Grilled Spam Burger with Fries

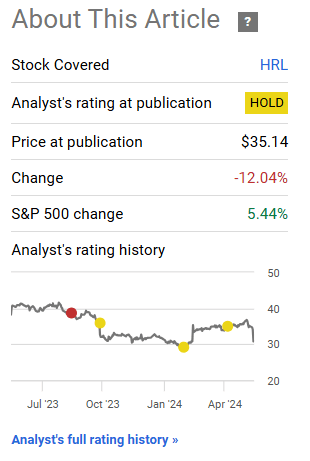

While we have not been buyers of Hormel Foods Corporation (NYSE:HRL) in any of our past reviews of this business, we have usually called the directional moves right on this one. In our most recent coverage a couple of months ago, we suggested that an exit for the bulls would be perfect. Lofty valuation, the stock being back at its 200-day moving average, and an expectation of a slowdown in the dividend growth story were our reasons at the time. Those that exited at that time would not have been disappointed.

Seeking Alpha

The majority of that drop was driven by the earnings release, though. We examine that for clues as to where the company is headed.

Earnings

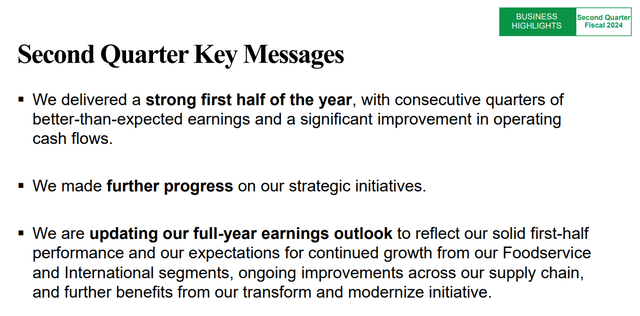

Hormel has an October year-end, and the recently released results were for the second quarter of the fiscal year. The Q2 messaging began with Hormel telling everyone that the first half (not necessarily the second quarter) was strong, and they delivered better than expected earnings.

HRL Earnings Supplement

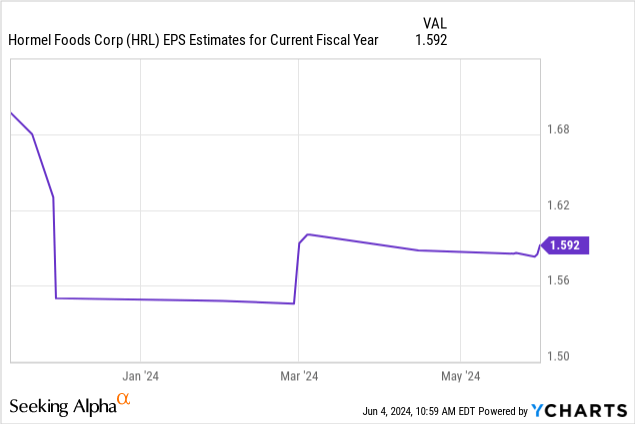

It is always funny when the company and the analysts work hand in hand to lower expectations and then deliver a “better than expected” result. You can see how the EPS projection for this year has moved since November 1, 2023.

Lower the bar and enjoy the beat.

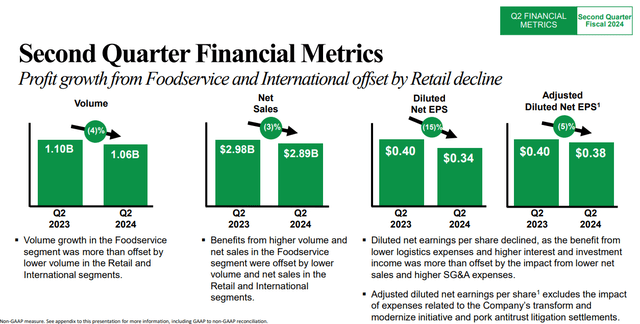

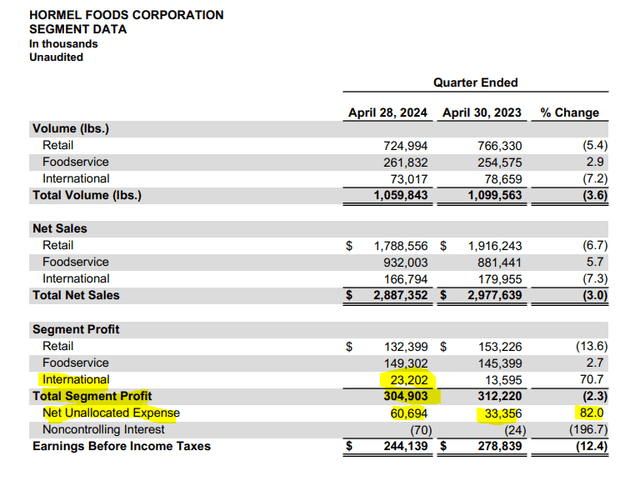

Despite the good setup, the second quarter numbers on a standalone basis weren’t anything to get excited about either. The 4% volume contraction that led off the next slide likely produced a good deal of the disappointment. Interestingly, Hormel’s product mix shifted a bit this quarter and that meant that the pricing increases were not able to offset the volume declines.

HRL Earnings Supplement

By all relevant measures, we have not really hit a proper recession, and Hormel showed declining operating income and declining margins.

Operating income of $252 million, compared to $296 million; adjusted operating income of $276 million.

Operating margin of 8.7%, compared to 9.9% last year; adjusted operating margin1 of 9.6%

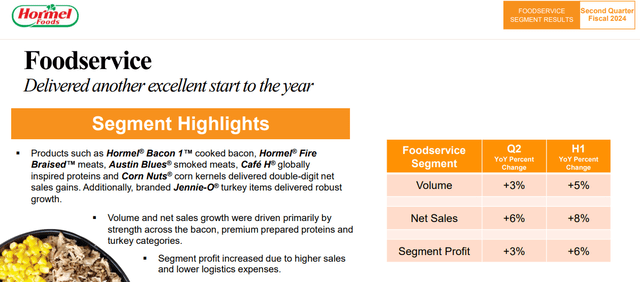

You can see the problem when you break down the Foodservice segment vs the Retail segment. Foodservice profit was up 3% in Q2 and 6% in the first half.

HRL Earnings Supplement

But the Retail segment (which is by far the largest in sales) fared quite poorly, with earnings drop accelerating in Q2. Segment profit was down 14%.

Net sales increased for many items, including Hormel® Black Label® bacon, the SPAM® family of products, Applegate® natural and organic meats, Hormel® Square Table™ entrees and Planters® snack nuts. These gains were negated by a significant year-over-year volume and pricing decline for whole-bird turkeys and lower net sales in the convenient meals and proteins vertical. Segment profit declined due to lower sales and higher SG&A expenses, which included increased advertising investments.

Source: Q2 Earnings Release

International segment profit was up a barn blazing 70%, but the impact was extremely muted as that formed less than 8% of total operating profits. You can see in the next picture that impact. You can also see there that net unallocated costs (i.e., corporate level costs) were up 82%.

HRL Earnings Supplement

Now, to be fair to the company, the investor presentation some time back telegraphed the challenges they were having and also prepared everyone for the high level of investments that were required.

Outlook

There was a small tweak to the annual guidance.

Reaffirming its net sales growth outlook of 1% to 3%.

Updating its expectations for diluted net earnings per share to $1.45 to $1.55 (previously $1.43 to $1.57) and its expectations for adjusted diluted net earnings per share1 to $1.55 to $1.65* (previously $1.51 to $1.65).

Source: Q2 Earnings Release

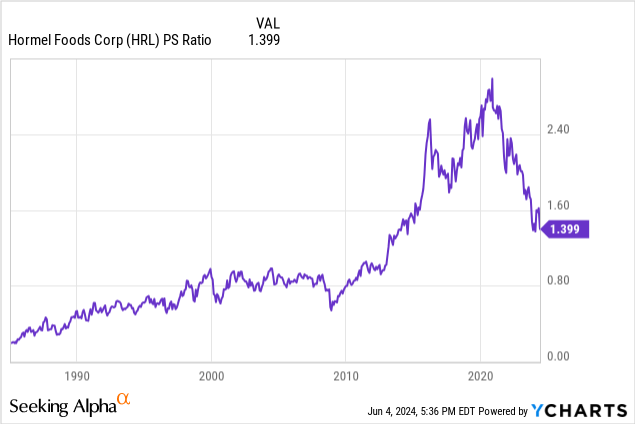

The first half came in about 8 cents ahead against consensus estimates, so the tweak above suggests more pressures in the back half. That is possibly what caused the shorter term reaction in the stock. Investors got extremely excited after the last quarterly set of results and were prepared for an earnings upgrade cycle. That is not coming to fruition. On a longer-term horizon, this is just the slow grinding down of adjusting to normal valuations. HRL was one of the most expensive consumer staples stock a few years back, and the journey to normal valuations takes time.

We had opined some time back that 1.0X price to sales was on its way. That journey looks about 60%-70% complete. What will happen next will depend on the broader markets. If we see a big bear market, Hormel will reach that multiple sooner. If we don’t, then it may take many more years to reach there. Of course, since the dividend yield is only 3.66%, almost any timeline you put on it reaching that multiple would mean really bad returns from here.

One miracle that would make us a bit more optimistic on the stock would be if sales actually started growing strongly. By sales here, we are referring to actual volume numbers. Even outside the specific pressures the company faced this quarter, volume growth has been really poor. If that can be turned around and the company can deliver 3% volume growth, then you can have a slightly more optimistic bent with an additional 2% to 4% pricing add-ons.

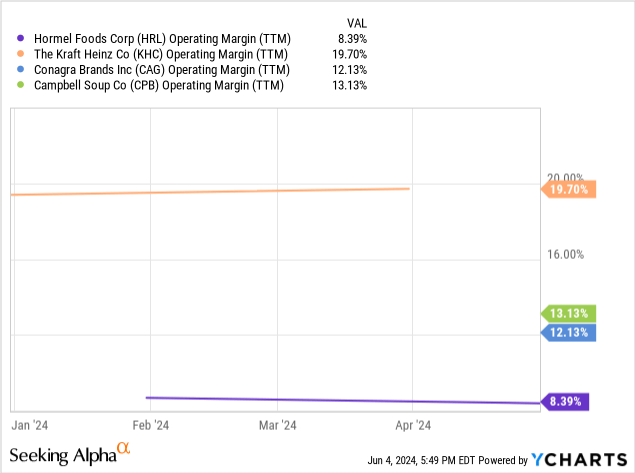

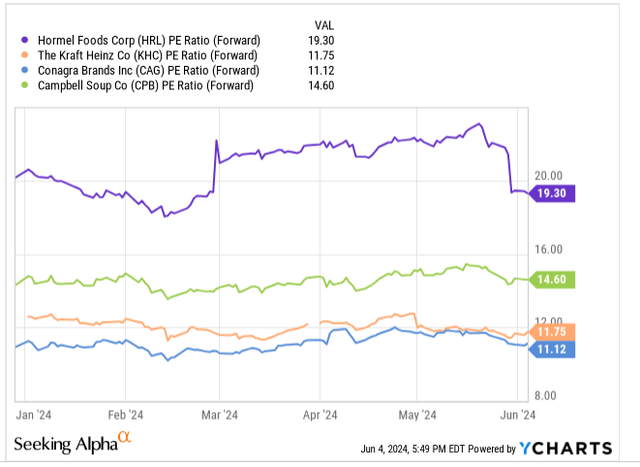

As it stands, we see no issues with Hormel trading at 12X-14X EPS. Even that might be optimistic. As you can see below, when run against The Kraft Heinz Co. (KHC), Conagra Brands, Inc. (CAG) and Campbell Soup Company (CPB), Hormel has the lowest operating margins. It is not even close.

And, it trades at the most expensive valuation relative to those 3.

YCharts

So you will get there. It is a matter of time. We stick with our earlier suggestion that Hormel will only enter a buy range under $25.00 per share. We would avoid long positions outside of that.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Read the full article here