In recent months, I’ve been offering an overview of the Brazilian Ibovespa stock market, which is closely mirrored by the iShares MSCI Brazil ETF (NYSEARCA:EWZ). In my most recent articles from August and September, I maintained a neutral stance regarding the potential for an advanced correction in Brazilian equities. This approach is based on Brazil’s effective inflation control through a robust monetary policy implemented last year, outperforming major global economies.

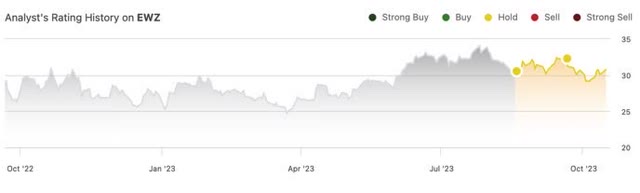

As you can observe, since my latest articles, the EWZ has essentially been trading within a narrow range without significant upward or downward movement.

Seeking Alpha

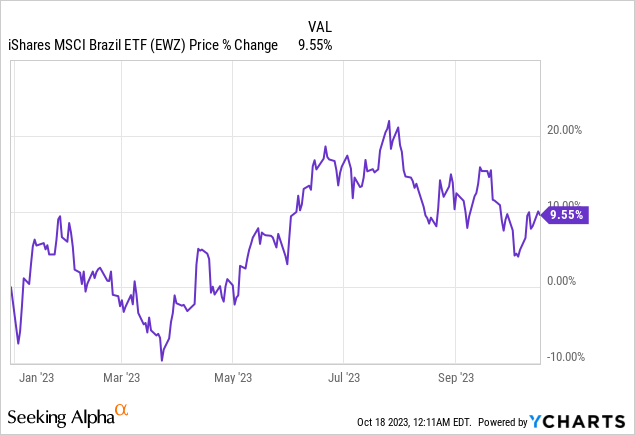

Throughout 2023, the EWZ has displayed a cumulative performance of 9.5%. This performance is primarily attributed to optimism in the year’s first half, driven by expectations of forthcoming interest rate reductions. The sentiment was further bolstered by diminishing concerns about a fiscal crisis, particularly following the change in leadership at the beginning of the year when President Lula assumed office.

Fast forward a month from my last assessment, and not much has substantially improved. However, I believe the outlook appears to be leaning more towards optimism than pessimism. Nonetheless, this isn’t sufficient to sway my cautious perspective on the momentum surrounding the key Brazilian equities represented by the EWZ.

For those who had anticipated a significant rally following the initial interest rate cuts in August and September, their hopes have been dashed. This is primarily due to the confluence of factors, including the surge in long-term American interest rates and the appreciation of the US dollar against the Brazilian real.

On the flip side, I see a silver lining in improving the commodities cycle. Gasoline prices have remained high due to expectations of increased demand, and iron ore prices have also held steady due to sustained demand from China.

Challenges Loom for Brazilian Economic Activity in H2

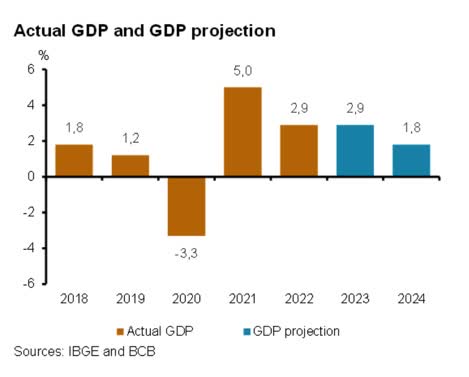

In the second quarter of 2023, Brazil’s GDP grew 0.9% in the seasonally adjusted series, exceeding market expectations. In the annual comparison, there was a significant increase of 3.4%. This quarterly solid growth can be primarily attributed to robust household consumption, a thriving services sector, a buoyant extractive industry, and increased government spending.

Despite the positive momentum witnessed in the year’s first half, it is challenging to foresee this trend continuing through the end of 2023. The outlook for GDP in the remaining part of the year appears relatively stable, with the possibility of minor declines.

Banco Central do Brasil and IBGE

Numerous factors, including the Brazilian Central Bank’s implementation of monetary tightening measures, the high levels of household indebtedness and defaults, the diminishing influence of contributions from the agricultural sector, and the persistent challenges presented by external economic conditions, are all a sizable risk to impede further enhancements in economic activity during the second half of the year.

Fiscal Outlook: Declining Revenue

Data from the Brazilian tax authorities reveals that in August 2023, the Federal tax and other revenue collection amounted to R$172.78 billion, marking the third consecutive month of decline. In the annual comparison, there was a drop of 4.14%.

From January to August this year, the total revenue reached R$1.52 billion, showing a decrease of 0.83% compared to the same period in 2022. It’s worth noting that this accumulated figure is the highest in the series since 1995.

Furthermore, according to the National Treasury, the central government reported a primary deficit of R$26.4 billion in August, and over the 12 months, a negative result of R$70.9 billion, equivalent to 0.69% of GDP.

The Net Public Sector Debt (NPSD) and Gross General Government Debt (GGGD) stood at 59.9% and 74.4% of GDP in August. With declining revenue and ongoing expenditures, the country is expected to close this year with a deficit of 1% of GDP.

Inflation: Trends Are Still Favorable

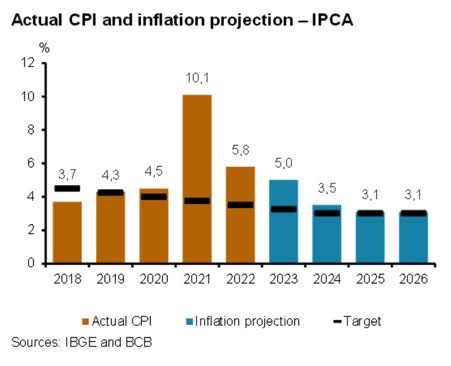

Brazil continues to experience a favorable trend in inflation, with notable deceleration observed in the prices of services, underlying services, industrial goods, and food, coupled with declines in the core and diffusion indexes.

The forecast indicates that the IPCA (Consumer Price Index) is expected to peak in September this year, with a projected increase of 5.33% over the accumulated 12 months. Subsequently, the index is anticipated to stabilize, concluding the year at 5%. Moving into 2024, the Brazilian Central Bank has set an expectation of 3.5%.

Brazil’s CPI (Banco Central do Brasil and IBGE)

Despite these positive indications, there are several noteworthy risks to consider. The external economic environment remains challenging, with slight signs of inflation slowing down, yet core figures persisting above the desired levels. Furthermore, persistent pressures on oil prices could potentially lead to increases in fuel costs. The potential effects of El Niño on food prices also pose a risk, while internal fiscal uncertainties within Brazil may impact inflation expectations.

Interest Rates In a Downtrend Trajectory, but at What Pace?

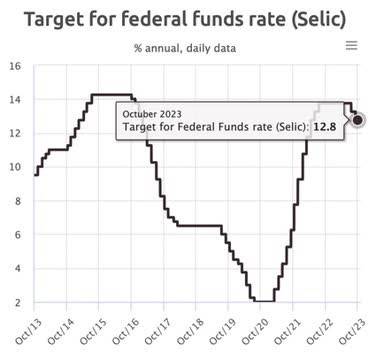

The interest rate scenario in Brazil is currently experiencing a downward trend, but the pace of this decline remains uncertain.

In September, the Copom (Monetary Policy Committee) reduced the Selic rate by 50 basis points (0.5 percentage points), bringing the interest rate to 12.75% annually. In my assessment, Copom’s decisions have been quite assertive. The monetary authority has consistently emphasized the importance of addressing the fiscal deficit issue, aiming to achieve a balanced budget by 2024 to help anchor inflation expectations.

Brazil Interest Rate (Selic) (Banco Central do Brasil)

Furthermore, Copom has highlighted the need for caution in the fight against inflation since some inflation indicators, particularly the underlying measures, still exceed the Central Bank’s target. This suggests that there is only partial anchoring of inflation expectations.

The expectation is a further 50 basis point cut in the interest rate over the next two meetings. The Brazilian Central Bank projects a terminal interest rate of 11.75% per annum in 2023, expected to decline to 9.25% in 2024.

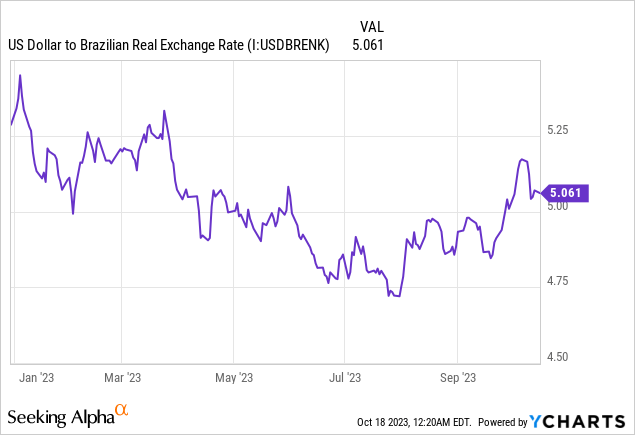

U.S. Dollar Strengthens Against the Brazilian Real

In September, the real-dollar exchange rate closed at R$5.00, a slight increase compared to its August closing rate of R$4.92. Although the exchange rate initially displayed some appreciation in the first half of the month, it experienced a notable surge following significant monetary policy decisions in both Brazil and the United States.

Towards the end of the month, a combination of external uncertainties strengthened the U.S. dollar. These factors included concerns about a potential interest rate hike in the U.S., which put pressure on the longer end of the yield curve, the looming risk of a government shutdown in the U.S., and issues in the Chinese real estate sector, causing international apprehension.

Furthermore, foreign investors seem to be harboring concerns about Brazil’s fiscal situation and are skeptical about its ability to achieve its deficit reduction goal for the coming year. Nevertheless, it is noteworthy that two factors are exerting downward pressure on the exchange rate: Brazil’s favorable trade balance and its real interest rate, which remains one of the highest globally. These elements continue to attract and maintain investment.

Commodities: Encouraging Signals

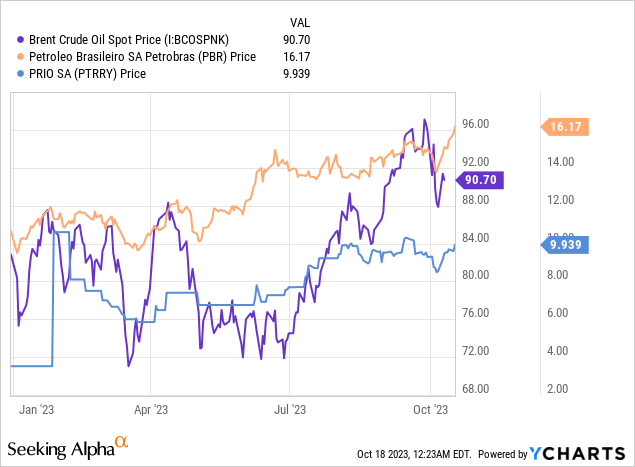

In the realm of oil, the recent price surge can be attributed to the announcements of production cuts by Saudi Arabia and Russia. Additionally, reduced concerns about a recession in the U.S. and expectations of more robust growth this year have bolstered the demand outlook.

The oil market is expected to maintain relative stability, with demand predicted to outpace supply by the end of the year. This should result in prices remaining near their current levels, approximately between $90 and $95 per barrel. This increase in oil prices has positively impacted the performance of Petrobras (PBR) (PBR.A), which holds the most significant weight in the ETF, and Prio S.A. (OTCPK:PTRRY), making up approximately 17% and 1.8% of EWZ, respectively.

However, it’s important to note that Petrobras continues to maintain its pricing structure, and with Brent crude oil prices remaining high, the company is likely to operate at a loss. This puts pressure on profits and leads to lower dividend distributions.

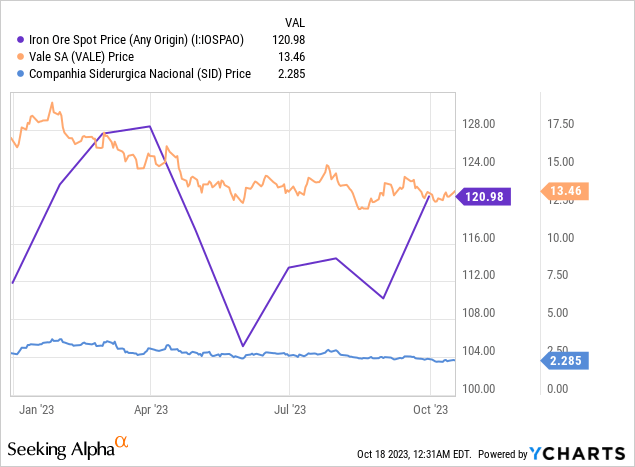

Conversely, iron ore has maintained its elevated prices, hovering around US$120 per ton. Several factors contribute to this stability, including the sustained demand from Chinese steelmakers, economic stimulus measures from Beijing, and the positive seasonality of the current period.

Vale’s (VALE) shares have experienced a 17% decline over this year. It’s important to note that Vale is the second-largest holding in the EWZ, representing 13% of its composition. Another stock affected by the pressure on iron ore is Companhia Siderúrgica Nacional (SID), which is also in a downtrend with a 15% decrease and constitutes about 0.50% of EWZ.

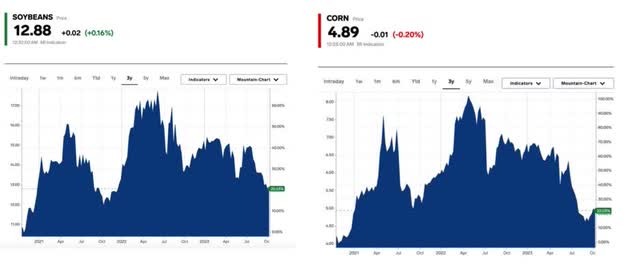

Lastly, the continued price decline in agricultural commodities is primarily due to a significant increase in global supply, driven by record harvests in Brazil, improved weather conditions in the U.S., and weakened Chinese demand. Both corn and soybean prices have reached their lowest levels in three and two years, respectively.

Market Insider

This situation is anticipated to positively impact the third-quarter results of the food and beverage industries. It may boost the stocks of companies like Ambev (ABEV) and JBS (OTCQX:JBSAY), constituting approximately 3.2% and 0.9% of EWZ’s composition, respectively.

Maintaining a Neutral Stance

In a broader context, I still observe that major Brazilian companies within the index are trading at notably discounted price-to-earnings (P/E) ratios compared to their industry peers. These companies are likely to yield substantial dividends over the next two years.

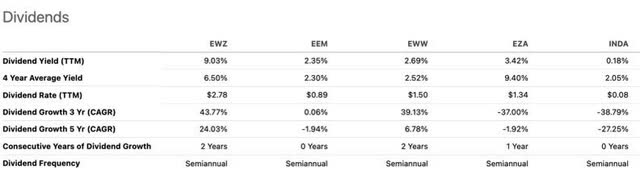

As a result, with a P/E ratio of 5x, the iShares MSCI Brazil ETF (EWZ) continues to be an attractive option for gaining exposure to emerging markets compared to other counterparts. For instance, the iShares MSCI Emerging Markets ETF (EEM) trades at a P/E of 11x, the iShares MSCI Mexico ETF (EWW) at 10x, and the iShares MSCI South Africa ETF (EZA) at 10.5x.

Regarding dividends, the EWZ also stands ahead of its emerging market peers with a yield of 9%.

Seeking Alpha

Ibovespa, Brazil’s stock market, saw a modest recovery in September, registering a 0.71% increase after a significant 5% decline in the previous month. However, the landscape remains uncertain, characterized by frequent and unpredictable movements among the index’s constituent stocks. These shifts in-stock positions are challenging to forecast, contributing to the market’s overall uncertainty despite the potential for an improved environment due to declining interest rates.

To adopt a more optimistic stance, I would await more precise signals of China’s economic progress, a decrease in long-term American interest rates, and a stronger indication of fiscal improvements in Brazil to ensure that interest rates continue to decline faster.

For these reasons, for now, I maintain a neutral bias and consider more favorable opportunities for profitability in the Brazilian and American fixed-income markets rather than exposure to the Brazilian stock market.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here