HSBC logo (HSBC)

Investment Thesis

It has been a while since we last covered HSBC Holdings (NYSE:HSBC) here in SA. It is our largest financial position. Therefore, we are not complaisant about their development. We regularly check “under the hood” to see if it is running as it should be.

Despite the recent pullback in share price, it has been a good place to be invested in over the last year with the share being up 39%.

HSBC share price last year (SA)

Let us start by looking at the latest financial results

Net profit after taxes was down in Q3 of 2023 to $6.27 billion from $7.05 billion on a Q-o-Q basis. When we look at the first 9 months, the story is very different as the net profit has more than doubled from $11.59 billion last year to $24.34 billion.

EPS for the quarter came in at $0.29 per share, compared to $0.34 in Q2.

Their annualized net return on tangible equity was 19.7%.

NIM also seems to have peaked in Q2 at 1.72%, although it only fell by 2 basis points to 1.70% in Q3.

HSBC – NIM development (HSBC Q3 2023 Presentation)

Cost efficiency on a Y-o-Y basis has improved significantly as this was 66.3% at the end of Q3 of 2022 and is now 44.2% as of the end of Q3 2023.

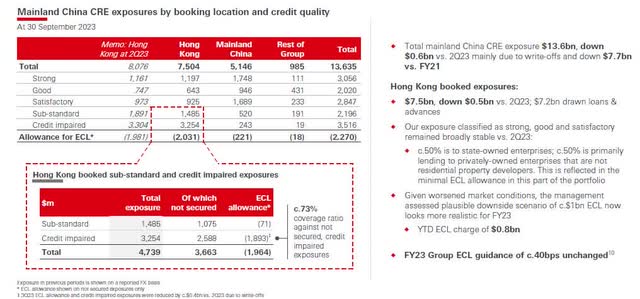

We do keep an eye on their estimated credit losses. For the estimated credit losses or ECL, we prefer to look at the first 9 months of 2023 compared with the same period a year earlier. In 2023, the ECL up to and including Q3 was $2.4 billion, compared with charges of $2.2 billion in 2022.

Both periods included allowances relating to the ECL for the commercial real estate sector in mainland China, which were $800 million for the period up to and including Q3 of 2023.

ECL charges were 32 basis points of the bank’s average gross loans, including loans and advances classified as held for sale.

Now, let us look at their balance sheet.

Loans and advances to customers as a percentage of customer accounts deposits were 59.9% at the end of Q3.

The bank’s CET-1 ratio is 14.9%, and its liquidity coverage ratio is 134%

NAV per ordinary share is $8.56

We have already pointed out that 1 ADS represents 5 ordinary shares. This means that the NAV per ADS is $42.80. Based on a share price of one ADS as of Friday 27th October at $36.71, it does give us a very attractive P/B ratio of only 0.86.

In terms of value, this is considered good value for us.

Returning Capital To Shareholders

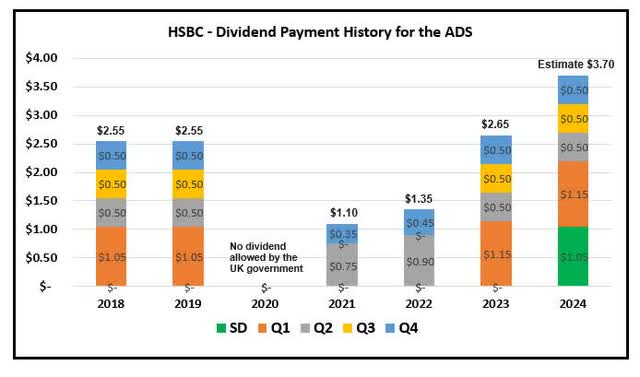

As expected, HSBC’s board approved an interim dividend for Q3 of $0.10 per share.

We are now back to HSBC’s dividend policy which existed under the previous management. For many years, HSBC would be paying out three quarterly interim dividends of $0.10 per share plus a final dividend for Q4 of approximately $0.20. That brings the total dividend for the year to $0.50 per share or $2.50 per ADS.

In the announcement of Q3 financial results, management also communicated that they remain committed to considering the payment of a special dividend of $0.21 per share as a priority use of the proceeds from the completion of the sale of their banking business in Canada. This should take place in Q1 or latest Q2 of 2024.

Here is how yearly dividend payments, and an estimate for next year, look like;

HSBC dividend payment history and projection for the ADS (Data from HSBC, estimate and graph by author)

The dividend yield works out to 7.2% in 2023 and potentially 10% next year.

On top of that, the bank is also returning capital to shareholders in the form of share buyback.

HSBC had announced 3 share buy-backs this year totalling up to $7 billion.

When we check the total number of ordinary shares outstanding, we can see a reduction of 464 million shares from the 31st of December 2022 up to the 30th of September 2023. If we use an average price of HK$57 per share over that period, the value of this comes out to approximately HK$26.45 billion, or US$3.4 billion.

This reduction of ordinary shares means that it has been reduced by 2.35%.

The share buyback program is intended to continue with an additional $3 billion, which is expected to commence shortly and be completed by 21st of February next year. That is the date when HSBC is expected to announce its 2023 FY financial results.

All in all, a very shareholder-friendly return of capital.

Business Update

Even if the interest rate now might have peaked, and if central banks around the world, and in particular the Federal Reserve in the U.S., will start to reduce the interest rate, we do believe that HSBC still can deliver excellent earnings going forward. The business volume has good opportunities for growth

Here are areas we see potential growth in earnings going forward:

Further economic integration within the Greater Bay Area:

A big part of this is selling investment products across the border. We have earlier been optimistic about their prospects of earnings from their insurance business. As such, we were pleased to see that their insurance business in Hong Kong continues to grow this year. New business contractual service margin has increased by 40% in the first nine months of the year to $1.1 billion.

With the resumption of normal traveling between Guangzhou Province and Hong Kong, more business will come.

Here is what the CEO Edward Moncreiffe at HSBC Life of HK and Macau had to say to South China Morning Post recently:

With more international arrivals coming to Hong Kong over Q3, we see continued growth in demand for our wealth and health solutions.

According to the article in SCMP HSBC Insurance sold HK$8 billion worth of new policies to overseas visitors, where 70% of it comes from travelers from Mainland China.

The Hong Kong government is working closely with the government across the border to make it easier for people in the GBA to purchase investments and insurance products in Hong Kong. Likewise, arrangements are made to make it easier for young Hong Kong entrepreneurs to set up and run businesses in the tech-driven city of Shenzhen.

HSBC is placed to take part in this.

Increase in Wealth Clients:

HSBC has been quite aggressive in growing its footprint in the wealth management arena outside of Hong Kong. More resources are put into Singapore and India to grow it there.

In addition to this, in line with their plan to grow wealth management in Mainland China, they recently announced the purchase of Citigroup’s (C) retail wealth management portfolio in Mainland China. With their large customer base, also comes an AUM of about $3.6 billion.

We were also pleased to learn that their wealth business attracted $34 billion of net new invested assets in Q3.

This focus on wealth and HSBC’s investing in it is starting to bear fruits, and we believe that it will continue to grow.

Risks To Thesis

HSBC’s management did state in Q3 financial results that they –

“continue to monitor risks related to their exposures in mainland China’s commercial real estate sector”

How big is this exposure?

HSBC’s exposure to China’s CRE (HSBC Q3 of 2023 Presentation)

The total exposure of $13.6 billion is significant. However, it is important to bear in mind that 55% of this is booked in Hong Kong with the bulk of this being lending to state-owned and non-residential real estate developers.

In February this year, management communicated that they assessed a plausible downside scenario of around $1 billion.

We do think that this risk is quite manageable for the bank.

We do have some concerns that the high profits HSBC and many other banks are delivering might prompt the UK government to increase taxes like they did for the oil and gas industry. It was called a “windfall” tax. Hopefully, the UK bank taxes, which are already in place, are enough taxes from the banks.

Conclusion

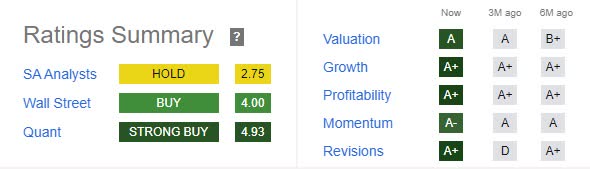

The last 10 articles here on SA this year covering HSBC has produced a mixed conclusion by the analysts. Five of them, including our call, were a Buy, with 3 calling it a Hold and 2 giving it a Sell stance.

We are unsure how accurate Quant projection is but it gives HSBC a Strong Buy.

HSBC’s Quant rating on SA 27 September 2023 (SA)

Is the drop in net profit Q-o-Q this year something we should be concerned about?

We think not. The first two-quarters’ profit was extraordinarily good. After all, profit before taxes in FH 2023 was up 158% compared to a year earlier.

It is quite likely that the NIM has peaked. We might get another quarter increase by the Federal Reserve by year-end. How long the current interest rate environment is going to last is anybody’s guess. From our observations, reading the same reports as everybody else, it seems a consensus now is forming for a “high for longer” period.

It is hard to tell whether we will have a soft landing or a recession. Central banks and government response is to either push or pull a string depending on monetary or fiscal requirements.

Regardless of the outcome, it is our conclusion that HSBC is a quality company that will as we often state “make billions of dollars year in and year out”, even in times of war, financial crises, and pandemics.

It is not immune to what is happening with credit and the economy at large, but we sleep well at night trusting it will be there when we wake up. And to quote Warren Buffett –

If you don’t find a way to make money while you sleep, you will work until you die.

HSBC works while we sleep. We continue our Buy stance.

Read the full article here