In volatile markets, it’s sometimes scary to bank on turnaround names, but if I had to pick one out of several, I’d say Lyft (NASDAQ:LYFT) is one of the most promising. The rideshare company, which is leagues behind Uber (UBER) in terms of global scale, has succeeded in defining its moat and focusing on its domestic operations, accelerating both its ridership growth as well as boosting its profitability.

Year to date, shares of Lyft have jumped more than 20%, beating the broader market as well as Uber, which is up only ~10% on the year. In my view, there’s further upside ahead:

I last wrote a neutral note on Lyft in February, noting the risks that came with Lyft’s insurance renewal (boosting its cost structure) as well as the company’s frequent discounting in order to grab market share in select markets from Uber. Since then, the company has released terrific Q1 results that showed a jump in adjusted EBITDA, with further upside ahead in Q2; on top of a re-acceleration in both bookings and ridership rates. With this in mind, I’m bumping up my viewpoint on Lyft to bullish.

In addition: Lyft is also exploring additional routes to monetization. One area of focus for the company recently is Lyft Media, which is advertising within the Lyft app to make full use of the company’s captive audience. Though the company doesn’t break out the revenue contribution from advertising, this “free” source of revenue growth will be a key catalyst to further margin expansion down the road.

Lyft Media (Lyft Q1 shareholder deck)

Here, in my view, are the best reasons to be bullish on Lyft:

- Secular tailwinds for rideshare and away from car ownership. By now, we should recognize that the rideshare market is a “Coke and Pepsi” situation. Most riders don’t have a preferred app, switching between Uber and Lyft depending on wait times and prices. Lyft continues to grow active riders as well as revenue per rider; so even if its scale is dwarfed by Uber, it still has a place in the market.

- Diversified modes of transport. Lyft also has Lyft Bikes and Lyft Scooters under its brand, as well as full-on car rentals, diversifying its revenue stream beyond simply rideshare and making Lyft a leader in last-mile transport.

- Operational focus. Lyft is no longer trying to “grow at all costs”: it is honing in on the core domestic markets in which it has meaningful market share and investing in growing these markets profitably.

- Strong balance sheet. On top of just starting to tip into FCF positive territory, Lyft has ~$1.7 billion of cash and short-term investments on its most recent balance sheet (~$0.8 billion of net cash, after accounting for $0.9 billion in debt), giving it plenty of financial flexibility and firepower to invest in growth strategies.

Stay long here and keep riding the recent rebound upward.

Q1 download

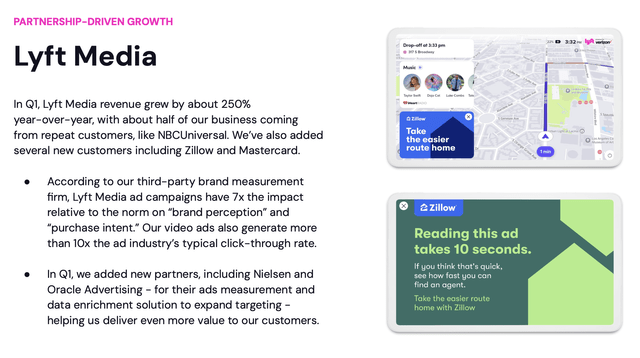

Let’s now go through Lyft’s latest quarterly results in greater detail. The first thing to note: active riders saw accelerating growth in Q1, up 12% y/y to 21.9 million. Though this represents a seasonal decline (a lot of which is weather-related, as the cold winter weather reduces outbound travel particularly for bikes and scooters) in active ridership from Q4, y/y growth accelerated two points from Q4’s 10% y/y growth rate:

Lyft riders (Lyft Q1 shareholder deck)

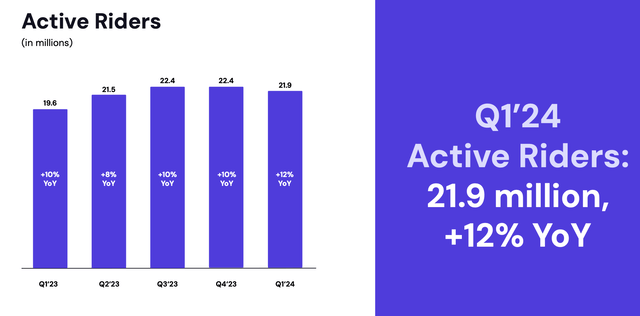

Gross bookings, meanwhile, also accelerated to $3.7 billion, up 21% y/y and accelerating four points from 17% y/y bookings growth in Q4 (which, in turn, accelerated from 15% y/y growth in Q3):

Lyft bookings (Lyft Q1 shareholder deck)

The company has been focused on making both the driver and rider side of the marketplace experience better for its community. On the driver side, the company introduced a new earnings commitment that guarantees drivers will make at least 70% of any given ride’s posted fare. The company notes that 75% of drivers say they now have better understanding and transparency over their earnings.

On the rider side, Lyft has worked hard at increasing driver supply to reduce the frequency of surge pricing. Rider frequency is also up. Per CFO Erin Brewer’s remarks on the Q1 earnings call:

In particular, driver hours increased by more than 40% year-over-year and ride frequency, referring to the average number of rides per active rider, was the strongest it’s been in four years. We also saw continued sequential momentum from Q4 to Q1 in driver hours, ride intents and frequency, demonstrating that we continue to improve execution quarter by quarter.

Now, let’s turn to our performance for the quarter. We supported 188 million rides and 21.9 million active riders. Total rides grew 23% year-over-year, reflecting strong demand across use cases. Growth in early-morning commute and weekend evening trips was particularly strong, which is a continuation of the trends we saw in the back-half of 2023.

Active riders grew 12% year-over-year reflecting an improvement in rider retention along with an increase in new riders. Gross bookings were approximately $3.7 billion, up 21% year-over-year. This reflects strong rise growth, partially offset by lower total prices year-over-year, reflecting lower levels of prime-time given the significant improvements in the health of our marketplace.”

The company notes as well that it’s working hard on improving the airport pickup experience, especially heading into the graduation season in Q2.

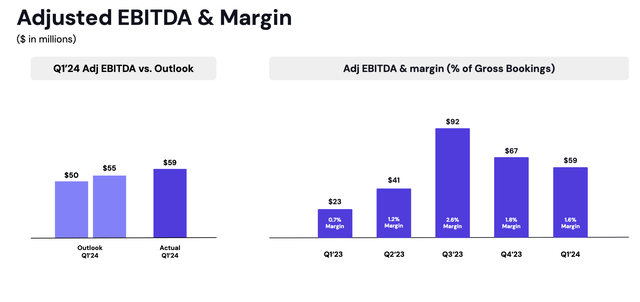

Meanwhile, the company also achieved notable operating leverage. Adjusted EBITDA more than doubled to $59 million in the quarter, reflecting a 1.6% margin of gross bookings: 90bps better y/y:

Lyft adjusted EBITDA (Lyft Q1 shareholder deck)

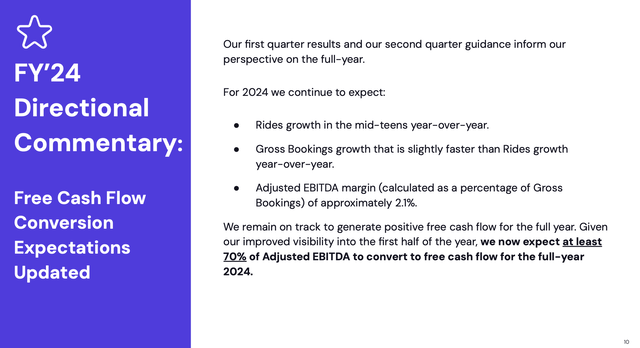

The company’s Q2 outlook also calls for an even better adjusted EBITDA performance at 2.4% of bookings (+120bps y/y), while from a full-year basis, the company is expecting a 2.1% adjusted EBITDA margin against roughly high teens growth in gross bookings:

Lyft outlook (Lyft Q1 shareholder deck)

This represents a 50bps full-year boost versus 1.6% adjusted EBITDA margins in FY23. Note that it’s possible for us to extrapolate forward and arrive at a reasonable valuation for Lyft based on adjusted EBITDA, now that its profitability is starting to take shape.

Valuation, risks, and key takeaways

This year, the company’s guidance of “mid teens” ride growth and “slightly faster” gross bookings growth implies gross bookings of ~$16.1 billion, assuming a 17% y/y gross bookings growth rate. A 2.1% adjusted EBITDA margin here implies $338 million of adjusted EBITDA, up 52% y/y. And if we assume that gross bookings grow at a low teens (~12%) pace in FY25, and adjusted EBITDA continues to gain a similar 50bps of leverage versus gross bookings, we’d arrive at $469 million of adjusted EBITDA in FY25 (+39% y/y).

At current share prices near $17, Lyft trades at a $6.82 billion market cap; and after netting off the $1.67 billion of cash and cash and $942.2 million of debt on the company’s most recent balance sheet, Lyft’s resulting enterprise value is $6.09 billion.

This puts Lyft’s valuation multiples at:

- 18x EV/FY24 estimated adjusted EBITDA

- 13x EV/FY25 estimated adjusted EBITDA

Considering the number of growth levers Lyft still has at its disposal, I think investors still have an opportunity to buy Lyft stock on the ground floor. That being said, there are of course risks to the bull case. More aggressive price competition from Uber is the biggest risk, as price wars and discounting battles between the two rideshare giants are common in the U.S. (especially in battleground markets like San Francisco, which is home turf to both companies) and may eat into Lyft’s recent trend of profit gains. New local regulations that aim to boost driver earnings and benefits could be another threat to Lyft’s recent rise in profitability.

That being said, I now see more opportunity than risk in Lyft. Stay long and buy here.

Read the full article here