Introduction

Caterpillar Inc. (NYSE:CAT) is an industrial conglomerate that leads across construction, mining, and heavy industry. The company has been fairly consistent over the past three decades despite broader industry cyclicality thanks to conservative financial practices. Kinda like that old outdoor cat that occasionally returns home when the weather is poor.

Predominantly, share buybacks, increasing profit margins, and consistent free cash flow generation have been the drivers of above-market returns over the years. With only a $140 billion market cap, favorable industry tailwinds, and maintained operational success, I find it likely that CAT will continue succeeding long term (especially when compared to other conglomerates like 3M (MMM)).

However, we can also consider whether younger companies will replicate CAT’s past success and offer better growth opportunities as they mature. For long-term investors, this may play out better for capital appreciation, but volatility and risk will certainly be higher. Therefore, it will be important to select smaller peers wisely. The selection is small, but two names stand out: Metso Oyj (OTCPK:OUKPY) and Epiroc (OTCPK:EPOKY). With a simple comparative analysis, investors can imagine situations where these major peers can be integrated into the CAT ecosystem and support the success of the industry, and this success can allow all three names to serve investors well.

Metso Oyj

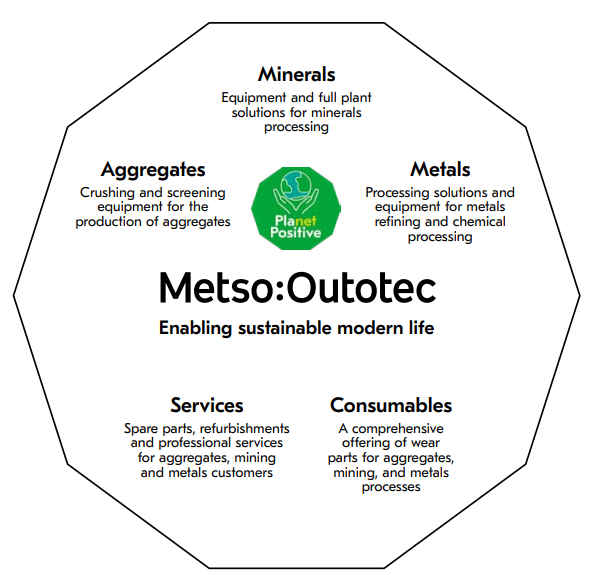

Metso is a 20-year-old company, formerly joined by paper and pulp processing company Valmet (OTCPK:VLMTY). Now each going their separate ways, Metso has joined with the nearly 100-year-old mining technology company, Outotec, formerly part of Outokumpu (OTCPK:OUTKY), one of Europe’s main stainless steel manufacturers. The combined $10 billion market cap company offers an extensive range of leading equipment and services for aggregate, mineral, and metal mining operations.

Epiroc AB

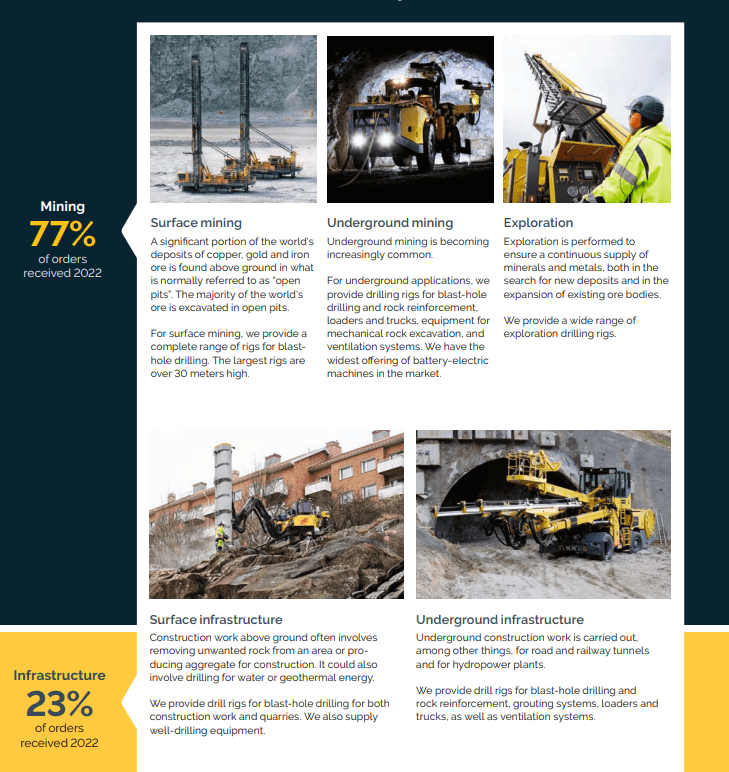

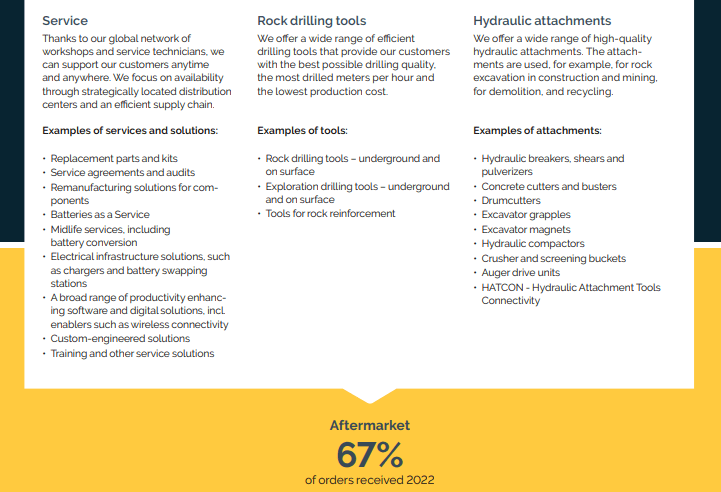

The other $20 billion peer, Epiroc, has over 150 years of experience in the design and manufacture of construction, mining, and industrial machinery and attachments (with most focused on drilling and blasting), but was recently spun off from their former parent, the industrial solutions giant Atlas Copco (OTCPK:ATLKY). Some may initially believe that a spin-off company is an underperformer (especially from a top-tier company such as Atlas), but as the data shows, Epiroc holds its weight or more.

Quick Financial Summaries

While Epiroc and Metso have traded similarly since their IPOs over the past 5 years, they have not traded in line with CAT. However, they do offer competitive financial features of lower leverage and similarly high earnings growth. I believe that while these smaller peers face some issues at the moment, which will be discussed, the general theme is that their financial performance indicates that they will have a lasting impact on their industries and can survive for generations just like CAT. As I dive deeper into the three names, I believe this theme will become clear.

| Company |

Total Return 1 Year (%) |

Total Return 3 Year (%) |

5-yr Average Net Income Margin (%) |

3-Year EPS Growth (Diluted CAGR %) |

Leverage Ratio (Net Debt / EBITDA TTM) |

P/E (TTM) |

|

CAT |

55 |

70 |

10.5 |

28.9 |

2.0x |

16.9 |

|

Epiroc |

35 |

35 |

15.3 |

21.8 |

0.4x |

25.0 |

|

Metso |

45 |

35 |

6.4 |

26.5 |

0.8x |

14.6 |

The Broader Picture

Before we even consider an investment, or adding shares, to one of these peers, we must first consider the effects of cyclicality on the mining and construction industries. Bull markets offer tremendous return possibilities, but economic slowdowns can be damaging. Every investor must consider their own goals and circumstances, as there is never a single right answer to investing. Therefore, I will begin by addressing the market to get an idea of the long-term opportunity that is available for the mining and construction industry.

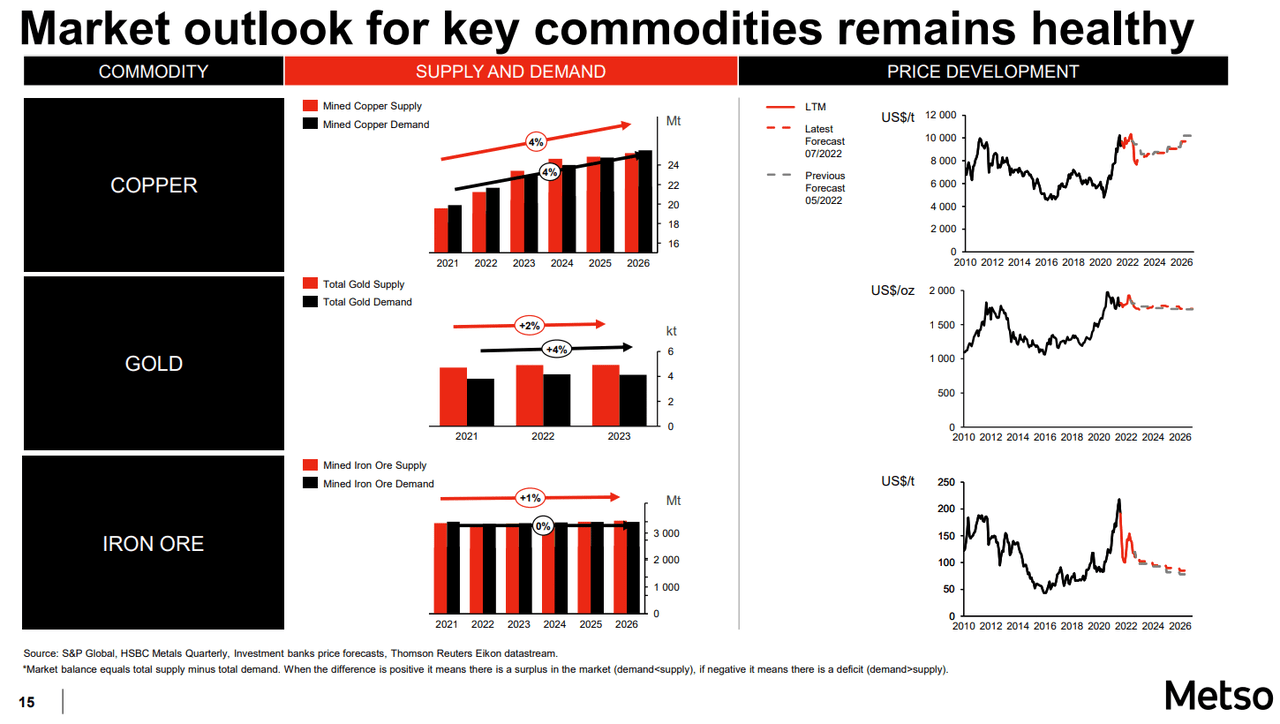

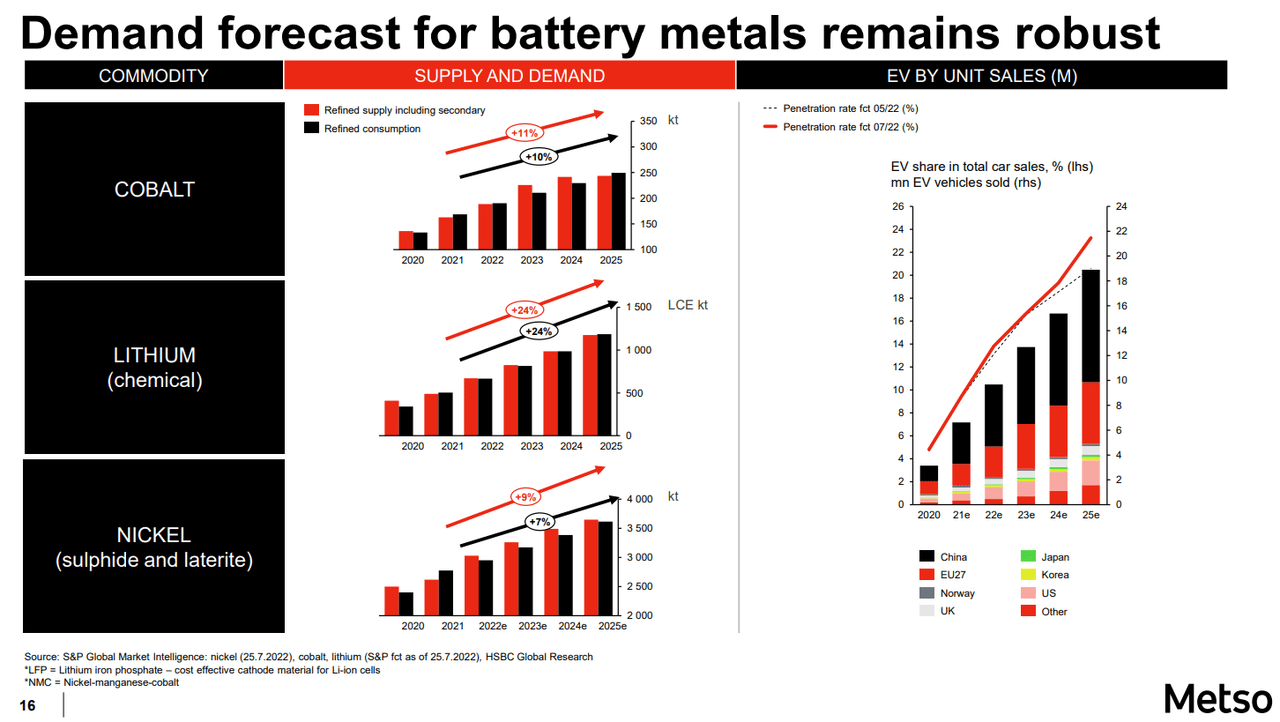

With 2023 nearly over, many investors may have missed the swift cycle that occurred in the commodities market. Rising interest rates and an incredible slowdown in demand caused material prices to plummet in 2022, but product prices have rebounded as inflation remains sticky, recession risks ease, and the world continues to industrialize. Price isn’t everything, and there is also good data that suggests demand is expected to outpace supply, allowing prices to remain favorable for the industry. This leads to increased investment in high-quality tools and services from our three peers. Also, there is continued evidence for significant market growth from commodities for the renewable energy industry such as cobalt, lithium, and nickel.

With their huge array of equipment and services, CAT is the number one beneficiary of any mining and construction spending worldwide. And, since Metso and Epiroc are more premium/high-end and cutting edge, they will benefit from these healthier industry dynamics. In fact, there are many examples of new mining projects around the world that have already announced the support of the three peers, including:

-

ioneer (IONR) has partnered with CAT for autonomous haulage systems for their Rhyolite Ridge lithium borate mining project in Nevada.

-

Epiroc’s sale of over 23 mining vehicles will allow Glencore’s (OTCPK:GLNCY) Onaping Depths mine to be one of the first all-electric mines in the world.

-

Metso is a major partner of Rio Tinto (RIO) in their drive to develop sustainable smelting solutions.

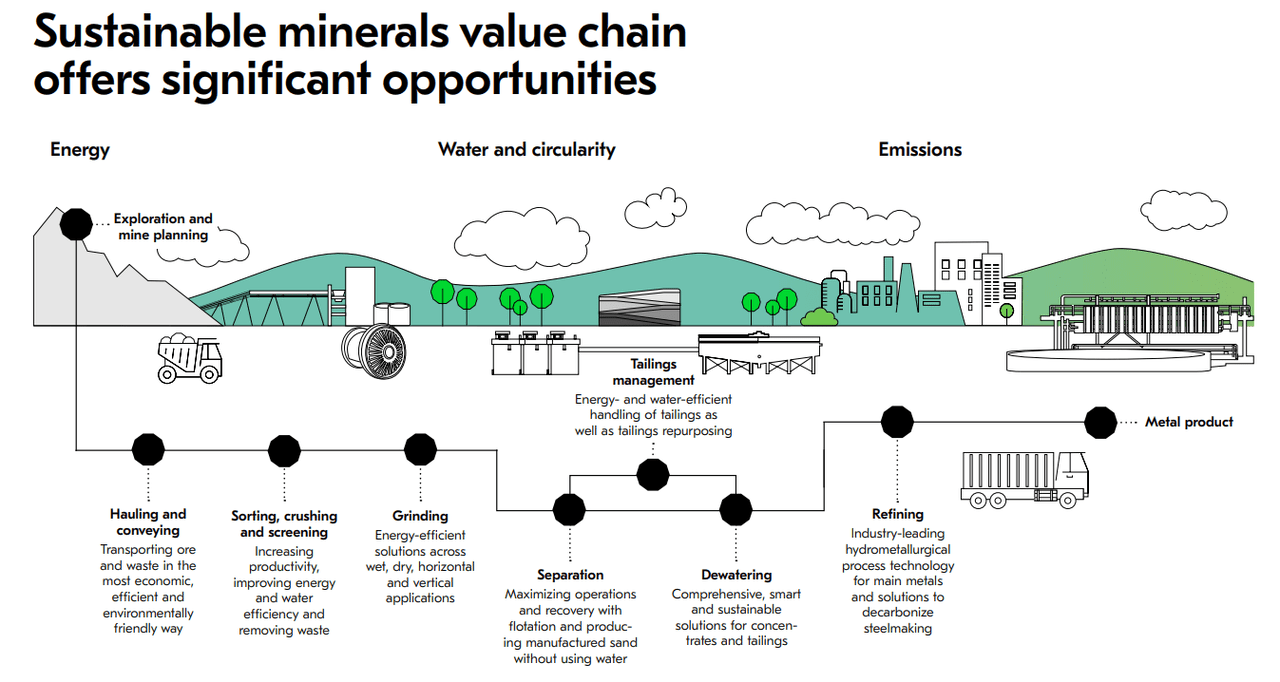

Metso Investor Presentation Metso Investor Presentation

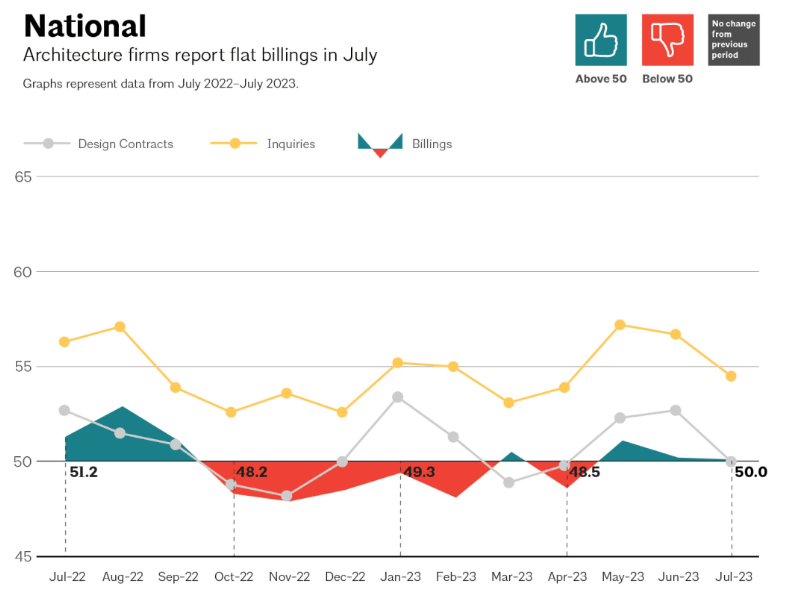

Mining isn’t the only industry that these companies face, although data on the broader infrastructure market is varied. We see that there is significant weakness at the moment due to supply chain, labor, and high interest rate headwinds around the world. Everywhere, large projects are being delayed. There is also a major risk in China as a construction boom continues to create an extremely weak real estate market with the responding waves affecting the global markets. In the US, data from the AIA suggests that there is a slowdown in billings nationwide as infrastructure bill stimulus battles against a high-cost environment.

Therefore, companies offering essential vehicles, equipment, and services such as CAT and Epiroc will see weak, but lasting demand. This will likely reflect in the financials as slower revenue growth, but I will address the financial implications of cyclicality later. Metso may seem unaffected due to their exposure to mining, but aggregates are a major raw material for the construction/civil engineering industry and so the economic factors are similarly detrimental. For now, I think the main takeaway is to understand that cyclicality will be ever-present, but leading companies can manage their way through the risks – if operationally and financially capable.

AIA

Operational Strengths

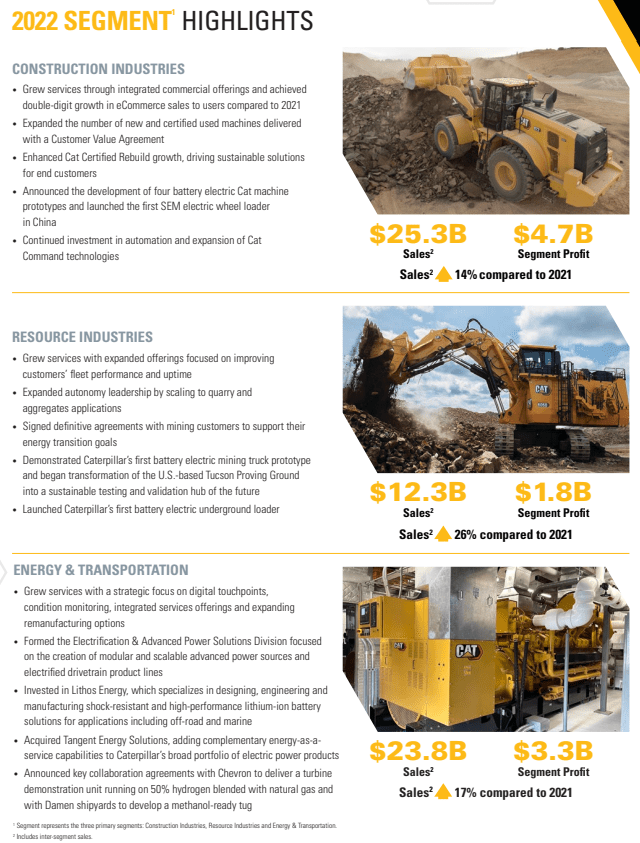

Caterpillar’s major strength is their diversification and leading market share across all revenue segments. The company focuses on the design and sale of vehicular machinery that drives the modern construction site, mine, quarry, infrastructure project, and beyond. Everyone is familiar with Caterpillar dump trucks, shovelers, and many other pieces of machinery, and their hold over the industry is strong. Thankfully, the peers I will discuss do not have to directly compete with CAT.

First, Epiroc does design and sell vehicular construction and mining equipment, but their expertise is specialized in drilling and boring for mines and infrastructure projects, along with underground material handling. With a focus on selling attachments and providing services, margins are the highest of the group. This also signals top-tier intellectual property. Considering that many CAT equipment owners use Epiroc tools, there is limited competitive risk.

This is similar to Metso, which is focused on automated material handling with equipment such as mobile and stationary crushing machines, conveyor belts, smelting arrays, and other aggregate and mineral processing solutions. CAT does not have stationary material handling solutions, instead focusing on vehicular transport. While Metso projects are larger in scale per sale, and this causes margins to be lower, the quality is just as high due to their customer base and growth outlook. However, the lack of diversification may be an issue for some. As such, Metso faces the most uncertain future as its services are far more niche and unpredictable.

There is even the opportunity for the two smaller peers to either be acquired by, invested in, or partner with CAT, all of which are favorable activities. The issue is that since these smaller peers are more specialized, cyclicality will be far greater. Some investors are uncomfortable with that. If you stick with just CAT, you also get diversification into energy generation equipment such as turbines and heavy industry engines. While still cyclical, the diversification reflects financially.

Neither Metso nor Epiroc offer exposure to a similar amount of diversification, so some investors may seek out a third small or midcap company to cover the gap (only if they want three higher risk/reward companies rather than going with CAT). One example includes Babcock & Wilcox (BW), although the wider competition is relatively weak. However, my main thesis is that the two highest quality small peers, Metso and Epiroc, remain the best alternative exposure for those who want to invest in the sector.

CAT 2022 Annual Report Metso Metso Epiroc Annual Report Epiroc Annual Report

Financial Summaries

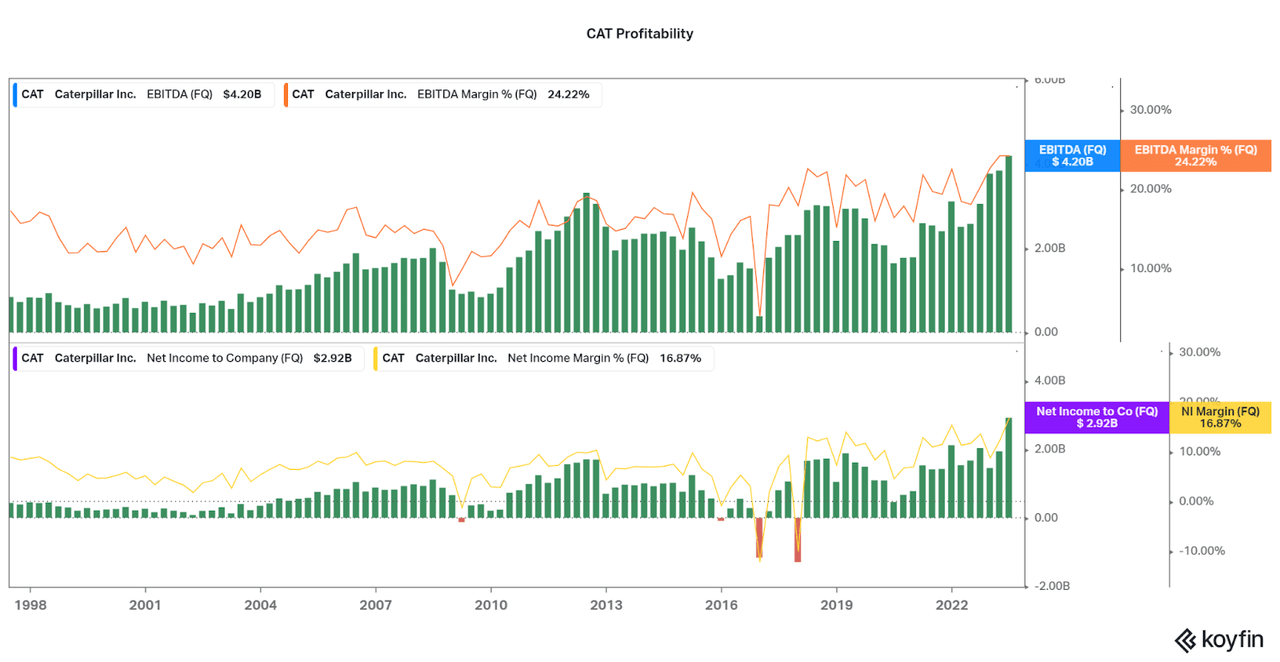

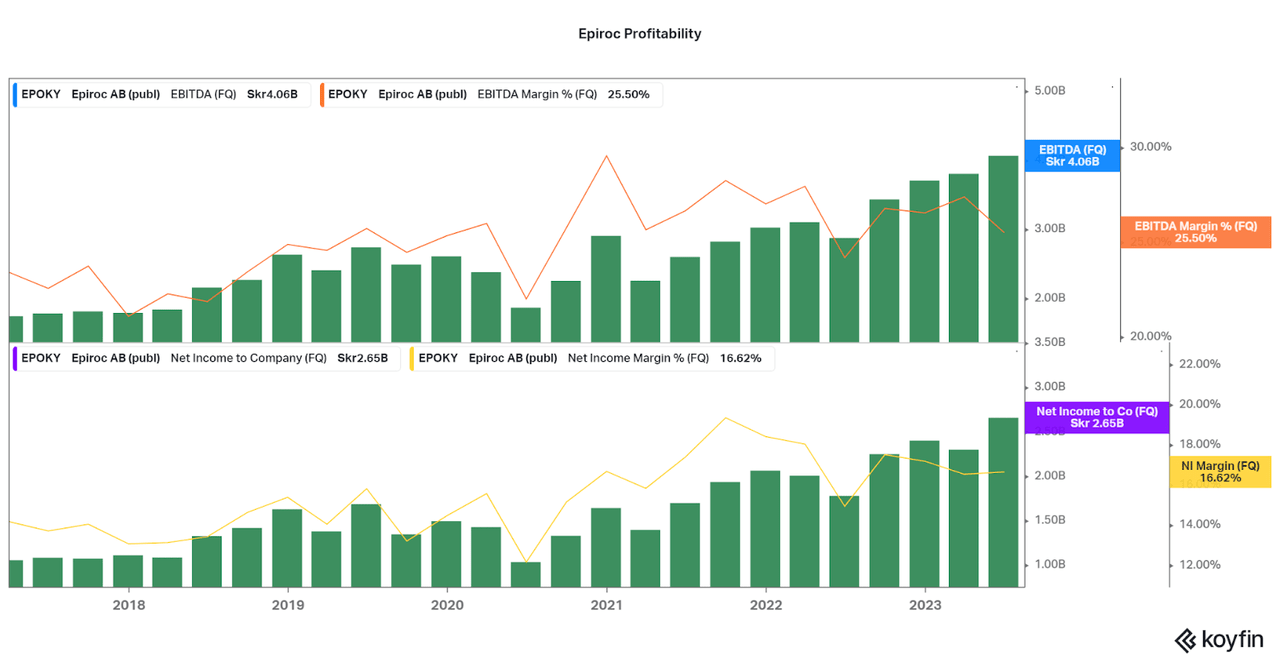

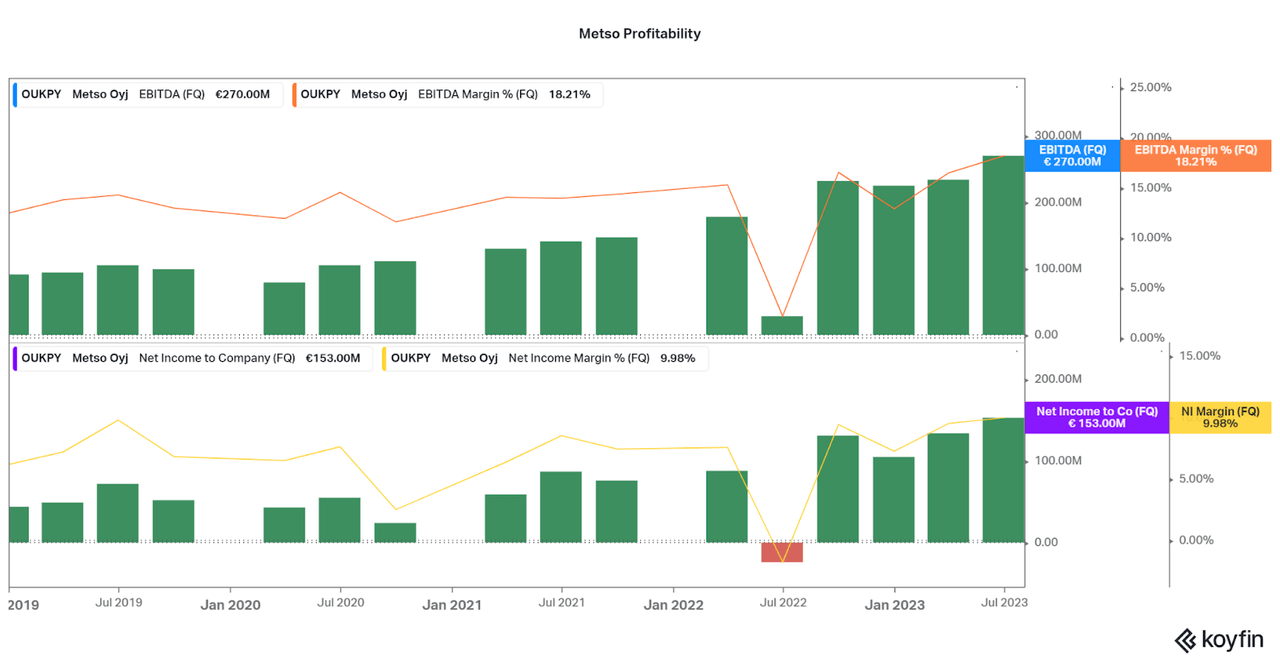

While I could show revenue growth charts for all three companies, there are only 2 main takeaways: Epiroc and Metso grow rapidly compared to CAT, and CAT has been very cyclical over the past three decades and more. Therefore, I find it more important to assess current profit generation since it’s clear smaller peers will grow faster and the industry will always be cyclical. When looking at the charts below, one theme arises: Epiroc and Metso remain competitive in terms of generating profits on a quarterly basis. In fact, Epiroc outshines CAT in terms of profit generation based on margins. However, we do see that we have yet to establish long-term patterns as quarterly margins fluctuate.

This contrasts with our ability to visualize CAT’s long-term ability to drive new highs in profit margins despite short periods of weakness. Profit generation is now at all-time highs, and the uptrend looks untarnished since a weak 2020/21. Uptrends rarely last though, and so I expect a downtrend over the coming quarters. For CAT, the balance between falling revenues while maintaining these high margins will certainly lead to a drawdown, but the extent of which remains unclear. As I discussed, there are headwinds in the profitable mining industry, but construction will remain a thorn in the side for some time. For this reason, I also believe that Metso will hold on to its profit margins longer over the coming years. Those interested in trading around can take note of these opportunities.

Koyfin Koyfin Koyfin

Balance Sheet Flexibility

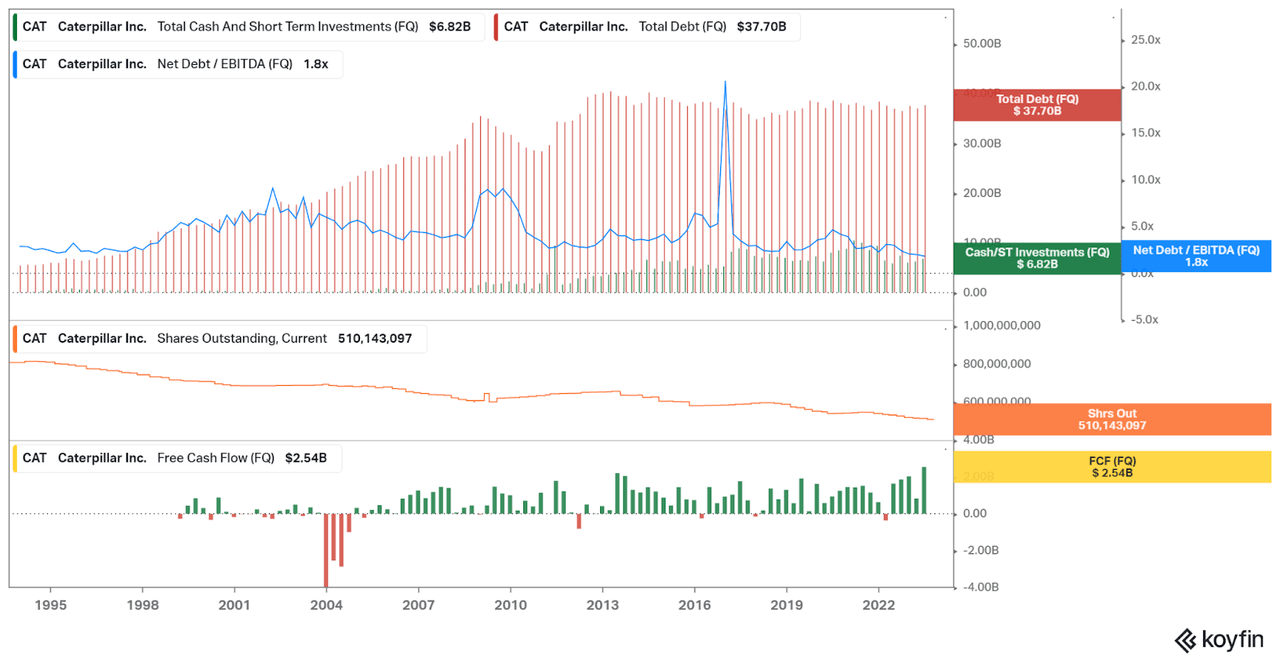

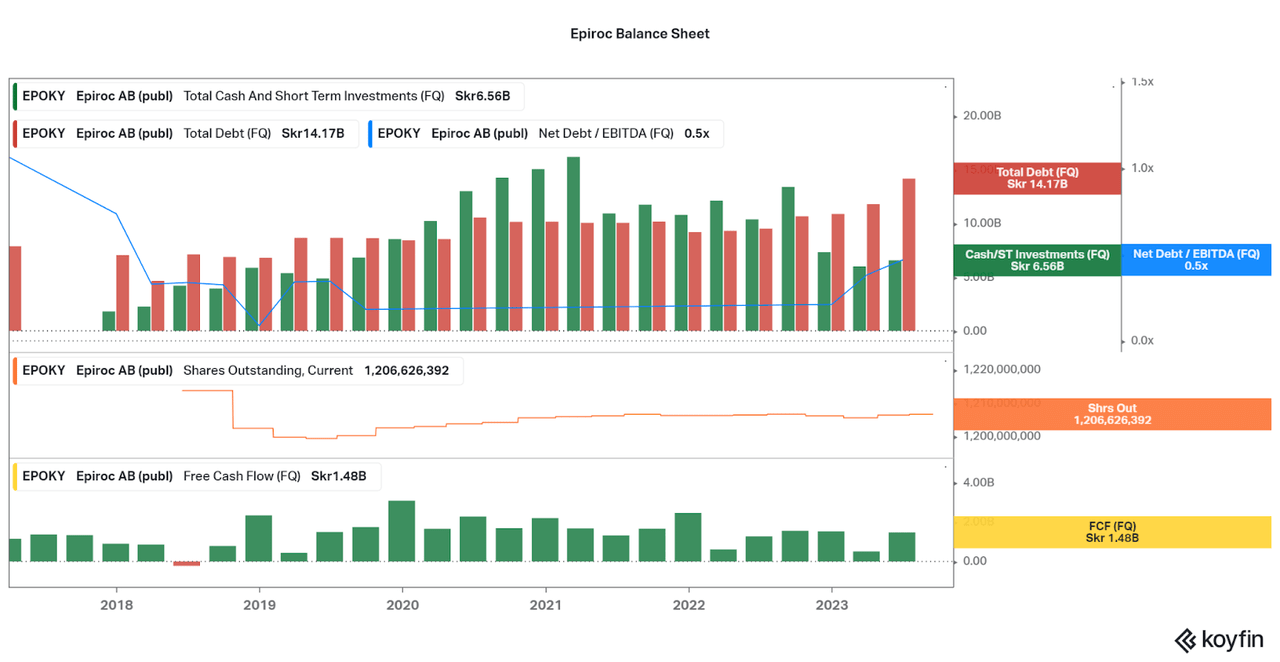

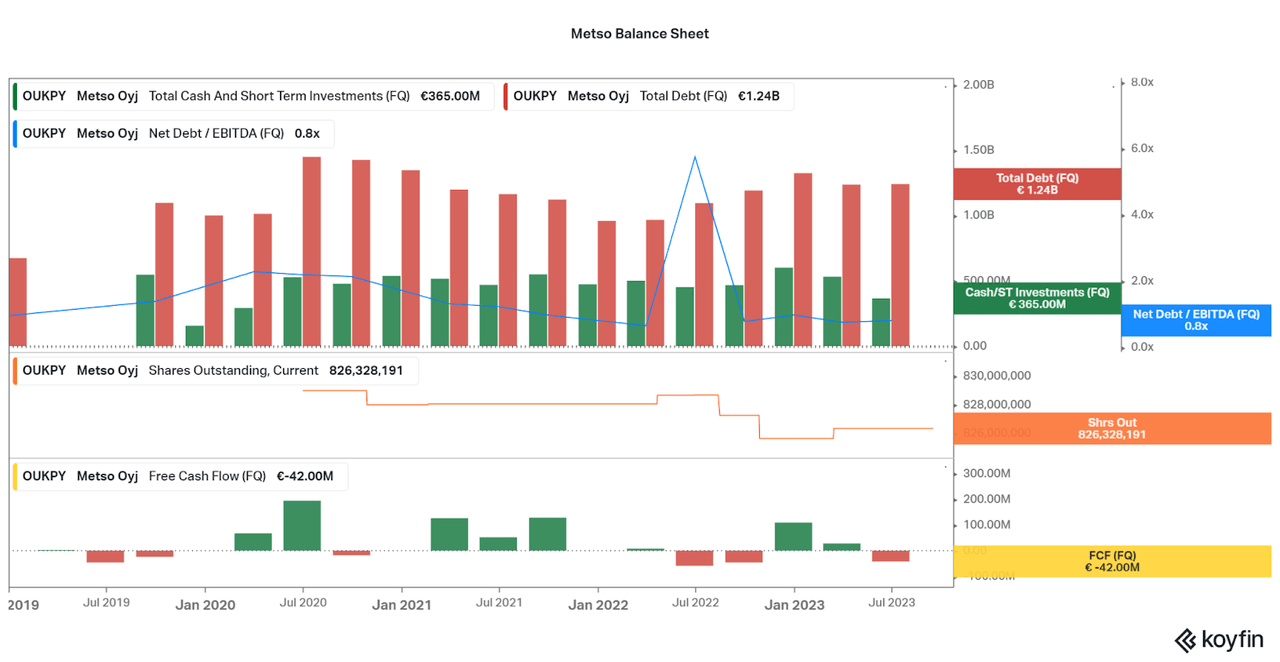

One of CAT’s key weaknesses will always be leverage. However, they have done well to bring leverage down to levels not seen since before the 80s. Still, both Metso and Epiroc tend to keep leverage below 1.0x Net Debt / EBITDA (TTM). This additional flexibility allows the more volatile peers to survive industry downturns, and activities such as acquisitions or capital investments will allow the companies to outperform the competition. However, the smaller companies are new to the market and still have work to do in regard to dilution.

While share counts are not going up, if these two companies can replicate the buyback pattern of CAT then investors certainly want to acquire shares sooner rather than ever. For CAT, the ~2% reduction in shares outstanding per year helps boost EPS to 9.7%, even as revenues are flat over the same time period. However, buybacks may be withheld as the current share prices remain close to all-time highs. Instead, look for a strong balance sheet to be put to work making tactical moves, M&A included. In fact, a pick-up of Metso or Epiroc would not be out of the picture.

Koyfin Koyfin Koyfin

Conclusion

While CAT continues to be a solid performer for conservative investors thanks to their leading products, diversification, financial risk-aversion, and earnings growth, I hope I introduced two kittens that may be influential to any investor, whether they own shares or not. While there is always a case to continue adding or holding Caterpillar, I believe that long-minded investors can see shades of CAT’s early days with Epiroc and Metso. It is true that they must prove themselves over the coming years, but so far, they are performing incredibly well for their size and market position. Each investor must assess their goals, but I expect that Epiroc and Metso will outperform CAT from this point on.

I will look to add these two names to my watchlist as the industry is a bit extended for my liking and I will be establishing my initial position. However, investors already in Epiroc or Metso may look to add shares on a regular basis as predicting the future is difficult. While the chance for shares to go down is certainly there, perhaps we will just see a flat trading pattern instead. So, when considering your own investment, be sure to look for the valuation to be just as appealing as the underlying businesses:

-

CAT: The 20-year mean P/E is 21.2 compared to the current 17.0x. However, the company looks expensive in terms of the current P/S (2.1x current vs 1.3x mean) if revenues and profits fall with industry weakness. If revenues and earnings fall, look to add between a 12-15.0x P/E or 1.25x P/S.

-

Epiroc: With the same market risk as CAT, Epiroc also is risky when trading at close to the mean P/E, EV/EBITDA, and P/S since IPO. However, growth prospects also negate this risk. Therefore, it may be unlikely that it trades below the mean for long. I believe adding between a 15-20.0x P/E will be the best opportunity. Or less than 3.0x P/S if earnings begin to weaken significantly.

-

Metso: Of the group, Metso offers the best current value in my eyes, although the company has been trading for the shortest amount of time. With broader exposure and continued success, I see the most chance for value expansion from this name. I will look to add between a 10-13.0x P/E, especially if the market begins to struggle.

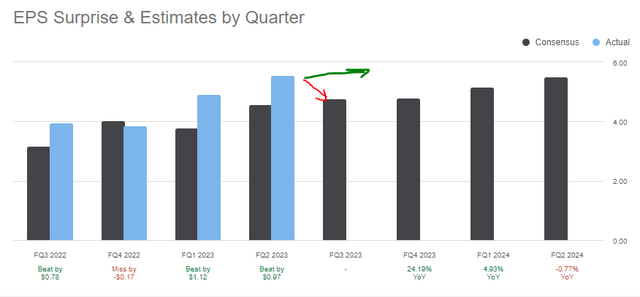

In terms of catalysts to look for in the coming months, CAT’s Q3 earnings at the end of October will be a key indicator for short-term performance. In the first two quarters of the year, CAT handily beat expectations as the market remained strong and recession fears fell. However, consensus estimates for Q3 have not been significantly adjusted upwards (analysts have moved up, but a decline in earnings is still expected). This is surprising as CAT had two of their top earnings reports of the past few years and the economic momentum seems to be lasting. Therefore, there may yet be an upside surprise even analysts remain wary.

Seeking Alpha

If CAT begins to show signs of an earnings decline, earnings will either be in line or below expectations. This will cause the shares to fall across the industry, leading to an opportunity for my valuation metrics to be met for all three companies. However, if the bull trend continues and expectations are beat once more, then I find it unlikely for Epiroc or Metso to fall to the valuation levels I laid out. I would still see an issue of a flat trading pattern as the economy slows down due to higher interest rates, and so if my valuation requirements are not met I will remain on the sidelines.

If the requirements are met, and no other issues arise, I will certainly consider establishing a position in the smaller names to accentuate my high-growth, low-risk portfolio (please refer to my other articles for more information). I also enjoy the fact that these names suit my environmentally friendly asset expectations thanks to the sale and design of sustainable products. While this is not a factor for all investors, I would like to highlight how Metso’s and Epiroc’s financials remain strong while doing so. ESG is not a total lost cause in this circumstance. I will be sure to provide updates as possible.

Thanks for reading. Feel free to share your thoughts below.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here