Overview

Real Estate Investment Trusts unlock the ability to gain exposure to an avenue of investments that wouldn’t typically be accessible through traditional means. I live in the suburbs, a short commute outside of NYC, and there isn’t exactly an abundance of farmlands around me. Gladstone Land (NASDAQ:LAND) is a REIT that makes it possible to gain exposure to its portfolio of farmlands across the USA. The company owns and operates different farms and farm related properties and then leases those properties to individual farmers. The company has a wide range of properties across the US.

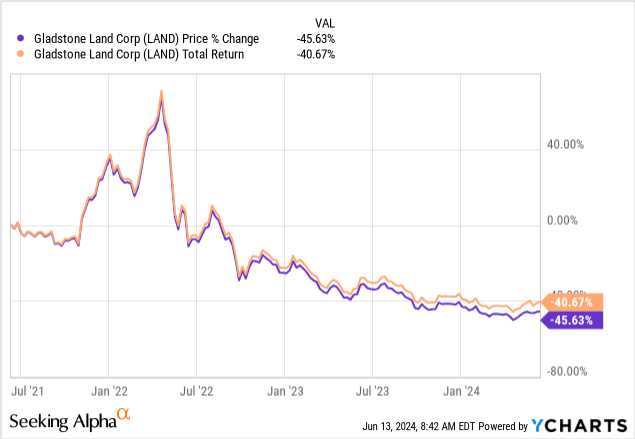

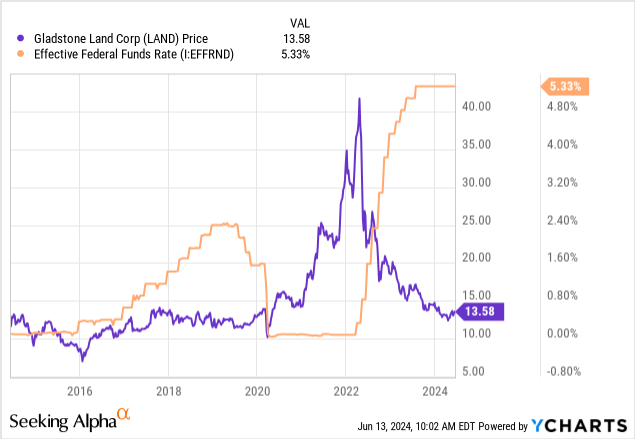

However, we can see that LAND has suffered a massive 45% price reduction over the last three-year period. There are a multitude of factors that have contributed to this, with interest rates being one of the main drivers of this loss. Despite the significant price movement downward, I believe this presents a great opportunity to get in while valuations are low. As macro conditions improve for the real estate sector as a whole, I believe LAND will ultimately recover and see its share price gain some upward momentum eventually.

One of the appealing factors of this REIT is that the current dividend yield sits at 4.15% and is paid out to shareholders on a monthly basis. This monthly cash flow may make this an appealing choice for investors looking to prioritize a bit of income. Even though the starting yield is low when compared to other REITs, LAND offers some consistency with over 9 years of consecutive raises in the dividend. Before digging into the valuation or income aspect, I wanted to start this off by first reviewing their portfolio of properties and methods of operation.

Portfolio & Strategy

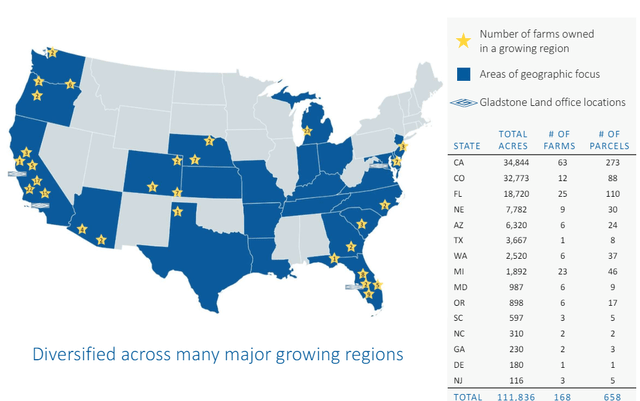

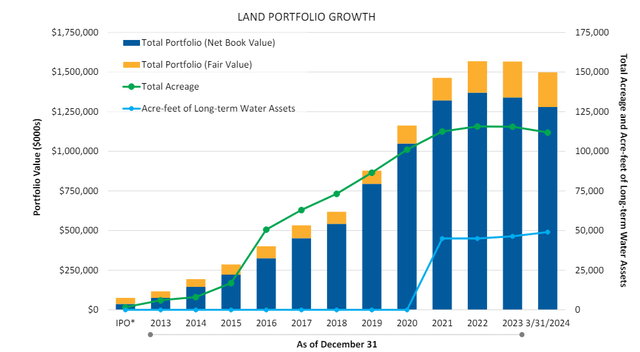

LAND owns approximately 168 farms which spans over 112,000 acres of land. Their portfolio of properties and land stretches out across 15 states while having a total value of about $1.5B. They buy these farmlands with the intent to grow health foods like veggies and fruits. Their main strategy is to lease out these properties and land on a triple net basis, which is one of the best approaches in my opinion.

A triple net lease strategy is great because this means that a lot more of the responsibility is transferred over to the tenant, which means that LAND has better profitability margins. For instance, a tenant may be responsible for paying property taxes, insurance, and any maintenance costs that may be associated with the land. This leaves LAND with a more steady and predictable stream of tenant income since they no longer have to worry about those costs which may vary month to month. Since a lot of these responsibilities are pushed off onto the tenant, LAND no longer has to account for upkeep costs and other typical operating costs.

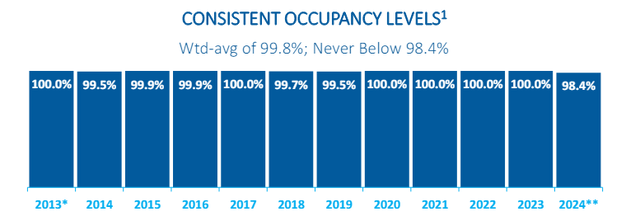

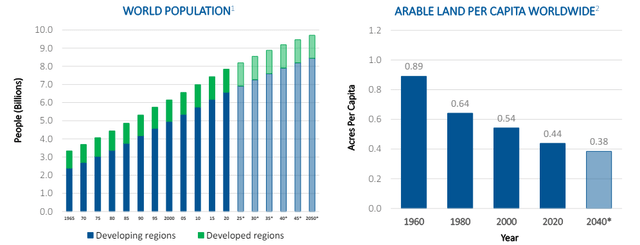

More impressively, their acreage is currently leased at a 99.4% occupancy level, meaning that almost all of their properties and land are generating some form of income from tenants. Data supports that the amount of farmland across the US continues to shrink. As this happens, this increases the value of the existing farmlands as they become a more valuable resource.

LAND Q1 Presentation

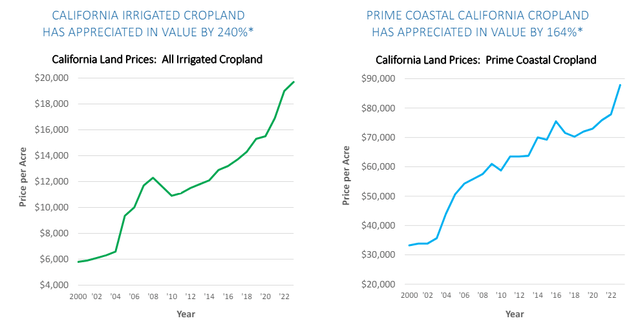

We can see that their portfolio is spread across the US, with California having the largest total acres and most number of farms. LAND is focused on areas of operations that can best support the growth of fruits and vegetables, as well as focusing on areas that have the potential for significant farmland appreciation. For instance, California has seen prices appreciate drastically over the last two decades, and they are looking to capture similar growth in other areas of their portfolio through their intensive underwriting process of properties.

LAND Q1 Presentation

LAND analyzes each potential farmland property by first ensuring that it sits in an active rental market that makes sense. They run water and well testing to ensure that it would be a good fit for growing crops, and even run soil tests to determine the quality. When a potential tenant arises, they perform underwriting for their operations to investigate the tenants’ ability to successfully sell crops and evaluate their financial standing to see the probability of that tenant falling into a default. I mention all of these aspects of LAND’s strategy because I believe that the recent weakness in price is a reflection of external factors in the market, rather than any fundamental weaknesses of LAND’s operations.

Financials & Increasing Vulnerabilities

LAND reported their Q1 earnings at the beginning of May and the results were a bit mixed. Revenue experienced a year-over-year decline of 4.5%, totaling $20.25M for the quarter. FFO (funds from operations) landed at $0.167 per share, beating estimates by $0.02. A lot of the recent price decline can be attributed to decreases in this operating revenue, which has fallen from $21.2M in the prior year’s Q1 and $24.4M in Q4 of 2023.

We can see that the growth of the portfolio has plateaued in 2022 and coincidentally, this aligns with the start of the rapid hiking of interest rates. Similarly, we can see that total acreage fell slightly from its all-time high in 2022. Interest rates have had a major impact on real estate as a whole, but even deeper than this, it has made it very difficult for farmers to remain profitable as profit margins are tight due to the combination of lower demands for goods and higher costs of goods.

LAND Q1 Presentation

Over the last earnings call, we received the following insights into tenants that have reached non-accrual status, as well as information regarding the vacant properties that LAND currently has.

Regarding the vacant and farms that are operating farms, we are in discussions with various potential buyers or tenants to buy or lease these properties. And I think we will have a lot of this done during the next 6 months. So I am hopeful that when we report to you in July that we fixed a lot of that. There are two tenants on non-accrual status. One of them is now current on their rental payments to us and we are continuing to work with a collection of other tenants. On a total year-over-year impact on our operating results, these tenants issued decreased our net operating income by about $750,000 for the first quarter. – David Gladstone, Chief Executive Officer

We can see that the history occupancy rate sits at the lower level it ever has over the last decade. While an occupancy rate of 98.4% is still really solid, it should be seen as a reflection of the challenging times for tenants. As mentioned, interest rates play a big role here, as it increases the cost of capital and slows growth.

LAND Q1 Presentation

To offset this, LAND has accumulated lots of cash and sits on a strong liquidity factor. Cash and cash equivalents are now at a decade high, totaling $51.6M. For reference, the typical cash and equivalents total has historically set at less than $20M. Long-term debt amounts to approximately $612M, which has consistently been on the decline since 2020, which is a great indicator that LAND is trying to reduce the current debt burden. This excess of cash on hand can be used to navigate current and future headwinds, but can also be used to further reduce the debt burden.

It would be wise to eliminate any unnecessary debt during these higher interest rate times as well. Higher interest rates increase the cost of borrowing funds to fuel expansion, acquisitions, or operational efficiencies. Similarly, higher rates can reduce property values since it can lead to higher capitalization rates. We can actually see the direct reaction of LAND’s price to the interest rate changes. As interest rates were cut to near zero levels in 2020, we can see how the price skyrocketed to all-time highs. Conversely, when rates were rapidly increased to their decade highs starting in 2022, we saw the price of LAND slide to the downside and only recently stabilized.

Since LAND remains sensitive to rate changes, we may see LAND’s price remain suppressed for the remainder of the year. As of the Fed’s latest meeting, they have decided to leave rates unchanged and now forecast only one rate cut happening by the end of 2024. The consensus seems to be that they are awaiting more economic data to roll in around inflation, the labor market, and consumer spending.

Dividend

As of the latest declared monthly dividend of $0.0466 per share, the current dividend yield sits at 4.15%. While LAND has provided about 9 years’ worth of consecutive growth of the dividend, the growth has been very weak. Therefore, I’ll say upfront that if you’re looking for a REIT with some strong and consistent dividend growth, you’ll have to look elsewhere. As previously mentioned, FFO per share amounted to $0.167 as of the last quarter earnings report. This equates to a payout ratio of about 83%, which is a typical range for REITs, so there are no worries here at the moment, although I would love to eventually see a larger safety cushion.

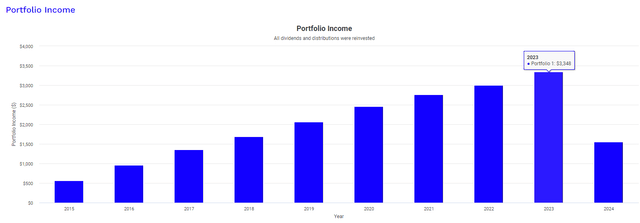

Unfortunately, the dividend has only increased at a CAGR (compound annual growth rate) of 1.09% over the last three years. On a five-year time frame, this is even weaker, with the dividend increasing at a CAGR of 0.87%. Despite the lack of dividend growth, you may be able to create your own income growth through reinvestment of any distributions received, combined with a long term holding outlook. To demonstrate this, we can reference the below chart made by Portfolio Visualizer.

Portfolio Visualizer

This visual assumes an initial investment of $10,000 in 2015, as well as a fixed monthly contribution of $500 per month throughout the entire holding period. This also assumes that all dividends were reinvested back into LAND to accumulate more shares. In 2015, your dividend income would have only totaled $567 annually. Fast forwarding to 2023, the total amount of dividend income received would have grown to $3,348, while your position size would now be valued above $92,000.

This is a great example of how consistency of reinvestments and a long-term holding period can still create higher levels of dividend income growth, despite the actual dividend raises lacking in size.

Valuation & Risk

We saw shares of LAND cross the $40 mark at its peak in 2022, which was likely due to the near-zero interest rate environment that encouraged and fueled growth. However, the price to now come back down to its pre-pandemic levels since then as we sit at interest rate highs. I get a bit of a mixed outlook here on valuation because from traditional standards, LAND may still seem a bit overvalued. For example, LAND’s price to AFFO ratio sits at 23.06x, much higher than the sector median price to AFFO ratio of 14.81x.

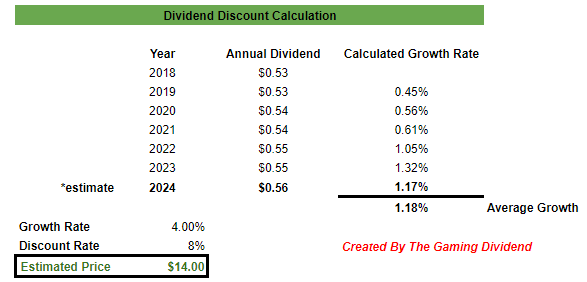

Conversely, Wall St. has an average price target of $15.20 per share. This represents a potential upside of about 12% from the current price level. I decided to conduct my own dividend discount model to get another source of reference. I started by compiling the annual payout amounts of the dividend dating back to 2018. I also estimated the full-year payout for 2024 to amount to $0.56 per share, since this would equate to a 1% raise, which aligns to prior years. Lastly, I input an estimated growth rate of 4% since year over year AFFO growth averages 4.2%.

Author Created

These inputs bring me to an estimated fair price value of $14 per share. This would represent a very modest upside of about 3.3%. Therefore, I feel that LAND trades at a near fair value at the moment. However, I would understand accumulating shares here if you believe that the market can only improve from here. The market opportunity for which LAND’s properties operate within is huge.

For instance, fresh produce has a total market value of $119.9B and as the population increases, the need for this will likely continue to grow over the next decade. Data forecasts suggest that the fresh produce market is likely to grow at a CAGR of approximately 7% through the end of 2028. As the population continues to increase, so will the demand for the fresh produce and goods produced on farms.

LAND Q1 Presentation

Aside from interest rate vulnerabilities, there are some risks down the pipeline for LAND. For instance, they have five individual leases at will expire within the next six months. These leases make up approximately 9% of LAND’s total lease revenue. This has the chance to further increase vacancies, which in turn lower the total revenue received as there are a lesser amount of paying tenants to collect from. Also, LAND management hasn’t really provided many insights into the details surrounded the non-accruals, but with interest rates higher, we may see this number tick up.

If we see an increase in defaults for tenants, we may see AFFO per share get impacted over the course of the year. If LAND isn’t able to effectively grow their portfolio or replace these troubled tenants, there’s a possibility that the price continues to deteriorate to the downside.

LAND Q1 Presentation

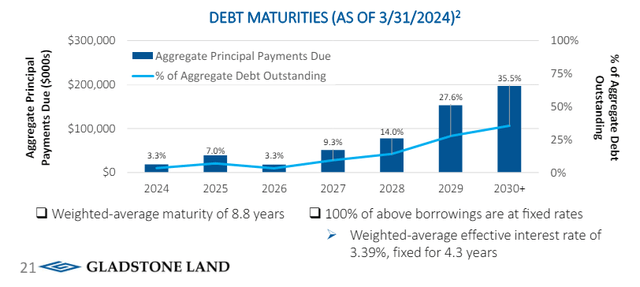

Additionally, LAND has some debt maturities approaching for the remainder of 2024, as well as over the course of 2025. According to the last earnings call, maturities over the next 12 months are expected to be $35M.

Takeaway

While LAND has a solid portfolio of farmland properties, the conditions of the sector remains challenging. With interest rates having a clear impact on the value creation here, we may see LAND trade sideways or even deteriorate further until the Fed starts to cut interest rates. Their occupancy levels have slightly dropped, but still remain above 98%. However, from a valuation perspective, the price seems to be trading near fair value, and I’d rather wait for conditions to improve before considering a position. Additionally, the lack of any meaningful dividend growth is something to consider for investors who may be seeking a higher yield or better growth. Therefore, I am rating LAND as a Hold for now.

Read the full article here