Investment Thesis

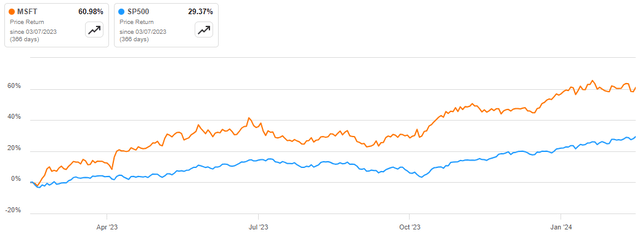

Microsoft Corporation (NASDAQ:MSFT) is one of the largest and most successful tech companies globally. It is diversified with software, cloud computing hardware, and gaming products. Over the years, the company has been a consistent performer financially which has been reflected in its share prices. For example, its trailing EPS growth rate is 33.24% which has translated to a share growth rate of 60.98% over the last year, outperforming the S&P 500 (SP500) with a margin of about 31.61%.

Seeking Alpha

Despite this solid performance, I am bullish given the company’s strong financials which I believe will keep improving courtesy of its competitive advantages and growth opportunities. In addition, MSFT has a strong market position which I believe will be key to its long-term growth. From a valuation perspective, I believe this stock is undervalued and, therefore, recommend it to potential investors at its current value.

Technical Take

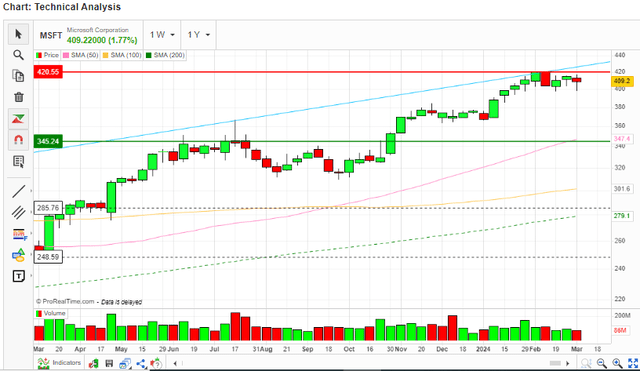

Before getting into the fundamental analysis, I believe it’s important to look at the price chart. To begin with, this stock is in a strong upward trend as indicated by the blue trend line in the chart below. Most importantly, the price is above the 50-day, 100-day, and 200-day moving average, an indication that the stock is bullish in the short, medium, and long-term horizon. Notably, a bullish crossover between the 50-day and 100-day MAs occurred in September 2023, signaling that the upward momentum is very strong, and it can be confirmed by the divergence and upward trajectory of the moving averages and the price.

Market Screener

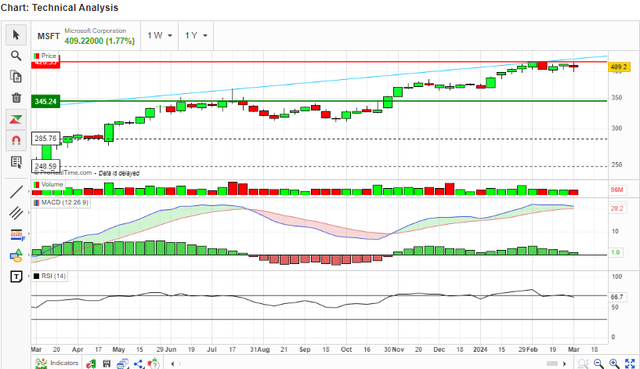

To assess the price movement further, let’s look at other indicators to get a clear direction. Considering the MACD which measures the strength of price movement, it is evident that the upward trajectory is strong. This can be confirmed by the bullish crossover between the MACD and the signal line and the fact that the MACD is above the signal line. Interestingly, the RSI is at 66.7 which implies that despite the stock surge, it has not yet been overbought and therefore it has room to grow before reaching the overbought region of above 70. This further shows that the upward trajectory is not yet due for a reversal.

Market Screener

In summary, the technicals are very strong and this shows that the bulls are still in control with no signs of a reversal. Consequently, a buy decision is justified.

Financial Performance: It’s All Rosy

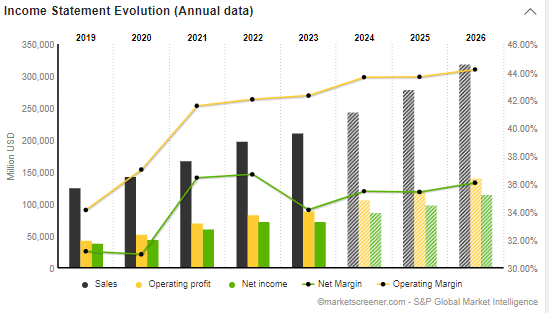

Since 2019, MSFT has been reporting impressive financial performance with consistently increasing revenues and profits, except that in 2023 net income declined, perhaps due to inflationary pressure.

Market Screener

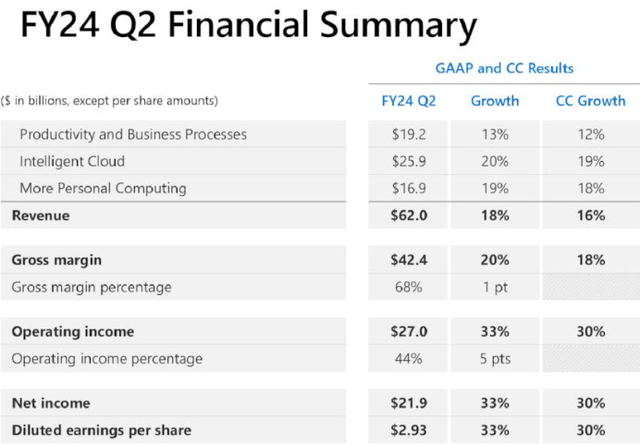

To discuss this company’s strong performance, I will refer to the Q2 2024 earnings report dated January 30, 2024. In the MRQ, the company reported revenue of $62.02 billion representing a YoY growth rate of 18% and 16% in constant currency [CC] and beating estimates by $890.68 million. In addition, operating income came in at $27 billion a 33% growth rate YoY and a 30% CC growth. Net income was $21.9 billion a 33% YoY growth and a 30% CC growth, translating to a diluted EPS of $2.93 a 33% YoY growth.

Q2 2024 Presentation

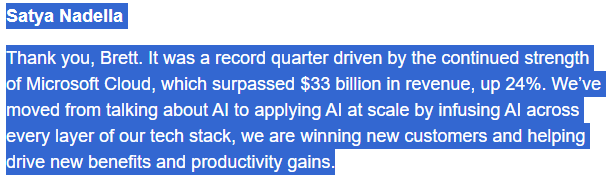

Looking at these figures, all we can see is a double-digit growth which is quite impressive and encouraging. With such a performance, it is important to reflect on what went right. The company attributed its impressive performance to its innovation in cloud computing, AI, and gaming markets. Most importantly, they benefitted from a strong demand for its offering in the wake of digital transformation and hybrid work trends. Below is a quote from the CEO regarding their customer growth which reflects the increasing demand.

Q2 2024 Transcript Call

To further support the company’s growth and that demand for its product is increasing, I refer you to the stellar performance of its three business segments which was quite attractive and pleasing as shown below.

Q2 2024 Presentation

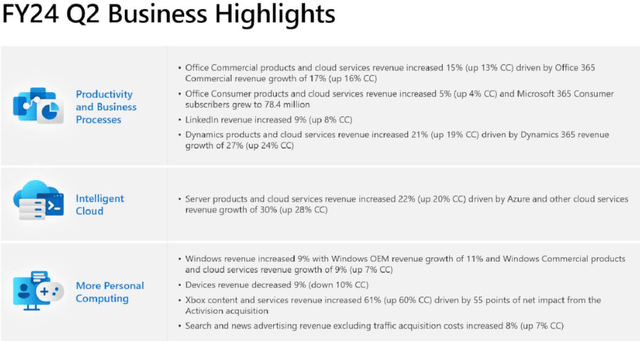

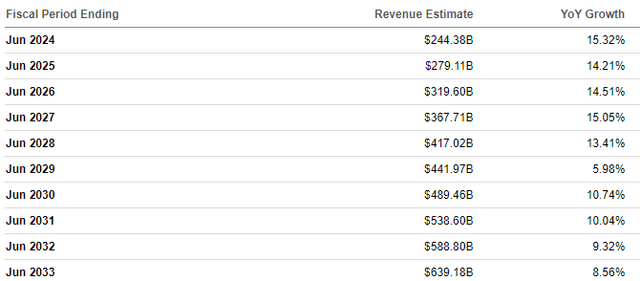

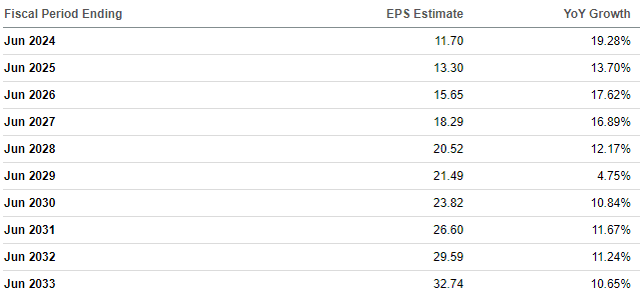

While I believe past performance has little if not nothing to do with our investment decisions today, let’s look at the company’s financial outlook. It is interesting to note that MSFT is projected to increase both its revenue and EPS consistently from 2024 to 2033.

Seeking Alpha

Its revenue is projected to grow from $227.58 billion in 2023 to $639.18 billion in 2033.

Seeking Alpha

Its EPS is also projected to grow from $9.81 in 2023 to $32.74 in 2033. This is undoubtedly a bright outlook that any investor would be attracted to and could potentially prove compelling in making an investment decision. With the company’s history of beating estimates, I believe these projections are to a greater extent achievable and this to me affirms that the future is bright.

While I hold this optimistic view of the company’s long-term financial growth and success, let’s dive deeper and evaluate the factors that I believe will enable Microsoft to deliver in the long term. Walk with me in the section that follows where I will cover these factors.

The Backbone Of Future Possibilities

Based on my assessment of this company, its future success is anchored in several strong factors. To begin with, the company has a competitive edge that stems from its innovation, strong brand recognition, and scale. To support this I will refer to its consistent expenditure in research and development which has enabled them to create new products that meet the evolving consumer needs. Since 2018, Microsoft has been increasing its R&D expense every year, from $14.73 billion in 2018 to $29.54 billion in 2023 growing it by about 2x in that time frame. Its increasing efforts on this front have resulted in the creation of successful franchises such as Windows Azure and Xbox among others.

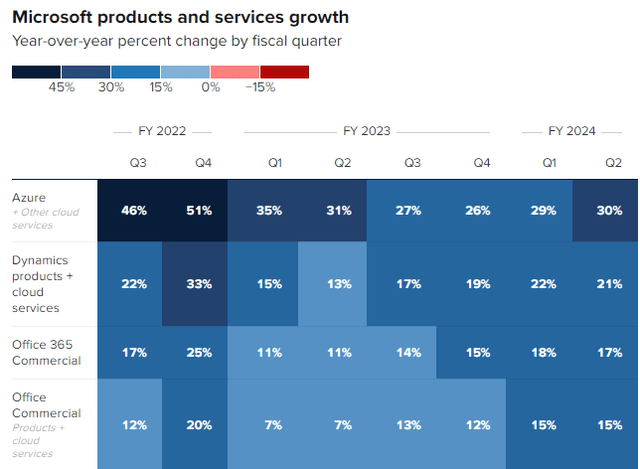

I am pleased to note that the company’s innovations are delivering impressive performance which in my view shows that this company’s products are aimed at high-growth market segments and the demand for its product is high. Below is a snapshot of some of its innovations performance.

CNBS

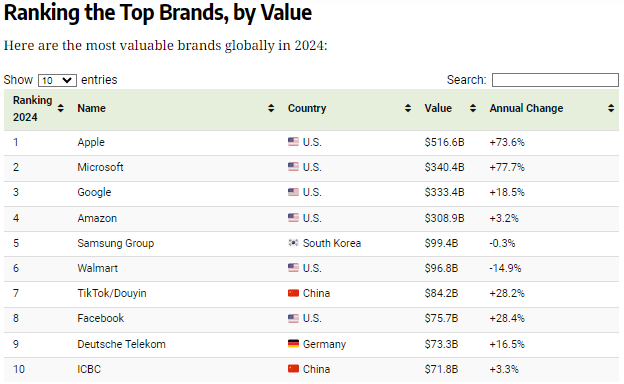

The second competitive advantage is its strong brand recognition. According to Visual Capitalist, MSFT is the second most valuable brand after Apple with a value of $340.4 billion. Interestingly, it has the highest annual change (77.7% growth) among the top 10 which reflects the strength of its brand recognition growth.

Visual Capitalist

I believe its solid brand identity is a reflection of a good reputation for quality satisfaction and customer loyalty, something I believe will serve as its MOAT.

Lastly, the other competitive advantage is its scale. This company has a vast global presence with operations in more than 190 countries and serves more than 1 billion customers. It’s worth noting its robust ecosystem which enables them to lock its users into its products thus enabling them to create cross-selling and up-selling opportunities. For instance, its Office 365 office suite has about 320 million active users monthly. In my view, this scale enables the company to achieve network effects and thus synergies across its business. Such as cost synergy because through the network effect, administration cost is reduced.

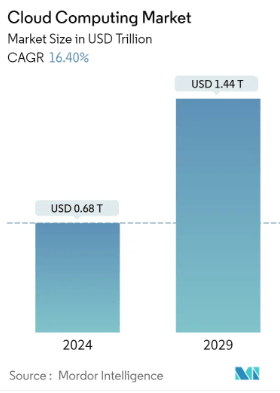

Besides its competitive advantages, Microsoft has diversified in end markets of high growth potential which I believe will be instrumental to its long-term growth. First off, one of its end markets is cloud business. The cloud computing market is projected to grow by a CAGR of 16.40% between 2024 and 2029.

Mordor Intelligence

The company is well positioned to capitalize on this growth given its innovative products targeting this market segment. A good example is its Azure and Microsoft Viva. In other words, the market potential is high and the company has positioned itself with different products to address diverse customer needs in this end market something I believe will translate to its success here.

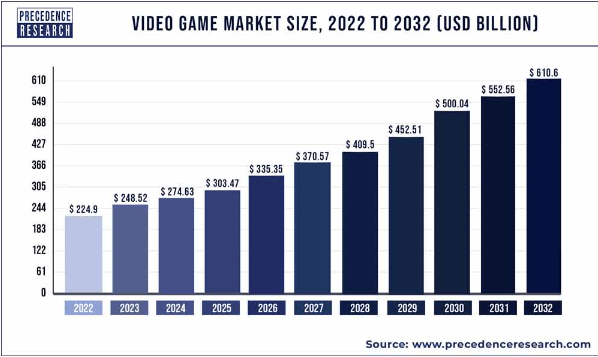

Further, the company is also operating in the gaming business with products such as the Xbox Series XS and Game Pass. According to Precedence Research, the global video game is projected to grow by a CAGR of 10.5% between 2023 and 2032.

Precedence Research

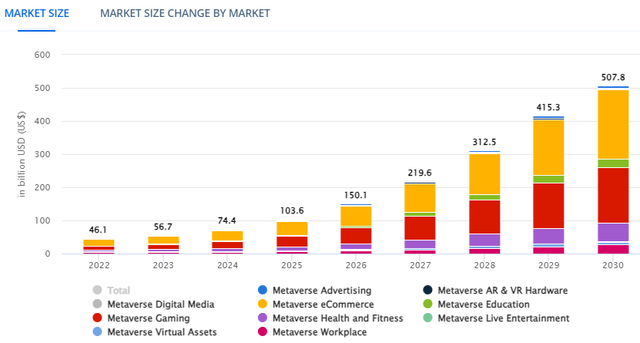

Lastly, Microsoft has also entered the Metaverse business which is somewhat of a new emerging segment. I see this as a growth area given that it is based on its existing products such as Azure and LinkedIn among others. According to Statista, the metaverse market is projected to grow by a CAGR of 37.73% between 2024 and 2030.

Statista

In summary, MSFT has invested in a high-growth market, and it is strategically positioned in these markets through its diverse and innovative products which I believe help the company address a wide range of customer needs. For this reason, I believe this company’s future possibilities are very great backed by favorable market trends. In addition, given the company’s growing budget in R&D, I am confident that this company is in a prime position to keep innovating to capitalize on any arising market opportunity.

Valuation

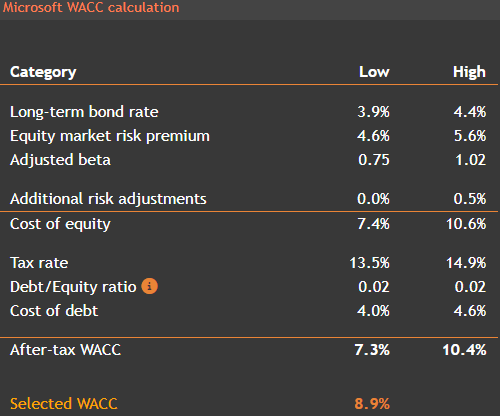

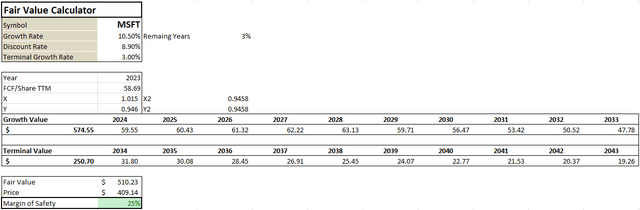

In valuing this company, I will use a discounted cash flow (“DCF”) model to estimate its fair value. In my calculations, I assumed a growth rate of 10.5% which is conservative given the company’s FCF 5-year CAGR of 16.14%. I also assumed a discount rate of 8.9% which is the company’s WACC according to value investing, a value I agree with given the realistic inputs as shown below.

Value Investing

Given these assumptions and assuming the trailing free cash flow of $58.69 million as the base case, I arrived at a fair value of 510.23 translating to an upside potential of about 25%.

Author

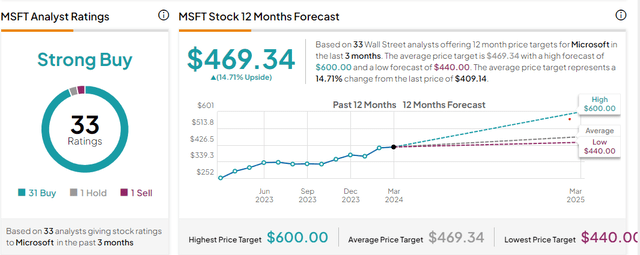

My estimates are within range with 33 Wall Street analysts who have a target price between $440 and $600 with a consensus rating of strong buy.

TipsRank

Given this background, it is evident that this stock has a double-digit upside potential which makes it a good value opportunity at the moment. For this reason, I recommend this stock to potential investors at its current value.

Risks

While I am bullish on this stock, I would like to highlight the possible drawbacks of investing here. One of the major risks of investing in MSFT is the possibility of product cannibalism. Microsoft has a wide range of products in the same target market which can result in product cannibalism. For instance, in the gaming market segment, it has products such as Xbox Game Pass, Xbox Cloud Gaming, and Microsoft Flight Simulator among others.

In my view, this existence and introduction of many products in the same market segment could eventually lead to dilution of brand value as well as reduced sales of existing products when new ones are launched. In addition, it can also lead to increased costs without a commensurate revenue growth thus affecting the company’s growth and financial performance.

Conclusion

In conclusion, I believe Microsoft Corporation is a good investment since it gives investors a combination of consistent and improving financial performance and a bright outlook which is backed by strong growth levers. For these reasons, I rate Microsoft Corporation stock a buy given its double-digit discount and upside potential.

Read the full article here