Marathon Petroleum Corporation (NYSE:MPC) is one of the largest petroleum refining and marketing companies in the world, with an almost $60 billion market cap. The company faces heavy volatility in its core business but has the ability to drive hefty shareholder returns, making it a valuable investment opportunity.

Marathon Petroleum Business

The company has continued to execute well with its business.

MPC Investor Presentation

The company is building up a strong advanced midstream business with $1.6 billion in adjusted EBITDA with mid-single-digit YoY growth. The company received a $550 million quarterly distribution from MPLX LP (MPLX) reflective of its 64% ownership of a more than $40 billion midstream company (almost 50% of MPC’s market capitalization).

The company managed to return a massive $3.2 billion of capital to shareholders, showing its financial strength and ability to drive future returns.

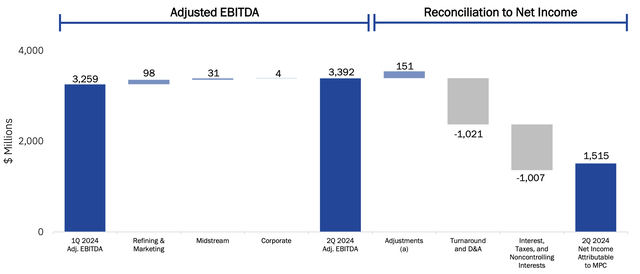

Marathon Petroleum Net Income

The company has continued to generate strong EBITDA with QoQ growth from a strong business.

MPC Investor Presentation

Refineries aren’t a popular business right now and the company is maintaining a strong long-term market position supported by midstream assets. Its EBITDA increased by 0.3% QoQ and the company has continued to maintain strong investment in its business with $1.5 billion in net income. That’s a profit level that can continue driving substantial shareholder returns.

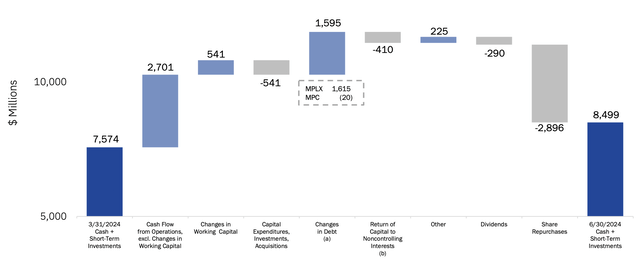

Marathon Petroleum Cash Flow

The company has continued to generate strong cash flow quarter over quarter.

MPC Investor Presentation

The company saw $2.7 billion in CFFO along with modest capital expenditures, resulting in FCF at ~$2.2 billion. That puts the company at an almost 15% dividend yield. The company’s debt has gone up almost $1.6 billion, but it’s at the MPLX level. The company can comfortably afford shareholder returns with $290 million in dividend, an almost 2% yield.

At the same time, the company managed to increase its cash position despite a substantial commitment to shareholder returns with almost $2.9 billion in share repurchases. The company has managed to reduce its outstanding share count by almost 50% since mid-2021, and we expect it to continue aggressively doing so.

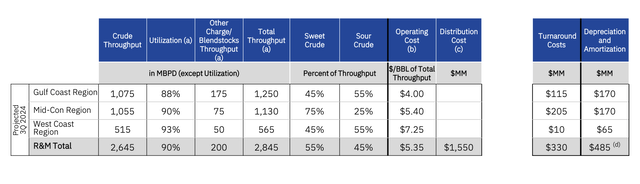

Marathon Petroleum Outlook

The company’s outlook is to continue driving substantial shareholder returns.

MPC Investor Presentation

The company is expecting hefty utilization across its assets, which are key to seeing strong returns. Given that the assets are fixed, the higher the company’s utilization, the better the company can spread out fixed costs and drive shareholder returns. The company expects roughly 2.6 million barrels / day in throughput, with $5.35 / barrel in operating cost.

The company’s distribution costs come out to ~$6.5 / barrel. The company is continuing to build up a strong business and with hefty demand for refined assets, we expect the company to be able to generate strong cash flow with these assets. Crack spreads remain relatively strong, which will support continued returns.

Thesis Risk

The largest risk to our thesis is long-term volumes. The company operates in midstream and refining, and volumes are expected to remain strong into the end of the decade. However, there remains concerns about the long-term potential of the markets after that and demand. That could hurt the company’s ability to generate long-term shareholder returns.

Conclusion

Marathon Petroleum has an impressive portfolio of assets. The company’s assets are tough to replace, and a strong midstream segment through MPLX shows the values of the company’s portfolio and is continuing to support hefty cash flow for the company. The company is utilizing that cash flow to be able to drive hefty shareholder returns.

Marathon Petroleum Corporation has been paying a modest dividend of almost 2%, and it’s continuing to aggressively repurchase shares. The company has managed to reduce its outstanding share count by 50% in just a few years, and it’s continuing to invest in its portfolio. MPLX provides strong baseline cash flow and the company is a valuable long-term investment.

Read the full article here