Innovex Downhole In Brief

Innovex Downhole Solutions, Inc. (INVX) has filed to raise $100 million in an IPO of its common stock, according to an SEC S-1 registration statement.

Innovex designs, rents and sells well downhole technologies to oil & gas firms worldwide.

The firm is producing growing profits, but topline revenue growth is slowing down.

I’ll provide a final opinion when we learn more about the IPO from management.

What Does Innovex Do?

Humble, Texas-based Innovex Downhole Solutions, Inc. was founded to develop a variety of drilling and extraction products for use by exploration & production firms in their drilling activities.

Management is headed by CEO Adam Anderson, who has been with the firm since 2016 and was previously in senior management roles at Baker Hughes Company (BKR), a direct competitor to Innovex.

The company’s primary offerings by category are the following:

-

Well construction products

-

Well completion items

-

Well production and intervention products

-

Related services.

As of September 30, 2023, Innovex has booked fair market value investment of $180.5 million from investors, including Amberjack Capital Partners.

The company sells its product primarily to E&P operators, who then employ the products via their oilfield service providers.

Management says it has around 1,600 active customers, with the top ten customers accounting for 28% of revenue.

The firm is active in over 65 countries. In 2022, about 51% of its revenue was from products that the company has developed internally.

Selling, G&A expenses as a percentage of total revenue have remained stable in recent periods as revenues have increased, as the figures below indicate:

|

Selling, G&A |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Nine Mos. Ended Sept. 30, 2023 |

13.3% |

|

2022 |

13.3% |

|

2021 |

18.9% |

(Source – SEC.)

The Selling, G&A efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling, G&A expense, fell to 1.5x in the most recent reporting period, as shown in the table below:

|

Selling, G&A |

Efficiency Rate |

|

Period |

Multiple |

|

Nine Mos. Ended Sept. 30, 2023 |

1.5 |

|

2022 |

2.8 |

(Source – SEC.)

What Is Innovex’s Market?

According to a 2023 market research report by Rystad Energy, the global market for international and offshore markets is expected to grow capital spending by 21% from 2022 through 2025, ex-China and Russia.

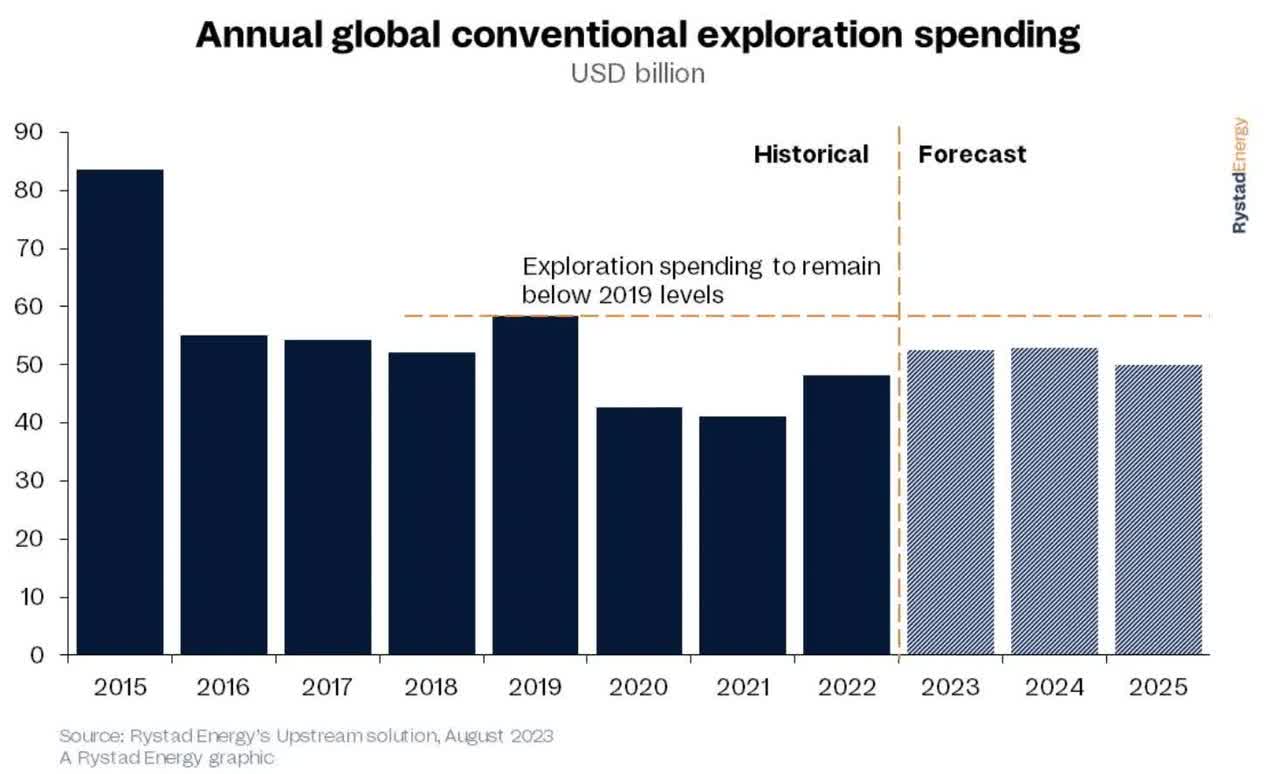

Annual global conventional exploration is expected to stabilize at slightly above 2022 levels, at around $50 billion per year through 2025, as the chart shows below:

Rystad Energy

The main drivers for this expected growth are significant spending by oil majors, which are expected to contribute 14% of total spending in the near term.

Also, there are a significant amount of well completions that remain to be performed based on existing projections.

Major competitive or other industry participants include the following:

-

Baker Hughes

-

Halliburton

-

Schlumberger

-

Weatherford International

-

NOV.

Innovex Downhole Solutions, Inc. Recent Financial Results

The company’s recent financial results can be summarized as follows:

-

Slowing top line revenue growth

-

Higher gross profit and gross margin

-

Increasing operating profit

-

A swing to cash flow from operations.

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Nine Mos. Ended Sept. 30, 2023 |

$ 422,349,000 |

24.5% |

|

2022 |

$ 467,189,000 |

58.5% |

|

2021 |

$ 294,841,000 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Nine Mos. Ended Sept. 30, 2023 |

$ 130,144,000 |

28.0% |

|

2022 |

$ 138,685,000 |

99.1% |

|

2021 |

$ 69,661,000 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

% Variance vs. Prior |

|

Nine Mos. Ended Sept. 30, 2023 |

30.81% |

0.8% |

|

2022 |

29.68% |

25.6% |

|

2021 |

23.63% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Nine Mos. Ended Sept. 30, 2023 |

$ 74,051,000 |

17.5% |

|

2022 |

$ 76,552,000 |

16.4% |

|

2021 |

$ 14,077,000 |

4.8% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

Nine Mos. Ended Sept. 30, 2023 |

$ 55,174,000 |

13.1% |

|

2022 |

$ 63,741,000 |

13.6% |

|

2021 |

$ 9,504,000 |

3.2% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Nine Mos. Ended Sept. 30, 2023 |

$ 54,479,000 |

|

|

2022 |

$ (5,811,000) |

|

|

2021 |

$ (2,025,000) |

|

|

(Glossary Of Terms.) |

(Source – SEC.)

As of September 30, 2023, Innovex had $8.3 million in cash and $179 million in total liabilities.

Free cash flow during the twelve months ending September 30, 2023, was $41.0 million.

Innovex Downhole Solutions, Inc.’s IPO Information

Innovex intends to raise $100 million in gross proceeds from an IPO of its common stock, although the final figure may be higher.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

The firm is claiming to be an “emerging growth company” according to the 2012 JOBS Act. This designation will enable management to provide less information to shareholders if it chooses to do so.

Management says it will use the net proceeds from the IPO as follows:

to fully repay borrowings under the Revolver, without a permanent reduction of the commitments thereunder; and

any remaining amounts for general corporate purposes.

(Source – SEC.)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said any currently open legal proceedings would not have a material adverse effect on its financial condition or operations.

The listed bookrunners of the IPO are Goldman Sachs, Piper Sandler and J.P. Morgan.

Innovex Is Performing Well, But Growth Is Slowing

INVX is seeking U.S. public capital market investment primarily to pay down debt, with any leftover for working capital.

The firm’s financials have shown reduced top line revenue growth, increased gross profit and gross margin, higher operating profit and a swing to cash flow from operations.

Free cash flow for the twelve months ending September 30, 2023, was $41.0 million.

Selling, G&A expenses as a percentage of total revenue have stabilized recently; its Selling, G&A efficiency multiple fell to .15x in the most recent reporting period.

The firm currently plans to pay no dividends and retain any future earnings for reinvestment back into the company’s growth and working capital requirements.

INVX’s recent capital spending history indicates it has spent moderately on capital expenditures as a percentage of its operating cash flow.

The market opportunity for providing downhole well oil & and gas extraction technologies is large and will continue to be stable in the coming years.

Risks to the company’s outlook as a public company include growing demand for sources of energy outside the hydrocarbon complex as well as much larger competitors who may seek to retain market share by cutting prices.

Another source of risk is that as new technologies are developed, E&P firms can extract a greater quantity of hydrocarbons from fewer wellheads.

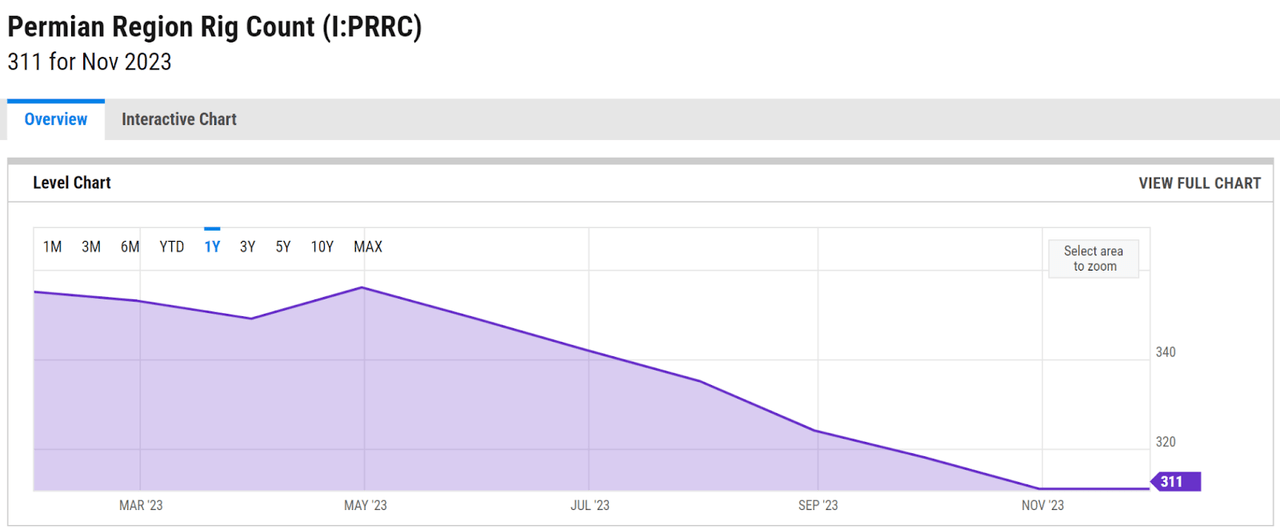

For example, the rig count in the Permian Basin is continuing to drop, as the chart shows here:

YCharts

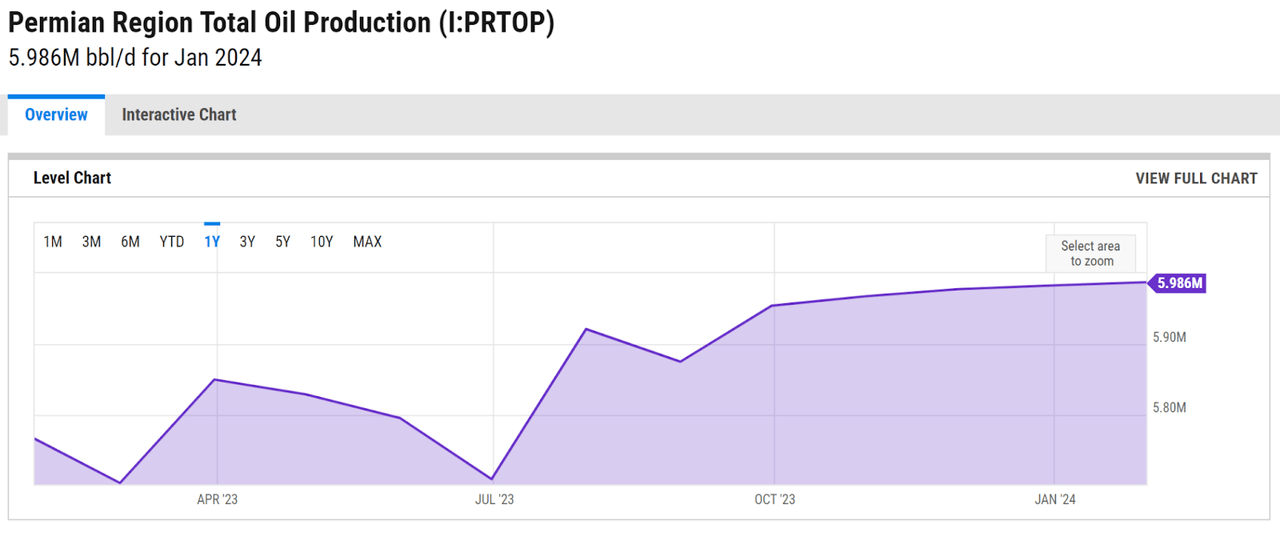

However, Permian production has continued to rise, per the chart here:

YCharts

So, with continued productivity and technology enhancements, the firm’s product sales may be hampered to some degree.

But, a number of the company’s products are consumables, so if use continues to grow, so will its revenue, at least as a function of those consumable products.

While Innovex Downhole Solutions, Inc. growth is slowing, it appears management has shifted to a focus on profitability, which is a positive in the current stock market environment where a premium has been placed on growth with profits.

When we learn management’s pricing and valuation assumptions, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Read the full article here