Thesis

Hubbell Incorporated (NYSE:HUBB) has managed to deliver strong earnings growth in recent times due to effective execution. The company boasts strong brand recognition and competent management, operating in fragmented markets that have the potential for consolidation through careful mergers and acquisitions. However, although the management is focused on maintaining differentiation, I believe there is a real concern relating to the sustainability of margins from current levels. Given the company’s current high valuation multiple, I do not see an attractive enough risk/reward at current levels, leading to my hold rating on the stock.

Business Overview

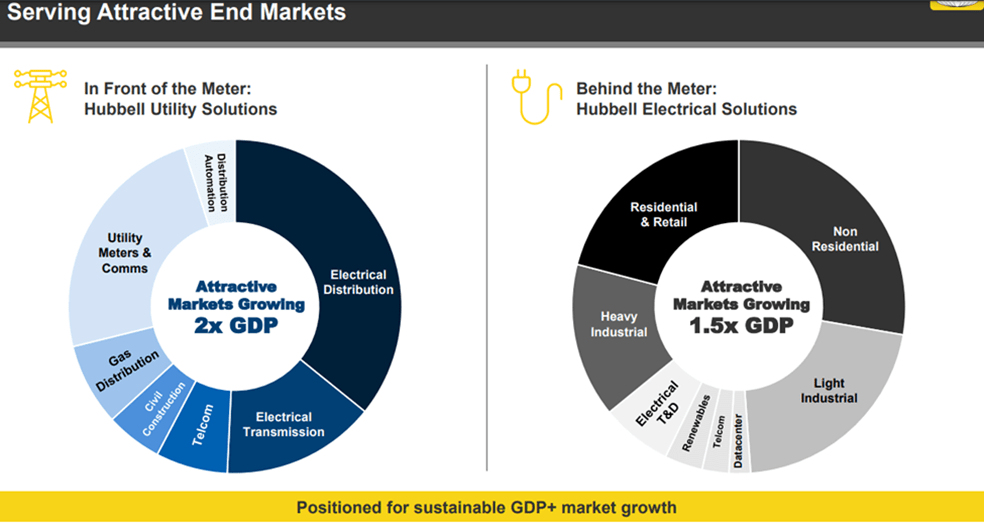

Hubbell Incorporated is a diversified multinational corporation operating with its two main business segments: the electrical sector (39% of sales) and industry utility solutions (61% of sales). The company has an overweight position in the utility, non-res, and US general construction markets. Hubbell’s products include switches, fuses smart meters, and relays in the Utility area as well as enclosures fittings, and controls under the Electrical division.

Mixed Q4 Results: Return of Volume Growth Positive

On 30th January 2024, Hubbell released its fourth quarter result. The performance of the company during the quarter was mostly consistent with market expectations. HUBB exceeded sales expectations on a combination of organic, and mid-December close of Systems Control. The organic growth was driven by the Electrical segment, and the management now expects channel inventories in commercial markets. The beat in the electrical segment was partly offset by a ~1% miss in the Utility segment as it was affected by continued destocking in distribution, which it expects to normalize by 1Q-end.

The margins remained mixed with a ~100 basis point beat at Electrical that was more than offset by a ~100 basis point miss at Utility. Hubbell has continued to raise prices over the past year to deal with the inflationary cost pressures, now that costs continue to normalize, the company’s margins can remain elevated in the near term. The management gave guidance for 2024 and expects an EPS of ($16-16.50). The commentary from the management largely is in line with the recent commentary from peers in the space with Utility T&D markets expected to remain robust driven by strength in transmission and distribution automation, though telecom markets may remain weak resulting in 4-5% growth expected for the segment. In Electrical, the company sees growth markets in Electric T&D, Renewables, and Data Center driving results, partly offset by non-residential, leading to 3-4% organic growth. With operating profit growth seen at 10%, on 8-10% sales growth, implied margins are guided up ~20 basis points YoY (from 21% in 2023). All in all, the return of volume growth at Hubbell’s Electrical segment, which signals an end to distributor destocking, and management’s 2-4% volume-growth outlook implies earnings expansion in 2024 despite tough comparisons. The Utility segment disappointed slightly, with organic sales growth below consensus and a steeper-than-historical seasonal margin contraction over 3Q.

Seeking Alpha

Focused on Fast-Growing Sector Expansion

Hubbell has traditionally had a strong presence in Transmission and Distribution (T&D) equipment that’s used by utilities and the electricity grid, though management is also actively expanding its presence in fast-growing end markets both organically and with acquisitions. Renewables represent around $100 million in annual revenue, though the changes they’re causing, such as bidirectional production and consumption on the grid, are also driving demand for other Hubbell products. The acquisition of PCX, an integrator of data-center power systems, is another step in expanding its presence in these growth markets. Additionally, Hubbell is showing interest in providing solutions for utilities in the growing Electric Vehicle charging market, indicating a keen focus on capitalizing on emerging opportunities in the industry.

Company Presentation

Financial Outlook

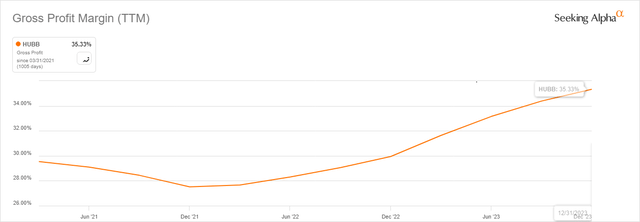

Hubbell continues to benefit from the electrification and modernization of the US power grid. The issue of distributor destocking, which was impacting the Electrical segment, has improved and is expected to slow down for the Utility segment. The company’s streamlined operations, combined with carefully planned capacity expansions in lucrative areas like high-margin enclosures, position it well to meet the surging demand while maintaining a high operating margin in the high teens. I believe Hubbell’s adjusted operating margin target of 17% by 2025 can be achieved through robust pricing strategies and increased volume. The strong demand, selective capacity expansion, and exceptional service levels are driving an uptick in the adjusted operating margin, particularly in the Utility Solutions division. The company’s organic growth may also improve at HES following the unification of its organizational structure and sales force to better serve demand by end markets.

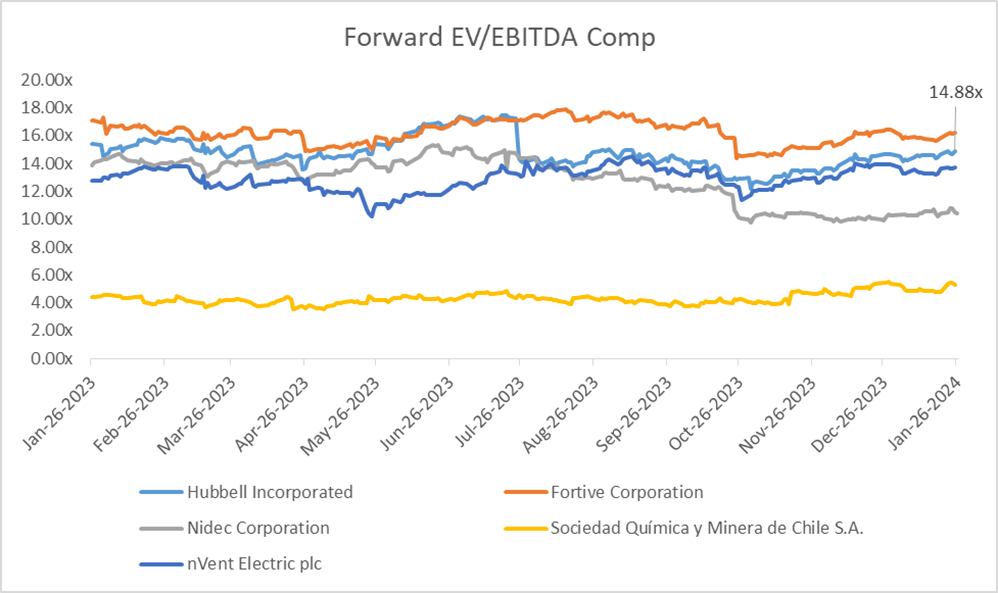

HUBB is estimated to generate $1.3 billion in EBITDA in fiscal year 2024 as per Capital IQ estimate. Hubbell’s valuation multiple has improved over the past few years, consistently trading around 14-16x EV-to-forward EBITDA vs. 10-11x pre-pandemic, which reflects faster growth expectations as well as the company’s leaner operations. Its primary end markets — utilities and the grid — are at the early stages of a multiyear investment boom, lifting organic growth prospects to mid-single digits from low-single. The stock is trading at a valuation premium to its US and European peers like Vertiv Holdings Co (VRT), nVent Electric plc (NVT), and Legrand SA (OTCPK:LGRDY) despite having similar operating margins (mid-teens operating margins) and growth profile. Moreover, the stock is trading slightly higher than its five-year and two-year averages as well. In my view, at current levels, HUBB is viewed as fairly priced and there is limited upside from current levels. Hence, I remain on the sidelines and assign a hold rating to the stock.

Capital IQ

Risks to Rating

HUBB has substantially improved margins over the past year, thanks to the company’s pricing strategies and operational improvements. However, the margin trajectory can trend downwards in 2024, as any significant deflation could turn prices negative and potentially lead to margin compression. Moreover, Hubbell has a relatively small backlog, particularly in the Electrical segment. Any shift in customer sentiment could result in a sales and earnings downturn, especially considering the current environment of excess inventories.

On the contrary, the effects of US stimulus measures could start to become more pronounced over the next few years which could benefit HUBB and cause an upward momentum in the stock price. Moreover, higher pricing could result in higher growth and margin expansion for Hubbell.

Conclusion

HUBB can be an attractive stock for defensive investors looking to get exposure to utility markets, non-residential sectors, and the US general construction industry. The management has continued to deliver higher margins over the past one-year driven by price strategies and operational optimization. However, a significantly slower spending environment raises doubt over the company’s ability to continue to raise prices and maintain margins. At current levels, I don’t see a compelling enough risk/reward from current levels which is why I assign a hold rating to the stock.

Read the full article here