Introduction

The telehealth company Hims & Hers (NYSE:HIMS) has seen its stock price range from under $6 to over $25 during the last 52 weeks. Since the stock price peaked in June, the stock has almost been cut in half. Back in May Hims surprised the market by announcing its affordable GLP-1 offering which immediately sent the stock soaring. However, recent news regarding Hims ability to continue with its GLP-1 offering beyond the temporary shortage has led to uncertainty around the stock. As of writing this piece, all the gains since the GLP-1 announcement have been wiped out. During the same period, the company presented flawless Q2 numbers even when subtracting the new GLP-1 offering, which undeniably shows that the core business is performing very well.

The current valuation of a forward P/S of 2.5 is cheap considering the impressive growth prospects. The GLP-1 launch was initially perceived as something very positive for the company but has since then almost evolved as being perceived as a net negative for the company. I believe this to be a considerable misjudgment of the current situation by the market. These factors offer an intriguing investment opportunity, with an interesting setup of GLP-1 being perceived as a net negative by the market, when it in reality should be a strong growth engine in the quarters to come.

Leadership

Founded in 2017 by among others the current CEO Andrew Dudum, Hims & Hers should be considered a young company. With a 10% ownership of Hims & Hers, Dudum is the biggest shareholder who clearly has aligned his interests with the shareholder base. Before founding Hims, Andrew Dudum co-founded “startup studio” as well as the investment fund “Atomic Labs”. Andrew Dudum has shown to be an excellent leader as Hims has become a leader in the growing telehealth market in a relatively short timeframe. The management has regularly outperformed its guidance, which depicts their ability to exceed expectations. In July, Kåre Schultz, who worked for Novo Nordisk for 25 years, most notably as COO and President, joined Hims’ board of directors. The experience he will bring to Hims & Hers leadership should be considered as promising for scaling up the business even further.

Performance in Numbers

Hims & Hers has shown exceptional growth during the years since initiating the process to go public through a SPAC in 2020. At this time, Hims had around $30 million in quarterly revenue, which is substantially less than the $315 million that they reported in the recent Q2 report, a 52% YOY increase. Naturally, this explosive growth is significantly easier to achieve when the starting point is relatively low; however, a 10x in revenue from $30 million a quarter over a 4-year period is still remarkable.

Furthermore, 2024 will be Hims’ first full year of being net income positive, which in combination with their healthy balance sheet ensures Hims’ strong financial position. The rapid increase in free cash flow has and continues to enable Hims to initiate share repurchase programs. After completing the $50 million share repurchase program in the first part of the year, a new program worth $100 million has been initiated. This is bullish for the stock and shares outstanding should continue to decrease in the coming quarters.

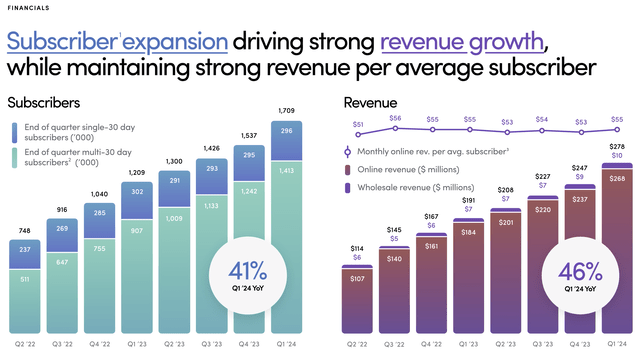

The net income for the Q2 results landed around $13 million, meanwhile, the EBITDA reached $39 million. The subscribers increased 43% YOY in Q2, now totaling 1.9 million. One interesting factor to consider is that the revenue growth at 52% YOY exceeds the subscription growth, which ultimately means that the average customer spending at Hims has increased. These achievements provide a clear path to at least meeting the recently updated 2024 full-year guidance of $1.37-$1.4 billion in revenue and $140-$155 million in adjusted EBITDA. The guidance, as of the first quarter 2024, was $1.2-$1.23 billion in revenue and $120-$135 million in adjusted EBITDA. The updated and increased guidance depicts Hims’ impressive ability to overachieve despite the already high growth rate that the original guidance indicated.

Figure 1: Note, not updated with Q2 results (Hims & Hers IR presentation)

Opportunities

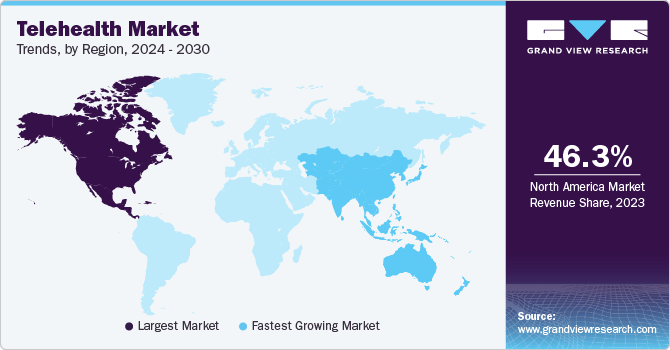

In 2024, the global telehealth market, which Hims operates in, was estimated to be worth $101 billion. The market size is expected to grow by over 24% CAGR from 2024 to 2030. Clearly, this is a huge opportunity and Hims is at the forefront to thrive in this rapidly growing market. Hims & Hers will have a long runway of structural growth due to how massive the TAM is, and there will be room for multiple players. North America is currently representing the biggest share of the telehealth market; however, the market is growing substantially faster in other parts of the world. This presents Hims with an exciting opportunity to expand internationally. Hims’ current markets are still far from being mature, thus the company will probably limit its international expansion plans in the short term. Nevertheless, it could be a growth driver long-term, that could expand its TAM by a substantial amount.

Figure 2 (Grand View Research)

Another opportunity, which recently became the main focus for an investment in Hims, is the GLP-1 launch. The opportunity of the affordable GLP-1 launch is colossal in terms of adding even more revenue growth. Not to mention how much cross-selling that can be achieved simultaneously. Unfortunately, there is a catch, Hims’ ability to sell GLP-1 depends on the drug’s current status as being listed on the FDA shortage list. This enables Hims and other players to sell versions of the FDA-approved drug as long as the shortage remains. This has led to cause for concern among investors due to fear of lawsuits if the company continues to sell GLP-1 after the shortage ends.

For these reasons, doubts around GLP-1 as being a net positive for the business model have surfaced, due to it only being considered as a temporary boost in revenues. Andrew Dudum has previously stated that they will continue to sell weight loss drugs after the shortage in terms of selling the versions from Novo Nordisk or Eli Lilly. Still, the market seems skeptical whether the GLP-1 even is a net positive for Hims, considering all the gains since the launch have been erased. This interpretation is unreasonable, considering that even a temporary boost in revenue, etc. would result in more resources that can help the company grow in other ways. Not to mention the amount of GLP-1 customers that I am convinced will stay on as Hims & Hers customers for other reasons. The GLP-1 sales for Q2 reached $16 million, which shows that GLP-1 could increase revenue even in a short time frame, considering it wasn’t being sold for the full quarter. The third quarter will be the first full quarter of offering GLP-1, and it’s also available in more states than during the previous quarter. This suggests that the GLP-1 revenue will be substantially higher in Q3 than Q2.

Hims recently acquired an FDA-approved compounding pharmacy with the intention to double down on weight loss drugs and expand into other categories. This should lead to better margins in the not-too-distant future due to production being “in-house”. The bottom line could consequently get a significant boost by this approach and could be seen as a bullish signal for the margins long-term. The management has previously stated in their investor presentation that they believe they could reach an EBITDA margin between 20% and 30%, this acquisition is one of the components to realize this.

Threats

Ever since starting the process to go public through a SPAC during 2020, a large part of the bear thesis has been about competition, most noteworthy from Amazon. Amazon could hypothetically start to aggressively compete with Hims by lowering prices to the point of both businesses achieving a negative profit margin. Amazon would, of course, afford this, whilst Hims wouldn’t; however, this is an unreasonable scenario for multiple reasons. Amazon is a behemoth of a company, with countless business segments that each require the leadership’s focus. It is likely that Amazon will increase its presence in the telehealth market as a whole, but not likely it will start to aggressively compete with Hims to win the market. The most reasonable path forward includes Hims & Hers as well as Amazon in the market, it is not a “winner takes all” scenario. Furthermore, Hims stands out with their personalized offering and will continue to win by personalization rather than having the lowest prices.

There is, however, more that suggests this Hims killer scenario as being irrational. Amazon’s place as one of the world’s biggest companies exposes the company for scrutiny around antitrust legislation. In other words, it would be irrational for Amazon to aggressively out-compete Hims due to the large consequences it would imply in terms of scrutiny and antitrust lawsuits. This is especially relevant since the recent news around the Google antitrust situation.

Amazon is not the only big company that is potentially going after Hims. The affordable GLP-1 offer makes Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound appear expensive at over $1000 per month. This is a big contrast to the Hims GLP-1 offer that amounts to $199 a month. Recently, Eli Lilly lowered prices on its lowest dosage version to $399 in order to compete with the cheaper generic substitutes. This proves that Eli Lilly and Novo Nordisk are afraid of losing potential customers to actors like Hims, but even after this measure, a substantial price difference remains. Therefore, it is not surprising that Novo Nordisk and Eli Lilly seek to restrict other players like Hims from selling these substitutes. Consequently, fear of lawsuits against Hims has surfaced, even though they are legally allowed to continue with its GLP-1 offer until it delists from the FDA shortage list. For these reasons, I believe this fear is overblown, and I am convinced Hims will adjust their offering as the drug’s shortage status changes.

Current and Hypothetical Valuation

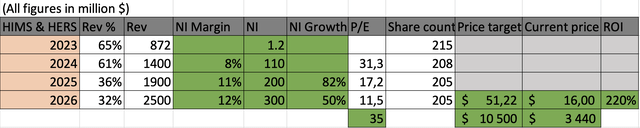

Assuming Hims reaches the current guidance for 2024 of around $1.4 billion, it’s trading at a P/S of 2.5, based on the current market cap of $3.5 billion. This is extremely cheap for a company that is expected to grow 60% for the full year of 2024 according to the updated guidance, and should grow over 30% in the coming years. The explosive revenue growth should be valued higher on its own, let alone the combination of high revenue growth and rapidly increasing profitability. Since the management has a history of exceeding or at least meeting expectations, I am convinced the current guidance will be reached.

In 2025, I believe Hims can achieve $1.9 billion in revenue, with $200 million reaching the bottom line. For fiscal year 2026, I expect $2.5 billion in revenue and around $300 million in net income. I assume a 5% decrease in share count until 2026 due to the current and continued share repurchase program. This suggests that Hims is currently trading at a P/E just under 12 for fiscal year 2026. I am convinced Hims will continue to grow rapidly beyond 2026 and should be priced thereafter. Hims being valued at a P/E of 35 in 2026 is not unreasonable given the high growth that will follow. This equals a price target of $51 within a 2-year timeframe, which would mean explosive upside potential (see Figure 3 below).

Figure 3: Valuation model (Authors contribution)

Conclusion

Hims & Hers’ current decline in its stock price is a clear overreaction that presents an interesting investment opportunity. There are certainly risks that could compromise this positive outlook, which is important to consider. However, I believe these risks to be greatly overexaggerated and that the potential upside more than justifies these risks. The management has proven to be successful in exceeding its already ambitious guidance and taking advantage of promising opportunities. The rapidly growing telehealth market will enable Hims to continue growing until 2030 and beyond. It is often said, “the trend is your friend,” and the trends that support Hims as an investment opportunity are no exception.

Read the full article here