I last covered International Money Express (NASDAQ:IMXI) in February, and since then, the stock has gained 0.72% in price. In this analysis, I am reiterating my Buy rating because I believe the value opportunity remains intact, and the upside from my initial thesis is still yet to come. There are several operational developments that support the company’s continued expansion, which could result in the investment potentially compounding over 10+ years. I believe that the company is likely to continue to benefit from the high levels of immigration to the United States that have happened in recent years and that its Mexico business will be strengthened by stronger border control under a Trump administration. In my DCF analysis, the company is currently ~35% undervalued.

Operational Developments

In April 2024, Intermex partnered with Félix Pago, enabling money transfers via WhatsApp, making the process more effortless for customers. Furthermore, the company unveiled a strategic data partnership with FXC Intelligence in April and joined forces with PickTrace in March 2024 to help agriculture workers send money cross-border.

Each of these partnerships is significant in expanding the utility of Intermex’s offerings and working to increase the target market and potential user base of its offerings. At a time when immigration is on the rise in the United States, the company has developed as one of the key linchpins between immigrant and migrant workers in transferring funds back to families in their home countries, typically in South America.

The collaboration with PickTrace is particularly noteworthy to me and deserves further elucidation, in my opinion. PickTrace is a labor-management platform for large-scale farming operations. It has integrated Intermex’s money transfer service into its mobile app, which is likely to increase the utility of its services significantly. As many agricultural workers are unbanked or underbanked, the Intermex and PickTrace partnership bridges the gap by providing an accessible and reliable means of transferring money.

At this time, if the Trump administration is elected in November, it is likely to significantly reduce immigration. However, the short-to-medium-term impact of previous immigration is already so high that Intermex is likely to continue benefiting for the foreseeable future, in my opinion. In addition, as I will discuss in more detail in my risk analysis toward the end of this thesis, stricter border controls are likely to increase remittance.

In addition, the company announced a new headquarters at the Datran Center in Miami-Dade on April 9, 2024. The new headquarters is intended to attract top talent from the financial, digital, and technology sectors, and its location in Miami is significant, as this is an emerging financial and technology hub in the United States. This further signals management’s commitment to developing long-term quality in company operations.

Financial Analysis

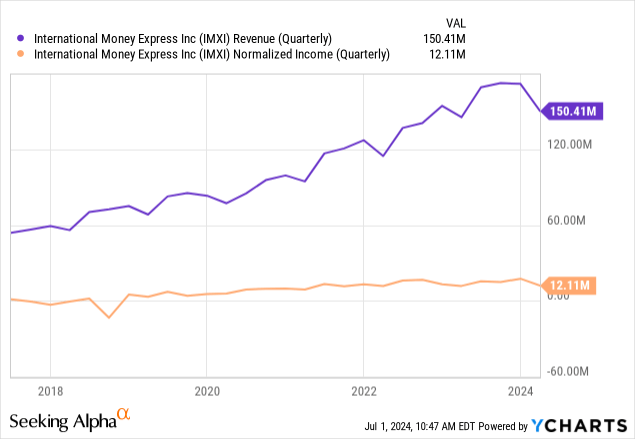

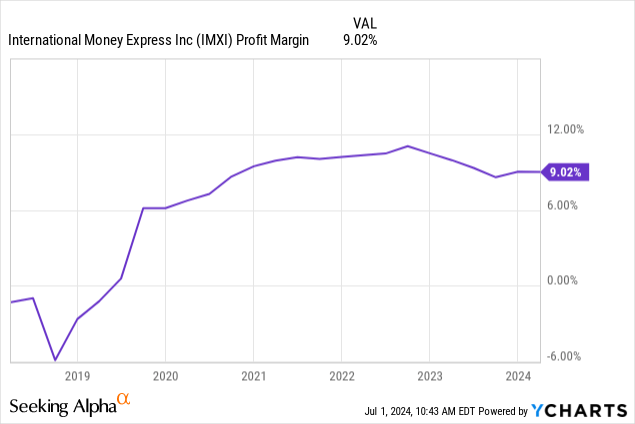

The main concern that I have outlined with investing in Intermex at the moment is that the current undervaluation has been caused by a reduction in growth, particularly in normalized net income but also in revenue. The relocation to the new headquarters and ongoing technology improvement and acquisition costs are likely to have short-term impacts on earnings, but the company’s margins have still been improving over the long term. Therefore, I think most of the current stagnation in growth is from market demand and the knock-on effect this has had on the company, more than issues with operational inefficiencies. Moving forward, I think it is reasonable to expect a contraction in growth rates in the short term due to stricter U.S. federal measures taken against immigration in the future. However, over the long term, I expect stricter border controls to increase growth rates for Intermex due to the higher need for remittance services.

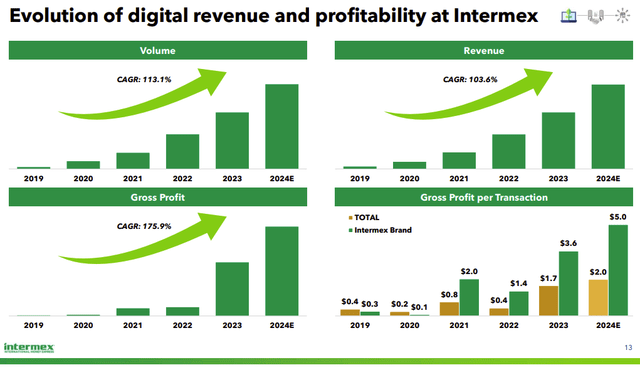

Intermex has been strategically investing in its digital channels, and this has been paying off, with 59.1% YoY growth in digital transactions as of the latest quarter. This significantly outpaced total money transfer transactions, which were an 11.7% YoY increase. In addition, total revenue only increased by 3.5% YoY. In my opinion, there is a significant opportunity for the company to grow its digital services, and there is likely to be better profitability in the long term as it scales this due to the potential for better accounting efficiency, especially if the firm begins to utilize more advanced forms of AI and automated software to further aid in the management of the transfer of funds and data.

IMXI Q1 2024 Earnings Presentation

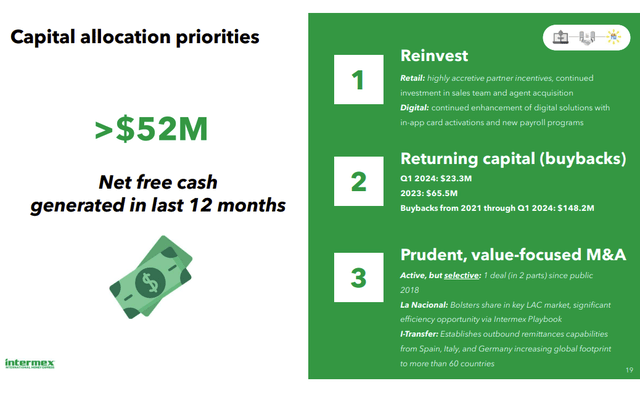

Additionally, in terms of long-term strategy, the company has outlined strength in capital allocation, favoring long-term shareholder value over short-term interests. This is made evident by the fact that management currently chooses not to pay a dividend and has stated that it plans to use its >$52m in net free cash generated in the last 12 months to reinvest in its sales team and agent acquisitions, continue to enhance its digital solutions, continue to buy back shares, and continue to look to expand its value-focused M&A strategy.

IMXI Q1 2024 Earnings Presentation

I mentioned in my previous thesis on Intermex that the company has a balance sheet that could be stronger. This is made clear by its equity-to-asset ratio of 0.25 (0.28 = 10Y median) and its debt-to-equity ratio, including lease obligations, of 1.34 (1.39 = 10Y median). Intermex has used debt to fund acquisitions in the past, which is evidenced by the increase in debt from $99.2m to $193.3m attributed to the close of the LAN Holdings acquisition, which included i-Transfer. I think that the likelihood of the company needing to acquire more businesses to expand is quite likely—however, as it stands, it is somewhat inhibited by the high levels of debt it already holds. Therefore, I do think there is added caution warranted about how rapidly the company will be able to expand, given the debt obligations it currently has.

That being said, the company has been expanding its margins over the long term, which is very promising. I expect the current period of stagnation in revenue growth to be momentary, but during this time, the company’s net margin has still contracted down from 10.48% in December 2022 to 9.02% as of the last report. However, this is mainly due to the strategic investments management has been making rather than any major adjustments management has had to make in response to the recent quarterly revenue contraction.

Valuation Analysis

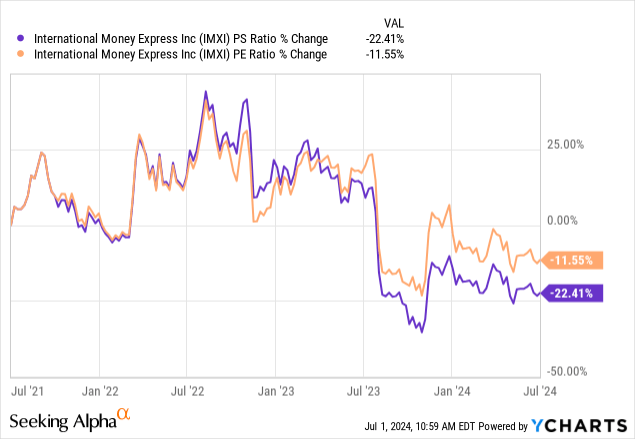

In my opinion, the main appeal of investing in Intermex at the moment is the valuation. The stock is currently trading around 24% below its high, and as such, many of its valuation multiples have reduced. I think this has opened up an opportunity because even in the scenario where the company’s valuation multiples stay at a lower rate than historically, I think it is unlikely that a 22.41% reduction over three years in its P/S ratio is warranted. This is especially true when I consider that the long-term expansion strategy of the company remains intact, and the Wall Street consensus is YoY revenue growth of 4.47% for the fiscal period ending December 2024 and 8.34% for the fiscal period ending December 2025, both based on the forecasts of 7 analysts.

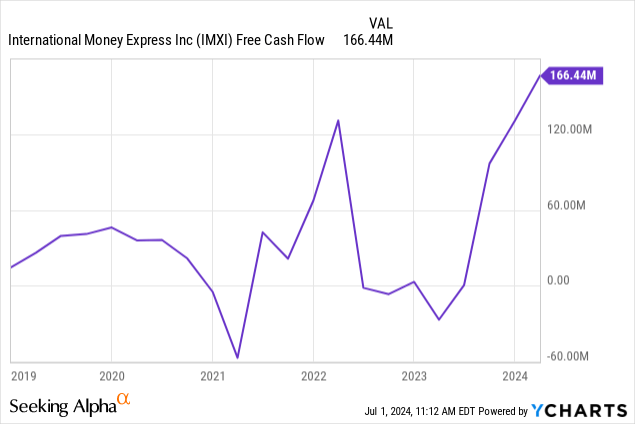

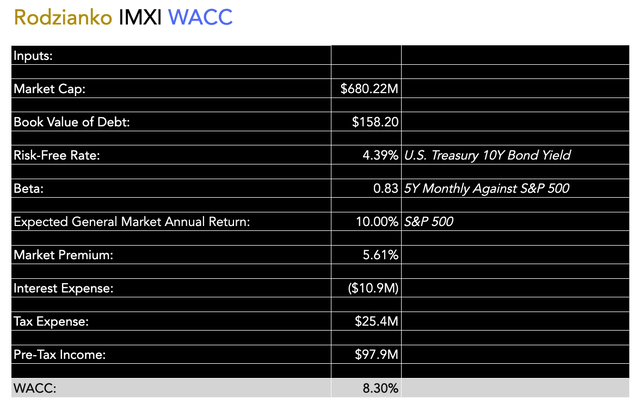

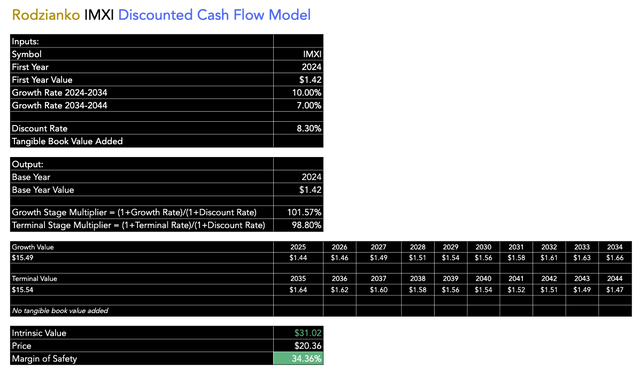

In my previous thesis, I outlined a fair value for IMXI stock of $32.27, and I think this was largely accurate and quite conservative. However, in this thesis, I am presenting a discounted cash flow analysis, which takes into account the company’s WACC as the discount rate and uses a 10% FCF annual growth rate for the first 10 years and 7% for the following 10 years, which is conservative given the following chart. I have opted for the average FCF per share since 2016 for my starting FCF value in my DCF model to stabilize expectations in growth moving forward due to historical volatility. My estimate is that IMXI stock is trading at roughly a 35% discount from its intrinsic value at this time.

Author’s Calculation Author’s Model

Risk Analysis

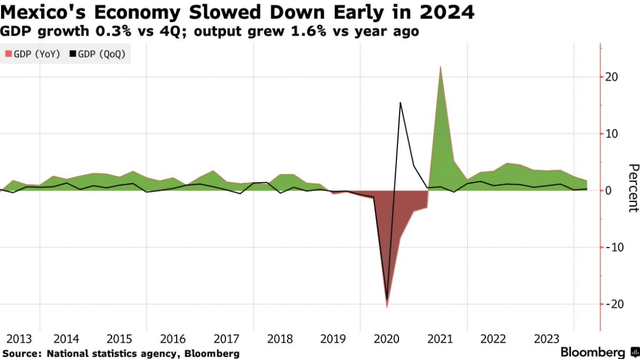

Recently, there has been a slowdown in Intermex’s Mexican market, which is particularly concerning because it affects a large customer base for Intermex and a high-volume corridor (US-Mexico), which could also lead to ripple effects on other Latin American markets. There is the potential that the incentive for some customers to send money to Mexico is reduced at the moment because the value of remittances has become poorer as Mexico’s GDP growth has slowed from 2.5% in 2023 to 2% in 2024.

Bloomberg

I think there is some potential for the company to continue to grow its services more aggressively in other Latin American countries, but Mexico is a crucial market for Intermex and is one of the largest remittance corridors globally. I think it shouldn’t be underestimated at this time how much immigration is happening from Mexico into the United States, and as such, this is going to reduce Mexican GDP and also potentially reduce remittance services if entire families are crossing the border rather than one or two members of a family for work purposes.

Counterintuitively, I think that if Trump is elected to the White House in November and enacts fiercer border controls, the level of remittances is likely to go up. However, if the Biden administration is elected and maintains more relaxed border controls, the level of remittances is likely to stagnate or go down. The reason for this would be that many families are crossing into the United States, which is reducing the need for money sent back home to foreign countries in South America, particularly Mexico. In this respect, I think the Biden administration would be bad for Intermex shareholders, as the dynamics of border control are a significant growth risk moving forward for Intermex.

Historical data supports my view that stricter border controls under a Trump administration could lead to an increase in remittances. Historically, increased immigration enforcement has restricted undocumented immigration and employment opportunities, but legal migrants often increase their remittances to offset this. Therefore, moving forward, I consider the largest risk for IMXI shareholders to be how the United States government approaches border control.

Conclusion

I am reiterating my Buy rating at this time because Intermex is offering a crucial business that will continue to be in high demand after the current high levels of immigration we have seen into the United States in recent years. Stricter border control under Trump, who I see likely will be elected in November, is likely to increase remittances and strengthen Intermex’s Mexico business due to stronger immigration controls meaning whole families are not relocating to the United States. Management has outlined critical strategic initiatives, including acquisitions, digital investment, and share buybacks to support long-term shareholder value. I estimate the stock is currently trading around 35% below its intrinsic value, and I believe the investment will likely be worth holding over the long term.

Read the full article here