The Gold Miners Index (GDX) has gotten off to a bit of a rocky start in 2024. While January is typically the best month of the year from a seasonal standpoint, that hasn’t been the case so far this year. In fact, the index is down 9% for the year, which is especially disappointing when you consider that the price of gold has been above $2,000 for 10 straight weeks now.

The poor performance can be partially attributed to weaker-than-planned production results from some larger producers that have weighed on the index and curtailed investor appetite for producers as the sector gets ready to report Q4 and year-end results next month.

Fortunately, Karora Resources (OTCQX:KRRGF) was one name that stood out among the pack, beating its guidance for a third consecutive year under new leadership in Paul Huet, and reporting another record year for production. Meanwhile, we should see new records in 2024 and 2025 as mining rates ramp up from its flagship Beta Hunt Mine, and the company has done a solid job extending its mine life with successful reserve replacement. In this update we’ll dig into the Q4 and FY2023 results, the forward outlook, and where the stock’s updated buy zone lies.

Q4 & FY2023 Production

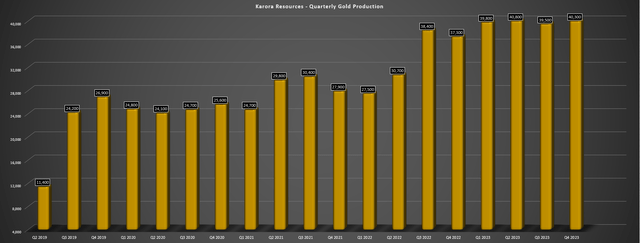

Karora released its Q4 results earlier this month, reporting quarterly production of ~40,300 ounces, an 8% increase from the year-ago period and just shy of its previous record of ~40,800 ounces set in Q2 2023. This solid performance helped the company to deliver ~5% above its guidance midpoint of 152,500 ounces, with ~160,500 ounces of gold produced, setting a new record for the company. The reason for the strong performance was improving mining rates at Beta Hunt with the expansion of the new mining fleet and better grades in Q4. However, this growth in production at Beta Hunt is still in the early innings, with tonnes mined per month expected to increase to ~167,000 tonnes by the end of this year. So far, these plans remain on track, with 3/3 vent raises completed and the new permanent primary ventilation fans expected to be installed and commissioned by this summer.

Karora Quarterly Gold Production – Company Filings, Author’s Chart

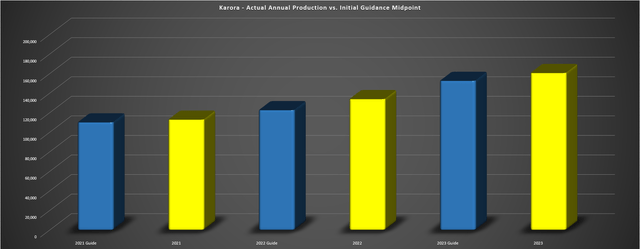

Looking at annual production relative to guidance in a little more detail, Karora’s delivery on guidance has been extremely impressive relative to its peer group and the sector as a whole. This is because Karora is one of the few companies that’s beat its guidance midpoint for three consecutive years, and it’s done so by a wide margin. In fact, the company’s average annual beat has come in at ~7,400 ounces (median ~8,000 ounces), representing an average beat of over 5% which is a glowing track record in a sector where it’s been a sea of misses since 2021. Hence, while some investors might be skeptical of the company’s ability to deliver on its ~200,000 ounce goal in 2025, this is certainly not a team I would bet against as they’ve done a phenomenal job of delivering on their promises and are now armed with a stronger team with a new managing director (Leigh Junk from Doray Minerals pre-Silver Lake takeover), and additional expertise on the Board with one of the top leaders sector-wide from a track record standpoint (Tony Makuch from Kirkland Lake Gold).

Karora Actual Annual Production vs. Initial Guidance Midpoint – Company Filings, Author’s Chart

2024 Outlook

Following an exceptional year in 2023 with record production, Karora is set up for more records next year. This is because the company should be able to maintain a mining rate of ~400,000 tonnes per quarter in H1 2024 (up from ~357,200 tonnes in Q3), setting Beta Hunt up for a ~120,000 ounce year depending on grades and a significant step up from ~100,000 ounces this year. Meanwhile, 2025 production should come in closer to 200,000 ounces with Beta Hunt alone capable of doing 145,000+ ounces at a 2.0 million tonne per annum run rate. The company has certainly timed this expansion well as the ounces stayed in the ground at lower gold prices, but production should ramp up in time to benefit from what looks to be a new average price for gold upwards of $1,950/oz. So, while free cash flow may not surpass $50 million this year, we should see significant free cash flow next year with a decline in capex, with free cash flow set to come in closer to ~$120 million even under more conservative assumptions.

Reserve & Resource Growth

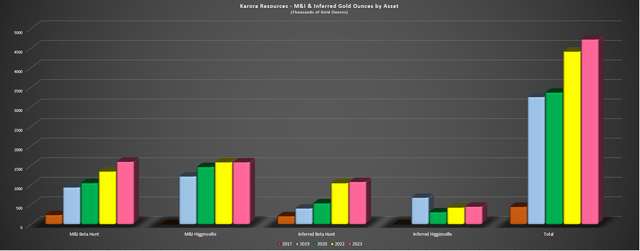

While the production growth is important for Karora, resource and reserve growth is just as important when Beta Hunt is going to be depleting ~2.0 million tonnes per annum starting in 2025. Fortunately, Karora is firing on all cylinders in this category as well, reporting a 16% increase in Beta Hunt’s measured and indicated resources to ~1.6 million ounces, with its highest grade and largest zone (Western Flanks) growing to ~1.06 million ounces at 2.9 grams per tonne of gold. Other contributors to total resource growth at Beta Hunt were Larkin (+30,000 ounces), and a maiden resource at Cowcill where the company reported 19,000 ounces at 2.4 grams per tonne of gold. Finally, inferred resources increased marginally year-over-year despite the resource conversion with the addition of maiden resources at Mason (67,000 ounces at 2.7 grams per tonne of gold), and growth in inferred resources at Larkin and its lower-grade A Zone.

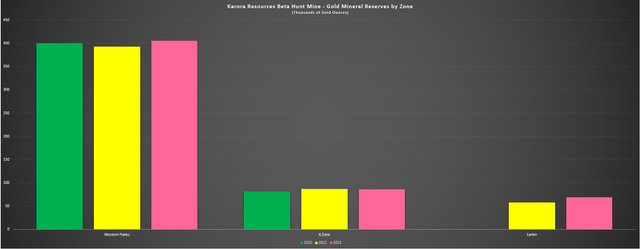

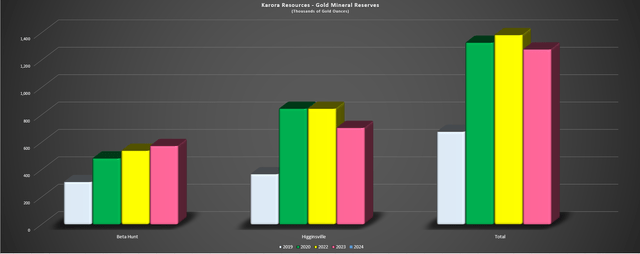

Karora – Beta Hunt Mineral Reserves – Company Filings, Author’s Chart Karora Company-Wide Reserves – Company Filings, Author’s Chart Karora M&I/Inferred Resources by Asset – Company Filings, Author’s Chart

As for the company’s company-wide mineral resources, we saw growth here as well, with Karora’s total resource base growing to ~4.73 million ounces of gold, up from ~4.42 million ounces in 2022 and ~3.37 million ounces in 2020. This was driven by increased M&I resources at Beta Hunt and a slight increase in inferred resources, offset by a marginal increase in resource ounces at its Higginsville Operations. Finally, from a reserve standpoint, Karora finished the year with ~573,000 ounces of reserves at Beta Hunt at a $1,500/oz gold price assumption (FY2022: $1,450/oz) and at a higher grade of 2.7 grams per tonne of gold (FY2022: 2.5 grams per tonne of gold). The strong reserve growth at Beta Hunt (+7%) helped partially offset a moderate reserve decline at Higginsville (~705,000 ounces vs. ~845,000 ounces). However, while reserves were up year-over-year company-wide, we saw a slight decline in reserves per share because of a slightly higher share count and an 8% decline in reserves overall.

That said, while we saw a slight dip in reserves per share, this is not reflective of the larger trend. This is because the current reserve base does not include any resources/reserves from Fletcher, which should provide an additional boost next year when drilled to tighter spacing (helping to offset future mining depletion). For those unfamiliar, Fletcher is a structural analog to the company’s most productive zone, Western Flanks, and we’ve seen impressive results here to date with thick intercepts like 34.5 meters at 3.6 grams per tonne of gold, 32.0 meters at 4.8 grams per tonne of gold and 52 meters of 2.8 grams per tonne of gold, besides a highlight intercept of 7 meters at 46.5 grams per tonne gold right near existing nickel development. So, with a 2.0-kilometer strike and solid continuity, this should be a pleasant addition to help offset higher mining depletion over the coming years.

Valuation

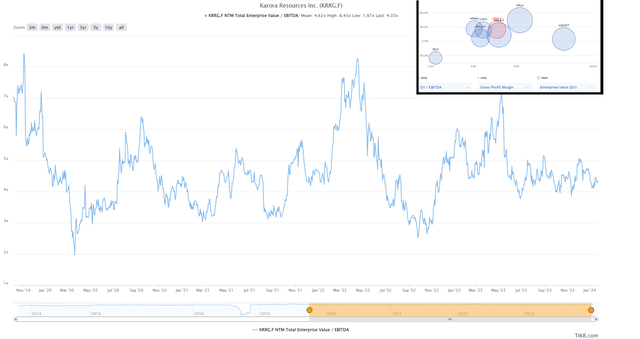

Based on ~187 million fully diluted shares and a share price of US$3.15, Karora trades at a market cap of ~$590 million. This is a significant improvement from its March 2022 peak at a ~$1.0 billion market cap, when I warned against chasing the stock above US$4.90. Meanwhile, Karora is a larger producer today, has executed successfully thus far on its growth plans, and is well positioned to grow into a 200,000-ounce producer in 2025 with a further ramp-up to 2.0 million tonne per annum mining rates at Beta Hunt. Just as importantly, the company has a larger reserve and resource base and the addition of the Fletcher Shear Zone should help to reduce the impact of higher depletion, with mining rates on track to double. Given these upgrades and using what I believe to be conservative multiples of 6.0x P/CF and 1.0x P/NAV and a 65/35 weighting (P/NAV vs. P/CF), I see a fair value for the stock of US$4.60 or a 46% upside from current levels.

Karora EV/EBITDA Multiple & Valuation/Margins vs. Peers – TIKR, FinBox

That said, I am looking for a minimum 40% discount to fair value for starting new positions in small-cap producers, even if they are consistently delivering on promises like Karora and operating out of Tier-1 jurisdictions. This is done to ensure an adequate margin of safety if there are any negative surprises and to protect against commodity price risk. If we apply this discount to Karora, the stock’s ideal buy zone comes in at US$2.77 or lower. Hence, while I see the stock as reasonably valued at current levels, I still don’t see enough margin of safety just yet. Instead, I continue to prefer Argonaut Gold (OTCPK:ARNGF) in the junior producer space, which trades at less than 0.40x P/NAV and barely 2x FY2024 cash flow estimates.

Summary

Karora had another impressive year evidenced by it beating its guidance midpoint (third consecutive year), progressing well in its growth plans, adding reserves net of depletion, and seeing continued exploration success at Beta Hunt. Meanwhile, 2024 should be another record year for the company, with low double-digit growth to ~183,000 ounces per my estimates. That said, while Karora is easily a top-5 junior producer sector-wide given its solid execution, I prefer to pay the right price or pass entirely, and while Karora is undervalued; I don’t see a low-risk buying opportunity just yet. Hence, if I were looking to put new capital to work today, I would prefer B2Gold (BTG) in the mid-cap space and Argonaut Gold among junior producers over Karora because of their more attractive relative valuations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here