JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) is designed primarily for income-focused investors as it pays a monthly dividend. Based on its relatively attractive 8.3% payout, it’s expected to be a core holding of income investors looking to focus on generating a sustainable monthly dividend.

However, it’s important to consider that JEPI isn’t designed to replicate the S&P 500 (SPX) (SPY). I believe it’s important to consider this as JEPI is designed to offer a less volatile approach over a “full market cycle” (three to five years) compared to the SPX. With its more defensive portfolio selection, JEPI is expected to underperform the S&P 500 in a bull market. As a result, I assessed that JEPI isn’t the best vehicle for total return investors looking to outperform the SPX consistently. I last updated JEPI investors in mid-September 2023, highlighting its uptrend recovery thesis. Although JEPI has underperformed the S&P 500 since then, the thesis has still panned out, as the market went on a rampaging run. As a result, I believe it’s apt for me to provide an update on JEPI, to help investors reassess whether the entry levels are still timely to add exposure, and whether they should anticipate a pullback before buying more.

Observant investors should be aware that JEPI fund managers indicated in its prospectus that its income-driven, lower volatility strategy could “underperform compared to the S&P 500, particularly in bullish markets.” Investors should know that JEPI executes its covered call strategy by “targeting 30-Delta OTM calls.” As a result, it aims to “balance capturing some index upside while earning option premiums.” However, even with this approach, it’s still vulnerable to substantial underperformance in bullish markets, as seen over the past three months.

Accordingly, the S&P 500 posted a 3M total return of 18.6%. In contrast, JEPI posted a 3M total return of 10.1%. As a result, the fund captured about 54% of SPX’s total return over the same period. Zooming out over the past year, JEPI posted a total return of 10.3% compared to SPX’s 22.3% over the same period. Despite the relative underperformance, it seems like JEPI has fallen short of what the fund managers have intended to do, which is to “deliver a significant portion of the returns associated with the S&P 500 Index but with reduced volatility.”

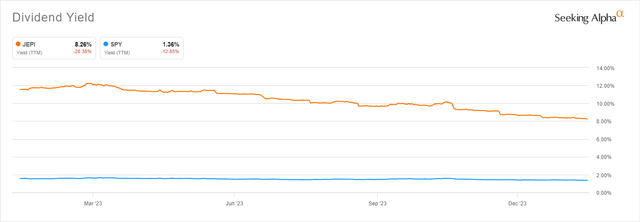

JEPI Vs. SPY TTM dividend yield (1Y) (Seeking Alpha)

Still, we could see that JEPI has still delivered a much higher dividend yield than SPX. Therefore, it still fulfills one of JEPI’s value propositions, identified as a “key differentiator, offering regular cash flow to investors.”

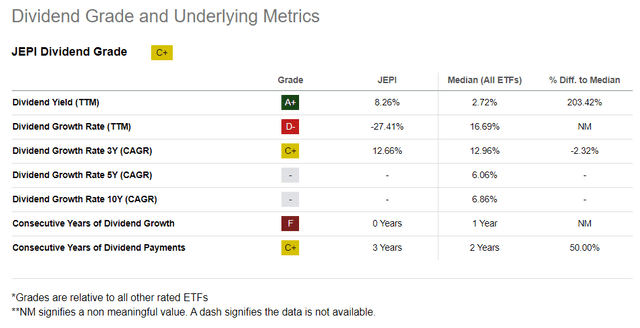

JEPI Dividend Grade metrics (Seeking Alpha)

As seen above, JEPI is assigned a relatively neutral “C+” dividend grade by Seeking Alpha Quant. Its “A+” yield grade is considered best-in-class, although the growth rates in its dividends have not been superior. As a result, income investors looking for a more consistent and market-leading dividend growth opportunity might need to consider its less appealing consistency in their assessment.

Moreover, JEPI is designed with a lower portfolio concentration than the SPX. Accordingly, the top ten constituents in JEPI accounted for just 15.5% of its total net assets. In contrast, the S&P 500’s top ten holdings accounted for nearly 32% of its total allocation. Therefore, investors looking for a more diversified portfolio should find JEPI more appropriate.

There’s little doubt that the Magnificent Seven have significantly influenced the S&P 500’s performance over the past year. The continued surge could also lead to over-optimism risks as most are no longer undervalued. According to Morningstar’s valuation analysis, only Google (GOOGL) (GOOG) is still below its fair valuation. With the tech sector accounting for about 31% of the S&P 500’s exposure, investors attempting to chase alpha by going after its current upward momentum could be struck by an unanticipated pullback. As a result, I have confidence that JEPI’s more defensive construct could help even total return investors mitigate these risks by reallocating some exposure from the S&P 500.

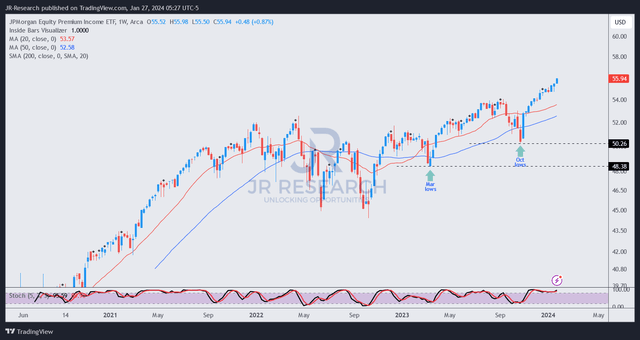

JEPI price chart (weekly, adjusted for dividends) (TradingView)

As seen above, JEPI has regained its uptrend bias since October 2023 when adjusted for dividends. As a result, I assessed that JEPI’s strategy is working, notwithstanding its relative underperformance to the S&P 500.

With the S&P 500 continuing its rally after the recent consolidation, I don’t expect the relative underperformance to reverse in the near term. However, JEPI could benefit from a subsequent pullback and potentially higher implied volatility, which has consolidated at its June 2023 lows.

In addition, JEPI should still receive robust support from income investors looking to capitalize on its relatively attractive yields. As a result, I see fewer reasons to turn more cautious on JEPI, even though it’s not immune to potential market volatility leading to a pullback.

In view of this, investors can consider the zone between the $50 to $52 levels if they anticipate a pullback in the broad market. While JEPI’s covered call strategy can potentially mitigate downside risks, they don’t provide full protection. As a result, steeper pullback in the broad market will likely still impact JEPI’s upward bias, affording investors a more attractive opportunity to buy weakness.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here