Investment Thesis

What truly sets Harrow (NASDAQ:HROW) apart isn’t its impressive 52% sales growth projection this year, or its prospects serving the healthcare needs of an aging population. The biotech industry is full of such stories. The most important aspect, in my view, is management – those folks who’d be looking after your money when/if you invest.

Mark Baum, HROW’s CEO, took the company from an OTC penny stock with so little cash, to a leader in the ophthalmic compounding drug market. His talent hasn’t gone unnoticed, winning him the Ernst & Young Entrepreneur of the Year award in 2017, six years after founding Harrow.

Baum summarized his journey in a Q1 2022 Letter to Shareholders stating:

We’ve evolved from a 2500 square foot pharmacy with no products or customers in 2014, to a national leader in US ophthalmic pharmaceuticals.

Now that HROW is flush with cash, liquidity, and access to capital markets, one can only imagine what they’ll do next, having done so much with so little.

Mark Baum’s down-to-earth communication skills and ability to motivate investors and employees alike are remarkable characteristics. He’s the kind of person who’d used the terms ‘Marketing-Ninja’ and ‘Compliance Ace’ to describe his executive team. His business-oriented language is refreshing, setting him apart from the technically heavy, jargon-full language during the earnings calls of HROW’s peers in the biotech sector.

The rise of Tesla (TSLA) shares on the back of Elon’s stardom shows how far connecting with stakeholders could impact the stock market. This is the case here, with the only difference being that HROW’s CEO, Mark Baum, is kinder, and simply a stand-up guy. Since before becoming financially well-off in the past decade, he’s always allocated time for those in need, being a trustee in multiple charities in the US.

His background coming from a working-class environment as the first in his family to obtain a college degree, has influenced HROW’s strategy, focusing on accessible healthcare, with HROW pricing its drugs much lower than peers. When pharma boy Martin Shkreli pioneered predatory pricing strategies, capitalizing on market vulnerabilities, Mr Baum quickly responded by rolling out alternative therapies at the same old prices, earning him the respect of the public. Two years later, he won the E&Y Entrepreneur of the Year award.

HROW’s value proposition extends beyond its charismatic CEO. The company offers exposure to three distinct business models

- A profitable compounding pharmacy focused on eyecare

- A fast-growing portfolio of FDA-approved drugs

- An incubator for biotech startups – one of which is now publicly traded

What these business models have in common is a focus on minimizing regulatory and commercial risk, focusing on de-risked assets such as low-cost compounding pharmaceuticals, FDA-approved drugs, and late-stage drug candidates with high commercial potential. Instead of letting a tech development platform dictate the company’s direction, as is the case for most biotechs, HROW buys drugs and drug candidates with the highest chances of commercial success.

Compounded Drug Segment

HROW sells its compounded drugs under the Imprimis brand. Its product catalog includes about 38 drugs almost exclusively focused on the ophthalmic (eye care) market. The portfolio offering changes frequently, as Harrow adjusts its portfolio according to demand, regulatory changes, and launch of new products.

Compounded drugs are custom-made chemical formulations composed of one or more FDA-approved ingredients, but they’re not themselves FDA-approved and don’t require FDA approval either.

There are two types of compounding pharmacy licenses; 503A and 503B.

503A can only produce custom-made drugs for individual patients on a per prescription basis. These facilities aren’t authorized to manufacture big batches or market their products to patients or physicians. Many hospitals have their own 503A operations. They require modest manufacturing capabilities, and given their small size and limited impact on population health if anything goes wrong, 503A compounding pharmacies aren’t subject to regular FDA manufacturing inspections, as they don’t have to adhere to the Current Good Manufacturing Practice ‘cGMP’ standards.

503B, on the other hand, is authorized to hold inventory and manufacture bulk batches, but 503B facilities are subject to rigorous FDA inspection.

Currently, HROW’s 503A and 503B facilities are located in one compound in New Jersey. The space is leased until 2027, and isn’t small, but not huge either, covering 38,153 square feet, roughly 1/2 the size of a soccer field.

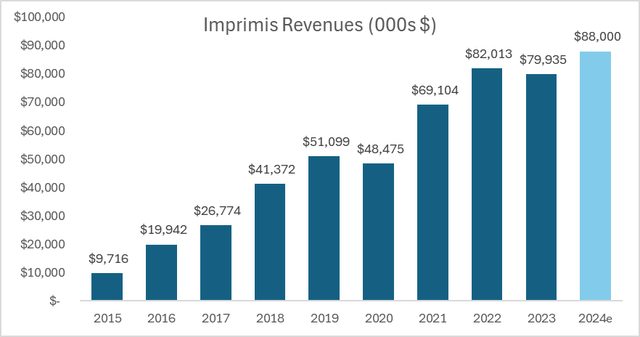

Last year, the company has been citing challenges in the compounded business, because of FDA inspections, which found deficiencies in how the New Jersey facility is managed. This led to disruptions and required sizable investments to rectify these issues. However, this year, management expects the Imprimis segment to grow 10% to $88 million, or 45% of total sales.

Author’s estimates based on HROW filings

Branded Products

In recent years, HROW started venturing into the branded FDA-approved drug market. These drugs command higher prices and margins, but on the other hand, require much more marketing expenses than compounded drugs.

While this step brings HROW closer to being a traditional biotech company, one should note the emphasis on low-risk assets and operations.

Instead of letting its tech capabilities dictate its direction, as is the case for most biotechs, HROW instead buys FDA-approved, or late-stage development drug candidates with strong commercial prospects that fit the company’s existing commercial apparatus.

Typically, HROW buys late-stage therapies with minimal exposure to the FDA regulatory requirements and relies on third-party Contract Research Organizations ‘CROs’ to continue the clinical trial process.

The company’s branded FDA-approved drug portfolio consists of 12 ophthalmic drugs, according to its latest earnings call presentation.

The market opportunity for these drugs is robust, as evident in the Wall Street’s 52% revenue growth forecast this year. Management believes that they could grow sales to $1 billion in the next five years, as noted in the Q2 2023 Letter to Shareholders.

IHEEZO is particularly important for HROW, constituting the first new ocular anesthetic approved in over a decade, creating unique excitement in the ophthalmic industry. Its market opportunity is enhanced by the 12 million eye surgeries and office intravitreal injections in the US annually, as noted in HROW’s Q2 23 Letter to Shareholders.

VEVYE capitalizes on what management sees as an underserved dry-eye disease market. It is unique in that it is water-free, which, according to HROW, creates exceptional comfort and increases adoption.

TRIESENCE targets about 600,000 vitrectomy surgeries. It has been on the market for some time but has suffered from supply chain issues under Novartis (NVS). HROW bought the drug as part of the Fab 5 Acquisition in early 2023, which included, in addition to TRIESENCE, VIGAMOX, ILEVRO, MAXIDEX, and NEVANAC. HROW bought these drugs for $130 million early in 2023.

Biotech Incubator

The de-risking commercial and regulatory approval process is at the center of HROW’s strategy. Any new drug ideas that the company’s medical chiefs come up with are vetted by third-party consultants before being packaged and securitized into a new company, with HROW contributing the patents and seed funding while raising capital and bringing independent leadership to move the drug forward.

Many of the drug ideas that are currently being developed at HROW’s subsidiaries are compounded drugs that are still sold by Imprimis. Management believes that for some of its compounded pharmaceuticals, it is best to seek FDA marketing authorization to make them widely available to the public. This strategy allows the company to leverage its compounded pharmacy expertise while pursuing a larger market audience via FDA marketing authorization.

While sale cannibalism risk exists, with new FDA-approved therapies developed by HROW’s subsidiaries potentially eating away some of Imprimis sales, this is offset by HROW’s royalty agreement with its biotech subsidiaries and their equity interest in these companies.

The company’s biotech incubator has yielded three independent companies

- Melt Pharmaceuticals (MELT): Develops non-opioid sedation products. HROW owns about 46% of Melt.

- Surface Ophthalmics: Focused on ocular surface diseases such as chronic dry eye, and pain following surgery. HROW owns 20% of the company

- Eton Pharmaceuticals (ETON): Focuses on rare diseases beyond the ophthalmic arena. HROW owns about 10% of Eton.

Financials and Valuation

HROW’s sales reached $49 million, up 40% in the six months ended June. As the newly launched products continue to ramp up, I think we should see accelerated growth in the second half of the year.

- IHEEZO: Launched in May 2023

- VEVYE: Launched January 2024

- TRIESENCE: Expected to recommence later this year, as the company, through its third-party partners, validates its manufacturing process to the FDA.

Gross margin continues to go up, as the company benefits from economies of scale. Gross margins in Q2 and Q1 2024 were 74% and 72% respectively, up from 70% and 69% in the same period of last year.

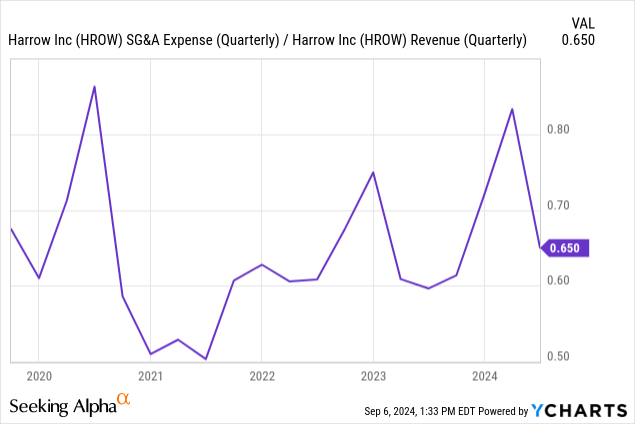

Profitability was impacted by a surge in SG&A expenses, as the company ramps up hiring in anticipation of increased growth. FDA inspections and warning letters regarding Imprimix also contributed to this increase. In Q2, 2024, we saw expenses easing a bit.

Next year, the company is expected to turn profitable, with Wall Street’s EPS consensus standing at 77 cents. This translates to a forward 25′ PE ratio of 50x, which isn’t exactly cheap. Still, with this level of growth, I think we should see shares continue to rise.

How I Might Be Wrong

One shouldn’t underestimate the risk of HROW’s new venture into the branded product market. It’s a different ball game than compounded pharma. Historically, HROW didn’t have to worry about establishing reimbursement pathways or adoption rates because its compounded products were sold on a cash basis, being not covered by insurance companies. That was okay because they weren’t expensive. Also, historically, the company didn’t need to worry about adoption because it had access to demand information from the Professional Compounding Center of America ‘PCCA’, according to HROW SEC filings. PCCA owns shares in Harrow. The marketing costs of compounded drugs are also lower than those of branded products. For the ophthalmic portfolio, the company only needed to spend on marketing its products to physicians. Its products were mostly generic, and spending on expensive consumer-targeted ads wasn’t necessary.

Branded products are a different story. The company will need to spend on direct-to-consumer ads to spur demand. Direct-to-consumer drug ads are common in the US, encouraging patients to request certain brands from physicians, regardless of medical necessity, or equivalence with generic formulations. This is important, given that HROW has the capacity and willingness to spend tens of millions on branded drugs.

Finally, while the market opportunity seems attractive, investors have very little view of the intricacies of competition in the drug market. That brings us to the main point here; management talent.

Summary

For those seeking a moderated risk to Harrow’s growth story, the company’s 2026 Notes (NASDAQ:HROWL) currently trade at $25.4. While this is above the redemption price of $25, this small loss is well compensated by the notes’ 8.5% annual yield. The 2027 notes (NASDAQ:HROWM) have an even higher yield of 11.4%. The short duration of these loans lessens the risk of material changes in the company’s circumstances. The company ended Q2 2024 with $185 million in debt (mostly HROWL and HROWM), weighed against $138 million in current assets (mostly cash and accounts receivables), and equally important, a fast-growing business expected to turn to profitability next year.

I’m bullish on HROW and its publicly traded notes. I think that its charismatic leader is a trustworthy steward of shareholder’s capital. The company enjoys multiple streams of revenue and tailwinds manifested in:

- Profitable compounding business, set to grow 10% this year.

- Equity and revenue royalty agreements with 3 de-consolidate subsidiaries, and counting

- Growing branded FDA-approved portfolio, benefiting from key product launches in the past few quarters.

Read the full article here