Portland General Electric (NYSE:POR) offers an attractive 4.2% dividend alongside an earnings yield of about 6.5%, the latter referencing Warren Buffet’s “Equity Bond” method. Both rates easily top the 10-year Treasury bond. With a P/E ratio of 15.6, the stock is trading below its historical average, and other metrics discussed below point to potential undervaluation. After comparing the company with peers that met stringent screen criteria, I argue that POR deserves a look from investors seeking to shift funds from treasuries or money market accounts, especially with the anticipated federal interest rate cut in September.

Prepping for Rate Cuts

I have been perfectly content earning 5.25% (on average) in T-Bills for the past eighteen months. Short-term Treasuries have been an attractive place to park cash—they’re exempt from state tax, unlike CDs and money market accounts, and they’ve offered their highest yields since before the Great Financial Crisis. But with a rate cut coming in September and more likely to follow, many investors, myself included, are seeking relatively low-risk equity options that offer attractive income.

Higher-yielding sectors such as Consumer Staples, REITs, and Utilities tend to do well during periods of rate cuts. In light of this, I’ve been gradually shifting some of my cash position into dividend-paying companies in stable industries with predictable cash flows—qualities that can offer resilience during economic downturns, which historically have coincided with rate cuts. Throughout the summer, I’ve been increasing my holdings of Coca-Cola FEMSA (KOF), Brookfield Renewable (BEPC), and Agree Realty (ADC). Now my focus is on identifying additional opportunities—particularly those with favorable valuations, since these sectors are already seeing strong gains:

|

5 Years / Sector Rank |

30 Days / Sector Rank |

|

|

Real Estate |

+13.2% / #11 |

+6.6% / #1 |

|

Utilities |

+21.3% / #10 |

+5.4% / #2 |

|

Staples |

+42.9% / #9 |

+5.1% / #3 |

The Initial Screen

Given that most utilities offer dividends, I set out to narrow the list to those that meet the following criteria:

- Revenue and EPS growth that are both consistent and competitive. Screening criteria: minimum 5Y CAGRs of 5% and above the industry averages.

- A strong dividend with a history of consistent growth and a manageable payout ratio. Screening criteria: minimum 3% yield, 5Y CAGR of 5%, 10 years of growth, < 70% payout

These filters reduced the pool down to just three companies: Sempra (SRE), Essential Utilities (WTRG), and Portland General Electric Company (POR). Since I already have a position in Essential Utilities, I chose to focus on the two power companies:

POR – State-regulated electric utility primarily serving retail customers in the state of Oregon.

SRE – More diversified energy products and infrastructure (e.g. electricity and LNG exports) with a wider geographic scope (California, Mexico, and other international markets).

Financial Metrics Comparison

|

CAGR |

SRE |

POR |

|

Revenue 10Y |

2.3% |

5.7% |

|

Revenue 5Y |

5.1% |

9.1% |

|

Revenue 3Y |

4.5% |

12.6% |

|

Revenue Fwd |

4.2% |

7.9% |

|

EPS 10Y |

7.9% |

3.1% |

|

EPS 5Y |

6.2% |

5.5% |

|

EPS 3Y |

11.4% |

17.2% |

|

EPS FWD |

3.8% |

5.8% |

|

Profitability |

SRE |

POR |

|

Net Income 10Y |

10.7% |

5.6% |

|

Net Income 5Y |

7.8% |

8.2% |

|

Net Income 3Y |

11.1% |

22.0% |

|

Oper. Margin 10Y |

4.3% |

5.5% |

|

Oper. Margin 5Y |

5.5% |

9.3% |

|

Oper. Margin 3Y |

2.5% |

24.5% |

|

ROA 10Y (trend) |

ca. 3%; stable |

ca. 3%; stable |

|

ROIC 10Y (trend) |

ca. 3%; stable |

ca. 4%; stable |

POR has outperformed SRE in most categories over the past decade. It has been the more profitable company in terms of percentage gains and has slightly better solvency scores. Even better, POR’s current valuation metrics are more favorable; SRE’s has seen significant share price appreciation over the past five years, outperforming POR on a total return basis of 35% to just 1.5%. While this is excellent for SRE, its Quant factor rating for valuation has now fallen to D+, and several metrics, including P/E Non-GAAP, EV/EBITDA, and the dividend yield, are above their five-year averages. On the other hand, POR’s share price has been relatively flat over the past three years despite the strong performance outlined above, presenting a potential buying opportunity. Its overall Quant factor rating for valuation is B.

Comparing the Dividends

Both companies have Quant factor grades of A or B for dividend safety and consistency, but POR edges out SRE with its longer streak of dividend growth. It has also been raising its dividend at a slightly faster rate in recent years, and its yield is over a full percentage point higher while maintaining a payout ratio under 65%.

|

SRE |

POR |

|

|

Years of Growth |

13 |

17 |

|

Forward Yield |

3.04% |

4.20% |

|

10Y Growth CAGR |

6.8% |

5.7% |

|

5Y Growth CAGR |

5.5% |

5.5% |

|

3Y Growth CAGR |

4.3% |

5.2% |

|

Payout Ratio |

54.7% |

63.5% |

Another measure of income potential beyond the dividend is earnings yield, or EPS / Share Price. This calculates to around 6.5% for POR, which easily exceeds the yields of the Treasuries and savings instruments.

Given that I’m looking to deploy cash into companies where I can earn reliable income with the potential for modest capital appreciation, POR fits the profile somewhat better than SRE.

Investment Thesis

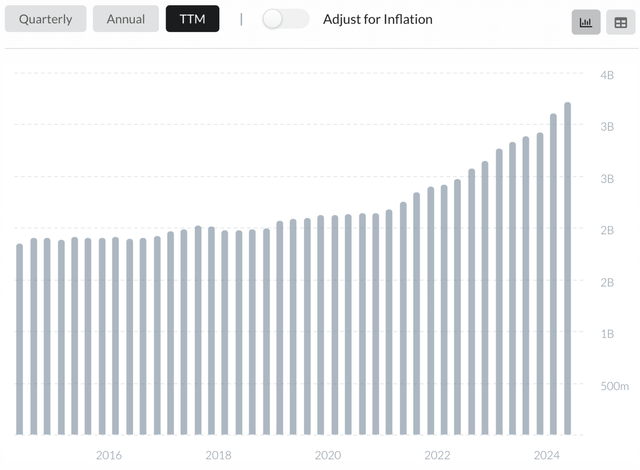

I see POR as offering an attractive blend of stability and growth. As Oregon’s largest regulated utility, serving just shy of a million customers, it has seen steady, slowly growing revenue:

POR: Increasing Revenue Since 2014 (AlphaSpread)

POR’s service area includes the “Silicon Forest,” where companies like Intel and Microchip Technologies are clustered, making it well-positioned to benefit from high-growth corners of the Tech, Industrials, and Health Care sectors. In recent years, the company has worked to fortify this position via significant investments in infrastructure, including a $6.2 billion plan to expand and modernize its distribution network. POR expects this will drive an 8% annual rate base growth through 2028, helping it meet the rising energy demands of its industrial customers. Such upgrades are crucial as the company anticipates significant load growth spurred by the expansion of data centers and other tech-driven manufacturing in the region.

POR’s focus on renewable energy also provides a competitive edge. The company ranks first in the nation for customer participation in renewable programs, and it is expanding its green portfolio through projects like the Clearwater Wind Facility, in partnership with NextEra Energy (NEE). Such initiatives align with Oregon’s ambitious clean energy targets, which commit the state to drawing 100% of its electricity from renewable sources by the year 2040. POR’s transition plan includes phasing out its remaining coal-fired plants while ramping up its investments in renewables and battery technologies.

Finally, POR operates in a favorable regulatory environment. The Oregon Public Utility Commission has consistently backed the company’s investment initiatives and rate increase requests. The OPUC approved a 14% increase in POR’s rate base in late 2023, and the company has requested an additional 7.4% rate hike for 2025. In general, such regulatory support gives confidence in POR’s ability to deliver consistent and growing profits, even as it undertakes significant CAPEX.

Price Target

POR is currently trading at around 15.6x the FY24 consensus EPS estimate of $3.09 and about 14.8x the FY25 estimate of $3.25. Both are well below the five-year average forward P/E of around 18. The table below shows that several trailing valuations are also significantly below the company’s recent historical averages:

|

VALUATION |

Current |

5-Year Avg. |

Difference |

|

P/E Non-GAAP (TTM) |

15.7 |

18.3 |

-14.1% |

|

P/E GAAP (TTM) |

15.6 |

17.9 |

-16.8% |

|

Dividend Yield (TTM) |

4.04% |

3.65% |

+10.8% |

Based on an expected EPS growth of around 5% through FY26, Wall Street analysts have a current price target of $52.20, suggesting the stock is undervalued by around 8.5%.

My Discounted Cash Flow analysis indicates a fair value of $53.75, using a discount rate of 7.5% (derived from an anticipated 3.5% ten-year Treasury Note as the risk-free rate plus a 4% risk premium) and assuming near-term EPS growth of 6% with a terminal growth rate of 4%. This analysis indicates that POR could undervalued by approximately 10.5% based on the FY25 EPS projection.

For what it’s worth, my Dividend Discount Model calculation values the company more richly, at $79.00. This factors in the payout ratio and average return on equity to derive an expected growth rate of 3.285%. Using the same risk-free rate and market risk premium rates as in the DCF model, the cost of equity comes out to just 5.9% due to POR’s low beta, which has historically been around 0.6.

While the DCF analysis and Wall Street target fall just below my preferred margin of safety for the sector, I rate POR a Buy based on the favorable valuation metrics compared both to its sector peers and own historical averages.

Risks

I see three main risks to the investment thesis outlined above:

- Operational Challenges – Weather disruptions such as wildfires, extreme heat, and ice storms pose risks to POR’s operations and profitability. The company has faced several such events in recent years that have impacted financial performance.

- Infrastructure Spending – As POR continues to invest in maintaining and upgrading its power grid, the cost of CAPEX may prove more costly than anticipated if interest rates remain elevated. This could pressure margins and slow growth.

- Regulatory Dependence – Like its peers, POR is vulnerable to unexpected regulatory and compliance changes that may impact operations and profitability. While the company has historically received support from the OPUC, this is not guaranteed in the future.

These and other risks are expanded upon in the company’s most recent 10-K.

Summary

With interest rate cuts just around the corner, investors can expect continued rotation to sectors that offer higher yields. Portland General Electric’s 4% dividend and even larger earnings yield of 6.5% are both well above the 10-year Treasury, and the company is priced well below both its historical valuation averages as well as those of its closest peers. It has also shown solid profitability metrics and sector-appropriate EPS growth over the past decade. For investors looking to diversify or pivot from treasuries and money market accounts, Portland General Electric is a strong candidate.

Read the full article here