Moderna: Endured A 20% Fall Yesterday

Moderna, Inc. (NASDAQ:MRNA) investors endured a torrid earnings release that added more pressure on MRNA, as the stock has declined almost 45% from its May 2024 highs. As a result, there’s no doubt that it has plunged firmly into a bear market as the market reassessed its optimism about the embattled MRNA Covid vaccine maker. While the world wants to move on from Covid, it should be noted that the dreaded disease isn’t expected to disappear.

The World Health Organization declared in May 2023 that Covid “no longer constitutes a public health emergency of international concern.” However, the organization also cautioned that it’s an “ongoing health issue.” Consequently, the market must recognize that moving to an endemic phase doesn’t indicate that Covid will “magically disappear.” Instead, it’s expected to remain “a complex public health challenge.”

In my previous bullish MRNA article, I highlighted why Moderna is expected to see approval in its RSV vaccine (which played out). In addition, I also highlighted the stock’s robust bottom in late 2023, underpinning its recovery. My bullish thesis played out through MRNA’s May 2024 highs before it suffered a stunning collapse through this week’s lows.

It’s critical for the market not to forget that it’s still a key player with pharma leader Pfizer (PFE) in the Covid vaccines market. Despite that, the market must also recognize the uncertainties about the underlying demand for Moderna’s Covid vaccines. Therefore, I’m not surprised that Moderna has lowered its product revenue outlook for 2024, given Pfizer’s updated outlook in its recent earnings release.

Moderna Q2: Outlook Resets Covid Vaccine Expectations

In Moderna’s Q2 earnings release, the company updated its product revenue guidance range to between $3B and $3.5B for FY2024. It indicates a marked reduction from the previous $4B target, attributed to weak sales in the EU and increased competition in the domestic US market.

Analysts have also downgraded their estimates on Moderna. Consequently, the post-earnings selloff is justified, given the concentration risks from MRNA’s Covid franchise to its overall revenue projections.

Moderna is expected to register a 43% YoY decline in revenue growth for FY2024, which will significantly impact the company’s adjusted operating profitability. However, given the steep revenue volatility, management assured investors of its commitment to improving operating efficiencies.

Moderna highlighted that it has cut operating expenses by $600M, bolstered by a 19% reduction in SG&A spending. However, low gross margins have continued to hamper a more significant improvement in its profitability. Accordingly, the company posted a cost of sales margin of 62%.

Notwithstanding the challenges, the company believes it can adjust its manufacturing cost structure accordingly to reflect the current realities. Consequently, Moderna telegraphed its outlook of hitting a cost of sales margin between 40% and 50% for FY2024, suggesting a solid improvement in the second half.

Moderna’s Pipeline Shouldn’t Be Understated

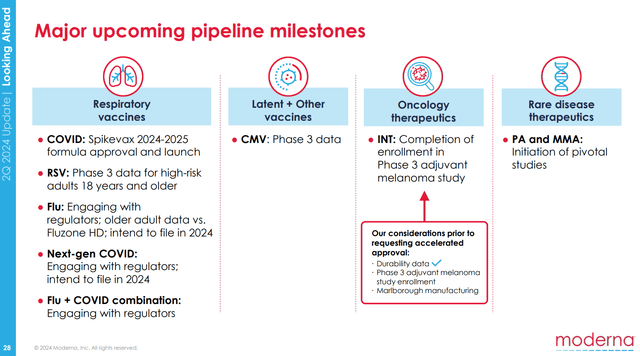

Moderna pipeline (Moderna filings)

The market is likely assessing Moderna’s near-term struggles with its Covid product revenue against the long-term opportunities afforded by its pipeline. As seen above, the company has identified several growth prospects to help lift its medium- to long-term outlook.

Moderna’s RSV vaccine is expected to play a leading role, although recent demand signals suggest the market share gains could be challenging. Concerns about Moderna’s RSV vaccine efficacy and the potentially smaller-than-anticipated RSV market could hamper more constructive progress. Moreover, as the third player in the market, Moderna faces stiff competition against Pfizer and GSK (market leader). In addition, seasonal trend uncertainties could compound the clarity on RSV vaccinations, where “sales typically peak in colder months and decline as the season progresses.” As a result, investors monitor and assess whether a more robust performance for Moderna transpires in the second half.

In addition, the potential for revaccination could also drive growth, although not likely in the near term. Moderna’s RSV vaccine is recommended to be administered as a single dose for specific unvaccinated adults. The ACIP has recommended “a single dose of RSV vaccine for all unvaccinated adults age 75 and above.” It has also recommended “a single dose for unvaccinated adults between the ages of 60 and 74 who are at increased risk.”

Moderna indicated that the recommendation for revaccination lies with the regulators. However, Moderna could provide the data highlighting potential “waning efficacy” as real-world data and scientific understanding of the disease and vaccine evolves.

Moderna revenue estimates (Seeking Alpha)

As a result, I assess that revised Wall Street estimates on Moderna seem reasonable. As the company laps the highly challenging comps against its Covid franchise, it should help “reset” market expectations as investors turn toward its RSV vaccine and other programs in its nascent pipeline.

Accordingly, analysts expect the worst is likely over in FY2023. Therefore, solid execution against Moderna’s pipeline could propel a continued recovery through FY2028, underscoring Wall Street’s confidence in its growth prospects.

MRNA Stock: Valuation Isn’t Expensive

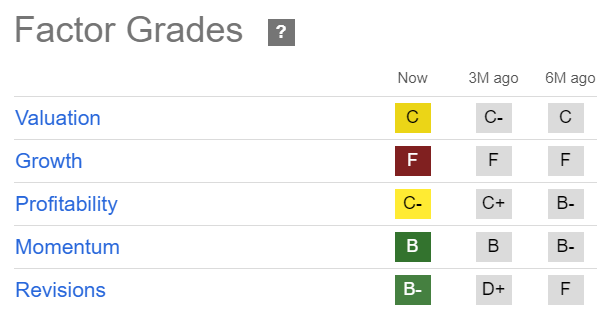

MRNA Quant Grades (Seeking Alpha)

Notwithstanding the recent bear market causing near-term volatility, investors are still generally confident in MRNA’s prospects. As seen with its “B” momentum grade, it suggests relatively robust buying sentiments in the stock. In addition, its “B-” earnings revisions grade suggests Wall Street is increasingly less pessimistic about MRNA, although the recent guidance cut for FY2024 could intensify execution risks.

Despite that, MRNA’s relatively reasonable “C” valuation grade suggests it’s not overvalued, providing more confidence for investors looking to buy its dips.

Is MRNA Stock A Buy, Sell, Or Hold?

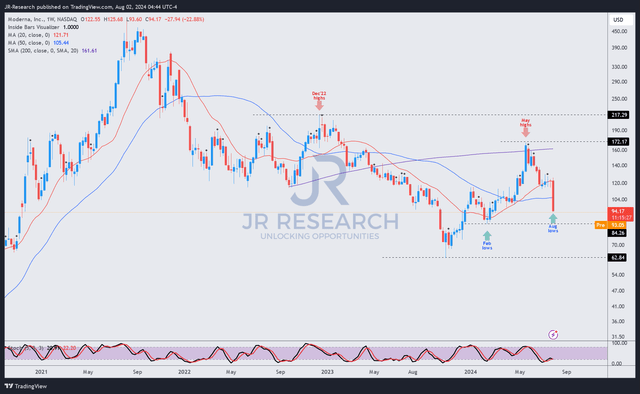

MRNA price chart (weekly, medium-term) (TradingView)

As seen above, MRNA’s 20% decline yesterday battered the stock hard, threatening to damage its bullish recovery significantly. As a result, MRNA has dropped back to lows last seen in March 2024, wiping out the gains made over the past few months.

I assessed a critical support zone above the $85 level, potentially attracting dip-buyers to add exposure. While the near-term downside could continue if current market sentiments remain weak, the risk/reward profile for MRNA has improved markedly.

Therefore, the market has already attempted to price in the downward revision of its Covid vaccine outlook. A potentially more robust RSV vaccination drive in the second half may also offer a valuation re-rating opportunity as investors look ahead to 2025.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here