Thesis

To kick off 2024 I decided to take a look at the energy markets from a different perspective. The market doesn’t always get things right, so I took a look at the worst performers over the course of 2023. I screened both American and Canadian energy companies with a minimum market cap of $1 billion.

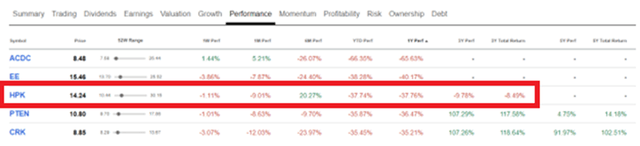

The image below gives the five worst performers of 2023 as a result of this screen. These companies each have their own flaws that have led to them falling out of favor with investors. In a search of value and future appreciation prospects, I took a dive into these companies to see if any of them were diamonds in the rough.

Seeking Alpha Stock Screener

HighPeak Energy(NASDAQ:HPK) took the silver medal for second worst performer in 2023, down 37% YTD in 2023. What caught my eye about the company was that 84% of its production volume was oil and 93% was liquid. This leads to extremely high margins that are not easy to replicate. HPK has just become free cash flow positive, so I knew it had potential that needed explored.

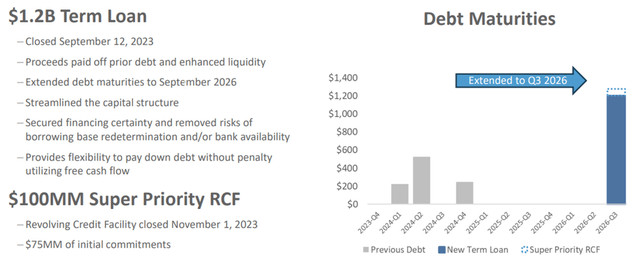

Over the course of the year the company grew production from 37,000 BOE/d to over 57,000 BOE/d. All growth prospects were overshadowed by the financial burden of nearly $1 billion in notes due in 2024. However, in Q3 the company announced that all of its debt had been rolled into one loan that is now due in September of 2026. This has given the company a 30-month window to be able to continue its high growth drilling program while incrementally chewing away at the loan principal.

With the near-term financial dilemma in the rear-view mirror, HPK can get back to being a growth story. Having some of the most profitable rock in the Permian makes HPK a potential diamond in the rough. This analysis will determine if HPK is financially healthy enough to sustain its growth trajectory and warrant an investment in 2024.

Small But Mighty

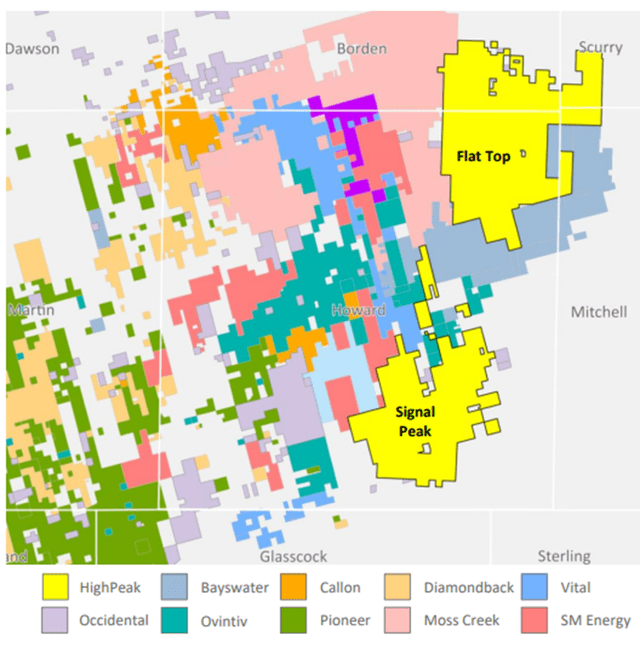

HighPeak is a small producer of 52,700 BOE/d in the Midland basin. It is easy for the average investor to pass over this small cap company. With only 114,000 acres in its portfolio and a dividend less than 1%, HPK doesn’t grab a lot of headlines.

By having a liquids rich production profile, HPK is cash flow advantaged compared to other oil and natural gas producers. The term BOE (barrel of oil equivalent) can be a misleading figure. It has the tendency to make some producers look better than they actually are. But all BOE’s are not created equal.

It takes six MCF of natural gas to equate to one BOE. However, the value of this ‘barrel’ is nowhere near the same as the real thing. In Q3, Henry Hub natural gas has averaged $2.59/MCF, while WTI averaged $82.16/barrel. At this strip, a barrel of oil is worth over 5 times that of a BOE of natural gas.

HPK Investor Presentation

With a production profile of 84% crude, 9% NGLs, and 7% natural gas, HPK had a realized price of $71.27/BOE in the 3rd quarter. This is far in excess of even some of the large cap Permian players including Devon Energy, Diamondback Energy, and Pioneer Resources. The table below compares the difference between HPK and the ‘name brands’ of the industry. All data is based on Q3 production from each company’s 10-K report.

|

Realized Price per BOE |

Operating Margin |

% Difference from HPK |

Operating Expense |

|

|

Devon Energy (DVN) |

$46.92/BOE |

$34.73/BOE |

(40%) |

$12.19/BOE |

|

Diamondback Energy (FANG) |

$54.37/BOE |

$43.86/BOE |

(24%) |

$10.51/BOE |

|

Pioneer Natural Resources (PXD) |

$52.13/BOE |

$40.55/BOE |

(29%) |

$11.58/BOE |

|

HighPeak Energy (HPK) |

$71.27/BOE |

$57.74/BOE |

N/A |

$13.53/BOE |

HPK has the best margins of the group by a healthy spread despite having the highest operating expenses. This margin gives the company the potential to be a major FCF generator as production beings to ramp beyond the breakeven point.

Production Growth

HPK’s high margins give it a substantial amount of security to confidently grow the business. While still placing an emphasis on capital discipline, HPK has added a third drilling rig to its operating program to bolster growth.

Jack Hightower, CEO of HighPeak Energy, provided the following projections for near term production during Q3’s conference call.

But undoubtedly, we’re going to hit the 57,000 barrel a day exit and then production will continue increasing into the first quarter. And of course, adding the third rig, and we may even add another rig once we get down to less than 0.75 debt-to-EBITDA, 3/4 of a turn. We can increase drilling, but we’re going to do that with very much adherence to capital discipline and not get out over our skis, so to speak.

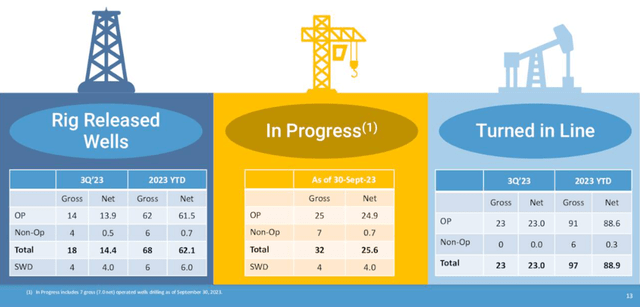

I believe HPK is extremely well positioned to exceed the guidance of 57,000 BOE/d in a very meaningful way. At the end of Q3, the company had 25 wells under development that had not yet been turned to sales. With only 225 wells currently in operation, this alone equates to an 11% expansion in producing wells.

Assuming a slight decrease in completion activity, the company should be able to turn at least 20 wells to sales in Q4. Assuming a conservative production rate of 400 BOE/d per well, this equates to an additional 8,000 BOE/d in production growth. HPK should comfortably exit Q4 at a production rate of over 60,000 BOE/day, which will bring with it significant free cash flow growth.

HPK Investor Presentation

Debt Impact

Debt has been the Achilles heel of HPK and one of the primary reasons for it being a member of the bottom five energy stocks in 2023. The company was able to work out a refinancing deal to preclude the payment of all debt that was due in 2024. As you would imagine, the terms of this loan are somewhat steep in our current interest rate environment.

Below are the three key points of the refinancing agreement.

1. Quarterly principal repayments of $30 million starting in Q1 of 2024.

2. Interest rates are set at 7.5% + SOFR. As of 1/4/24, SOFR was set at approximately 5.5%. Therefore, in the near term in cost of debt is 13%.

3. The company is restricted on the number of drilling rigs it is allowed to deploy based on leverage ratios.

- Two rigs are allowed if the leverage ratio is between 1.0x and 1.25x.

- Three rigs are allowed if leverage lowers to between 0.75x and 1.0x.

- There are no restrictions if the leverage ratio is less than 0.75x.

Oddly enough, despite having a rate of 13%, the new debt agreement is a net positive for HPK. In Q2, interest expenses cost $39 million. The new loan will cost approximately $37 million per quarter at the current interest rate, while also allowing the company to paydown portions of the debt through the quarterly principal payment. The small quarterly payments will allow HPK to reduce this expense over the next two and a half years.

HPK Investor Presentation

Free Cash Flow Analysis

Despite the achievement of becoming FCF positive in Q3, HighPeak must now focus on ensuring it has sufficient funds to absorb a $30 million principal payment each quarter while also funding a growth-oriented drilling program. In Q3, the company was able to generate $75.7 million. This is sufficient to fully fund CAPEX as well as payments on interest, taxes, and dividends as shown below.

| Q3 2023 | |

| EBITDAX | $266.2 million |

| CAPEX | ($161.2 million) |

| Interest Expense | ($37 million) |

| Tax Expense | ($14.1 million) |

| Dividend Expense | ($3.2 million) |

| Discretionary FCF Remaining | $50.7 million |

With an estimated Q4 production rate of 60,700 BOE/d, and an average WTI price of $78.57/barrel during the 4th quarter, I project EBITDAX to increase to approximately $300 million. At this production rate, HPK should generate $82.6 million in discretionary FCF.

This leaves adequate room for HPK to fund the quarterly $30 million principal payment. All told, the company projects to have sufficient funds available to retire another $320 million in debt by the end of 2024, or nearly 30% of its total debt.

Taking this near term pause to clean up the balance sheet is an important hurdle for HPK. Any investor considering a position in HPK is interested in increasing production to reap the benefits of this high margin producer. Due to the covenants of the new loan agreement, HPK cannot add a fourth rig until the leverage ratio is less than 0.75x. Paying down debt now, increases FCF through reduced financing costs and paves the way for growth as it enters 2025.

Valuation

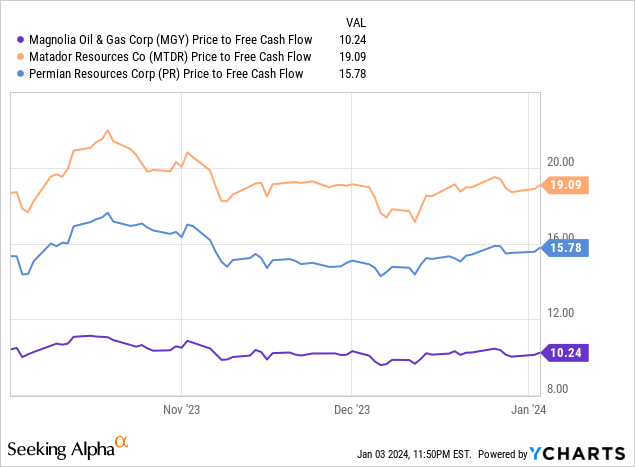

I chose Matador Resources (MTDR) and Magnolia Oil & Gas (MGY) as peers to provide some guard rails in the valuation process. Both companies are significantly larger than HPK but are still in the small cap category. MTDR is on a comparable high growth trajectory, projecting to grow production by 45% in 2023. MTDR trades for nearly 19x FCF. MGY is on the other end of the spectrum, emphasizing returning FCF to shareholders with a modest 12% growth rate since 2021. MGY trades at just over 10x FCF.

Due to HPK’s relatively high debt load, it should trade at a lower multiple than MTDR. Using forward looking FCF estimates and a modest 10x FCF multiple yields a share price of $15.92/share, slightly higher than today’s price of $15.21/share.

Using these metrics, HPK looks fairly valued at this time. It is worth noting that due to the high oil content of HPK’s production, the company has more upside compared to its peers. I rate HPK as a buy below $14.50/share.

Risks

Transitioning a small business from growth to positive free cash flow is a difficult task in any business. HighPeak finds itself at that inflection point and must now balance financial discipline with the need to continue to grow the business. Growing production is vital to continue to be more efficient and to drive free cash flow growth.

Debt management will remain as the key factor for HighPeak. Tapping into the company’s liquid rich rock to extract high margins is the ultimate goal. However, without fiscal discipline now, loan covenants will restrict HPK’s ability to add rigs and continue down the road of rapid production growth. How aggressive management is with debt reductions will ultimately determine the timing of adding additional rigs to the drilling program.

Paying down debt may not be the most exciting initiative, but at roughly 13% interest, the cost of doing nothing is high. I believe the most prudent action is for management to take a few quarters to improve the balance sheet prior to going back on the offensive.

Summary

HighPeak Energy has industry leading margins thanks to an extremely high oil cut. The company has heavily invested to grow production and has now become FCF positive after a slight pull back in activity. This pullback will allow the company to bolster the balance sheet in an effort to reduce debt expenses and improve its leverage ratio.

As the leverage ratio is reduced, covenants of the recent refinancing agreement will be met. This will remove any restrictions on additional rig deployment, paving the way for another high growth period.

I view HPK as fairly valued at a share price of $15.92 and rate it a hold at current prices. I also established a target entry point of $14.50/share. As debt levels are reduced, HPK should be set up for multiple expansion as production continues to climb and FCF grows.

HighPeak Energy has the potential to be a diamond in the rough. The high debt load and 13% interest rate associated with its loan are a blemish on the company. As the company allocates free cash flow to debt retirement, this blemish will be polished so HPK can shine.

Read the full article here