Hermès (OTCPK:HESAF) (OTCPK:HESAY) once again announced sector-best Q3-23 growth that exceeded expectations, yet even this luxury leader is starting to show signs of slowing down.

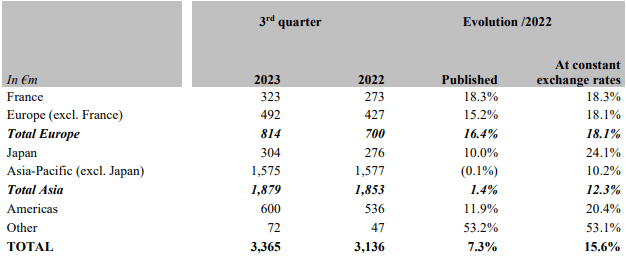

Revenues totaled €3.4B in the quarter, reflecting 7.3% reported growth, and 15.6% growth at constant exchange rates, a significant deceleration from the mid-twenties pace in the first half.

The company’s results demonstrate its differentiation as an ultra-luxury business but also remind us that a sharp recovery in aspirational consumer demand, when and if such a recovery occurs, won’t be as beneficial to Hermès compared to some of its peers.

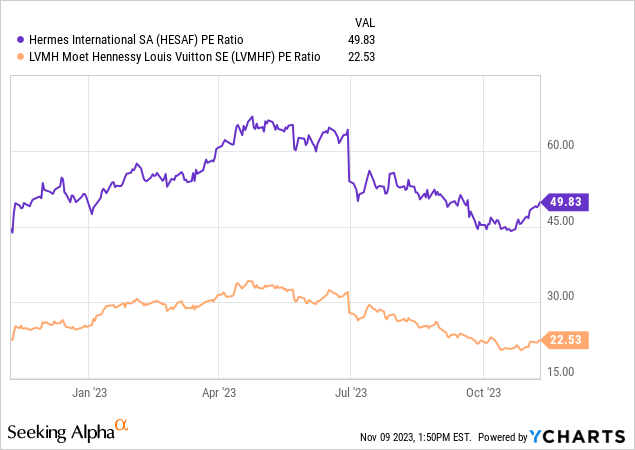

Even after the selloff, Hermès’ shares are still trading at high valuations relative to history, unlike LVMH (OTCPK:LVMHF) (OTCPK:LVMUY), which is trading at historically low multiples. Therefore, I reiterate Hermès as a Hold and LVMH as a Buy.

Introduction

It’s been a couple of months since I published my first article comparing Hermès with its closest rival in fashion luxury, LVMH. I claimed Hermès was valued at an ‘Unjustified Historically-High Premium Over LVMH‘, as it traded at a 100% premium over LVMH, compared to the historical 70%.

In the first half of 2023, we got to see the reason for the premium. Unlike LVMH, Hermès is deeply concentrated on the very high end of luxury. The majority of the company’s business caters to the extremely rich, the kind of customer who doesn’t care about a recession and isn’t sensitive to price increases.

However, as I wrote in my previous article, as the economic environment improves, I expect LVMH will outperform, primarily due to its higher exposure to aspirational consumers and other lines of business like wines and spirits, which are currently experiencing a tougher slowdown compared to fashion and leather goods.

In Q3-23, we got a chance to see the steadier environment case materialize. While Hermès continued to outperform, the gap did narrow. Let’s dive deeper.

Q3-23 Highlights

Hermès reported consolidated revenues of €3.4B, a 7.3% increase (15.6% c/c) from the prior year period. Based on its historical seasonality, the luxury house is on pace to deliver slightly more than 21.0% growth for the entire year.

Hermes Q3-23 Earnings Release

Growth at constant currency was above double digits in every geography, with Japan leading the way at 24.1%. The laggard was Asia Pacific, which includes China, reflecting the general disappointment in the sector from lower-than-expected recovery in Mainland China.

Hermes Q3-23 Earnings Release

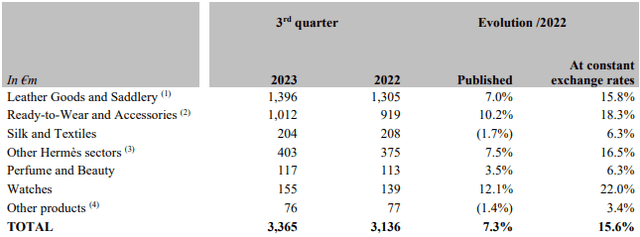

Looking at the product mix, growth was more fragmented, with watches the best performer, showcasing 22% growth. The core leather goods and ready-to-wear categories sustained a high-teens pace, whereas the less important categories in silk, and perfume grew at mid-single-digits.

Hermès Vs. LVMH

In my previous articles, I claimed that:

Covering most of the industry, you’ll pretty quickly realize that there’s Hermès, then there’s LVMH, and then there are others like Kering (OTCPK:PPRUY) and Richemont (OTCPK:CFRUY). While those others trade at significantly lower valuations, they are incomparable to the two royals of luxury, not in terms of growth, not in terms of margins, not in terms of future prospects, and not in terms of management quality.

And I can say that we got another confirmation in the first nine months of 2023. Hermès and LVMH grew revenues organically at an impressive double-digit pace, whereas supposed competitors like Kering saw revenue decline.

I think we can confirm that there are only two alternatives for an investor who wants to get exposure to the true advantages of investing in luxury fashion, and those are, as you can understand by now, Hermès and LVMH. The question that remains relevant is, which one is the better investment in light of their third-quarter results.

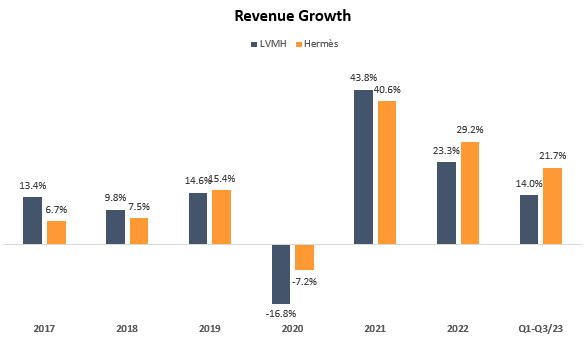

Created and calculated by the author using data from the companies’ financial reports; Growth at constant currency.

Looking at revenue growth, Hermès was only marginally higher with a 14.3% CAGR between 2016-2022, compared to LVMH’s 13.2%. However, the gap widened in the first nine months of 2023 as Hermès grew by 21.7% compared to LVMH’s 14.0%. It’s important to remember, however, that LVMH is more than 7x larger in terms of sales, so, in terms of absolute dollars, there’s no comparison here.

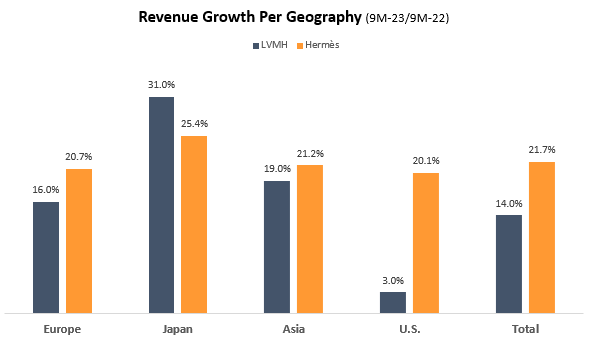

Created and calculated by the author using data from the companies’ financial reports; Growth at constant currency.

Digging into the specific geographies, we see a huge gap between Hermès and LVMH in the U.S., which is clearly one of the most important geographies in terms of profitability, although the geographic profitability gap for those luxury giants is not similar to what you’re used to seeing in other industries. Still, the U.S. is extremely important. And in the U.S., Hermès outgrew LVMH by 17.1 points.

Aside from the U.S., the gap is much smaller, with a 3.7 points outperformance in Europe, and an even smaller 2.2 beat in Asia (excluding Japan). Japan is the only outlier where LVMH surpassed Hermès by 5.6 points.

I don’t view Hermès’ higher growth as a devastation for LVMH. Rather, it is to be expected given the size and product mix differences.

Is Hermès’ Premium Justified?

In the past, Hermès has always traded for a significantly higher multiple than LVMH, with the former’s median multiple at 42.1 compared to the latter’s 24.7. So by their respective medians, Hermès was historically valued at a 70% premium. Today, the gap is much wider.

Looking at their GAAP P/Es today, Hermès is at 49.8 compared to LVMH at 22.5. Based on current consensus estimates for 2023, LVMH is trading at a P/E of 22.3 and Hermès is at 48.4.

So, Hermès is getting over a 115% premium compared to the historical 70% level. For the near term, Hermès should benefit from its concentrated customer and product mix, but in the near to mid-term, LVMH has a more significant recovery story, as the large aspirational customer cohort returns to shop, and the lagging wines and spirits category sees better inventory levels as well as easier comparisons.

Overall, I find it hard to justify Hermès’ historically high premium, as I expect that the quarters of peak outperformance in the sector are behind us. Naturally, Hermès will continue to outgrow LVMH, but to a lesser extent. As such, I remain in my opinion that LVMH is the better long-term buy at current levels.

Conclusion

Hermès is probably the most resilient company in luxury fashion, due to its limited exposure to aspirational customers, and high concentration on the ultra rich. At times of tougher economic environments, it provides the company with a significant advantage over LVMH.

Even in a more favorable economy, Hermès is projected to outgrow LVMH for the foreseeable future, even by the mere fact that it is significantly smaller.

However, the worst trough is seemingly behind us, as we’re slowly progressing towards a normalized growth period for the luxury sector. For LVMH, an attractive recovery story is at play, whereas Hermès is expected to continue to provide steady results, with no obvious catalyst for growth reacceleration.

Thus, I view the record high premium unjustified, rate Hermès a Hold, and reiterate a Buy for LVMH.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here