Thesis

The Manitowoc Company, Inc. (NYSE:MTW) is slightly undervalued at current price of $13.50 per share. On a comparative basis, shares could be worth double, and on a conservative cash flow basis, only slightly more at $16 per share. Being a global leader in cranes is a double-edged sword, and the firm needs to defend against competition and convince investors that its ‘growth’ plan is swinging in the right direction. I rate the stock a hold until shares go below $12, providing an entry with a larger margin of safety.

Business Overview

Manitowoc is a medium and heavy-duty crane manufacturer. The Wisconsin-based firm has over 120 years in business, although it originally was founded as a shipbuilding enterprise. The company diversified and sold many of its heavy manufacturing operations; most recently, in 2016 the divestiture of Manitowoc Food Services enabled Manitowoc to focus on its stand-alone crane business. Manitowoc is a household name in the American construction industry and its products provide the full range of lift solutions.

Manitowoc’s core business is the manufacturing and sale of its crane products across its five core brands, typically to ‘distributors’ who rent cranes to contractors. These cranes range from smaller truck-mounted cranes to medium-sized crawlers and lattice-style tower cranes used in the construction of high rise buildings. The company has manufacturing sites in the United States, Germany, France, Italy, Portugal, China and Peru. In addition to manufacturing, the firm provides after-market services through its MGX brand (formerly H&E and Aspen Equipment), like installation, repair, refurbishing, training and rental.

Macro and Geography

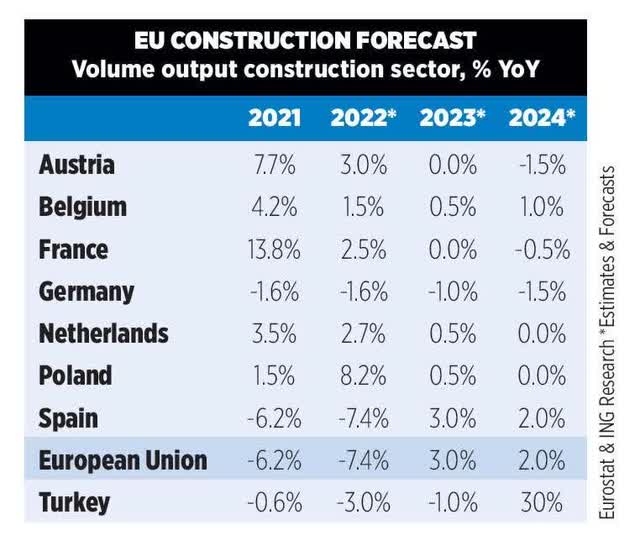

Macroeconomics and the geographic distribution of sales are strong drivers of Manitowoc’s top line growth. Rates in the US and Europe are high, although the North American construction sector has held up better than Europe. Europe, at least in my view, is in a recession, and the US may follow, but my crystal ball is as good as yours.

International Construction Magazine

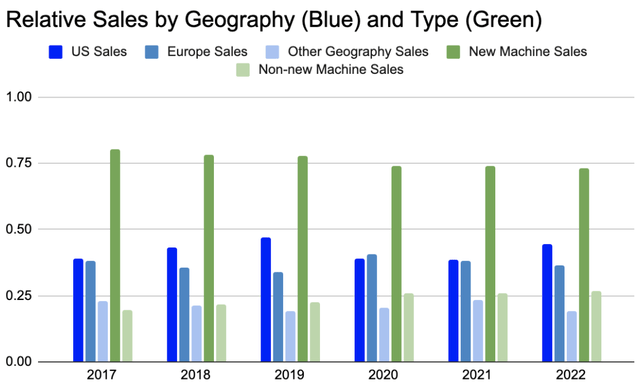

The European slowdown is a persisting challenge for Manitowoc, who produces and sells a significant portion of its products in European markets. Even with the ‘housing crisis’ in Europe, high rates seem to have crowded out private investment and homebuilders are not eager to start projects. Government investment will likely drive a majority of construction activity in Europe over the next 2 years, similar to the CHIPS/IRA Acts in the US. One bright spot for the firm has been in the Middle East, where Saudi Arabia has kicked off its 2030 vision, requiring the use of many cranes. On the whole, the composition of MTW’s sales has remained steady over the last 6 years:

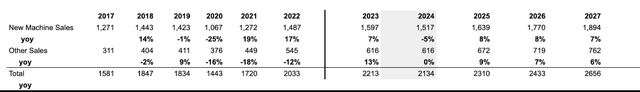

SEC 10Ks, Author’s work

Management and Strategic Review

The last five years have been a choppy run for Manitowoc. Although the firm has no ongoing concerns, Manitowoc is very much a turn-around story, at least for now. The pandemic, the outbreak of the war in Ukraine, a recession in Europe and goodwill impairments have cut the stock by nearly 70 percent from its highs in 2017. Since then, four new members have stepped into board positions, a new CEO was appointed in 2020 and a new CFO was appointed in 2022. Much of this turnover and reorganization is evident in the company’s new strategy; a healthy amount of skepticism is warranted moving forward with new management.

Furthermore, the fourteen members of management collectively hold about 690 thousand shares, less than two percent of the 35 million shares outstanding. This is not a red flag, but coupled with the lack of insider buying suggests that management isn’t certain of a blockbuster performance any time soon.

The firm’s new strategy outlined in 2020 and 2021 has not been a complete success. The firm set forth the following goals:

1) grow our tower crane rental and aftermarket business in Europe;

2) build out our China Belt and Road tower crane business;

3) reinvigorate our all-terrain crane product offerings to grow market share, field population and services; and

4) expand our aftermarket activities in North America

In 2021 the company expanded upon these goals with its, “CRANES+50 strategy to grow the non-new machine sales by 50%, or to approximately $675 million, by 2026.”

Cranes+50

When I first wrote this article, I didn’t understand the company’s focus on used-crane sales, referred to as the Cranes+50 program, nor its desire to break into the rental market. Why would a company emphasize selling anything other than its core product? After all, a healthy chunk (~40%) of management’s stock-based compensation is based on growth in non-new sales. The reason is simple: in the face of economic uncertainty, remanufacturing and used cranes capture sales that would’ve otherwise been priced out of the market.

By selling used cranes Manitowoc can compete in Emerging Markets that face dollar headwinds. Take Turkey for example, whose currency has devalued from 18 to 28 lira per dollar just this year. Earthquakes in February prompted an immediate rebuild of the country and its neighbors. Year-to-date, the firm delivered 22 used tower cranes to Turkey, Azerbaijan and Georgia, according to the CEO Aaron Ravenscroft. I presume a similar strategy is being employed in Latin America, where the company has opened 5 new locations.

To supplement used sales, Manitowoc’s remanufacturing program, EnCORE, allows customers to send in high-value parts or entire cranes to be refurbished at roughly 25% of the cost of a new placement. This makes the overall crane market more efficient, scraping fewer cranes (or letting it rot in the yard and stripping it for parts). Customers can realize value on otherwise left-for-dead capital.

US crane distributors looking ahead face a wall of uncertainty. Most distributors have an aging fleet and are aware that 2024 will be demanding, but recognize demand past 2025 is unclear. Manitowoc estimates that the average age of the global fleet is 15 years old. By remanufacturing older cranes lessors’ can limit uncertainty in Capex after IRA-related projects. On the latest call, Manitowoc announced a rebuild of 14 Manitowoc 2250s from the largest crane house in North America.

I warn, though, that these moves are not as innovative as they seem. On one hand, the CRANES+50 strategy is a way to attract and retain new customers with new offerings. On the other hand, the initiative seems like a company that is desperate to defend market share. A strong dollar has hamstrung demand for American cranes. China’s waning construction sector has pushed Chinese manufacturers to look for buyers abroad. Europe has a slew of quality crane manufacturers like Liebherr, Mammoet and Raimondi. Zoomlion, the Chinese provider of lighter lifting products announced its penetration into the European market in 2022. There is no easy competition in construction.

Other Strategic Concerns

I have two other concerns with management’s 4-point vision introduced in 2020. First, is on point 2): “build out our China Belt and Road tower crane business”. Why would an American equipment manufacturer seek to ride the coattails of Chinese-funded infrastructure projects? As mentioned, some of its largest competitors are Chinese equipment manufacturers like Zoomlion, Sany, and XCMG. I understand the company’s desire to compete with Chinese producers in other markets, but targeting Belt and Road initiatives as a source of income is beyond me. Since then, it’s been crickets on this point…oops.

Second, the management leaves a slew of unanswered questions regarding the new strategy. What are the margins like on aftermarket servicing? Is the used-crane business more profitable than new crane sales? How much time does a refurbished crane give distributors before they need to buy a new unit? Does the firm seek to compete in the rental market? What is the company’s plan when the dollar reverses?

Keep in mind that part of management’s turn-around is essentially global crane arbitrage. In Q2 earnings the CEO commented that, “owning H&E and the crane business in Aspen, [creates a] strategic opportunity where we can go chase business that we wouldn’t otherwise chase back in Europe. So, we would do a trade-in Europe, bring the crane to the United States and sell it into the U.S. market”. In Q3, the company did something similar by sourcing cranes in Asia and selling to Europe/Middle East. This isn’t a concern yet, but definitely adds some forex risk when a crane trade goes sideways.

Similarly, I remain cautious about the firm’s decision to purchase H&E’s and Aspen Equipment Company’s crane assets in FY 2021. The H&E acquisition closed at a final price of $130MM, inclusive of the rental fleet valued at $48.2MM. The Aspen acquisition closed at $50.2MM, with a rental fleet valued at $19.3MM. In the Q3 earrings, management mentioned that more acquisitions will be required to achieve growth targets set in the turnaround plan. Will this cash come from financing or operations? I don’t know.

Peers

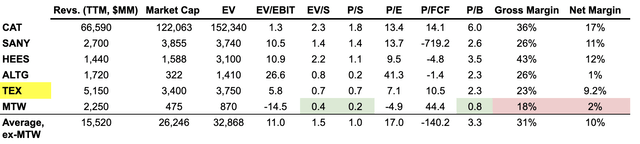

Author’s work, TradingView

I’ve selected 5 companies with similar geographic footprints, products and/or services to Manitowoc. They are Caterpillar Inc. (CAT), Sany Heavy Equipment International Holdings Company Limited (SANY, OTCPK:SNYYF), H&E Equipment Services, Inc. (HEES), Alta Equipment Group Inc. (ALTG) and Terex Corporation (TEX). Looking at peer averages, MTW is cheap on a EV and Price-sales basis, and on a price-book ratio. I think some of this discount is warranted; unlike CAT products, Manitowoc’s cranes are more of a one-trick pony (I’d rent a CAT excavator over a Manitowoc crane any day). Additionally, Manitowoc’s 2022 acquisitions need to prove themselves moving forward, and the company is just now turning the corner on profitability (keep in mind the numbers include Q4 2022, where MTW took a tough write-down on Russian assets, and profitability has been much better this year).

Gross margins, too, are lower in the crane business than in its peers’ businesses. The company hasn’t released numbers on aftermarket/remanufacturing service margins, so I don’t know how this changes moving forward with more aftermarket sales.

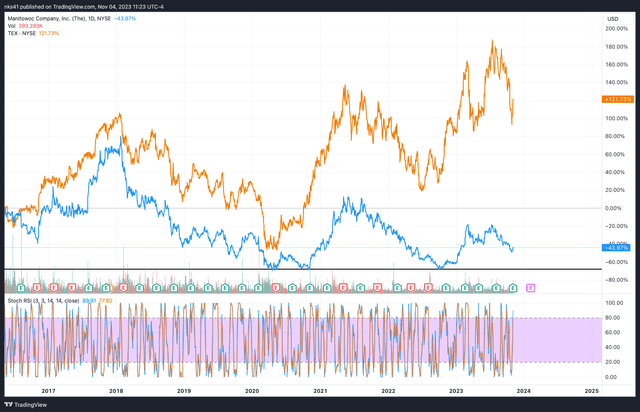

Finally, I would like to draw some attention to Manitowoc’s relationship Terex, who I believe is the firm’s largest competition since the sale of MTW’s food service business in 2016.

TEX vs MTW since 2016 (TradingView)

Terex has done extremely well over the last 6 years — certainly walloping MTW’s returns — and Terex’s management has engaged in some insider buying. However, I believe a large part of Terex’s success is its sales in ‘elevated work platforms’, like the Genie lift and other telehandlers, not necessarily crane products. This imbalance gives Manitowoc a chance to gain market share from Terex, provided it plays its hand correctly in distribution and pricing. Terex’s main competing products are its rough terrain cranes and tower cranes, specifically the self-erecting models. From my research online and speaking with a few crane-distribution sales reps, Manitowoc’s Grove brands are still slightly preferred over the Terex line and Manitowoc’s self-erecting line assembles faster than the Terex version. If Manitowoc can leverage its old-school reputation through its remanufacturing strategy, there’s a possibility that purchasers seek out more Groves than Terex on the next upcycle for larger models. Additionally, I think Terex’s success is largely due to its higher concentration of sales in North America over Manitowoc. If the dollar lightens up, this could be a major boost for MTW against Terex, since MTW already has a better foothold abroad.

DCF and Financials

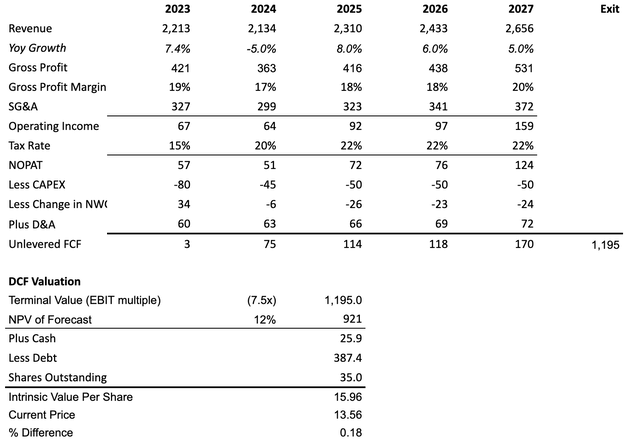

As a benchmark valuation I run a conservative DCF model using revenue estimates based on company guidance and historic trends in growth on new and non-new machine sales. I project a slowdown in sales in 2024, although the company has not released expectations for a recession to affect their business. I assume that gross margins remain near historic levels of 18% and that Capex increases heavily this year, but cools off in 2024-2027. I give the firm an exit multiple of 7.5x with a discount rate of 12%.

Author’s work, SEC 10Ks Author’s work, SEC 10Ks

My model estimates MTW’s intrinsic value to be about $16 dollars a share, or a discount of about 20%. With a multiple of 7x and a 14% discount rate, the estimated fair value is around $12.70 dollars per share.

There are no major red flags on MTW’s balance sheet, however, investors should be aware of a tangible book value of $10.70, which provides a nice downside target. One point of caution is MTW’s rise in inventory, valued at $720MM, up from $612MM in FY2022 and $577MM in 2021. The company says it plans to reduce inventory in Q4 and Q1 of next year.

As of Q3, MTW’s cash balance has risen to $40MM, up $15MM from 2Q. On the liabilities side, Manitowoc has a total $398.8MM of debt outstanding, with $300 million fixed at 9%, due 2026. I do not foresee debt-servicing issues, and I assume the company will begin to pay down debt in 2025 and refinance the remaining portion at lower rates in 2026.

Risks

There are three main risks to Manitowoc. The first two are straightforward and interconnected: a strong dollar and competition. High rates in the US and geopolitics have been a headache for MTW. If these conditions continue past 2024, I think MTW is going to have a tough time competing abroad. Cracks will start to show in the growth plan, and Chinese competitors like Zoomlion, will gain market share against Manitowoc. Sure, MTW is innovating, but so is everyone else.

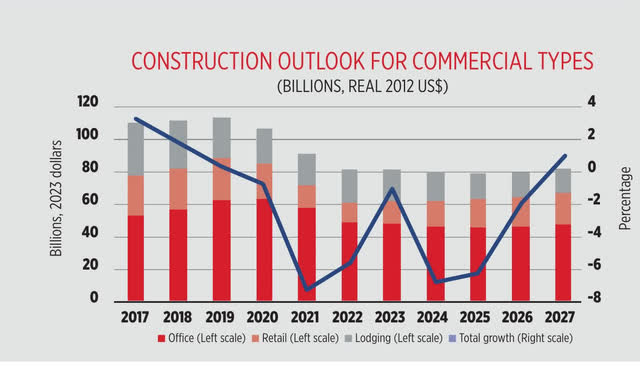

International Construction

This leads to our third, more nuanced risk. Crane demand is not necessarily comparable to other types of heavy equipment demand, so looking at general construction trends can be misleading. Dozers and excavators have more use cases, higher utilization rates, and wear out faster. Although some of the projects listed in the IRA may require cranes, I expect these less-vertical projects to require smaller, lower margin truck-mounted lift solutions, instead of the larger tower cranes used in, say, the construction of office buildings and skyscrapers. Wind projects, for example, are crane-intensive, but many have been canceled recently due to higher rates.

Final Thoughts

Frankly, there is nothing glamorous about the Manitowoc crane business. If you want to buy construction equipment equities, stick with Caterpillar Inc. (CAT) or Deere & Company (DE). Those are fundamentally better companies, and you’ll sleep better at night.

Manitowoc is, however, the leading manufacturer of truck-mounted and stand-alone cranes in the United States and for that, it deserves to be on your watch list. Under $12 dollars a share I would consider MTW worth the risk, or at least another look, since its focus on cranes gives the company leverage in good years.

Moving forward, Management needs to do three things: first, raise some cash and reduce inventory; second, convince shareholders that the firm can generate consistent returns regardless of global conditions; third, provide more visibility on margins, sales compositions and other KPIs in its company filings. As an aside, I would want to see heavy insider activity before buying. There are probably better investments out there right now.

For investors who can look past the current cycle, shares below $12 dollars are likely to give you a decent ‘lift’.

Read the full article here