NNN REIT (NYSE:NNN) is a popular dividend stock due to its consistent financial performance through various market cycles. Yet Wall Street appears to be growing in cautiousness amidst a rising interest rate environment. Higher interest rates have increased the company’s cost of capital, yet acquisition cap rates have not risen nearly enough to offset those headwinds. I expect growth rates to remain pressured due to having to refinance maturing debt at higher rates and am curious to see if management alters its capital allocation strategy given the declining equity valuation. I reiterate my buy rating for the stock but note my preference for cheaper peers.

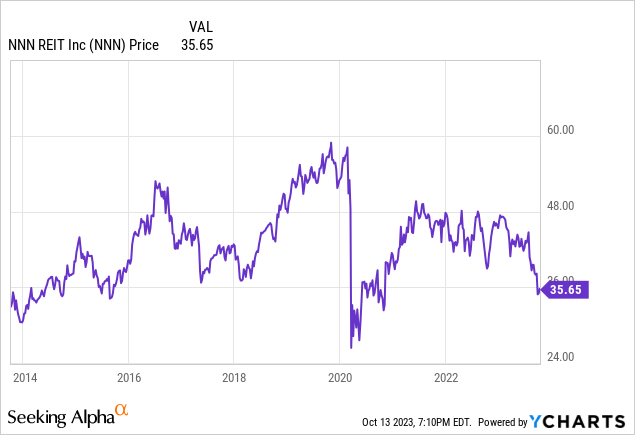

NNN Stock Price

There is a saying that rising interest rates are bad for REITs, and this time is no different. With growth rates coming to a standstill, NNN has seen its stock drop to the same levels as a decade ago.

I last covered NNN in February of 2021 where I rated the stock a buy following the company’s strong performance amidst the pandemic. The stock is down since then, but I caution that the pullback looks warranted given the headwinds to growth rates.

NNN REIT Stock Key Metrics

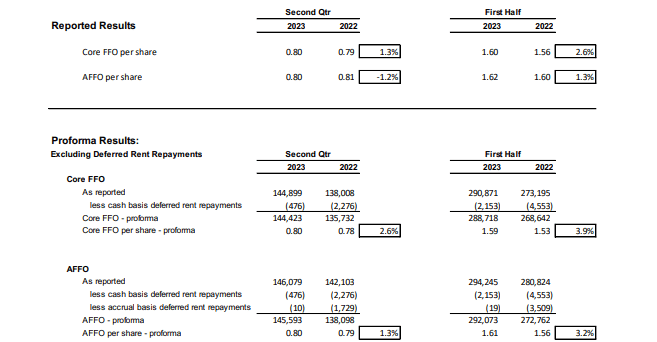

In its most recent quarter, NNN saw AFFO per share decline 1.2% YoY. Excluding deferred rent repayments, which boosted results in 2022, AFFO per share grew by 1.3%.

2023 Q2 Institutional Investor Presentation

We can see below that NNN is almost finishing the last remaining quarters with tough comparables – 2024 should be an easier year starting in the second quarter.

2023 Q2 Institutional Investor Presentation

Even so, 1.3% pro-forma AFFO per share growth is a disappointing result, considering that one might have expected around 2.5% of growth from retained cash flow and 1% from annual lease escalators. Rising interest rates have negatively impacted performance as it has increased cost of capital, leading to both higher interest expense, lower accretion from acquisitions, as well as a slowdown in acquisition volume altogether.

Management is guiding for full-year AFFO of just $3.25 per share, implying barely over 1% YoY growth.

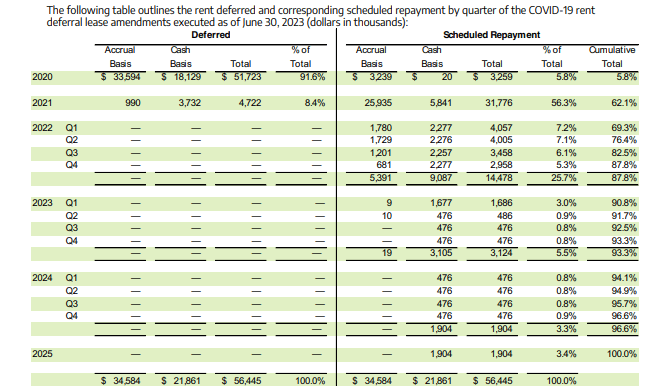

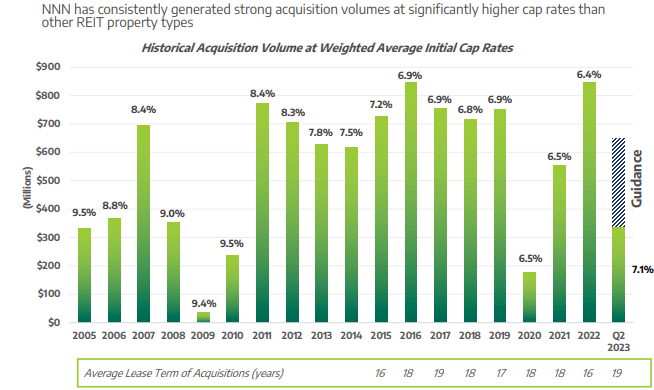

While cost of capital has been expanding, acquisition cap rates have grown at a far slower pace. NNN has been acquiring properties at a 7.1% cap rate YTD which is still below levels from the first half of the decade. My view is that elevated competition in the net lease space is to blame here.

2023 Q2 Institutional Investor Presentation

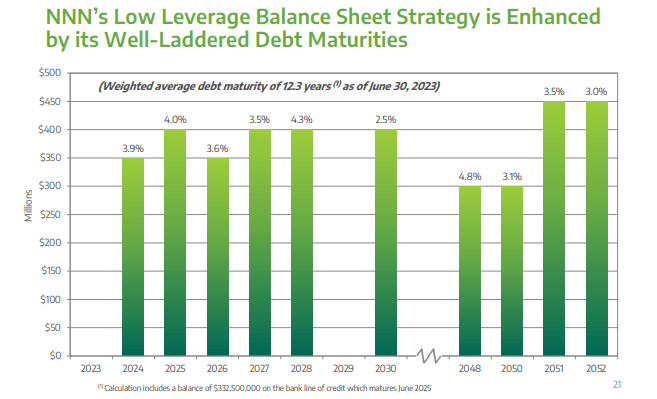

NNN maintains a solid balance sheet with 5.5x debt to EBITDA. But investors are likely more concerned about how refinancing debt maturities might impact the bottom line. We can see below that NNN has a well-laddered maturity schedule but the low weighted average debt yield will be a headwind.

2023 Q2 Institutional Investor Presentation

The company recently priced $500 million of 10 year notes at a 5.905% yield. Assuming that the company needs to refinance maturing debt at a 200 bps premium to prevailing yields and there are around $400 million of maturing debt annually, NNN might see around 1.4% headwinds to AFFO growth from refinancing debt alone. For a company that can typically expect around 3% of growth from retained cash flow and lease escalators, those headwinds are very significant.

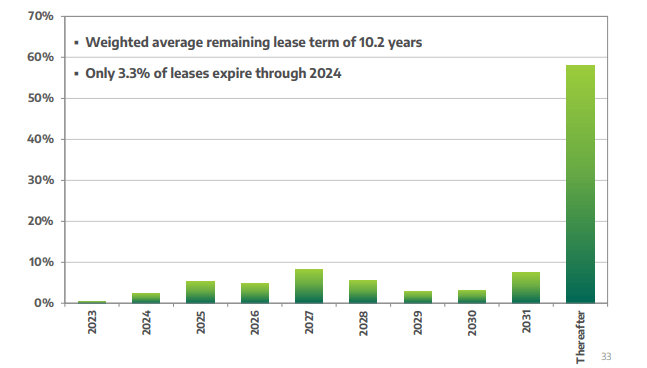

NNN has a manageable lease maturity schedule with a weighted average lease term of 10.2 years.

2023 Q2 Institutional Investor Presentation

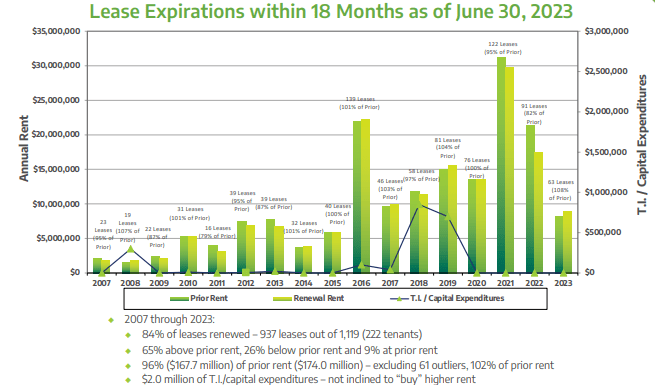

Historically, NNN has seen modest difficulty when renewing expiring leases though the company has somehow seen positive re-leasing spreads in 2023. The main risk to re-leasing spreads may be a weakening economy.

2023 Q2 Institutional Investor Presentation

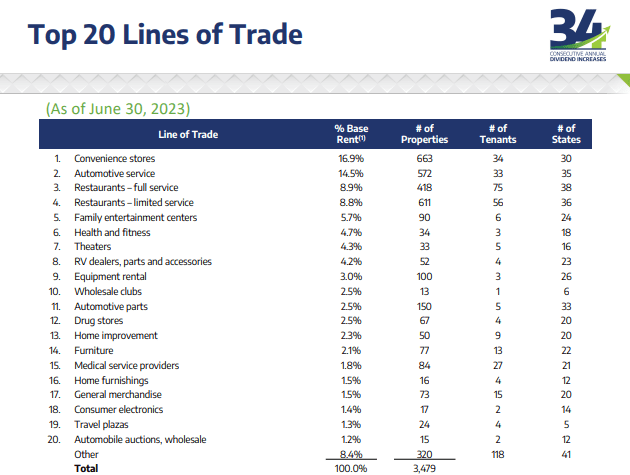

It is important to note that NNN does not appear to have significant exposure to office assets, if any.

2023 Q2 Institutional Investor Presentation

The office REIT sector has not recovered even following the pandemic, and struggling office assets has even led peer W. P. Carey (WPC) to spin off its office assets in a dilutive manner.

On the conference call, management noted that acquisition cap rates have been moderating in terms of growth, with the second quarter seeing only 10 to 20 bps of expansion sequentially. Management stated their belief that raising cap rates is “not a great way to solve a risk problem” due to making rent higher. I personally have different views but perhaps cap rates at some point will adjust higher given that interest rates continue to march higher. Management noted that if they were seeking to reduce risk, they would instead aim to reduce their investments allocation (while maintaining the same cap rate). NNN has a long history of conservative underwriting, so I am not concerned about yield chasing, and investors should hope that cap rates trend higher over coming quarters.

Is NNN REIT Stock A Buy, Sell, or Hold?

I remember when I first came across net lease REITs, I questioned the appeal, given that their properties did not seem as majestic or fancy as something like a Class A mall.

2023 Q2 Institutional Investor Presentation

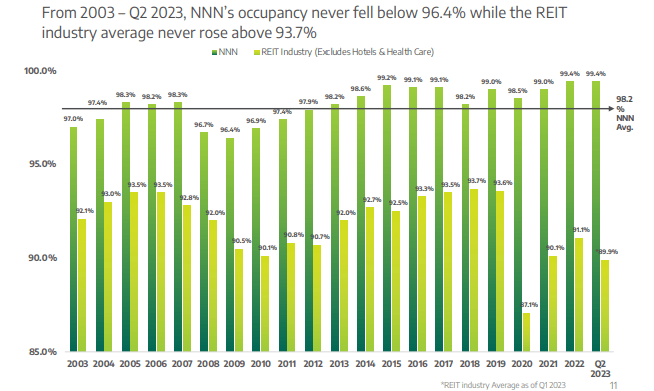

But aesthetics do not drive financial performance, at least not directly. These net lease properties carry important advantages. First, their smaller property values allow for greater liquidity, making it easier to exit losing investments. Second, the net lease structure means that the landlord has minimal recurring CapEx. Finally, these tenants tend to be more service oriented and less susceptible to macro conditions. It is impressive to see that NNN was able to maintain occupancy rates above 96% even during the Great Financial Crisis.

2023 Q2 Institutional Investor Presentation

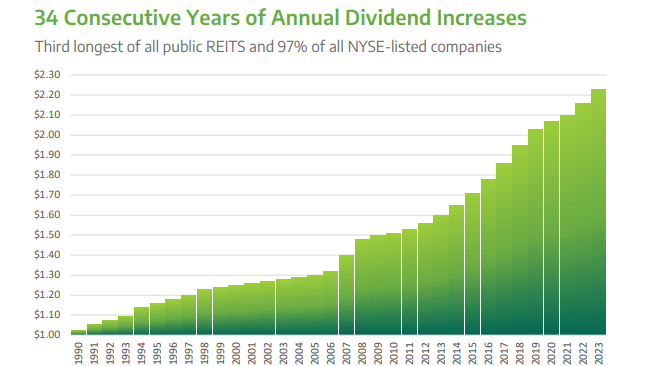

Within the net lease sector, NNN is one of the more famous operators due to its 34 consecutive years of dividend growth.

2023 Q2 Institutional Investor Presentation

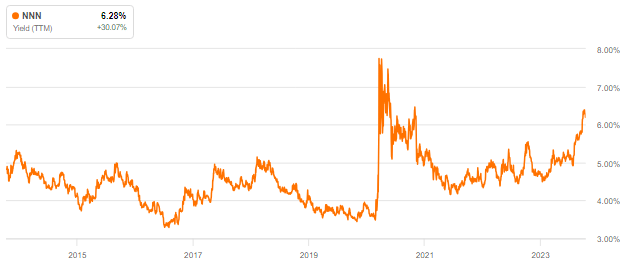

Yet NNN stock recently traded at among its highest yield over the past decade – it only traded at lower valuations during the pandemic.

Seeking Alpha

At a 6.4% dividend yield and 11x FFO, the stock looks at least reasonably valued here. The stock trades at some discount to Realty Income (O) and some premium to Spirit Realty (SRC). While the stock does indeed trade at a discount relative to this decade’s valuations, we mustn’t ignore that US Treasury yields range around 5%, which has made many other income-producing stocks cheaper as well. For that reason, I resist upgrading NNN to “strong buy” as the case for multiple expansion is not that compelling. I can perhaps see a case for the stock to rise to a 6% yield, but my conviction in such a case is not so high and the potential upside isn’t that much anyways. Between the 6.4% yield, 1% to 1.5% growth, and potential for 5.7% capital appreciation, I can still rate the stock a buy, but I need to be clear that it is at the upper end of my fair valuation range. I would much prefer to be buying this kind of stock at a 7% yield or higher, as it is much easier to bet on a rise to a 6.5% yield than 6% yield.

What are the key risks? Rising interest rates remain the main risk. With acquisition cap rates still hovering just above 7%, it is unlikely that NNN can create material excess value from retained cash flows. Due to lower accretion and acquisition volumes, I find it likely that NNN struggles to generate growth rates in excess of 2% due to significant headwinds from refinancing debt. There is also the possibility that a weaker economy leads to increases in the tenant watchlist. I note that even if interest rates were to not rise but stay at current levels, that refinancing risk remains. This means that in the absence of multiple expansion, NNN might deliver just around 7% to 8% annual returns, which might not be enough to keep up with the broader market.

I reiterate my buy rating for NNN stock, but am of the view that in this higher interest rate environment, buyers can afford to be choosy. I prefer the stocks of Spirit Realty at an 8% yield and NewLake Capital (OTCQX:NLCP) at a 12% yield in the net lease sector.

Read the full article here