The Nuveen Taxable Municipal Income Fund (NYSE:NBB) is a closed-end fund, or CEF, that investors can employ to generate a high level of current income from the assets in their portfolios. Unfortunately, the fund does not appear to be especially good at that task, as its 5.50% current yield is substantially lower than what can be obtained from other closed-end fixed-income funds. Admittedly, that yield would not be horrible if this fund got the same tax advantages as many other municipal bond funds. After all, a 5.50% after-tax yield would translate into an 8% to 9% before-tax yield, which is what many other bond funds are paying right now.

As the name of this fund suggests, though, this fund is not investing in income tax-exempt municipal securities. Thus, that yield cannot really compete with other options that investors have available to them that have similar risks.

The fund’s performance also appears to be nothing to write home about. As we can see here, the fund’s share price is down 19.14% over the past five years. This is considerably worse than the 9.89% decline of the ICE BofAML US Taxable Municipal Securities Index (BAB):

Seeking Alpha

The index has a yield-to-maturity of 5.00% right now, which is only 50 basis points worse than the Nuveen Taxable Municipal Income Fund. That is a strike against the Nuveen fund since it does not really seem worthwhile to take on the extra risk of investing in a leveraged closed-end fund when the performance difference is so small. This is especially true because the Nuveen fund is using a substantial amount of leverage, which we will discuss later in this article.

As I have pointed out numerous times in the past though, closed-end funds such as the Nuveen Taxable Municipal Income Fund work somewhat differently than exchange-traded index funds, or ETFs. In short, the Nuveen fund pays out all of its investment profits to the shareholders in the form of distributions. Thus, it is important that we consider the distributions paid by the fund when analyzing its performance history, as the distributions can sometimes be sufficiently large as to offset moderate share price declines. When we do this, we see that investors in the Nuveen Taxable Municipal Income Fund have actually made an 11% total return over the past five years. This is better than the 6.25% total return that investors in the index have received:

Seeking Alpha

In this respect then, the closed-end fund appears to be a much better deal than the index overall. However, I do not recommend buying this fund today because of the very strong probability that it will give up its recent gains. After all, this fund has delivered a 7.98% total return over the past month and an 8.56% total return over the past six months. It is very likely that it will correct in the near future, so investors might be best served by locking in these gains today.

About The Fund

According to the fund’s website, the Nuveen Taxable Municipal Income Fund has the stated objective of providing its investors with a very high level of current income. This objective certainly makes sense when we consider that the fund is investing its assets primarily in bonds. As the name of the fund suggests, the bonds in which the fund invests are a very specific type of bond issued by municipal governments around the United States. The website explains the strategy:

[The Fund’s] primary objective is current income through investments in taxable municipal securities. [The] secondary objective is to seek enhanced portfolio value and total return.

The Fund invests primarily in a diversified portfolio of taxable municipal securities. Up to 20% may be invested in other securities, including tax-exempt municipal securities and U.S. Treasury and other government securities. Also, the fund invests at least 80% of its managed assets in securities rated, at the time of investment, investment grade or, if they are unrated, are judged to be of comparable quality by Nuveen Asset Management. The Fund uses leverage.

As I have pointed out in numerous previous articles, bonds are by their very nature income vehicles. After all, investors purchase bonds at face value and they are also redeemed at face value when they mature. Thus, there are no net capital gains produced by these securities over their lifetimes. The only net returns that investors receive are the regular coupon payments that the issuer makes to the bondholder. These coupon payments obviously serve as income, so the bond’s primary objective of current income makes sense. The secondary objective does not make as much sense though, as bonds cannot deliver net capital gains (convertible bonds can, but these are not going to be found in the municipal space). It is certainly possible that the fund is aiming to exploit the changes in bond prices that accompany interest rate fluctuations in order to generate capital gains, though. However, the Nuveen Taxable Municipal Income Fund only has a 5% annual turnover, so it does not seem very likely that it is engaging in very much trading.

One of the biggest disadvantages of this fund is that the majority of the securities that it holds are not exempt from Federal income taxes. That removes a lot of the benefits of investing in municipal securities. For the most part, these are bonds issued by a local government that are not intended to finance a project that benefits the public so the Federal Government will not grant them tax-exempt status. As such, the yield on these securities should be higher than the yield of ordinary municipal bonds. However, Nuveen actually offers some municipal bond funds that offer similar yields to this fund and still have the tax-exempt status:

|

Fund |

Current Yield |

Tax-Equivalent Yield (37% Bracket) |

|

Nuveen AMT-Free Municipal Value Fund (NUW) |

3.71% |

5.89% |

|

Nuveen AMT-Free Quality Municipal Income Fund (NEA) |

4.63% |

7.35% |

|

Nuveen Dynamic Municipal Opportunities Fund (NDMO) |

7.39% |

11.73% |

|

Nuveen Municipal Credit Income Fund (NZF) |

5.15% |

8.17% |

|

Nuveen Municipal Credit Opportunities Fund (NMCO) |

5.44% |

8.63% |

|

Nuveen Municipal High Income Opportunities Fund |

5.16% |

8.19% |

It is difficult to see any reason to buy a taxable municipal bond fund with a 5.50% yield instead of the above funds, all of which have better tax-equivalent yields and some of which have very comparable headline yields. The only real reason that I can see to purchase a taxable bond fund at all given this situation is if you are making the purchase using a retirement account or some similar vehicle, so the tax benefits are basically irrelevant.

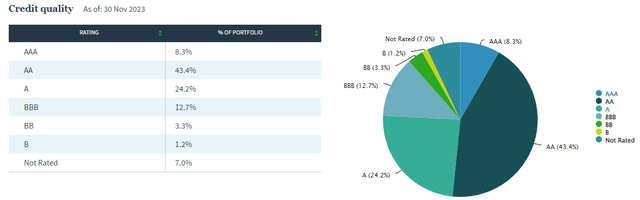

With that said one possible reason to purchase the Nuveen Taxable Municipal Income Fund over any of the funds shown above in a taxable account is if you are extremely risk averse. As I pointed out in a recent article, some of the higher-yielding municipal bond funds are investing in junk-rated securities issued to fund economically unviable projects. This fund, however, invests in somewhat safer securities. We can see this by looking at the credit ratings that have been assigned to the assets in the fund:

Nuveen Investments

An investment-grade bond is anything rated BBB or higher. As we can clearly see above, 88.6% of the fund’s assets are considered to be investment-grade. The fund claims that the unrated securities that account for 7% of the fund’s assets are of similar quality, but we cannot be absolutely certain about that. Nevertheless, we can clearly see that this fund is investing primarily in highly rated investment-grade securities that are issued by local governments that presumably have the ability to tax their citizens as needed in order to ensure that the necessary payments on the bonds are made.

Thus, the bonds in this portfolio are probably about as close to risk-free as anything that you can purchase, except for maybe U.S. Treasuries. As such, some investors who are highly risk averse and afraid of losing any money to defaults might be willing to accept the lower yield here in exchange for the perception of safety. With that said though, most bond funds are sufficiently diversified that we do not really need to worry too much about defaults. I have discussed this in various previous articles on junk bond funds.

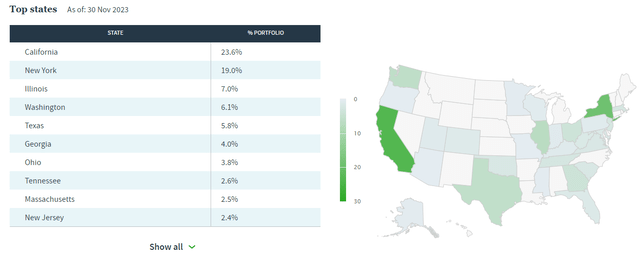

One significant concern with this fund is that it has substantial exposure to only a handful of states. For example, Californian taxable municipal bonds account for fully 23.6% of the fund:

Nuveen Investments

We also see fairly large allocations to New York and Illinois. Washington and Texas are the only other states whose bonds account for more than 5% of the portfolio. This is something that could be an issue because of the strained finances possessed by some of these states. For example, California is currently looking at a $68 billion budget deficit for the 2023/2024 fiscal year (see here). California is a bit strange as far as its budget goes because the state tends to have massive surpluses during years in which technology stocks deliver very strong gains, but it suffers a lot during other years.

New York also is facing large budget deficits, as the state’s comptroller currently projects that the state’s financial condition will continue to deteriorate until at least 2027. Illinois is often criticized for poor financial governance, and indeed that state is also expected to post deficits in the current year. It is uncertain what impact this will have on the securities that are held by this fund, as many of them are issued by local governments and not state governments. However, it still seems likely that investors might have concerns about the risks of any municipal issues from local governments in a given state if the state government is experiencing budget problems. The fact that the fund is so heavily allocated to states that have strained finances thus could be a real risk going forward.

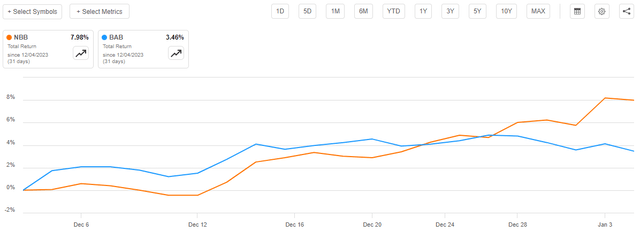

The big risk to this fund comes from interest rates, which I hinted at in the introduction to this article. As already mentioned, the fund has gained significantly over both the trailing one-month and six-month periods due to the market’s expectations that the Federal Reserve will rapidly decrease interest rates over the course of 2024. As we can see here, the fund’s shares have delivered a 7.98% total return over the past month:

Seeking Alpha

This was just slightly higher than the 8.56% total return that the fund’s shares have delivered over the past six months:

Seeking Alpha

The only logical reason for this performance is that the market was pricing in expected interest rate cuts over the course of this year. After all, the Nuveen Taxable Municipal Income Fund is investing in bonds and not stocks, so expectations of lower interest rates are the only thing that would really cause this sort of strength in asset prices.

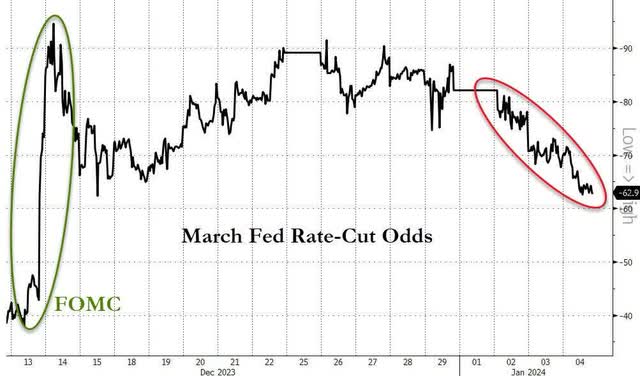

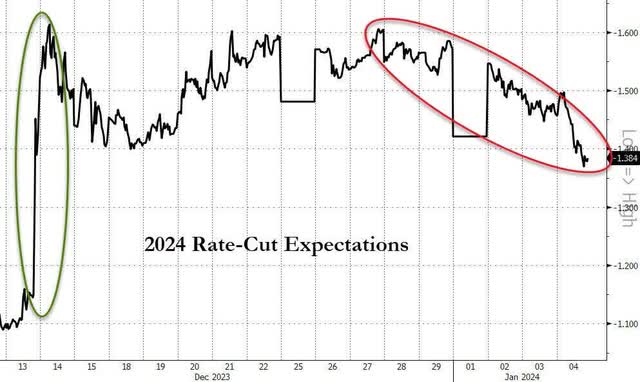

However, it seems exceedingly unlikely that the Federal Reserve will cut interest rates to nearly the extent that the market expects. It appears that the market has begun to wake up to this fact after the release of the minutes from the Federal Open Market Committee meeting on Wednesday. Yesterday, the federal futures market’s implied odds for a March rate cut plunged:

Zero Hedge/Data from Bloomberg

Bonds plunged on this expectation, with the yield up by 6-7 basis points all across the yield curve. As I have pointed out in various previous articles, the market was expecting 150 basis points of federal funds rate cuts at the start of this year. The market has reduced its expectations somewhat, as the federal funds futures market is expecting a total of 138 basis points of rate cuts as of yesterday’s close:

Zero Hedge/Data from Bloomberg

This would require five or six cuts from the Federal Reserve, which is still more than is likely to occur. The median prediction from the Federal Open Market Committee is three 25 basis point cuts in 2024 with eight committee members predicting fewer than three cuts and five predicting more. Thus, the Federal Reserve is still leaning hawkish, and it seems likely that this morning’s strong jobs report will push it further towards the hawkish side.

As such, it seems quite likely that the fund is likely to give up its gains over the next few weeks or months as the bond market continues to correct. This is a similar situation to what happened over the summer of 2023 which saw bond funds like the Nuveen Taxable Municipal Income Fund correct and reprice as the market adjusted to the reality that the Federal Reserve is serious about its “higher for longer” commitment. As such, it is a good idea to take your gains here and wait until after the correction to get back in.

Leverage

As is the case with most closed-end funds, the Nuveen Taxable Municipal Income Fund employs leverage as a method of boosting its effective portfolio yield. In fact, the fund specifically states that it uses this strategy in the strategy description on its website, which was quoted earlier. I have explained how this works in numerous previous articles on other closed-end funds. To paraphrase myself:

In short, the fund is borrowing money and then using that borrowed money to purchase municipal bonds that are not eligible for favorable federal income tax treatment. As long as the yield that the fund receives from the purchased securities is higher than the interest rate that it needs to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, that will usually be the case. However, it is important to note that this strategy is not as effective today with rates at 6% as it was a few years ago when interest rates were effectively zero.

Unfortunately, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. This is why the fund’s share price is much more volatile than the taxable municipal bond index. As such, we want to ensure that the fund is not employing too much leverage, as that would expose us to an excessive amount of risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the Nuveen Taxable Municipal Income Fund has leveraged assets comprising 39.66% of its portfolio. This is obviously substantially above the one-third level that we would ordinarily prefer to see. This is also the reason why I pointed out that this fund’s leverage is fairly high in the introduction, as this is a higher level of leverage than many other fixed-income funds.

A fixed-income fund can typically sustain a bit more leverage than an ordinary equity fund due to the fact that its assets are less volatile than common stocks. Ultimately, it is volatility that causes the most problems for a leveraged strategy, just like how margin borrowing can cause problems for a brokerage account. This fund invests in high-rated municipal bonds so the default risk here is probably negligible, so this improves its ability to carry its current leverage. Thus, the fund probably will not have too much trouble carrying its current leverage, but we should still keep an eye on it. My biggest concern is that this leverage will almost certainly amplify the fund’s losses in the impending bond market correction. The yield on this fund is not sufficiently high relative to unleveraged funds to appropriately compensate investors for this risk.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Nuveen Taxable Municipal Income Fund is to provide investors with a very high level of current income. In pursuance of that objective, the fund primarily purchases investment-grade securities issued by local and state governments that are not eligible for favorable income tax treatment. As such, these securities should have a yield that is just above that of comparable U.S. Treasury securities. After all, most local and state governments are going to be perceived as relatively safe investments due to the ability to tax the local citizens.

As of the time of writing, the ten-year U.S. Treasury (US10Y) has a 3.959% yield so we should not really expect too much in the way of yield from the securities that are held by this fund. The fund does use leverage to enable it to control more securities than it could by relying solely on its equity capital though, so that should boost the effective yield that the fund is receiving from its portfolio holdings. The fund collects all of the payments that it receives from the investments in its portfolio and then distributes them to its own investors, net of its expenses.

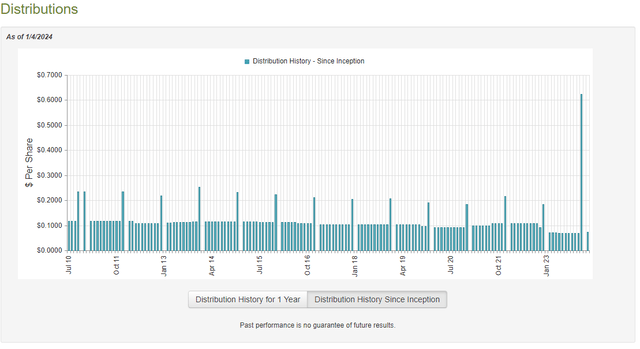

This gives the fund a reasonable, but certainly not jaw-dropping yield due to the nature of the securities in which it invests. The Nuveen Taxable Municipal Income Fund pays a monthly distribution of $0.0735 per share ($0.8820 per share annually), which gives it a 5.50% yield at the current price. Unfortunately, the fund has not been especially consistent with respect to its distributions over the years. As we can see here, it has changed its distribution numerous times over the course of its history:

CEF Connect

This may somewhat reduce the appeal of this fund in the eyes of those investors who are seeking to receive a safe and consistent income from the assets in their portfolios. This is a description that probably applies to most investors who would be interested in purchasing a fund such as this. After all, the yield is far too low for anyone who is willing to take on a bit more risk with their money. The fund did increase its distribution this year though, which might improve investors’ perception of it, especially since we generally need a rising income to keep up with the exceptionally high rate of inflation in the economy today.

As I have pointed out numerous times in the past though, a fund’s history is not always the most important thing for new investors to consider. After all, anyone who purchases the fund’s shares today will receive the current distribution at the current yield and will not be adversely affected by actions that the fund has taken in the past. The most important thing for this investor today is how well the fund can sustain its current distribution. Let us investigate this.

Fortunately, we have a relatively recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on September 30, 2023. This is a fairly good period of time to cover as it includes two very disparate market environments. The first environment was the euphoric state that existed in the first half of 2023. That was a period of time that was characterized by high expectations surrounding artificial intelligence as well as expectations that the Federal Reserve would pivot in the second half of 2023. Obviously, the pivot never occurred but bonds still went up in price and yields fell during the period. The exact opposite happened during the second half of the period covered by this report, as the market began to digest that there would not be a pivot and rates would remain high for an extended period. The movement in bond prices due to these expectations would have had an impact on the securities held by this fund, and this report should give us a good idea of how well it handled these events.

During the six-month period, the Nuveen Taxable Municipal Income Fund received $19,373,410 in interest from the bonds that are held in its portfolio. It had no investment income from other sources, so its total investment income was the same amount. The fund paid its expenses out of this amount, which left it with $10,826,159 available to the shareholders. That was, unfortunately, not enough to cover the $11,993,059 that the fund paid out in distributions during the period. While it did manage to get fairly close, the fund failed to fully cover its distributions out of net investment income. This is disappointing because this is a fixed-income fund, and we would ordinarily want a fixed-income fund to cover its distributions out of net investment income.

The fund does have other methods that it can employ to obtain the money that it requires to cover the distributions. For example, the fund might be able to earn some profits by selling bonds during a period of strength. Overall, the fund failed at this task during the period, as it reported net investment gains of $15,813,699 but this was more than offset by $44,698,731 net unrealized losses. Overall, the fund’s net assets declined by $30,054,616 during the period. That is disappointing as it suggests that the fund is failing to cover its distribution.

However, the only reason that the fund failed to cover its distribution is because of its unrealized losses. As we all know, unrealized losses are not necessarily permanent until the fund sells the securities and they can quickly be erased by any strength in the market. Thus, we probably do not need to worry about them too much. The fund did have sufficient net investment income and net realized gains to cover the distributions with a substantial amount of money left over that can be used to purchase new securities.

Thus, the fund did manage to cover its distributions during the period. It does remain to be seen how well it can sustain its distribution at the new level though, especially if the bond market shows signs of weakness due to the Federal Reserve’s reluctance to cut interest rates.

Valuation

As of January 4, 2023 (the most recent date for which data is currently available as of the time of writing), the Nuveen Taxable Municipal Income Fund has a net asset value of $16.92 per share but the shares currently trade for $16.05 each. This gives the fund’s shares a 5.14% discount on net asset value at the current price. This is substantially worse than the 7.77% discount that the fund’s shares have had on average over the past month. As such, it is probably best to wait for a better entry price.

Conclusion

In conclusion, the Nuveen Taxable Municipal Income Fund does not really appeal to offer a great investment proposition right now. The yield of the fund is too low to be attractive compared to tax-exempt alternatives and there is a very real possibility that the Federal Reserve will fail to deliver the interest rate cuts that are currently priced into the fund’s shares.

The Nuveen Taxable Municipal Income Fund does appear to be covering its distributions and it is trading at a discount, but the best course of action is probably to take your gains and wait for a better entry point, which will probably come in the near future as the market prices in fewer rate cuts than it is currently expecting.

Read the full article here