Investment Rundown

Back in early July, I covered Generac Holdings Inc (NYSE:GNRC) for the first time and the stock price has decreased by a little over 20% since then. I still think the business is somewhat interesting, enough to not make it a sell atleast. But I am still quite neutral on the growth prospects of the business, atleast for the short term. The last quarter showcased some difficulties as the sales declined by 21% to $1 billion for the quarter.

The price still indicates a premium based on metrics like p/s and p/b. With GNRC I want to get a decent discount rate atleast given that the FCF is still quite inconsistent, and the margins have taken a hit lately. The rising interest expense for the business has been a big culprit for the lower EPS this quarter compared to the last one. I tend to think that the interest rates will continue to be at a higher rate like this for a longer time, likely to the second half of 2024 least before eventually starting to decrease. That will put a lot of pressure on the earnings for GNRC. But once the rates decrease, I think the market will rally and the share price for GNRC along with it, is a large reason for the hold rating I still have for them, which I am reiterating now.

Company Segments

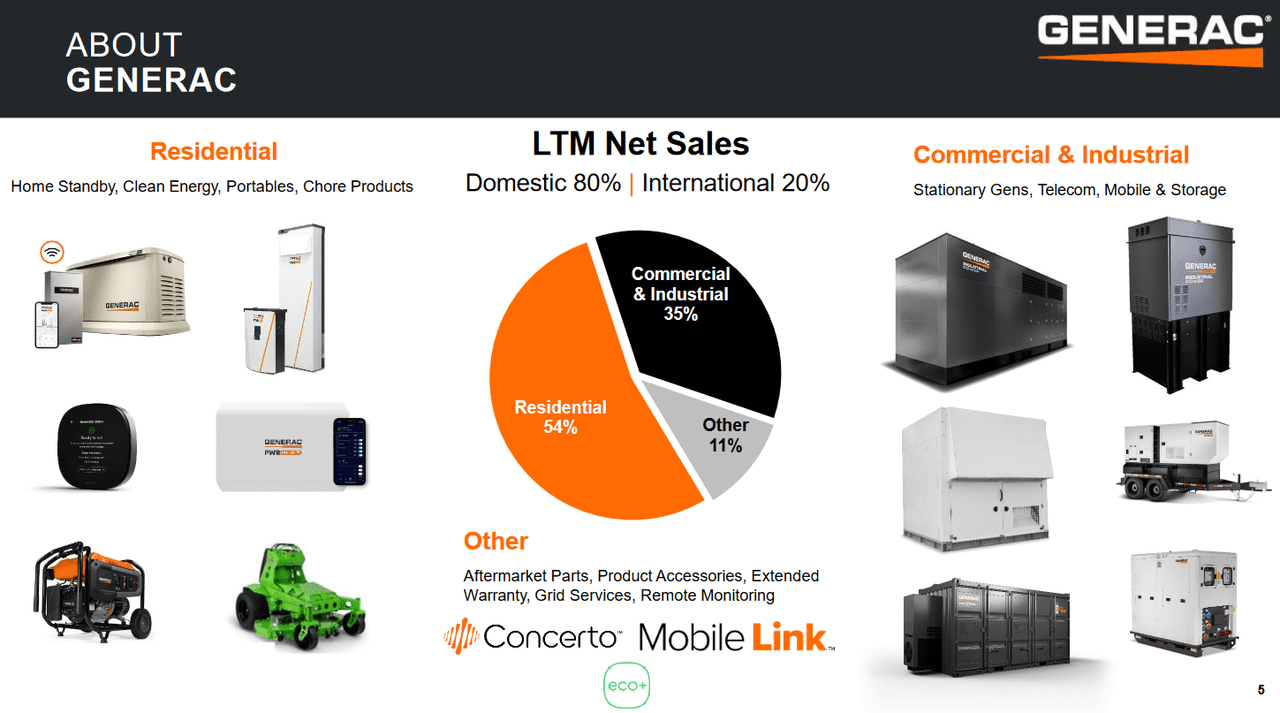

GNRC primarily operates within the realms of power generation equipment, energy storage systems, and energy management devices, with a substantial focus on both residential and commercial sectors. Notably, the residential segment accounts for a significant portion of their sales, comprising approximately 54% of their overall revenue. This dual-sector approach allows GNRC to diversify its revenue streams and cater to a broader customer base, enhancing its market resilience and adaptability to changing industry dynamics.

Investor Presentation

What has to be said though about GNRC is the impressive track record of growth they have had since their IPO back in 2010. The top line has grown by 16% annually since then and could perhaps be a reason for the premium the company is receiving right now. Some of the growth drivers for the company have been stronger natural gas generator sales and the solar and energy storage market growing very quickly. The energy storage market for example alone is expected to showcase an 8.4% CAGR from now until 2030 at least.

Investor Presentation

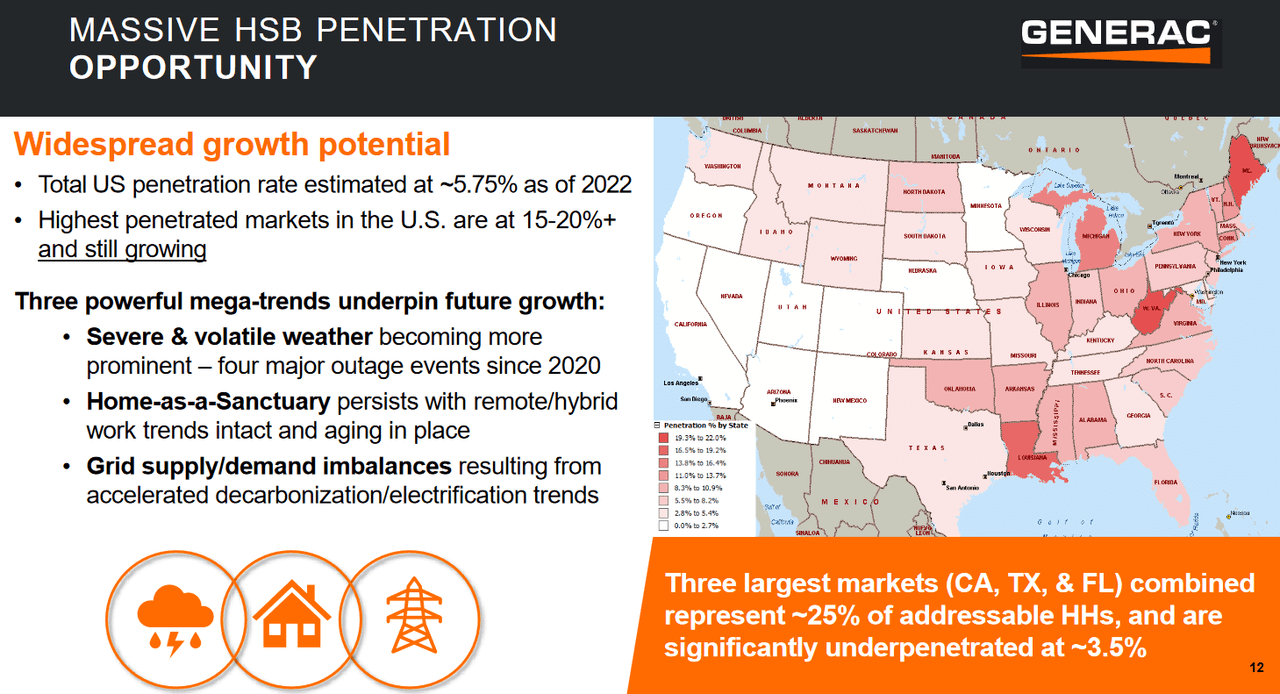

In the years of operations, GNRC has managed to position itself very well I think to benefit from several megatrends and still finds itself with a large market opportunity at hand. The three largest markets CA, TX, and FL have shown significant underpenetration at just 3.5%. If GNRC can efficiently tap into this, then I think that could drive significant growth for the business. With severe weather conditions being more and more common across the US, the necessity of some of the products that GNRC makes becomes ever so greater. Besides that, the electric grid in the US also showcases some imbalances in certain areas, which is further aiding the necessity of the services and products of GNRC.

Earnings Highlights

As I said at the beginning part of the article, the latest earnings report did not impress the market, and following the release of it the share price dropped a fair bit, from $153 to $115. It has since not been able to recover, but looking deeper at the report, I think I can see some pretty glaring issues that GNRC needs to attend to if it wants to look more appealing as a growth opportunity and business. For instance, the company has an inconsistent bottom line that is putting pressure on the margin retention and reliability of it being above the positive line.

Investor Presentation

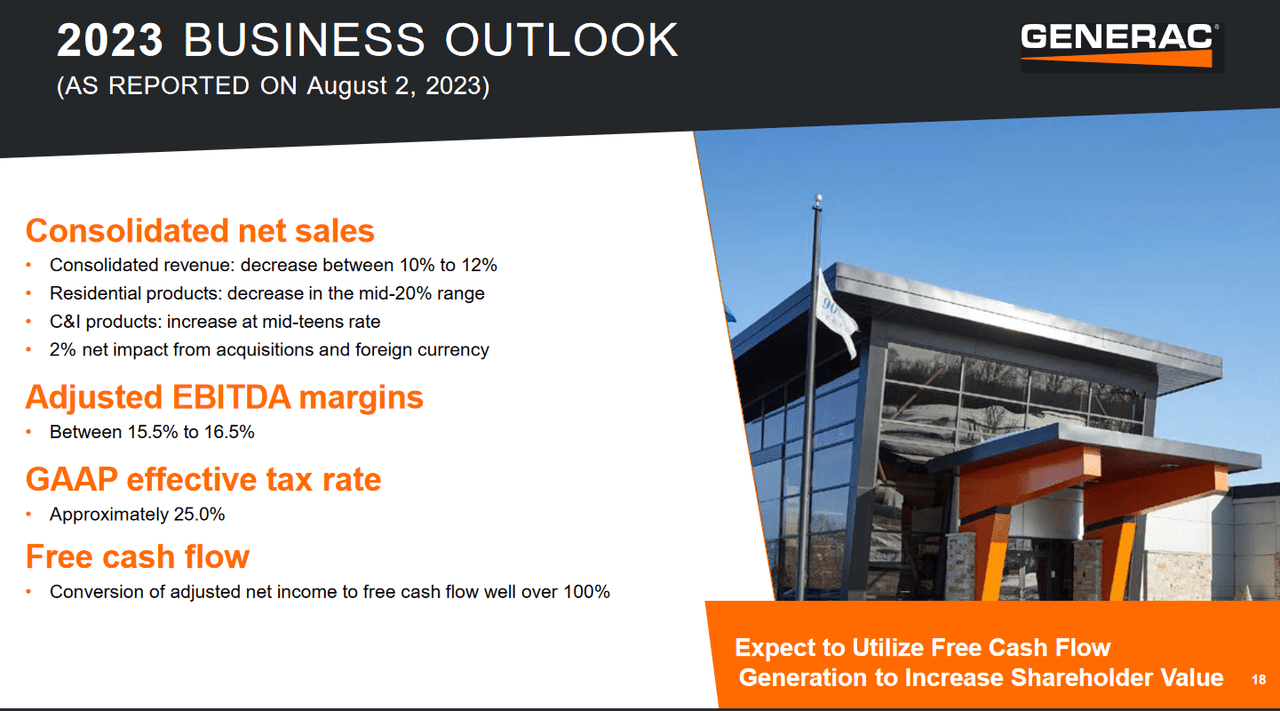

As for the remaining part of 2023, GNRC continues to expect some difficulties though, as the sales are expected to decrease between 10 – 12% and the residential products decrease in the mid-20 %. This seems to come from the heightened interest rates, which are making the spending of Americans more constrained. My views on the interest rates are that it won’t be at these rates for more than the better half of 2024. Then we should have lower as inflation is shown to be less sticky and that could potentially rally the demand for GNRC. I also don’t find it impossible we see the share price decrease for GNRC in the short-term, and a p/e of around 16 – 18 might even be possible. At those levels, I would consider the discount to the sector adequate to make for a buy rating.

Valuation

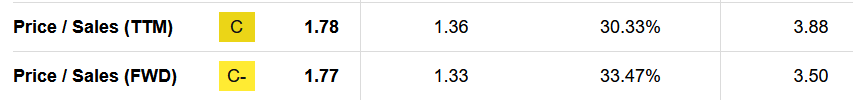

One of the foremost concerns associated with GNRC at present is the decline in sales, which raises questions about the current valuation and its attractiveness as an investment. With shares trading well below its 5-year average price-to-sales ratio of 3.5, the current price of 1.9 times sales may still appear relatively high. This becomes particularly pertinent when considering the mixed performance witnessed in the first quarter. The company’s ability to reverse this sales trend and demonstrate consistent growth will likely play a crucial role in shaping its investment appeal. I think its worth highlighting this because GNRC is expecting to show declines in their revenues and that makes the p/s look even more expensive and further adds risks to investors should a broader market correction occur, which could send share prices down significantly.

Seeking Alpha

Compared to a peer like Atkore Inc. (ATKR) I think that GNRC looks quite expensive still. The company exhibits a higher p/s multiple, and certainly a higher p/e as well, seeing as ATKR has an earnings multiple of just 7.4. Furthermore, ATKR has far better profit margins too with the EBITDA margin for instance being over 30%, and beating out the 5-year average for the business as well which is 23%. Based on this, I find ATKR to exhibit better potential right now than GNRC does, and that ties into my hold rating for the company.

Risks

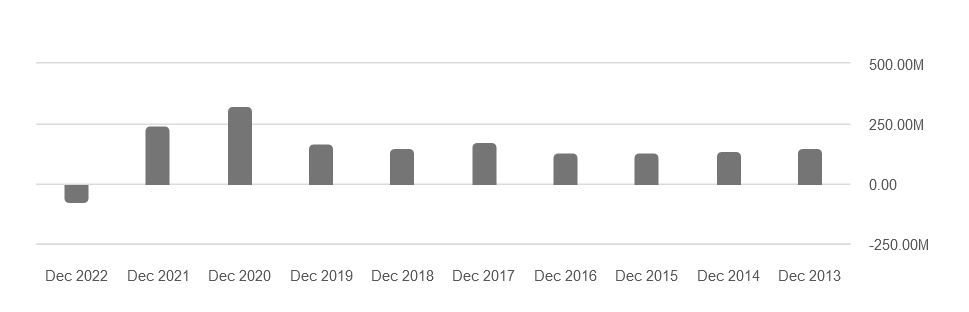

It’s worth highlighting the negative cash flows that GNRC has experienced, which adds another layer of complexity to the investment outlook. While the company enjoyed strong performance in 2020 and 2021, 2022 saw a substantial plunge into the negative territory, amounting to $77 million.

Net Income (Seeking Alpha)

Such inconsistency can indeed make it challenging to assess the true value of the business. However, there is potential for improvement if GNRC can enhance its backlog, leading to more consistent positive cash flow results. This improvement could help justify the current valuation multiples. The outlook for 2023 suggests that the adjusted net income conversion to free cash flows is expected to be significantly above 100%, which could provide a more stable financial foundation for the company.

Final Words

I am standing by my hold rating for GNRC, even though the share price has shrunk a fair bit since my last coverage of the business. The company showcased some difficulties in the last quarter like decreasing sales. The heightened interest rates are also weighing on the bottom line as GNRC is forced to pay higher interest expenses. With a growing position of debt, the company is likely to see suppressed EPS for the short term, which could open up better buying opportunities down the line. For the moment, I remain quite neutral on GNRC and will be sticking with my initial hold rating of the business.

Read the full article here