Introduction

When an investor thinks about real estate in Nevada, especially on the Las Vegas Strip, VICI Properties Inc. (VICI) is often the name that comes to mind. The REIT is very popular here on Seeking Alpha, and I’m a big fan of the company myself. I’ve published a few articles on the stock, and they are actually my largest holding in the sector, Vanguard Real Estate Index Fund ETF Shares (VNQ).

But one REIT that has been on my radar for quite some time is Gaming and Leisure Properties, Inc. (NASDAQ:GLPI). Unlike the former, the majority of GLPI’s properties are not concentrated on the Las Vegas Strip. But they have been making some moves into the city which I think are impressive and will benefit them in the long term. In this article, I discuss why GLPI may be a REIT you want to consider for your portfolio in 2024 and beyond.

Previous Thesis

I last covered Gaming and Leasing Properties back in September in an article, “Get A Smaller Piece Of Vegas With Gaming and Leisure Properties” you can read here. The REIT had entered into an agreement with the Oakland Athletics to bring the team to Las Vegas which I think will provide sustainable growth for the company. Unlike VICI who owns some of the more popular, iconic properties like Mandalay Bay, MGM Grand, and Caesar’s Palace, GLPI owns the land occupied by the smaller, lesser-known Tropicana.

In May of last year, the REIT entered into a ground lease with the MLB team to site their new ballpark on part of their Tropicana property. This increased rental income by $2.6 million for the REIT, allowing management to raise its full-year FFO guidance. Bally’s Corporation (BALY) owns the building while GLPI owns the land that the hotel sits on. For those unfamiliar with ground leases, these provide more stable, predictable income as these leases are typically for a longer duration, usually 50 years or more.

Finding Accretion

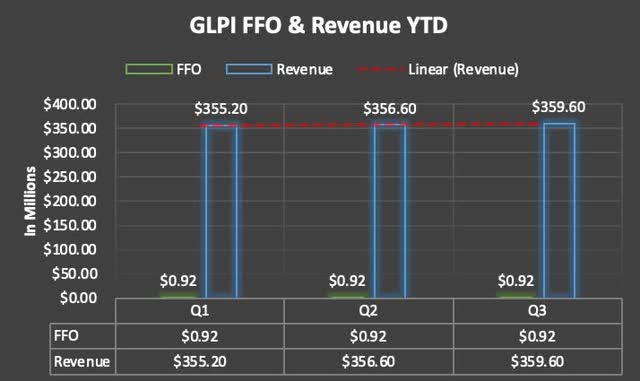

Since my last article, GLPI went on to report Q3 earnings back in October and continued to show its financial resilience. GLPI is a REIT that isn’t going to blow you away with a huge beat, but they do help you sleep well knowing their earnings are steady. FFO of $0.92 was flat quarter-over-quarter. However, revenue increased from $356.6 million to $359.9 million in the same period.

Author creation

Watching and researching over the past few years, GLPI has been very conservative and thoughtful in their investment approach. Given the economic backdrop where funding costs are up, and attractive spreads are harder to come by, management has maintained a disciplined approach to finding investments accretive for the business.

During the quarter the REIT entered into a ground lease with Hard Rock Casino in Illinois at an 8.0% cap rate and a whopping 99 years! Furthermore, they added three additional properties to bring their total to 61, up from 59 in Q2. This drove an increase in cash flow income of roughly $12 million.

The Las Vegas land lease increased cash rental income by $2.5 million while the other two properties increased income by $700k & $900k respectively. Year-to-date GLPI’s AFFO has increased more than 7% from $924 million for 2022 to $989 million currently. Furthermore, management raised guidance to $3.68 to $3.69, up from $3.66 to $3.68. So, although GLPI is overshadowed by peer VICI, the REIT continues to perform well despite the challenging environment.

Room For Dividend Growth

With a payout of $0.73 currently, GLPI’s dividend is well-covered at 79%. If earnings come in on the lower-end of guidance, this would give the company roughly the same payout for the full-year. This is also in line with VICI’s current payout ratio of nearly 77%. Additionally, GLPI paid a special dividend of $0.25 early last year. This is something the REIT does occasionally. They also rewarded shareholders with a special dividend at the end of 2021.

Additionally, the REIT has grown its AFFO at a CAGR of 7.8% in the past 6 years while their dividend has grown nearly 16% from $0.63 to the current. With a total expected payout of $3.15 including the special dividend, the payout ratio of nearly 86% would still be safe considering REITs typically pay out 90% of their earnings to shareholders.

Deleveraging

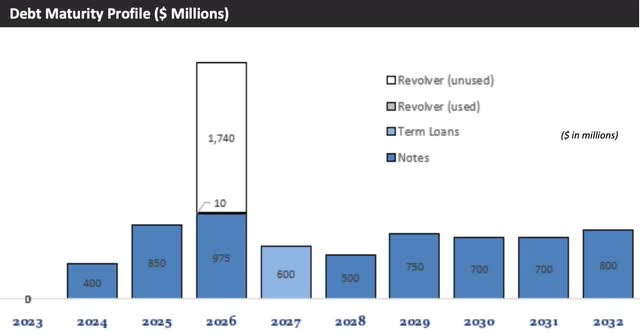

Besides the challenging economic backdrop because of high interest rates, GLPI not only increased their liquidity by $100 million to $1.8 billion, they also managed to lower their net-debt-to EBITDA to 4.7x, down from just under 5.0x in Q2. The way the company has been increasing its size with acquisitions and deleveraging, I wouldn’t be surprised if they received an upgrade to BBB or higher in the near future.

Furthermore, they have only $400 million in debt maturing this September and double that in 2025. But as seen by their increased liquidity and staggered debt profile, this is not something that should concern investors. Management has the option to pay this off with available cash if need be with their ample liquidity. Plus, I also expect interest rates to be on the decline by then.

GLPI investor presentation

Is It A Buy, Hold, Or Sell?

Right now I think the REIT is fairly valued. The stock touched roughly $44 this past October, not a huge drop from the current price of $46.93 at the time of writing. I think this shows Mr. Market knows the quality of GLPI. Especially when popular peers in the sector declined further, although they have since recovered somewhat.

With a forward P/AFFO ratio of less than 13x and below the sector median, it still trades in line with its 5-year average of roughly 13x. Furthermore, GLPI was listed by Morgan Stanley (MS) as one of the top stocks with high cash flow and EPS growth.

Seeking Alpha

They also offer some nice double-digit upside to its price target of $53.37. If interest rates are indeed cut 3 times, as predicted by some, I wouldn’t be surprised if GLPI’s share price moved closer to their high price target of $61 a share. To quote Warren Buffett: It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price. I think GLPI is a strong company in a growing industry, and the current price is good enough to dollar-cost average into while adding on any share price weakness.

Potential Catalysts/Risks

One catalyst I think will benefit the REIT positively for the foreseeable future is the move into Vegas. Being a huge attraction for tourists and one of the most well-known destinations in the world, GLPI is in a great position. In the coming years, I expect more professional sports teams to move into the city as well as other attractions and events.

And when the A’s are not in season, other companies will likely pay to use their land when it’s not occupied. Additionally, the upcoming Super Bowl LVIII is scheduled to be held next month in the city which will see an influx of tourists there as well.

The REIT also has ample room for expansion into other states. If an attractive opportunity arises, they have the option of entering into agreements outside the hotel & casino space, similar to VICI Properties with their moves with Bowlero Corp. (BOWL) and Canyon Ranch. Although, I suspect that this won’t happen for quite some time.

Their CEO reinforced this during Q3 earnings:

We look at everything, we’ve looked at bowling. I mean, I’m being very direct. And this decided particular transaction just didn’t fit what we’re looking for.

Look, I think the best answer is we’ll continue to look. So long as we can find the kind of transactions that we’re finding in the gaming sphere, and you’ve seen a couple right in front of you that we’ve presented today, we’re going to stick with that. It’s what we do. It’s what we do best.

I’ve always said someday, maybe we will be someplace else. But we’re not in a hurry to jump into bowling or frankly, anything else, unless it makes terrific sense that we could sit here with a straight face and say, this is a fat, fat deal, solid, solid, solid.

A risk for GLPI is if the economy enters into a recession. The casino is a business that relies heavily on consumer spending, so a downturn would likely cause a decline in revenues. With job losses likely to rise in a recession, this could cause consumers to be more selective with their spending. If so, GLPI’s properties would see a slowdown in foot traffic, therefore impacting revenues.

Furthermore, casinos are also subject to a lot of extensive rules & regulations, so compliance is always a significant issue. Another risk I could see for the REIT is the growth in artificial intelligence and other rapidly evolving technologies. With this, GLPI may have to allocate more capital for updates in their cybersecurity and theft protection.

Bottom Line

Gaming and Leisure Properties is a lesser-known REIT in the sector but has been focused on growing its portfolio with accretive acquisitions. They’ve also been adding additional ground leases to their portfolio with the earlier deal in conjunction with Bally’s Corporation (BALY), and a ground lease with Hard Rock Casino in Illinois for 99 years. This is longer than the one they signed with BALY last year for 50 years, and this provides the company with a stable, steady income for many years to come. With the move into Las Vegas, GLPI is also likely to benefit from the projected growth of the city in the coming years.

Furthermore, the company also has ample room for expansion and options to move into other spaces like their peer VICI has been doing recently, although I don’t see management doing this for quite some time. They’ve also managed to deleverage their balance sheet while increasing liquidity, making them well-prepared for an expected downturn. Because of their upside potential to their price target, and rates expected to decline sometime this year, I think the stock remains a buy.

Read the full article here