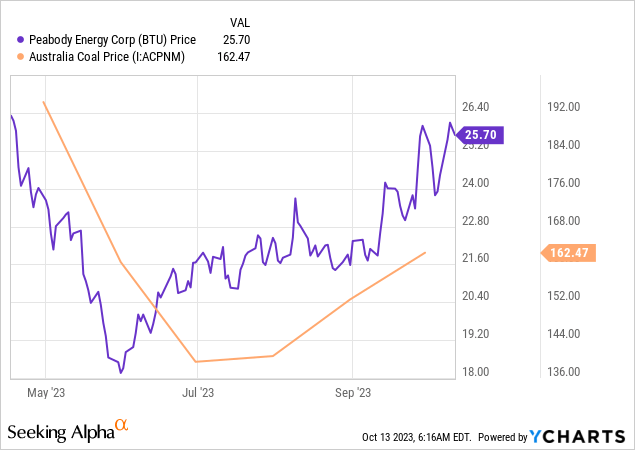

Peabody Energy Corporation (NYSE:BTU) is a U.S.-based coal producer. It has made it reasonably well through a sharp decline in coal prices. There’s been a sharp -62.29% decline in Australia Coal Price from one year ago, now around $162. The downward trend could be coming to an end because there’s been a 6.46% rise from last month’s 152.61. I think Peabody Energy Corporation is an attractive investment primarily because it combines an undemanding valuation with an incredible shareholder return program.

Let’s delve into the last quarter: Peabody returned $262 million through its shareholder return program. That’s on a market cap of $3.41 billion that’s net cash positive. The enterprise value is only $2.7 billion.

The regular cash dividend is tiny. Peabody is hitting the buyback hard. Managed guided, it would likely weigh the shareholder returns more towards dividends in the future. I think that’s likely to happen when it has run its cash down a lot and/or when shares are less undervalued. Officially, the company has 132 million shares outstanding. I believe this is more likely to be around 128 million, given the pace of buybacks.

This newly instituted massive capital return program didn’t really get them anywhere (in terms of short-term share price appreciation), as coal prices immediately started declining.

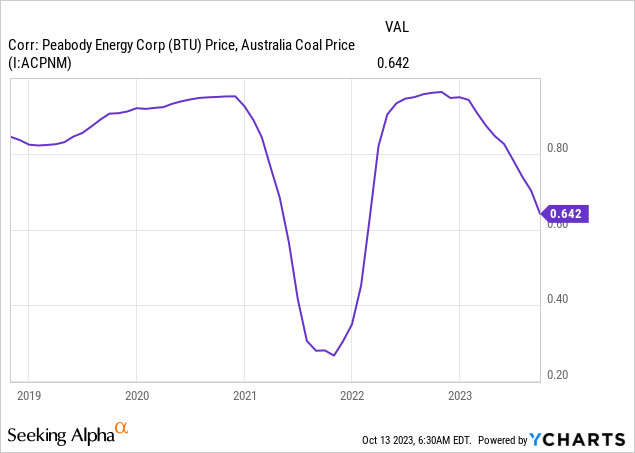

The company produces both U.S.-based thermal coal and metallurgical coal. The company only wants to invest in metallurgical coal for the future. Its stock price shows a stronger correlation with the Australian metallurgical benchmark than to Henry Hub gas prices (see below):

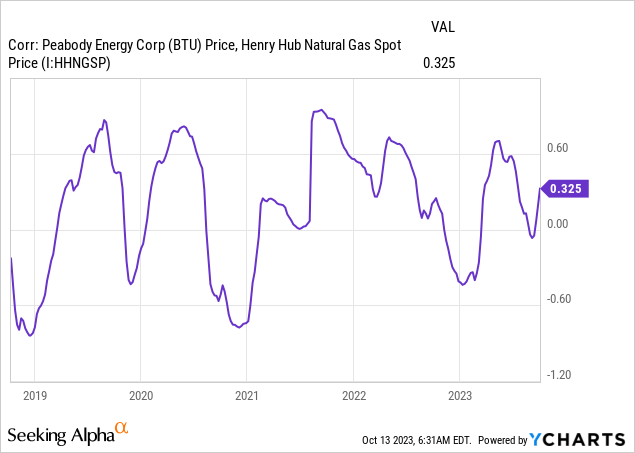

I’m looking at Henry Hub as a proxy for U.S. thermal prices, as gas/thermal coal are close competitors. Gas prices are notoriously volatile, while BTU often strikes long-term contracts for thermal coal offtake. I think that mostly explains why there isn’t really much correlation:

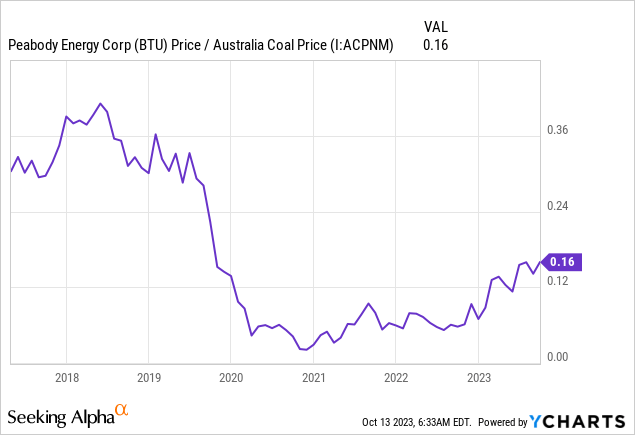

In terms of BTU’s price vs. the Australian coal price, the company has been cheaper. It has traded much richer in the past, though, so there’s not a clear ceiling from that perspective.

Market observers appear to be turning more bullish on seaborne coal. This can be observed in the price as well as through news items. The most recent example is B. Riley Financial (RILY), with raised price targets and outlook.

I’m not sure how prices will develop. China is really important for metallurgical coal. It is no secret China’s economy is currently weak compared to how it’s been for years. There are, however, tentative signs of the government considering stimulus as per this Bloomberg article:

Policymakers are weighing the issuance of at least 1 trillion yuan ($137 billion) of additional sovereign debt for spending on infrastructure such as water conservancy projects, said the people, asking not be identified discussing a private matter. That could raise this year’s budget deficit to well above the 3% cap set in March, one of the people said. An announcement may come as early as this month, another person said, though deliberations are ongoing and the government’s plans could change.

Stimulus towards infrastructure or housing tend to boost steelmaking and thus metallurgical coal.

Ukraine is still bravely fighting off Russia, and this war looks like it will continue into 2024. I wouldn’t be surprised if Putin was looking for opportunities to throttle energy markets opportunistically if it could give him some leverage vs. the Europeans. It’s not a sure thing to happen, but it clearly could happen. The time for that would be this winter.

As if things weren’t bad enough, there’s been a violent attack on Israel, followed by counterstrikes against Hamas. There is the possibility it turns into a broader conflict. A lesser concern is that it could contribute to tighter energy markets.

On the thermal coal side, there isn’t a lot of reason to be bullish yet. This is what BTU management said on its recent call:

In the United States overall electricity demand decreased nearly 4% year-over-year negatively impacted by weather. Through the six months ended June 30, 2023, electricity generation from thermal coal has declined year-over-year due to low gas prices and nearly level renewable generation. Coal inventories have increased approximately 50% during the six months ended June 30, 2023. Natural gas prices have recovered modestly from the lows of earlier this year with U.S. natural gas prompt pricing at $2.65 per mmBtu.

The EIA is currently forecasting U.S. natural gas prices to average $2.80 per mmBtu in the second half of 2023 up from the $2.40 per mmBtu in the first half of the year. Overall, near-term demand for U.S. thermal coal is anticipated to improve in the third quarter in comparison to the second quarter.

I suspect gas inventories aren’t generally as high as coal inventories. Coal inventories will have built because of the mild winter, and it will likely take more than a bout of winter weather to start working that off. Unless we have another mild winter, it will ultimately happen, but I think it will take some time.

Something I wasn’t too happy about on a recent earnings call was an exchange between an analyst and the CEO about potential acquisitions.

Nate, what I would say is in orders of prioritization organic growth investing in our own assets, extending leases, investing in equipment to bring down costs, increase efficiencies, those always have the best returns for our shareholders, and those always our number one emphasis or number one priority, and that’s what’s exhibited by North Goonyella. Then secondly, if we do get into M&A not saying we are — we aren’t — we’ve stated many times, and it hasn’t changed, that our focus is on the seaborne markets, we see the seaborne markets as growth markets in demand in both metallurgical and thermal. And we have more — much more of a focus on the metallurgical seaboard markets, but we certainly would look at both markets for potential growth in the future.

The analyst went fishing whether Peabody wanted to pick up Australian metallurgical assets. The CEO did restate they prefer organic growth, confirms they prefer metallurgical, but also says they’re potentially looking at either metallurgical or thermal. What I don’t like here is that there’s suddenly an opening to do M&A. In the previous call, the CEO still said he didn’t know how to justify it from a financing standpoint.

Yes, and there has seemed to be some uptick in M&A activity out there. A lot of discussions going on. To me, it the – it hasn’t – what hasn’t changed though, Michael is the availability of financing to do deals, right? It seems to me that you’re looking at scenarios where people ever have to use equity or cash on hand or cash they generate because of the financing or attractive financing isn’t really there. So while there is an uptick in activity, I still think the challenge that people are going have is, again, how to do the financing for some of these assets. Michael, did I answer all the questions that you asked or is there…

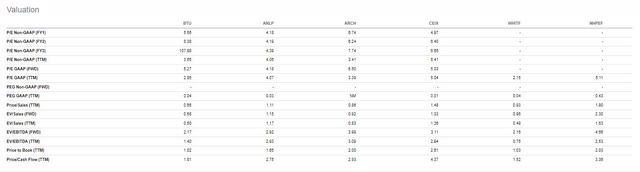

Indeed, buying coal assets tends to be quite expensive because the market ascribes very low values to them. Here’s an overview of the valuation data Seeking Alpha has on a number of coal companies:

Coal company valuations (Seeking Alpha)

All these coal companies are very cheap, trading at P/E’s between 4.2x – 6.4x. On EV/EBITDA, the ranges go from 2.11x – 3.93x. Peabody Energy Corporation generally trades at the lower end of the range. I suspect the two major reasons are: 1) its relatively new shareholder return program. They lagged others implementing this, and it started in a coal bear market; and 2) The company produces a lot of thermal.

But at these valuations, buying coal assets from a private seller makes very little sense unless they’re accepting even lower multiples on their assets.

Management and the board wisely implemented a billion-dollar buyback program. In my view, they should re-up it and take out as much equity as possible at these valuations. This will work out amazing if the market is wrong by awarding the coal sector such low multiples (indicating a dire future). It will still work out all right if the market is right, awarding these low multiples (just not fantastically so). If the company starts buying assets, it will likely work out fantastically if the market is wrong.

It will be a disaster if the market is right. With the market offering management and the board such a great option, it should clearly hammer that buyback and keep the dividend tiny. Ultimately, that should prove these market multiples misguided almost irrespective of coal’s long-term future (reasonable medium-term prices are enough). I still think this is a great position, but the changing thinking around M&A is a new risk to be mindful of.

Read the full article here