on February 21, after the market close.

Sandstorm Gold (SAND) reported record-high 2023 gold equivalent sales and revenues as well. The sales amounted to 97,200 toz of gold equivalent, and the revenues to $179.6 million. In Q4, the sales amounted to 23,300 toz of gold equivalent and sales to $44.5 million.

Euro Ressources (OTC:ERRSF) announced that the buyout offer from IAMGOLD (IAG) followed by a squeeze-out had been initiated on January 23. The offer amounted to €3.5 per share and was valid for 10 days.

EMX Royalty (EMX) optioned its Norwegian Sagvoll and Meraker properties to Lumira Energy. EMX will receive some relatively small cash and equity payments, however, there are also milestone payments of up to A$750,000 ($490,000). Moreover, EMX will retain a 2.5% NSR royalty over the two projects.

On January 30, EMX announced the acquisition of a 1% NSR royalty over Firefox Gold’s (OTCQB:FFOXF) Mustajarvi gold project in Finland. EMX agreed to pay $80,000 and 30,000 shares for the royalty.

Vox Royalty (VOXR) secured a $25 million revolving credit facility from the Bank of Montreal (BMO). The facility consists of a $15 million senior secured facility, and a $10 million accordion. The interest rate equals the Secured Overnight Financing Rate plus 2.5-3.5%, based on the actual leverage ratio. The facility will mature on December 31, 2025, with an annual one-year extension option. As a result, it is possible to expect that Vox will make some new acquisitions soon.

Trident Royalties (OTCQB:TDTRF) announced that Avino Silver and Gold Mines (ASM) signed a long-term land-use agreement regarding the La Preciosa silver project. As a result, silver production from surface stockpiles should start relatively soon. Trident holds a 1.25% NSR royalty on the Gloria and Abundancia veins and a 2% NSR royalty on the remainder of the property. It is also entitled to a $8.75 million milestone payment within 12 months after the production start-up.

Orogen Royalties (OTCQX:OGNRF) announced that in 2023, it received C$3.5 million ($2.6 million) for the sale of projects, and its partners funded exploration expenditures of C$20.2 million ($15 million). Four partner-funded drill campaigns are planned for 2024 so far. It also announced that around 80,000 toz gold and 1 million toz silver should be produced at First Majestic Silver’s (AG) Ermitano mine in 2024. Orogen holds a 2% NSR royalty on Ermitano.

The February Outlook

There should be more life in the precious metals R&S industry in February, as the earnings season will bring the Q4 and FY 2023 financial results, and more importantly, also some 2024 projections. Especially the guidances, if positive, may provide some boost to the share prices. But the most important question is whether the gold price remains above $2,000/toz. If not, the February report may be even worse than the January one.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here