If liberty means anything at all, it means the right to tell people what they do not want to hear.” ~ George Orwell

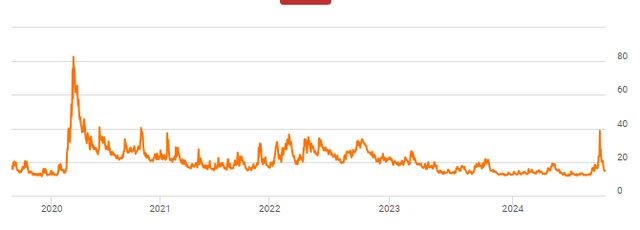

The S&P 500 had its best week of 2024 last week, posting a gain of 3.9%. The NASDAQ did even better, rising 5.2%. The big rally came less than two weeks after the S&P VIX Index (VIX) rose to over 60 briefly for the first time in over four years. The Japanese markets also had their biggest daily decline since 1987, and the S&P 500 suffered its largest one-day loss since late 2022 earlier this month.

Seeking Alpha

All the negativity was quickly memory holed, however. The VIX had its sharpest seven-day decline in its history, and investors were more than happy to put on their rally caps on as the beginning of rate cuts from the central bank at their September FOMC meeting became a near certainty. However, as I put in this recent article, the Federal Reserve is not going to save equities from their fate. This means significantly lower entry points, and at the latest, by the first half of 2025 in my view.

Seeking Alpha

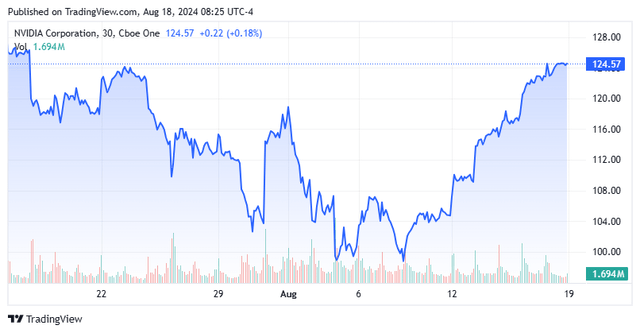

Two things stand out to me in this market. The first is how easily the investment community dismisses bad news. A few weeks ago, investors became concerned around AI juggernaut NVIDIA Corporation (NVDA) as its much-anticipated new Blackwell GPUs are likely to be delayed by at least three months because of ‘design flaws‘. But these worries were washed away last week, as NVDA once again became a market darling and on the vanguard of the ‘What, me worry?’ advance last week. The shares gained some 15% over five trading sessions and once again the company has more than a $3 trillion market capitalization. To put in perspective, this is roughly the annual GDP of the United Kingdom and almost six times that of energy Goliath Exxon Mobil Corporation (XOM). Exxon’s total profit in FY2023? $36 billion. NVIDIA’s revenue in FY2023? A bit less than $27 billion. To be fair, NVIDIA operates with a funky and early fiscal year. In FY2024, the company made just under $30 billion in profit.

Then we have all the key economic reports from various governmental agencies, that have had a habit of quietly being revised down in subsequent months. One of the key readings last week that buoyed investors’ belief that a ‘soft landing‘ (something the Fed has achieved once (1995) in three generations) was the July retail sales report. It showed a one percent month-over-month increase. This was the biggest rise since January 2023, when inflation levels were roughly twice as high and there were still significant amounts of Covid stimulus created excess savings in the system.

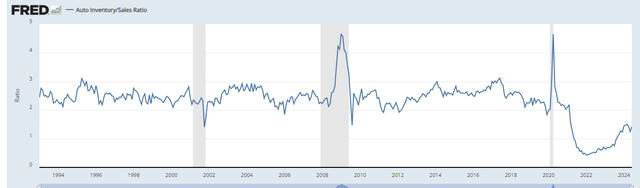

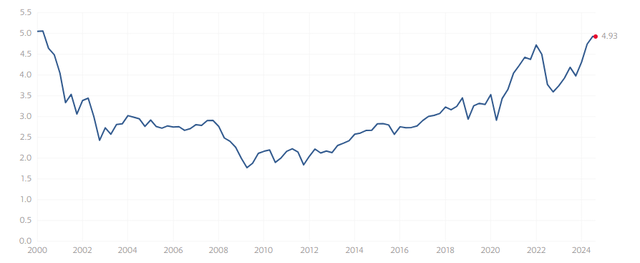

Auto Inventories/sales ratio (Federal Reserve Bank of St. Louis)

However, over 60% of this increase in retail sales was due to auto sales. Auto prices have started to fall as auto inventories started July with just over 2.9 million vehicles on dealer lots. This was over 50% year-over-year increase. To be fair, auto inventories were abnormally low in recent years due to global supply chain issues. However, and as importantly, June retail sales numbers were revised lower. This now makes eight months in a row the previous month’s sales number was taken lower in the subsequent update.

Investors have already forgotten the tepid July BLS Report that helped trigger the steep decline in equities to kick off August. The BLS reading showed just 114,000 positions created in July, far under the consensus. In addition, the jobs numbers for both June and May were also revised. Out of the last 14 jobs reports, 10 have subsequently been revised down, after 11 of the 12 monthly BLS reports in 2023 shared the same fate.

More importantly, the unemployment rate ticked up to 4.3%. Its highest level since October of 2021. The unemployment rate is now significantly above the 3.5% level of last summer. We also are firmly in ‘Sahm Rule‘ territory, which when triggered has accurately predicted every recession since the 1950s.

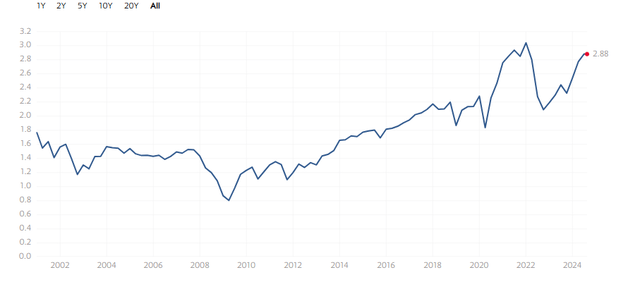

Price to sales ratio – S&P 500 (Market Price to Sales ratio)

Obviously, with the market trading at 22 times forward earnings on the S&P 500, equities are not anticipating this scenario in any way, shape or form. By other metrics, the overall market is even more overvalued. Looking at the price to sales ratio, the market has only been seen this extreme valuation once. That was in December 2021, just before equities took a huge dump in 2022 as the Federal Reserve unleashed the tightest monetary policy since Paul Volcker in response to the highest inflation levels since the early 1980s.

S&P 500 Market Cap/Book Value ratio (Multpl)

By other measures, the market has only been this richly valued during the last gasps of the Internet Boom, nearly a quarter-century ago. The Internet Bust that followed took more than 80% of the value off the NASDAQ peak to trough. I will also remind readers that the American economy is nowhere near as strong as it was in 1999. Back then, the huge Baby Boomer cohort was in their prime earning years. GDP growth in 1999 also came in at a blistering 4.8% following better than four percent GDP growth in 1998 (4.5%) and 1997 (4.4%).

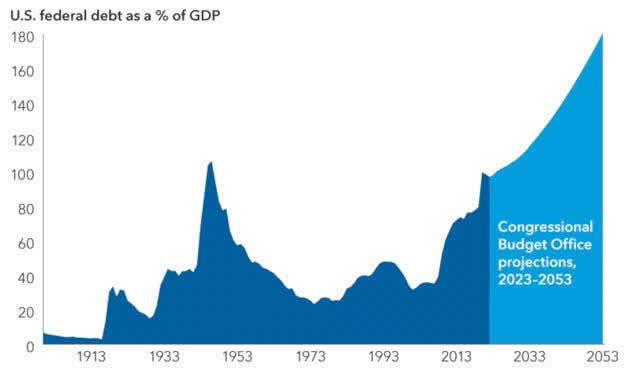

In addition, the federal government’s budget was almost balanced in 1999. The entire federal debt was just over $5.6 Trillion, or 58% of U.S. GDP at the time. Compared that to today where the national debt has ballooned to over $35 trillion, the federal government’s deficit for the first ten months of their fiscal 2024 year was $1.52 trillion, and the debt to GDP ratio has never been higher in U.S. history.

CBO/Capital Economics

As I noted in a piece earlier this month, investors are not going to get out of this mess scot-free, regardless of how any negative news is currently being memory holed.

You simply can’t raise rates the most in recent history at the fastest pace in recent history on the most debt outstanding in history and not face consequences.” – ZeroHedge

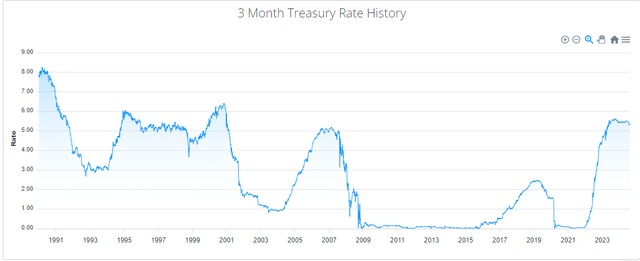

Given this outlook, my portfolio continues to be very conservatively positioned. Approximately 50% of my portfolio is in short term treasuries, yielding just over 5.3%. Almost all the rest is covered call holdings on the few stocks I am finding that have reasonable valuations.

3-Month Treasury Bill Rate (Slickcharts)

Finally, roughly two percent of my funds on a rolling 12-month basis is on long-dated, significantly out of the money bear put spreads on primarily the SPDR® S&P 500® ETF Trust (SPY) that will pay off 8 to 15 to 1 if we get a 15% to 25% correction over the next year in equities.

Investopedia

These small holdings will almost totally insulate the rest of my portfolio should we hit an anticipated and substantial downdraft. This configuration has delivered a more than acceptable return in 2024. As of the market close on Friday, the portfolio has produced nearly a 10% gain for the year. Not as good as the NASDAQ or S&P 500, but I am taking much, much lower risks and still nicely outperforming the equal weight S&P or Russell 2000.

In a time of deceit, telling the truth is a revolutionary act.” – George Orwell

Read the full article here