In my opinion, Itaú Unibanco Holding (NYSE:ITUB) is the most solid financial institution in Brazil backed by its tradition, high number of customers, and consistently high net profit. After being overtaken by Nu Holdings (NU), it is no longer the largest bank in market cap but still deserves a distinguished status for its consolidation and tradition in the banking sector.

In Q2 earnings, this continued to be reinforced, with Itaú reporting R$10bn in net income, while Banco do Brasil (OTCPK:BDORY) was its closest peer, with R$9.72bn, Nu Holdings and Banco Bradesco (BBD) didn’t even reach half that level.

With high profitability and competitive dividends, the obstacles to Itaú’s thesis are mainly twofold. The first is found in all companies exposed to the Brazilian domestic scenario, which are fiscal, economic, and exchange rate risks. The second is its margin of safety, which is no longer so attractive compared to a few recent quarters since Itaú Stocks (ITUB4) have advanced 38% in the last 12 months, with a highlight being the ~11% advance since the beginning of August.

Even so, Itaú’s shares are at a very reasonable level considering all its moats, making it a quality move.

Overview of Itaú’s Strong Q2 Earnings

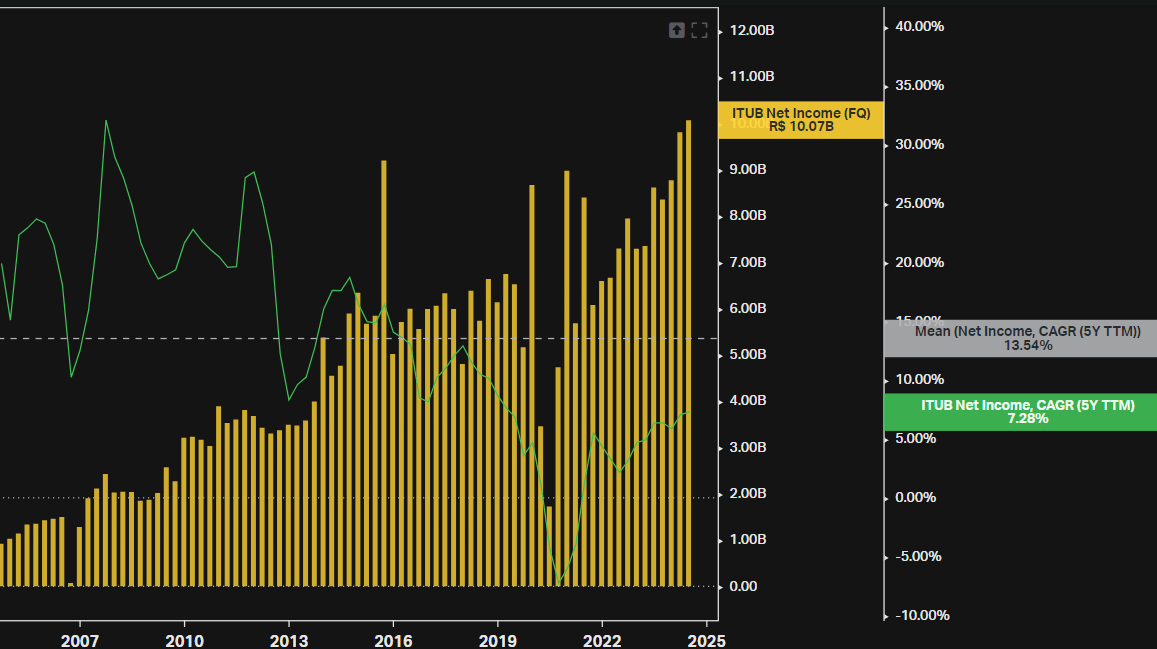

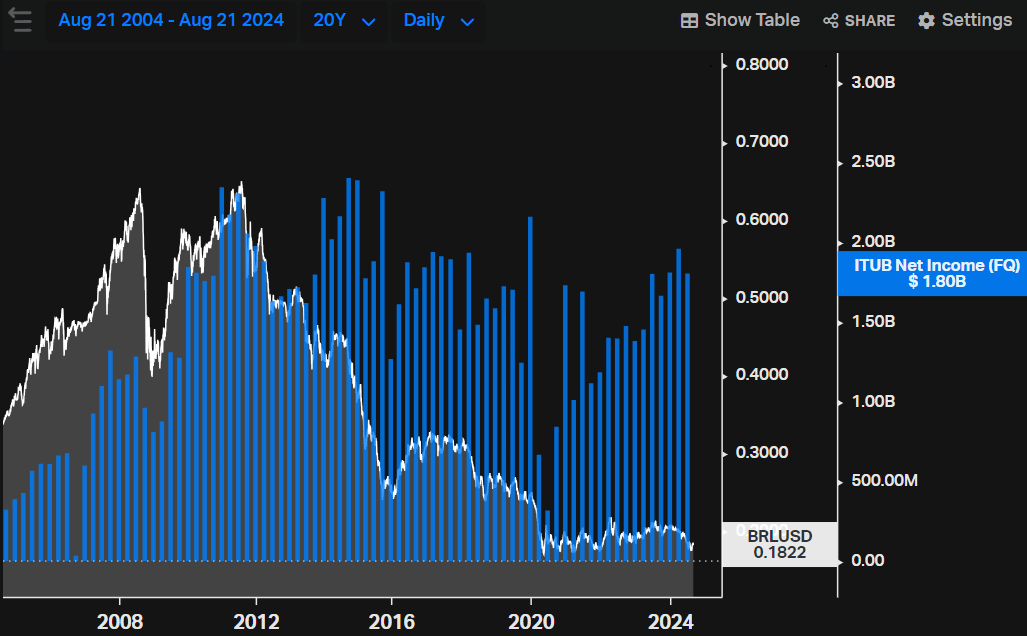

Itaú’s Q2 earnings were quite strong and solidified an excellent recent track record. In the aftermath of the pandemic, even in a stronger competitive environment against fintechs, Itaú proved capable of innovating and consistently increased its net income quarter after quarter. With this, the Net Income CAGR of the last 5 years was 7.28% even with an already very high net income volume, while the average of the last 20 years was 13.5%.

Koyfin

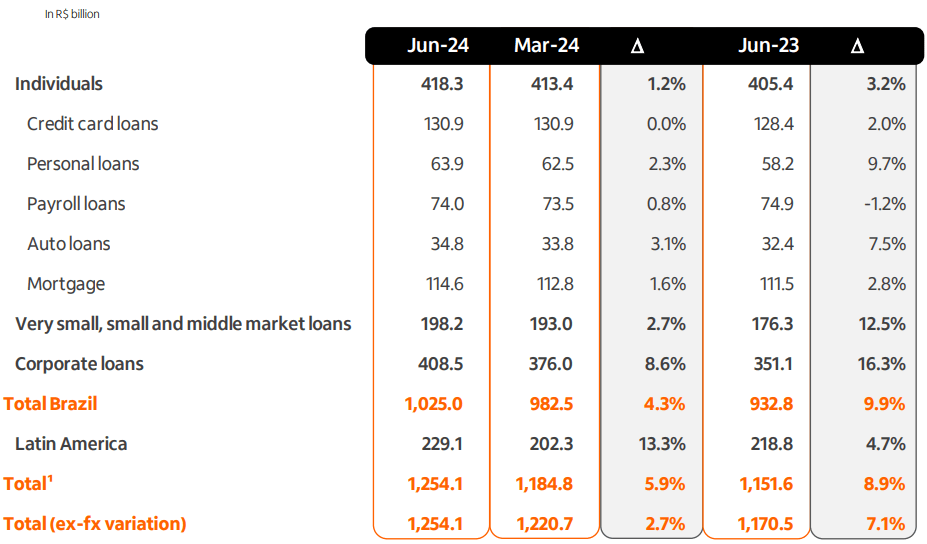

Operational indicators and better financial margins with clients and with the market drove this net profit. In Q2, Itaú’s total credit portfolio advanced 5.9% against Q1, reaching R$1.25 trillion, with a highlight for corporate loans which advanced 8.9%, and Latin America, which grew 13.3% driven by exchange rate factors.

Itaú Unibanco’s Q2 Presentation

Despite this growth, the consolidated 90-day NPL remained stable at 2.7%, while the consolidated 15-90-day NPL fell from 2.4% to 2.3%. The renegotiated portion of the portfolio also fell and shrank to 3%, against 3.2% in Q1. The coverage ratio fell slightly, from 221% to 215%. Finally, CET I also fell due to higher net income, from 13% to 13.1% (14.6% with additional tier I). In other words, the main quality indicators are still very robust and give confidence to the shareholder.

As for efficiency and profitability indicators, financial margin with clients rose from R$22.8bn to R$23.4bn, boosted by both higher volume and higher spread. Commissions and insurance also advanced 5% against Q1, driven by a growth of more than 33% in advisory services and brokerage. This, combined with good expense management, illustrated by an efficiency ratio that reached 37% in the first half of 2024, meant that the recurring managerial result reached R$10.1bn, with an ROE of 22.4%.

It is worth mentioning that the bank has a guidance for 2024 of growth between 6.5% and 9.5% for the credit portfolio, a growth for the financial margin with clients between 4.5% and 7.5% while core non-interest expenses grow in line/below inflation. According to management, the expectation is that by the end of this year, there will be a better vision, prospects, and some opportunities that should allow calibration and carry out a new (extraordinary) dividend distribution, especially after the uncertainties regarding regulations, IFRS9 discussions, and the like.

“Our expectation is to end the year with a good vision, prospective, four opportunities of regulatory, issues, good operation of capital capacity of generating organic capital. So we can do a good calibration and do another payments of extraordinary dividends. With the information that I have today, the payment will be done. There will be an extraordinary dividend. But we also see as an advantage that we have a capital base that is very solid, because the opportunities will come up.”

– Milton Maluhy, Itaú Unibanco’s CEO

Itaú Stands Out in the Banking Sector

Itaú’s thesis differs greatly from some companies I’ve written about recently, such as Nu Holdings and PagSeguro (PAGS). Unlike these fintechs where the focus is on growth and, in the case of Nu Holding, sacrificing an attractive valuation, and in the case of PagSeguro, sacrificing greater safety, in Itaú’s thesis the focus is on quality and security (while not losing all the growth). In relation to its traditional peers, Itaú also stands out in terms of quality, with a higher and more consistent ROE than Bradesco, and without the state risk of Banco do Brasil.

Currently, the Selic interest rate is at 10.5% and as Itaú is a predictable cash cow, many investors see Itaú Stocks as a place to earn slightly above this rate, something like this level with a small equity risk premium (for example, a return of 13% per year in Brazilian Reais).

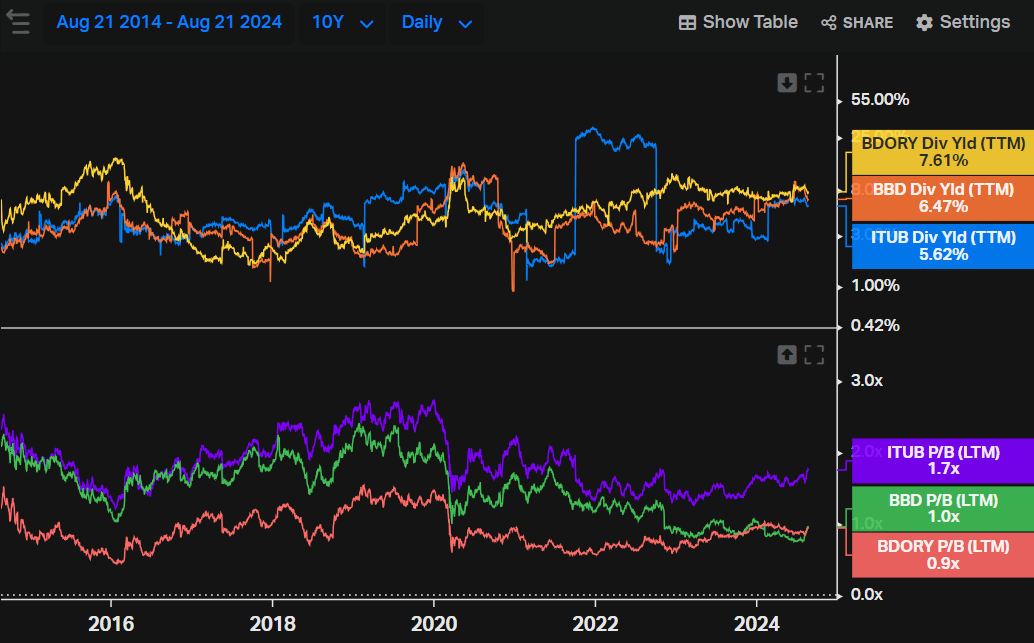

Combining this predictability, higher quality, and lower risk than its main peers, Itaú is trading at a premium. Its price-to-book is 1.7x, a reasonable level for a bank with an ROE above 20%, while Bradesco’s is 1x and Banco do Brasil’s is 0.9x. The dividend yield for the last 12 months was 5.6%, while BBD’s was 6.47% and BDORY’s was 7.6%.

Koyfin

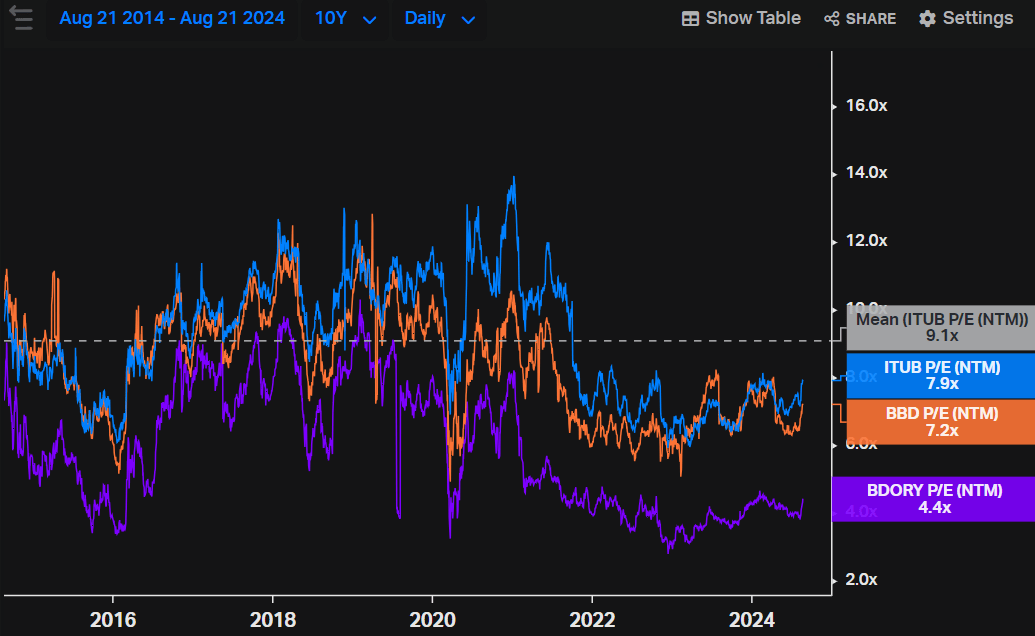

For forward price-to-earnings, Itaú is also trading above these other two, with a level currently at 7.9x, below its average of the last 10 years which was 9.1x. It’s worth noting that Itaú is reporting fairly consistent earnings (i.e. it’s far from being in its “low” cycle), and if there are no negative macroeconomic surprises that prevent this advance from continuing, it’s possible to expect a small upside through the normalization of these multiples.

Koyfin

In other words, this “premium” valuation level is completely justifiable, and 8x earnings for a bank that delivers gradually consistent earnings and a monthly dividend yield is an interesting level.

Itaú’s Valuation Is Solid But Not a Huge Bargain Anymore

In the first chart of Itaú’s net profit, it can be seen that from mid-2014 to 2019 there was a certain stagnation in its net profit, partly attributable to the economic crisis. This is the real risk of the thesis, Itaú not being able to grow its net profit at the expected rate due to macroeconomic obstacles. This is even more pronounced when viewed in US dollars. In the last 5 years, the Brazilian Real has devalued (against the US dollar) by ~24%. This makes the American investor’s position riskier and reinforces the caution needed when buying emerging country stocks. To illustrate this, the graph of net profit per quarter looks very different in dollars, with stagnation since mid-2010.

Koyfin

That’s a two-edged sword. If there is a strong appreciation in the BRL, foreign investors would benefit. Although this is not the base scenario – with the Brazilian Central Bank having more stable estimates for the exchange rate, and a problematic fiscal policy, but interest rates still at a restrictive level and inflation ok – this could happen due to the cyclicality of the Brazilian economy, being directly and indirectly affected by commodity cycles (note the appreciation of the Brazilian Real up until the subprime crisis in 2008).

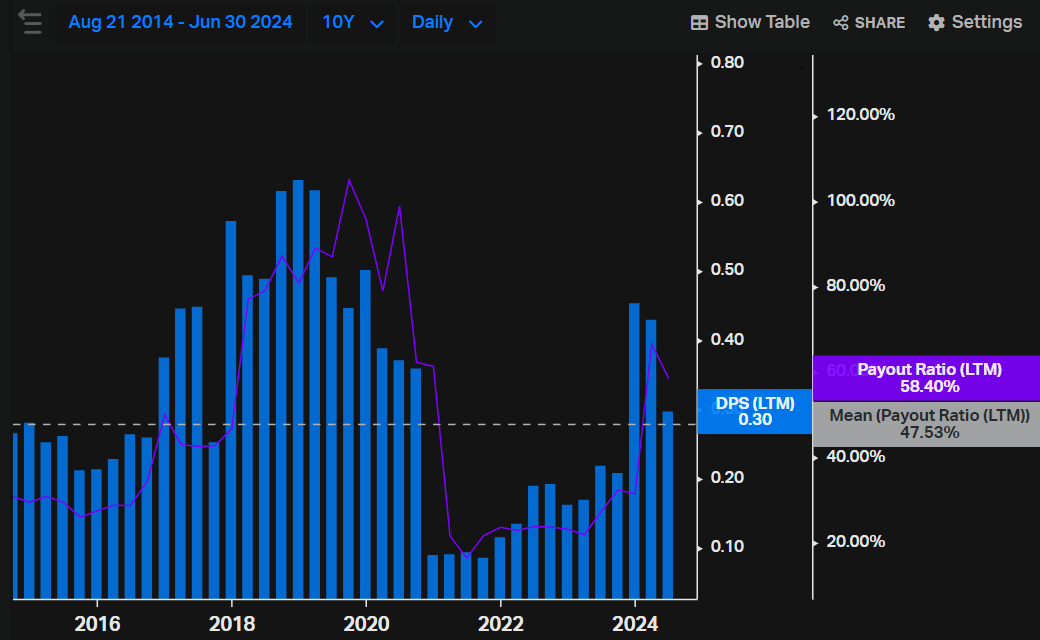

With these risks, it is necessary to adopt conservative assumptions when valuing Itaú, both in terms of the bank’s future growth and the discount rate. Historically, Itaú has distributed around 50% of its net income, which has already provided an interesting level, with a dividend per share mean of $0.32. Currently, these indicators stand at 58.4% and $0.30, respectively.

Koyfin

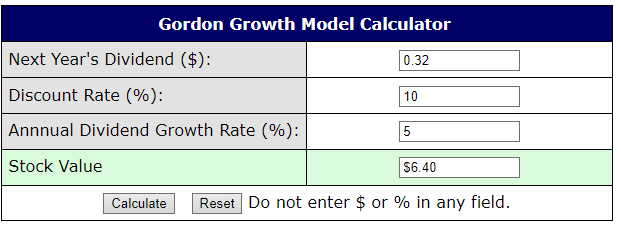

Considering the risks in Brazil and less aggressive growth for Itaú’s operations (given its consolidation), we will adopt conservative assumptions in a dividend discount model. With next year’s dividend of $0.32 slightly above the current DPS, reflecting the evolution of earnings; a discount rate of 10% which is an excellent level and already pays well even considering the exchange rate risk; and a growth rate of 5%, reasonable considering the recent history and the ability to increase the payout in stable scenarios. These assumptions reflect a fair price of $6.40 for ITUB Stocks.

buyupside.com

This fair price would be slightly below the current price, which already demonstrates a correction in the margin of safety. On the other hand, although I see this price as a better entry-level, the ~$6.80 at which the stocks are trading today is not expensive either, and considering the conservative assumptions, they are still capable of generating shareholder value via dividends.

Final Thoughts

Even after the gains in ITUB stocks, a very conservative dividend discount model is able to find a fair price slightly below, which provides that although the margin of safety is not huge, it still exists. This becomes even more true when we compare it with other alternatives in Brazil, such as Nu Holdings, Petrobras (PBR), or Vale (VALE), which, although good companies, offer greater volatility and less predictability when compared to Itaú.

Thus, Itaú appears to be a safe way to gain exposure to Brazil, which comes with macroeconomic and exchange rate risks, but which are partially offset by monthly dividends and an attractive dividend yield, helping with the cost of carry.

Read the full article here