FS KKR Capital Corp. (NYSE:FSK) reported a higher-than-anticipated increase in the non-accrual ratio in the December quarter, leading me to modify my stock classification from Buy to Hold.

In the quarter ending March 31, 2024, FS KKR Capital benefited from a QoQ improvement in the non-accrual ratio, meaning its credit quality improved, but the BDC continues to have a narrow margin of dividend safety.

FS KKR Capital, however, profited from growing demand for loans in 1Q24 and the stock is selling for a 16% discount to net asset value.

Though I don’t anticipate a full re-rating to transpire in the near-future, I think that FS KKR Capital’s 14% yield is a solid ‘Hold’.

Portfolio Composition And Non-Accrual Situation

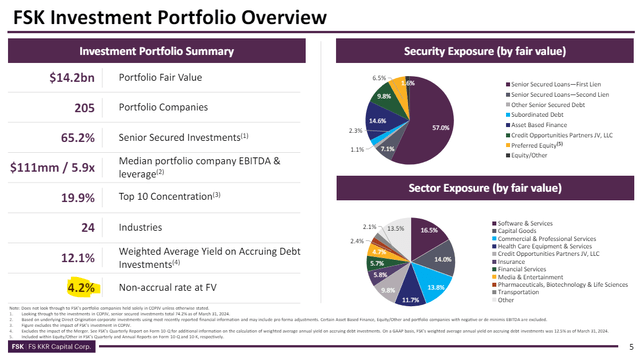

FS KKR Capital suffered a deterioration in its non-accrual ratio in the quarter ending December 31, 2024 which caused me modify my stock classification for the business development company. In the last quarter, FS KKR Capital’s non-accrual ratio fell to 4.2% in 1Q24, down from 5.5% in 4Q23, but it remains nonetheless quite elevated. Most BDCs that I reviewed lately have non-accrual ratios between 1-2% which I would consider to be normal.

FS KKR Capital’s credit issues are probably the primary reason why the BDC’s stock is selling at such a big discount to net asset value.

As far as the BDC’s portfolio composition is concerned, FS KKR Capital remained heavily exposed to Senior Secured First and Second Liens in the first quarter. The company’s total portfolio value, as of March 31, 2024, was $14.2 billion which makes FSK one of the largest business development companies in the industry.

FSK Investment Portfolio Overview (FS KKR Capital Corp)

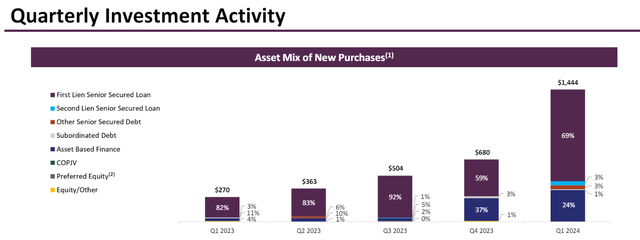

One development that caught my attention was that the BDC enjoyed a positive origination upswing in the last quarter, a trend that started back in the first quarter of 2023. This trend escalated in 1Q24, probably because companies now understand that the central bank is unlikely to continue to hike short-term interest rates in a low-inflation environment. This in turn is boosting demand for capital that business development companies such as FSK tend to provide.

In the first quarter, FS KKR Capital made a total of $1.44 billion in new investments, mainly First Liens (69%). Due to $1.86 billion in loan repayments, FS KKR Capital’s portfolio value nonetheless dropped by $400 million QoQ.

Quarterly Investment Activity (FS KKR Capital Corp)

FS KKR Capital makes the majority of its money from lending debt capital to middle market companies and charging interest for it. The company’s net investment income fell 7% YoY to $212 million in 1Q24, primarily because of lower income related to investments that were put on non-accrual.

The portfolio, like I illustrated above, does have some credit issues, so the most severe headwinds presently relate to contracting net investment income and possibly growing pressure on NAV if those investments are sold at a loss or written off. As we will see next, the business development company still covers its dividend with net investment income.

Operating Results (FS KKR Capital Corp)

Narrow Margin Of Safety For Passive Income Investors

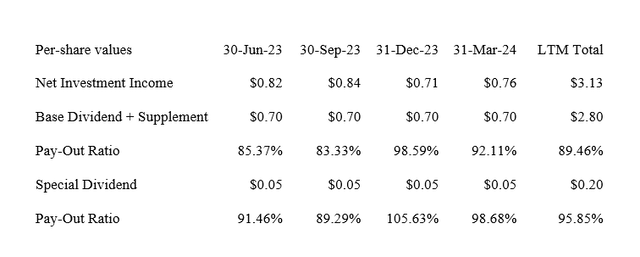

In the quarter ending March 31, 2024, FS KKR Capital continued to earn more than enough in net investment income than was required for the business development company to pay its dividend: FSK paid $0.70 per share per quarter (regular dividend of $0.64 per share + supplemental dividend of $0.06 per share) which was complimented by a $0.05 per share special dividend.

These payments translate into a dividend pay-out ratio of 92% in 1Q24, based on the regular + supplemental dividend only, and into a 99% pay-out ratio, based on cumulative dividends. The safety margin here is not as great as I would like it to be (typically I prefer BDCs with pay-out ratios of 90% of less).

Net Investment Income (Author Created Table Using BDC Information)

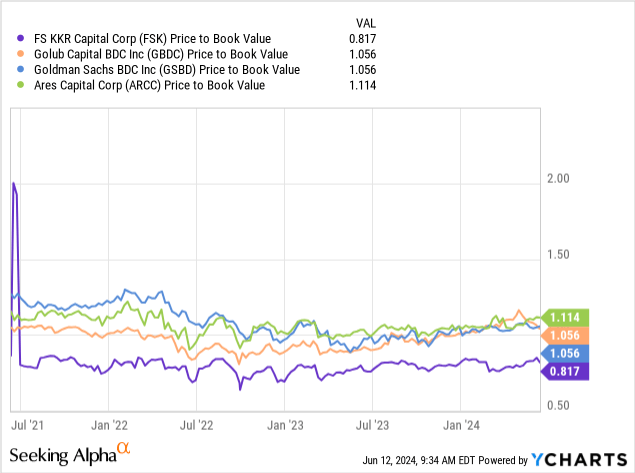

Discount To NAV Driven By Above-Average Credit Issues

It is FS KKR Capital’s high non-accrual ratio that is responsible for the business development company selling at a steep discount to net asset value which as of March 31 2024 was $24.32. If FS KKR Capital were to get control of its credit situation and lowered its non-accrual ratio to a more reasonable level of 2%, then I could see a catalyst for a stock re-rating.

At a present non-accrual level of more than 4%, I think it is not realistic to expect a full re-rating. From a valuation angle, FS KKR Capital’s stock is selling by far at the highest discount to net asset value.

Peer BDCs like Golub Capital BDC Inc. (GBDC), Goldman Sachs BDC Inc. (GSBD) and Ares Capital Corp. (ARCC) are all selling at premiums to net asset value, but they also all have healthier credit portfolios than FS KKR Capital.

Why FSK KKR Capital Might Not Re-Rate To NAV

The BDC’s non-accrual situation does not look great and a 4% non-accrual level is far from comforting. If FS KKR Capital’s non-accrual remains at its present level, or if the business development company were to recognize more loan losses moving forward, then I would anticipate for the BDC to drop its special dividend which has been paid quite consistently over the last year.

Furthermore, FS KKR Capital now has a diminished safety margin as far as the dividend is concerned, thanks to contracting net investment income.

My Conclusion

FS KKR Capital profited from a slight improvement in the non-accrual ratio in the first quarter, but the credit situation as a whole, with a non-accrual ratio of 4.2%, remains questionable.

Further loan losses might be in the cards which is poised to impact FS KKR Capital’s net asset value and safety margin as far as the dividend is concerned. Taking into account the concerning non-accrual ratio, I don’t think that FS KKR Capital is poised to re-rate to net asset value.

The BDC also profited from an increase in new loans which could indicate an improving environment for originations.

I think that the 14% yield for now is safe, but passive income investors should carefully watch the non-accrual ratio and NAV trend. Hold.

Read the full article here